Vipshop: Under the pressure, will the weak become weaker?

![]() 08/21 2024

08/21 2024

![]() 518

518

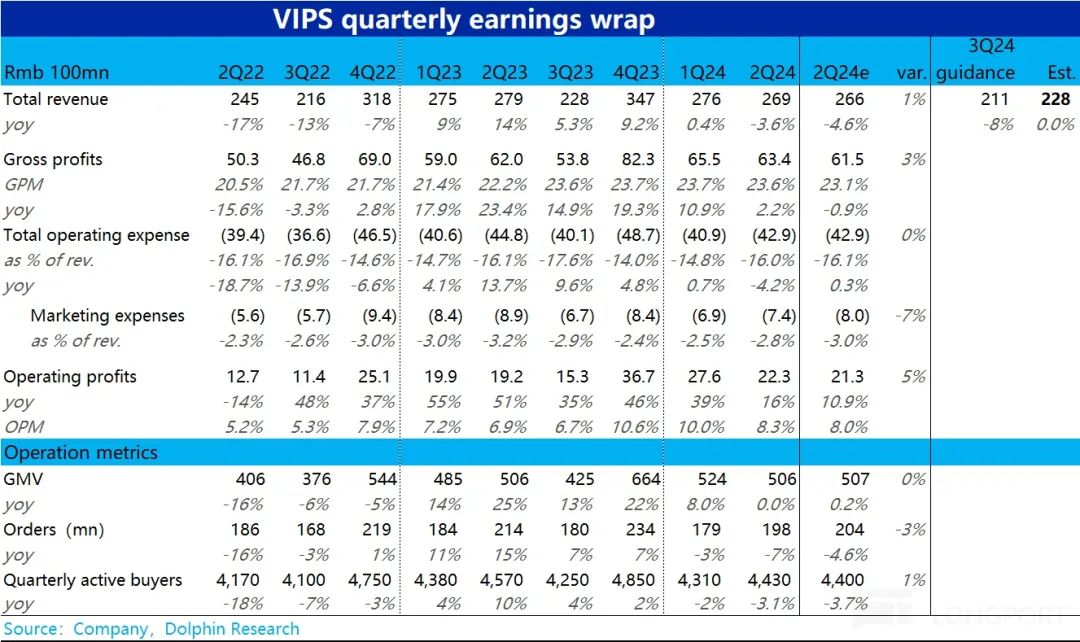

On August 20, Beijing time, before the US stock market opened, Vipshop released its second-quarter financial report for 2024. In summary, although the company's actual performance basically met market expectations under its prior guidance, the overall weakening of business and growth indicators revealed the pressure faced by Vipshop in various aspects. The details are as follows:

