Li Bin and Yu Chengdong, the most financially successful men in China's automotive industry

![]() 08/22 2024

08/22 2024

![]() 554

554

In just two days, Huawei's Vehicle BU and NIO have risen to the top in China's new energy vehicle sector.

Huawei's Vehicle BU secured a 10% stake in AITO for 11.5 billion yuan, marking the independence of its automotive division with an estimated value of 115 billion yuan. This places Huawei firmly at the forefront of China's automotive intelligence and second globally.

Preceding Huawei is Waymo, valued at 30 billion USD, followed by Intel's Mobileye at 12 billion USD.

Meanwhile, Li Bin announced NIO's "County-to-County" plan at the NIO Power Day, aiming to cover all counties in China with charging stations and battery swap stations by December 31, 2025, excluding Taiwan and Hong Kong. This further solidifies NIO's position as the leader in charging and swapping infrastructure in China, with little chance of competition from other automakers reaching the same scale.

The above outlines the harsh realities and new dynamics of China's automotive industry.

The industry can no longer rely solely on car sales for growth, as competition based on range, acceleration, and intelligence becomes increasingly intense.

The new game plan involves leveraging unique strengths to capture B-end and cross-industry partnerships, creating a new moat for C-end consumers.

Combining these two aspects, China's automotive industry has moved beyond traditional joint ventures.

Has China's automotive industry entered a new era of joint ventures?

'Cooperation is always the better option,' said Li Bin in a Harvard speech this year, echoed by Qin Lihong at the NIO Power Day. This aptly describes the new trends in the industry.

Unlike the previous lack of choice or limited options in traditional Sino-foreign joint ventures, today's Sino-Sino joint ventures encompass both technology and capital.

Taking Huawei's investment in AITO as an example, its new business model has formed a closed loop. According to AITO's announcement, post-investment, detailed cooperation agreements will cover areas such as joint branding, product definition and design, core technology prioritization, intelligent experience co-creation, preferential pricing, user experience design, priority component supply, smart cabin ecosystem co-creation, intelligent driving experience co-creation, and vehicle platform co-creation.

In other words, future Huawei events may feature AITO, and there will be no more instances of multiple automakers claiming to be the first to feature Huawei technologies. Additionally, AITO will enjoy the lowest cost for relevant technologies, priority in component supply, and access to core technologies and codes.

Looking at the overall joint venture model, the new closed-loop business model envisions 'AITO flying solo after leaving Huawei, becoming a top-tier supplier to China's automotive industry, on par with Bosch.'

Established in January 2024 with a registered capital of 1 billion yuan, AITO initially sought investment from FAW, Dongfeng, and Changan. While FAW and Dongfeng did not directly invest, Changan holds an indirect stake, and Seres has expressed its intention to invest, leaving a 30% stake available. Huawei is expected to hold 60% of the joint venture, with 40% remaining.

However, FAW and Dongfeng remain cautious about investing heavily upfront for technology and first-mover advantages before spending more on components. Nevertheless, recognizing Huawei's technological prowess has become a consensus in the industry.

Essentially, this follows the same logic as Volkswagen's joint ventures with FAW and SAIC, Toyota's with FAW and GAC, and Honda's with Dongfeng and GAC. Multinational giants drive industry growth through their technological advantages, which are now diminishing, prompting new cooperation models.

NIO's County-to-County and Partner plans align with this logic. Since 2021, Li Bin has showcased NIO's strengths at various energy conferences, changing perceptions. NIO has become a valuable supplement to China's national public charging network and a unique addition to battery swapping.

At many events, Li Bin and Qin Lihong emphasize the mantra, 'For battery swapping, come to NIO.' Notably, over 80% of NIO's charging services cater to other brands, led by BYD (17.18%) and Tesla (13.38%). Moreover, NIO has strategic battery swapping partnerships with seven automakers, including FAW, Changan, GAC, Geely, and Chery, with new vehicles expected within two years. Technically, NIO's unreplicable capabilities surpass even Huawei's.

Regarding NIO's capital strategy, Li Bin has innovated the business model for charging and swapping infrastructure, moving beyond NIO's solo efforts. At the signing ceremony, investment from urban investment and technology companies in East China, Xi'an, Guangdong, Ningbo, Shandong, and Guizhou marked the state's leadership in driving industry progress.

There are three cooperation models: NIO as a supplier, with partners responsible for sites, power, and construction, then sharing profits; NIO as a service provider, with partners investing in equipment and sites, offering returns higher than bank deposits, according to Qin Lihong; and a guaranteed minimum income plus profit-sharing model for charging and swapping stations.

Crucially, NIO does not collaborate with individuals; all partnerships are inter-corporate.

Yu Chengdong and Li Bin: The Money Makers of China's Auto Industry?

'Making money' is undoubtedly a compliment when applied to Yu Chengdong and Li Bin, signifying their ability to create and close new business models.

In terms of valuation potential, when Changan and Huawei first signed an investment cooperation memorandum in November 2023, rumors circulated of a 250 billion yuan valuation. While the current valuation is less than half that figure, Huawei's growing presence in automotive technology, with models like the Wenjie M7 and M9 leading their respective segments, indicates further potential for growth.

Similarly, NIO's expanding battery swapping network enhances its value and partnerships with other automakers, offering a safer haven amidst industry competition. It also bolsters the potential of NIO's Leda brand and a third, unnamed brand.

The more charging and swapping stations, the more partnerships and consumer awareness, as they serve as both energy hubs and billboards. As Leda targets families, competing with Tesla, its presence will expand where Tesla is, driving sales growth.

