ZEEKR: New model changes 'betray' old car owners, will it usher in a rebirth?

![]() 08/22 2024

08/22 2024

![]() 466

466

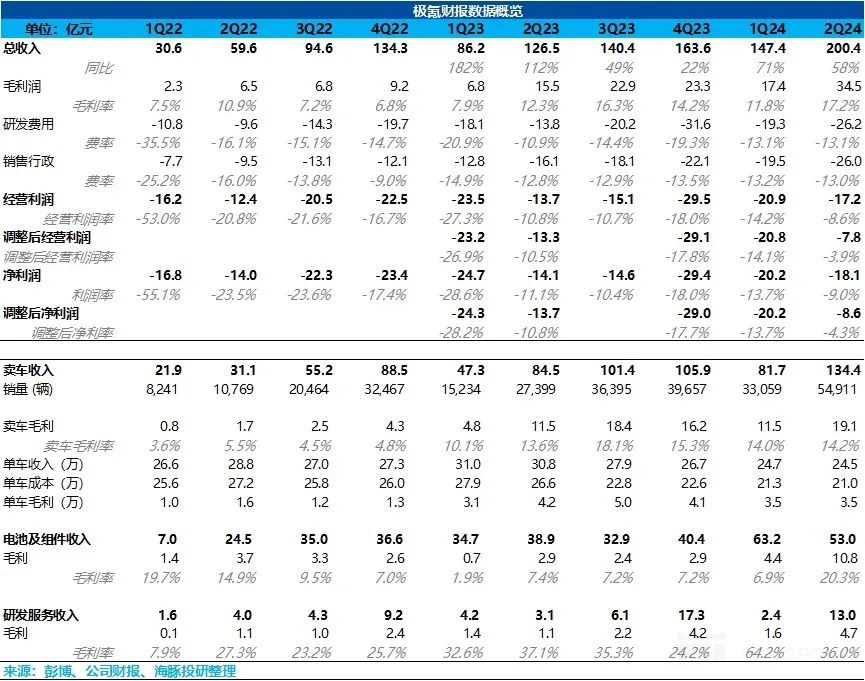

ZEEKR released its Q2 2024 financial report before the US market opened on August 21, 2024, Beijing time.

Let's review the key information:

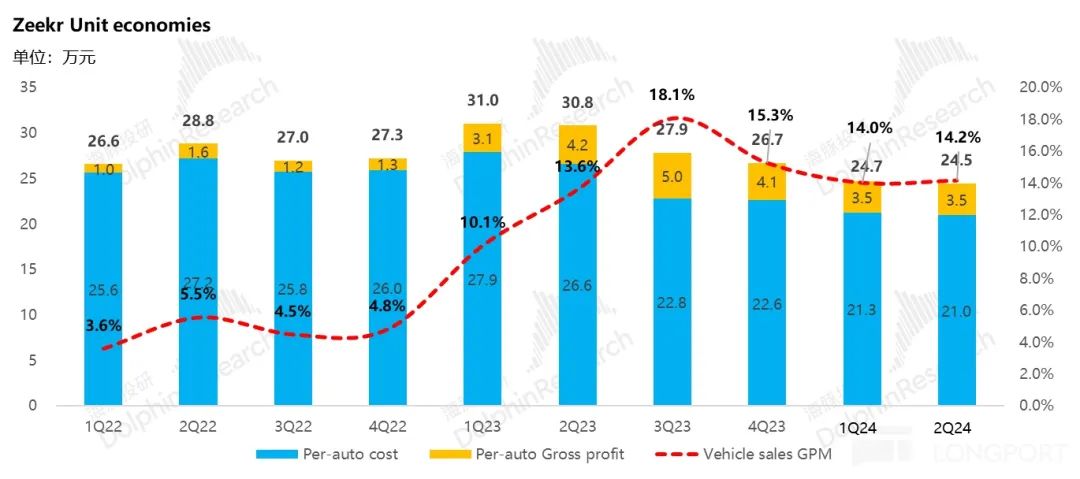

1. Gross margin of auto sales largely meets expectations: The gross margin for the auto business in Q2 was 14.2%, broadly in line with market and Dolphin Insights' expectations of 14%-14.5%. Although the average vehicle price decreased due to a reduction in the proportion of high-priced ZEEKR 009 in the model mix, the average cost per vehicle decreased due to a sequential increase in sales volume, resulting in some economies of scale. Consequently, the gross margin for the auto business increased slightly by 0.2% quarter-over-quarter.

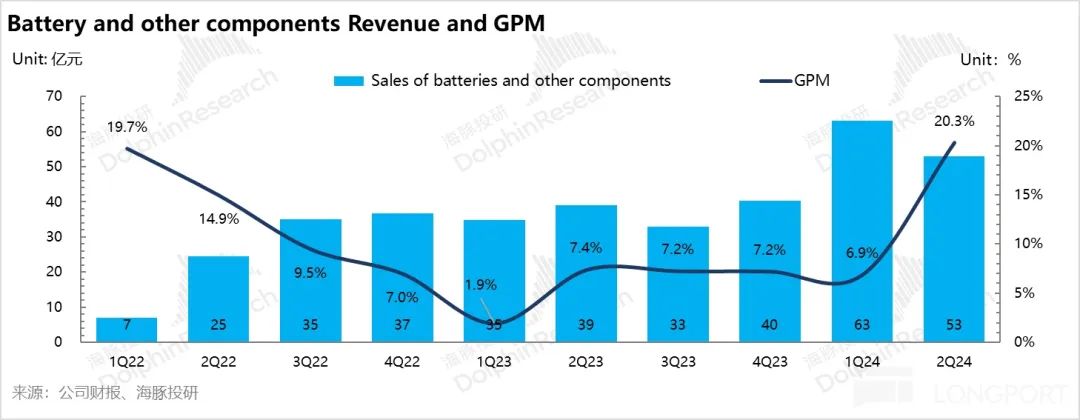

2. Overall gross margin increased significantly quarter-over-quarter: The overall gross margin increased by 5.4% quarter-over-quarter to 17.2%, primarily driven by a substantial increase in the gross margin of the battery and components business. This may be due to an increase in battery and component sales to overseas markets, contributing to the improvement in gross margin. However, this business is primarily driven by related-party transactions, and the sustainability of the gross margin is uncertain. The focus remains on the auto business.

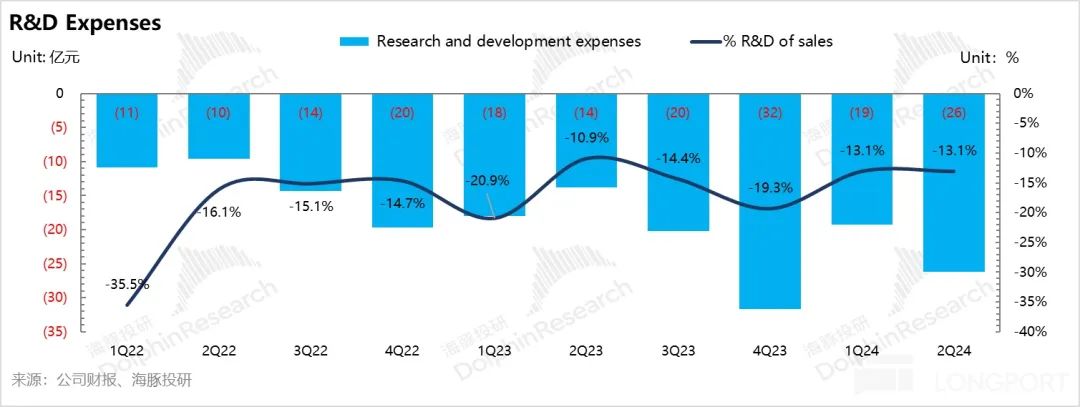

3. Operating expenses increased significantly this quarter, primarily due to the recognition of SBC expenses related to the IPO: Operating expenses increased by RMB 1.35 billion quarter-over-quarter, primarily due to the recognition of RMB 944 million in SBC expenses related to the IPO, compared to RMB 3 million in the previous quarter. Adjusting for this, actual operating expenses increased by approximately RMB 410 million, which is manageable, mainly due to the increase in R&D personnel and the expansion of sales channels.