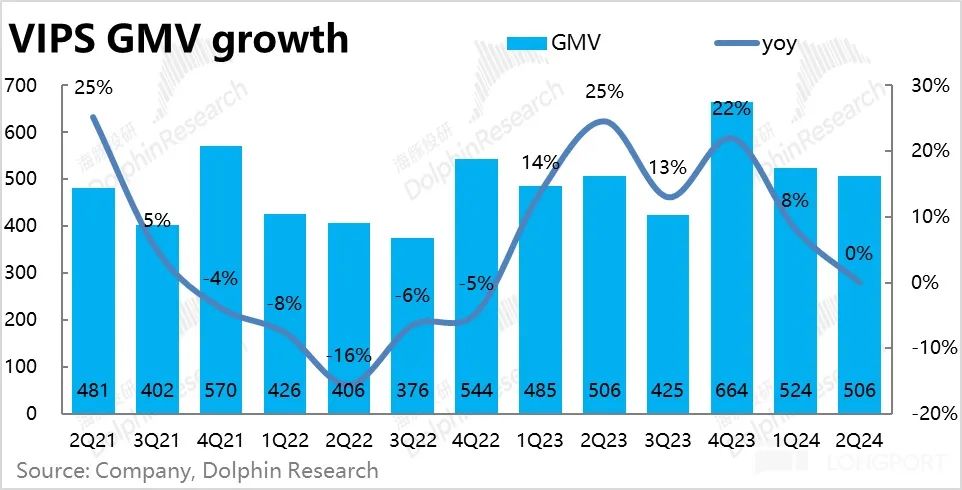

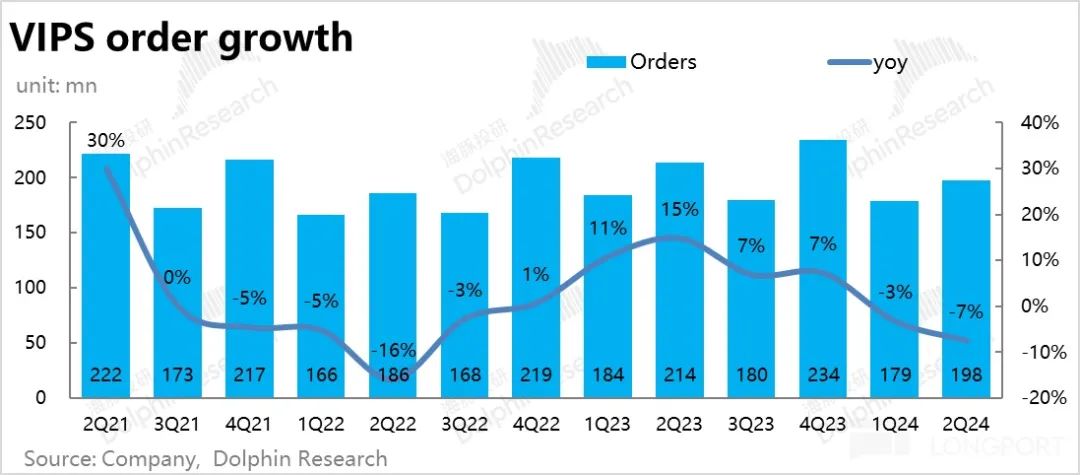

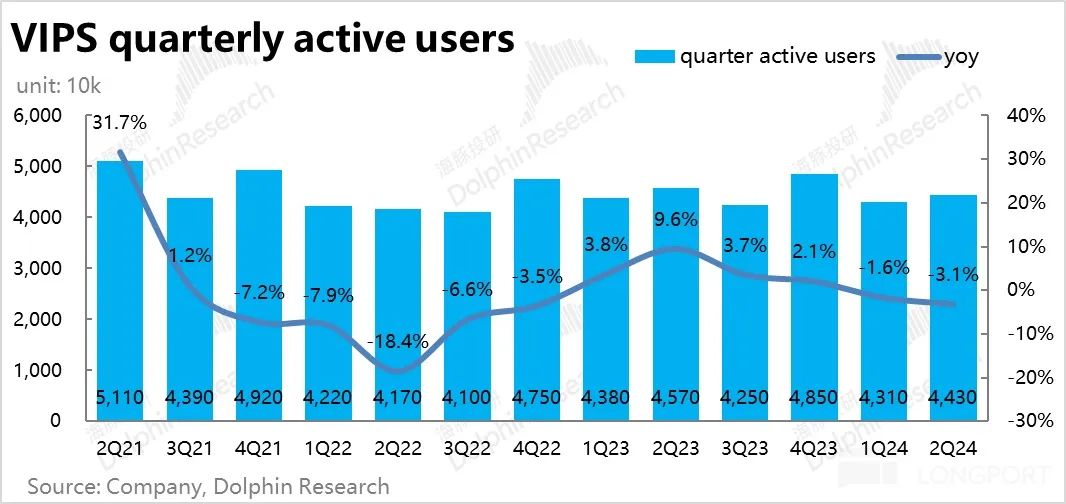

1. User and order loss, solely supported by SVIP members. Vipshop's GMV reached 50.6 billion yuan this quarter, nearly flat year-on-year, basically in line with market expectations. Although the market had already lowered expectations in advance, the actual performance still met expectations. However, the zero year-on-year growth was undeniably weak. In terms of drivers, Vipshop's order volume declined by 7% year-on-year, a wider decline than the previous quarter, while active users also decreased by approximately 1.4 million year-on-year, an expansion from the 0.7 million decline in the previous quarter.