So, the new B-end landscape has emerged, but what about the C-end consumer moat?

A comparative analysis, referencing traditional joint ventures prevalent in China for decades, offers insights.

Commonalities include cost reduction through operational optimization. Traditional joint ventures like Volkswagen and Toyota have reduced prices by over 50% in a decade, and AITO and NIO will likely follow suit.

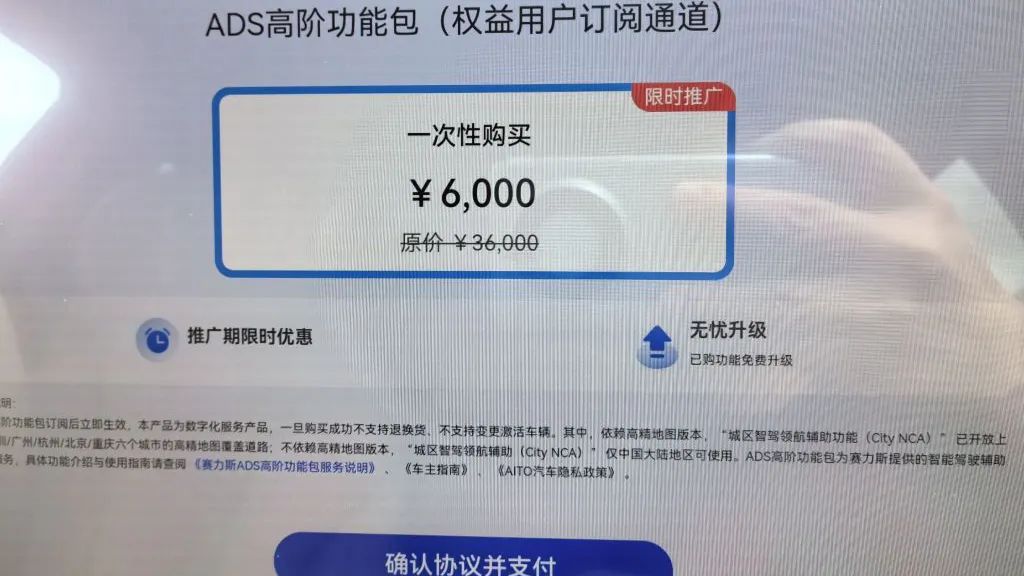

Huawei's influence has democratized intelligent driving in China. Previously, features like Xiaopeng's Intelligent Driving Package were optional, but now they're often included or offered for free, as with ZEEKR. If Tesla's FSD launches in China, it's expected to be significantly cheaper than globally.

Moreover, the upcoming Wenjie M7 Pro, featuring Huawei's Kunpeng ADS Basic Edition, may set a new price low.

Sales and service costs are also declining. Traditional dealerships were notorious for poor customer service, but the introduction of digital, proactive services via HarmonyOS and competition from new forces like NIO and Lixiang One have improved the experience. Tactics like price hikes and deceptive sales are becoming less common.

NIO's County-to-County plan addresses the growing importance of charging infrastructure as EV penetration rises. Factors like charging speed, power output, and cost significantly impact time and emotional costs. For instance, Ideal Car's 5C fast charging technology mitigates these issues by efficiently managing charging loads.

Emotional costs, exemplified by holiday travel chaos, are also being addressed through strategic infrastructure planning.

So at this time, with the addition of a third-party organization like NIO to form a supplementary network, Tesla China owners will surely understand the benefits immediately. Among the current NIO highway stations, the most frequently seen are Tesla vehicles undergoing fast charging. Compared to the public charging pile network, NIO's stability and charging speed are no longer alternative options but the preferred choice.

In addition, during the communication meeting, we also asked Li Bin about the timing. Why was the "county-to-county connectivity" introduced in August 2024? After all, if it was planned early on, NIO's style of doing things would have led to early leaks or even announcements of related information.

Li Bin's response was, "As we received more and more user demands and built more and more stations, this new logic emerged."

At the 2024 user annual meeting, a user suggested that Chongqing has 38 districts, with major urban areas already covered, but many counties and districts still lacked battery swap stations. Could swap stations be built there? Many live chat comments during the broadcast also asked this question. The demand for battery swapping in suburban counties and hometowns has also increased, giving rise to the concept of "county-to-county connectivity".

Closing Remarks

In summary, we can clearly see that Yu Chengdong and Li Bin have each established two new chessboards. Huawei's vision goes beyond the expected value of 115 billion yuan, and the same applies to NIO's "county-to-county connectivity" initiative, which also has the potential for a multi-billion-yuan valuation.

Through technological advancements, both companies have created technological and capital chessboards. This aligns with the current tone and demand for rejecting low-quality competition.

Consumers will be the biggest beneficiaries, as the driving effect of leading enterprises is quite evident. For example, in terms of intelligence, Huawei's rise has actually increased industry recognition and lowered overall pricing. Similarly, NIO's rise has made all automakers fully aware that to create a moat, they must either accumulate significant reserves early on, like BYD, to gain a first-mover advantage

or walk on two legs faster. Again, taking Huawei's BU division as an example, starting from 2024, the competition we can see goes beyond sales figures and the number of smart driving cities launched. The number of HarmonyOS SmartRide fast-charging stations is increasingly featured in promotional materials, with an average of 10 minutes to reach a station in urban areas and 20 minutes on highways. This breakthrough in marketing strategies is making people reassess new energy vehicles.

It's not just an arms race in technology and pricing; it's a restructuring of the energy system.