4. Substantial reduction in adjusted operating loss and net loss: Excluding the impact of SBC, both operating profit and net profit showed substantial reductions in losses this quarter, primarily due to the significant increase in gross margin, driven by the battery and components business.

5. Increase in cash and cash equivalents: Cash and cash equivalents increased by RMB 4.3 billion quarter-over-quarter to RMB 8.05 billion, primarily due to the reduction in losses, which slowed down cash consumption, and the contribution from IPO financing (raising approximately USD 440 million).

Dolphin Insights' Perspective:

From the second-quarter results, our primary focus on ZEEKR remains on its core auto business, with a gross margin of 14%, which is generally in line with Dolphin Insights' and market expectations of 14%-14.5%.

Although the proportion of the highest-priced model, ZEEKR 009, declined in the model mix, dragging down the average vehicle price, the strong sales of ZEEKR 001 drove a recovery in sales volume and some economies of scale, resulting in a slight increase of 0.2% in the gross margin quarter-over-quarter.

In terms of expenses, while operating expenses increased significantly quarter-over-quarter (by RMB 1.35 billion), this was primarily due to the recognition of RMB 944 million in SBC expenses related to the IPO, compared to RMB 3 million in the previous quarter. Adjusting for this, actual operating expenses increased by approximately RMB 410 million, which is manageable, mainly due to the increase in R&D personnel and the expansion of sales channels.

After adjusting for the impact of SBC, profits showed a substantial reduction in losses, primarily due to the quarter-over-quarter increase in ZEEKR's gross margin, which was mainly driven by the increase in the gross margin of its battery and components business (from 6.9% in the previous quarter to 20.3% this quarter), possibly due to an increase in the proportion of ZEEKR battery packs sold overseas.

However, as this business is primarily driven by related-party transactions, the sustainability of the gross margin is uncertain, and revenue growth ultimately depends on the success of Geely's new energy vehicles and ZEEKR's sales volume. Currently, Dolphin Insights' primary focus on ZEEKR remains on its auto business, so the overall performance of this quarter can only be considered as broadly in line with expectations.

Considering the current share price, if we use a conservative sales forecast of 180,000-200,000 vehicles for 2024 (assuming no incremental growth in overseas sales for conservatism, but ZEEKR is reportedly considering using Geely's existing European factories to bypass the 20% tariff, supporting its 30,000 overseas sales target for this year), the corresponding 2024 P/S multiple would be only 0.6-0.7 times, indicating a low valuation. While the reduction in losses this quarter (primarily driven by the battery and components business, although its sustainability is uncertain) and the increase in cash and cash equivalents (primarily due to IPO financing) are positive for ZEEKR, which is currently trading at a low valuation, the long-term upside potential of the share price ultimately depends on the expectations for the core auto business.

Below is the main text

I. ZEEKR's auto gross margin largely meets expectations this quarter

From a revenue perspective, ZEEKR's business is primarily divided into three segments: auto sales, battery and other component sales, and technical service revenue.