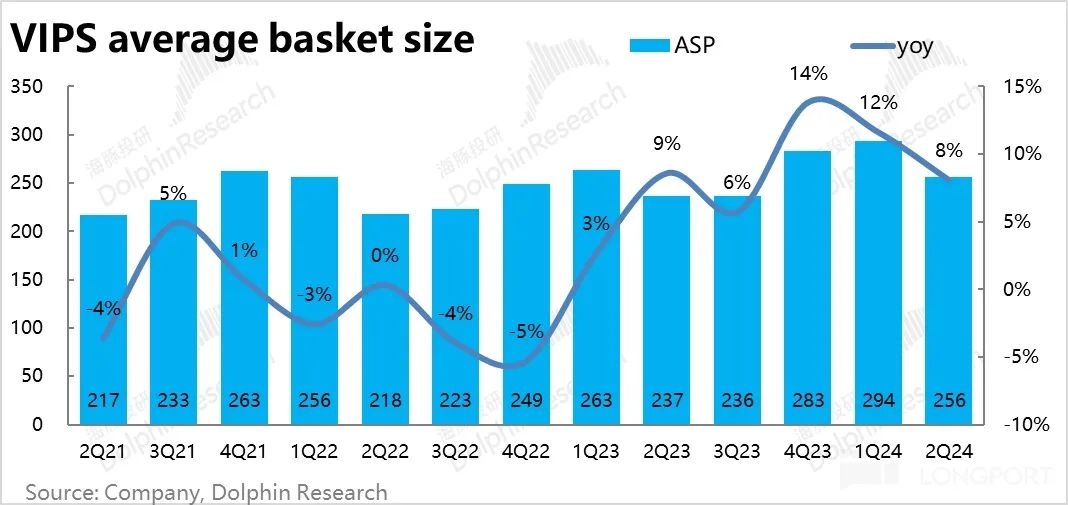

According to the company's explanation, the loss of users and orders this quarter was mainly due to higher subsidies offered by other platforms, leading some "swing users" to switch platforms. However, the spending of core users (such as SVIP members) was not significantly impacted, and the purification of users pushed up the average order value by 8%, maintaining the GMV at a year-on-year stable level.

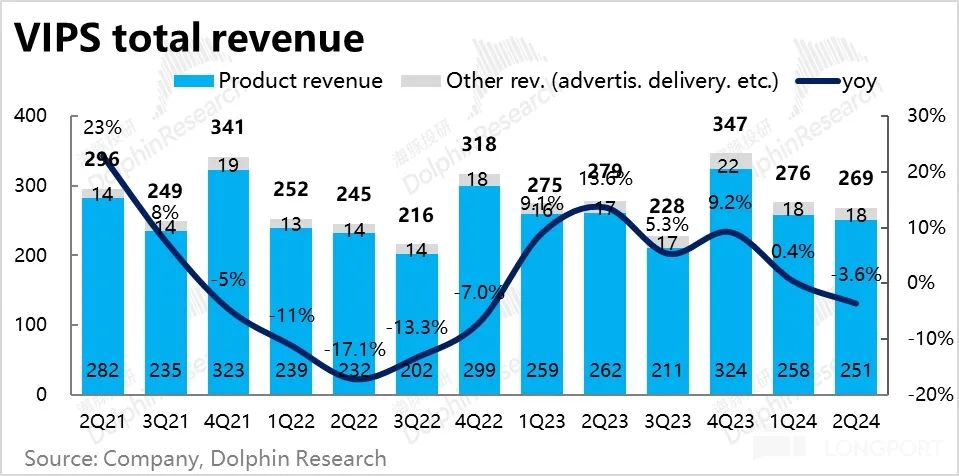

2. Due to an increase in returns and 3P revenue, the gap between revenue growth and GMV growth persisted this quarter. Revenue declined by 3.6% year-on-year to 26.9 billion yuan, slightly higher than the low expectation by 300 million yuan, but negative growth was undeniable. Nevertheless, as the base period of low return rates has largely passed, the gap between revenue and GMV growth is narrowing, from nearly 8pct in the previous quarter to less than 4pct this quarter, with further narrowing expected in the future.

