Internet stocks actively returning to shareholders

![]() 08/21 2024

08/21 2024

![]() 493

493

Recently, internet stocks have successively disclosed their financial reports. Although it is difficult to surprise the market with growth rates in a low-growth environment, the most intuitive feeling is that all companies are increasing returns to shareholders, whether through doubled repurchases or increased dividends. These are all signs of continued improvement for internet stocks.

Of course, the overall environment is still challenging, and foreign investors' attitudes towards Chinese assets have not yet changed. Even with increased returns to shareholders, it is still difficult for stock prices to surge significantly in the short term. Continuous efforts in returning shareholder value will be required to weather this period of low valuations.

I. Chinese Stocks Listed Overseas at Different Valuation Stages

After releasing their financial results, Tencent's share price remained relatively stable in recent days, while Alibaba's share price increased by nearly 10%, and JD.com's by over 12%.

From the perspective of shareholder returns, all three companies performed well in the first half of the year. However, considering their valuations and direct shareholder return ratios, these companies are at different competitive stages, resulting in varying degrees of share price reaction.

Tencent's second-quarter results showed that its advertising business grew by 20% beyond expectations, with game growth recovering. Local game revenue increased by 9% year-on-year, exceeding expectations of 5-8%. Additionally, there are positive growth expectations for video accounts. Despite concerns about a weakening overall environment in the second quarter, Tencent demonstrated strong resilience.

There is little need to worry about Tencent's growth potential, as it does not face the same intense competition from platforms like Pinduoduo and Douyin as Alibaba and JD.com. From a competitive perspective, Tencent's core business remains solid, and it is likely to continue increasing dividends year over year.

Assuming Tencent maintains daily repurchases of RMB 1 billion for the rest of the year, after deducting silent periods and public holidays, its annual repurchases could reach RMB 140 billion. Combined with dividends of RMB 33 billion, the overall shareholder return rate would be 5%. With a neutral growth expectation of 8%, an annual EPS growth of over 10% is foreseeable.

Looking at Tencent's shareholder returns over recent years, it has been the most generous among its peers. In 2021, Tencent distributed JD.com shares, resulting in a shareholder dividend rate of approximately 3.87%. In 2022, it distributed Meituan shares and repurchased shares, leading to a shareholder return rate of 5.4%. Even if Tencent no longer sells assets for dividends in the next two years, its repurchases and dividends alone could still reach 5%, with sustainability going forward.

As previously mentioned, the current reduction in holdings by South African shareholders has no impact on Tencent. Tencent's own repurchases of over RMB 100 billion and southbound capital inflows far exceed the selling by South African shareholders. So, why hasn't Tencent's share price risen significantly despite outperforming Alibaba and JD.com in financial results?

II. Continuity of Repurchases by Alibaba and JD.com

On the one hand, from a valuation perspective, Alibaba and JD.com currently offer higher potential upside than Tencent. Tencent trades at around 14 times next year's earnings, while Alibaba traded at 9.3 times and JD.com at 8 times before their recent rallies.

On the other hand, the market positions Tencent as a company with both growth potential and stable shareholder returns. While shareholder returns serve as a safety net, growth is the primary driver of Tencent's share price appreciation. In contrast, the market views Alibaba and JD.com more conservatively. As long as they can maintain their market share and stabilize their core businesses without further deterioration in performance, their current low P/E ratios of 8-9 times, combined with sustainable shareholder returns, could drive a rally in their share prices.

In the first half of this year, Alibaba and JD.com's core customer management and product revenue grew by 0-1% year-on-year, indicating stagnation amidst competition from platforms like Pinduoduo and Douyin.