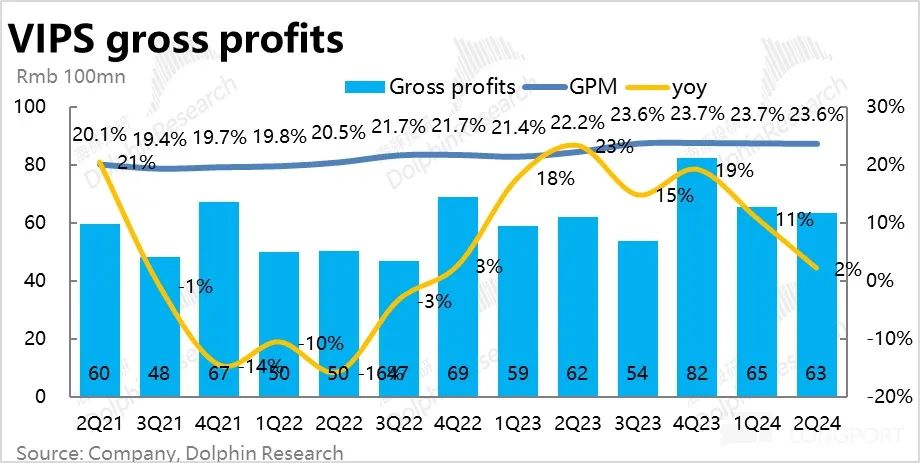

In terms of gross profit, the company achieved 6.3 billion yuan, a 2% year-on-year increase, outpacing revenue and GMV growth. However, it should be noted that the year-on-year gross margin base will significantly increase from next quarter, approaching current levels. In other words, the growth rate of gross profit will become more aligned with that of revenue in the future.

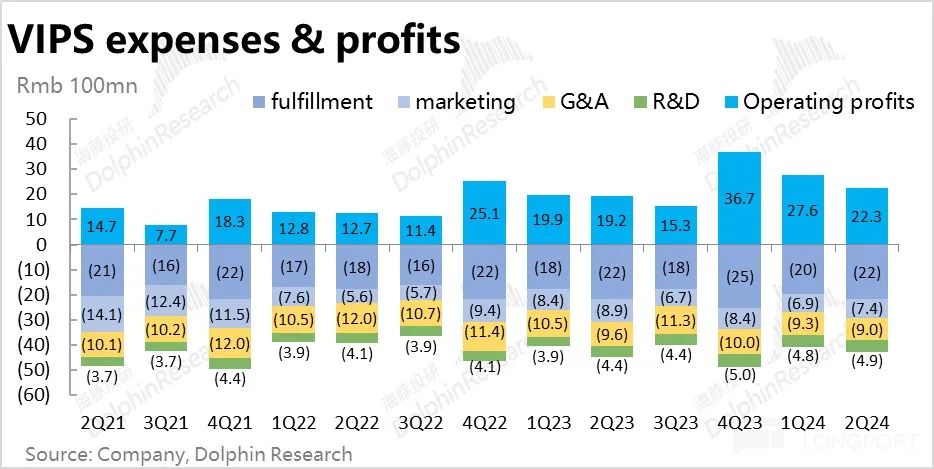

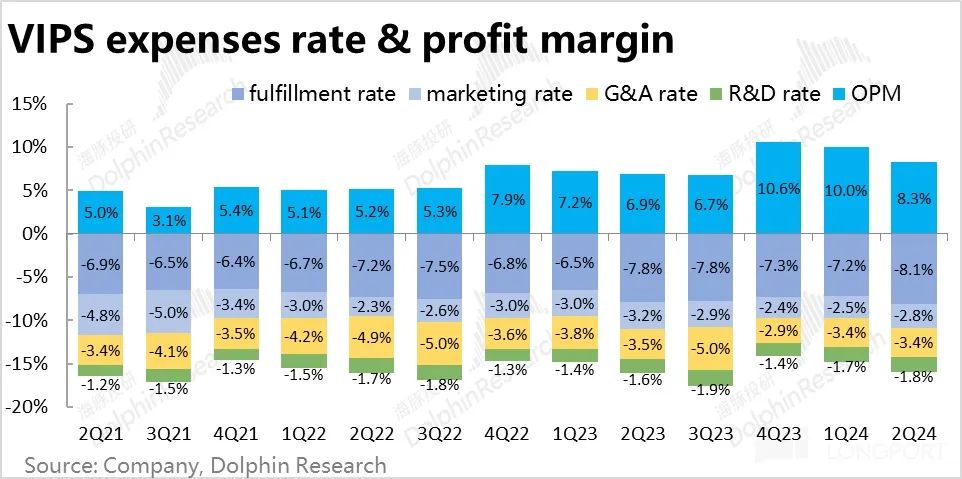

3. With unimpressive growth in GMV, revenue, and gross profit, cost control served as the last line of defense to preserve profit growth, which was achieved this quarter. Total operating expenses amounted to 4.29 billion yuan, a 4.2% year-on-year decrease, with a larger decrease than all the aforementioned key growth indicators. Marketing expenses were 740 million yuan, a 17% year-on-year decrease and lower than the market expectation of 800 million yuan.

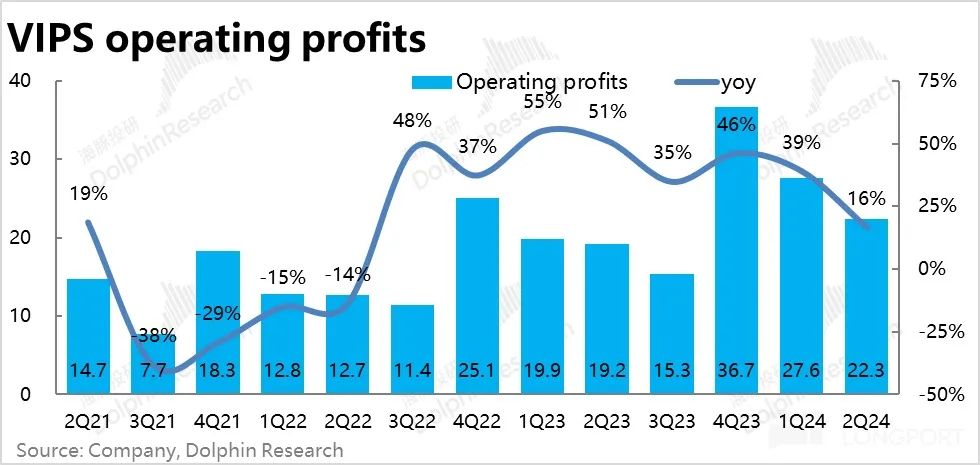

In terms of other expenses, both management and fulfillment expenses decreased year-on-year, while R&D expenses increased by 10% year-on-year, possibly due to investments in AI-powered shopping assistants and virtual try-on features. Ultimately, through excellent cost optimization, the company achieved an operating profit of 2.23 billion yuan, a 16% year-on-year increase and 5% above expectations, achieving double-digit growth in profits.

4. Looking ahead to the third quarter, the company's revenue guidance ranges from -10% to -5% year-on-year, while the market had originally expected flat year-on-year growth (though this expectation may not have much reference value). In other words, given the already weak performance this quarter, the company expects conditions to deteriorate further in the next quarter.

Dolphin Investment Research Viewpoint: Although the company's performance this quarter generally met market expectations after it lowered expectations in advance, beyond the expectation gap, the company's indicators reflect considerable operational pressure from an absolute perspective.