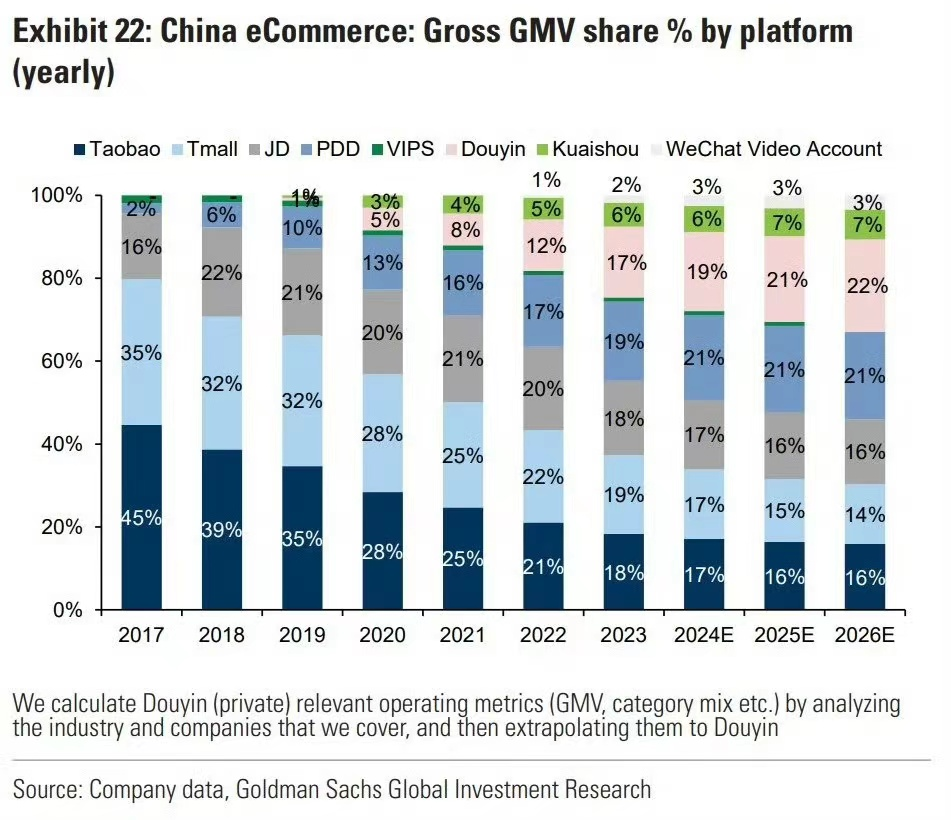

According to a foreign research report, e-commerce market share is expected to change in 2024. Taobao's share is projected to decline from 18% in 2023 to 17% in 2024 and further to 16% in 2025 before stabilizing. Tmall's share is expected to decline faster, from 19% in 2023 to 17% this year and 15% next year. JD.com's share is projected to drop from 18% in 2023 to 17% this year and further to 16% subsequently.

Comparing shareholder returns among the three companies, while Tencent's repurchases are substantial, Alibaba and JD.com offer higher shareholder return ratios due to their smaller market capitalizations. As of the first half of the year, Tencent repurchased HK$52.3 billion worth of shares, reducing its total share capital by about 1.45%. Alibaba repurchased US$10.6 billion worth of shares, reducing its total share capital by about 6%, while JD.com repurchased US$3.3 billion worth, reducing its total share capital by about 7.1%.

Assuming that Tencent, Alibaba, and JD.com maintain their repurchase efforts and dividend payouts at the same pace as in the first half of the year for the rest of the year, Tencent's total share capital would decrease by about 5%, Alibaba's by 12%, and JD.com's by about 10%.

Both Alibaba and JD.com's management have committed to continuing their share repurchase programs. Market expectations hinge on whether they can maintain their core businesses. If profits remain sustainable, investor sentiment towards Alibaba and JD.com could improve.

However, based on Alibaba and JD.com's current cash flow positions, if their core businesses do not stabilize, their repurchase efforts may weaken . The current large-scale repurchases may be one-time events. Currently, only Tencent faces minimal pressure to increase shareholder returns year over year.

As of the second quarter, Alibaba's net cash, excluding interest-bearing liabilities, was RMB 287.1 billion, a year-on-year decline of nearly 25%. Its annualized operating cash flow was slightly below RMB 140 billion. With the demand for AI capex, the sustainability of large-scale repurchases is a matter of debate in the market.

Assuming Alibaba's non-GAAP net profit for the year is expected to be around RMB 153 billion as per current market estimates, and if the repurchase pace remains unchanged for the rest of the year, the company would need to spend US$21.2 billion on repurchases, equivalent to its annual non-GAAP net profit. With a full-year non-GAAP net profit of RMB 153 billion, Alibaba trades at around 9.2 times P/E.

As of the second quarter, JD.com's net cash, excluding interest-bearing liabilities and including realizable assets, was RMB 139.5 billion. The market expects annual profits of around RMB 38 billion, corresponding to a P/E ratio of 7.9 times based on a market capitalization of RMB 300 billion. If we subtract net cash from market capitalization, the valuation falls below 4 times.

Assuming the repurchase pace remains unchanged for the rest of the year, JD.com would repurchase US$6.6 billion worth of shares, reducing its total share capital by 10% and costing approximately RMB 47.1 billion.

However, JD.com currently has only US$400 million remaining in its repurchase authorization, and it is uncertain whether it will significantly increase this amount. Nonetheless, like Alibaba, JD.com's business expansion has stagnated. Compared to investing or increasing AI capex, using accumulated cash for shareholder returns may be a more attractive option.

Considering shareholder returns and current valuations, are Alibaba and JD.com expensive?

Clearly not, which explains why Alibaba and JD.com's share prices have outperformed Tencent recently. First, they offer higher direct shareholder return ratios. Second, their valuations are lower.

In fact, internet companies are no less generous in returning shareholder value than some dividend stocks. The difference is that Tencent, Alibaba, and JD.com do not directly pay dividends but instead offer returns through share repurchases.

III. Conclusion

Overall, if you seek growth potential combined with shareholder returns, Tencent is the preferred choice. If you prioritize shareholder returns, Alibaba and JD.com are better options. For pure growth potential, Pinduoduo stands out. Meituan, which has not yet disclosed its financial results, has repurchased US$3 billion worth of shares so far this year, equating to a 3.5% reduction in its share capital for the full year based on current trends.

It's worth noting that large-scale repurchases can only support share prices; significant gains require macroeconomic improvements. When both conditions are met, internet stocks can deliver substantial returns.