In terms of core operational indicators, both active users and order volume declined by 3% to 4% year-on-year, and the low base period for gross margin will soon pass, making it difficult to rely on year-on-year increases in gross margin to offset the impact of declining revenue. While profit growth was maintained through cost control this quarter, cost reductions can only provide temporary relief. If the business continues to shrink, profits will eventually converge with revenue growth. The company's revenue guidance for the next quarter also implies that conditions may deteriorate further.

Considering the currently weak e-commerce industry and the fierce competition among giants, the limited growth potential is being divided among dominant players, inevitably putting pressure on niche players like Vipshop. The outlook is indeed not optimistic.

In terms of shareholder returns, after three quarters of significant scale contraction, Vipshop's buyback quota was once again increased to slightly over $200 million this quarter. Compared to its market value of just over $7 billion, this represents an annualized return rate of over 10%. However, there is a hidden concern: due to high capex expenditures and declining operating cash flow over the past two quarters (-1.3 billion yuan and -800 million yuan, respectively), maintaining high buybacks and dividends under sustained negative free cash flow is a question mark.

Detailed Financial Report

I. User and Order Loss Amidst Giant Competition

Vipshop's GMV reached 50.6 billion yuan this quarter, nearly flat year-on-year and in line with market expectations. Due to the company's prior guidance, the market had already lowered expectations, so the performance did not seem poor in terms of expectation gap. However, the zero year-on-year growth, a significant slowdown from the 8% growth in the previous quarter, was still quite weak.

Price and Volume Drivers

In terms of drivers, Vipshop's order volume declined by 7% year-on-year, a wider decline than the previous quarter and 3% lower than expectations. Meanwhile, active users decreased by approximately 1.4 million year-on-year, compared to a 0.7 million decrease in the previous quarter. Although the actual performance was not significantly different from expectations, the further loss of users and orders indicates that Vipshop faces considerable operational and growth pressure that cannot be ignored.

While order volume declined significantly year-on-year, GMV remained flat thanks to higher average order value. The average order value reached 256 yuan, a year-on-year increase of 8%. According to the company's explanation, the loss of users and orders this quarter was mainly due to some "swing users" switching to other platforms because of higher subsidies offered by those platforms. However, the spending of retained core users (such as SVIP members) was not significantly impacted, thereby pushing up the average order value.

II. Final Contribution from Low Gross Margin Base

With GMV essentially flat, and due to an increase in returns and the proportion of 3P revenue, the gap between revenue growth and GMV growth persisted this quarter. Revenue declined by 3.6% year-on-year to 26.9 billion yuan, slightly higher than the low expectation by 300 million yuan despite the weakness. However, we can see that the gap between revenue and GMV growth is narrowing, from nearly 8pct in the previous quarter to less than 4pct this quarter. We believe this is mainly due to the passing of the base period of low return rates, and the gap between revenue and GMV is expected to continue narrowing.

In terms of gross profit, the company achieved 6.3 billion yuan, a 2% year-on-year increase, outpacing revenue and GMV growth. However, we should note that the year-on-year gross margin base will significantly increase from next quarter, approaching current levels. In other words, the growth rate of gross profit will become more aligned with that of revenue from next quarter onwards.

III. Optimizing Costs to Preserve Profit Growth

With unimpressive growth in GMV, revenue, and gross profit, cost control was the last line of defense to preserve profit growth this quarter. Total operating expenses amounted to 4.29 billion yuan, a 4.2% year-on-year decrease, with a larger decrease than all the aforementioned key indicators. Marketing expenses were 740 million yuan, a 17% year-on-year decrease and lower than the market expectation of 800 million yuan. In terms of other expenses, both management and fulfillment expenses decreased year-on-year, while R&D expenses increased by 10% year-on-year. Considering Vipshop's high capex expenditures in recent quarters, we believe this may be due to investments in AI-powered shopping assistants and virtual try-on features.

Ultimately, despite unimpressive performance across growth indicators, through excellent cost optimization, the company achieved an operating profit of 2.23 billion yuan, a 16% year-on-year increase and 5% above expectations. Ultimately, double-digit profit growth was achieved.