Among these, the auto sales business is ZEEKR's core segment and accounts for the largest share of revenue. Let's first review the financial performance of ZEEKR's auto sales business this quarter:

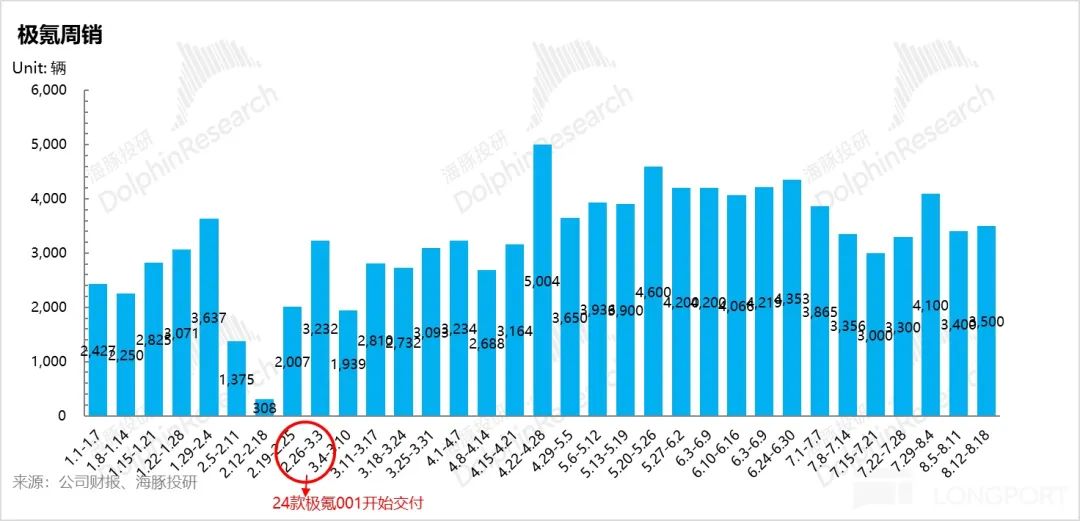

With the contribution of the new ZEEKR 001 model, ZEEKR has recovered from the operating trough in Q1, with sales increasing by 66% quarter-over-quarter. However, as sales volumes are known, the market is more concerned about the gross margin of the auto business:

The gross margin of the auto business was 14.2% in Q2, a slight increase of 0.2% quarter-over-quarter, which is generally in line with market expectations.

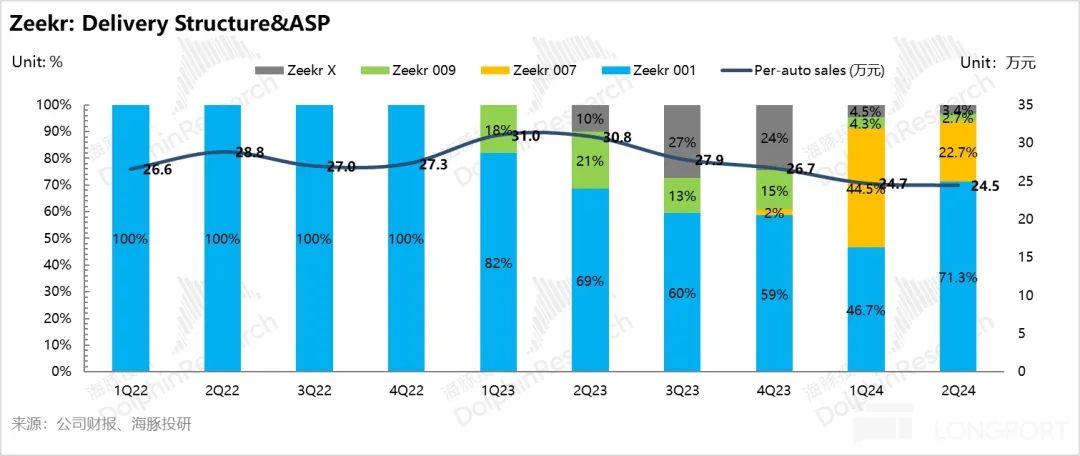

a) Average vehicle price: Decreased by RMB 2,000 quarter-over-quarter to RMB 245,000 this quarter

The average vehicle price was RMB 245,000 in Q2, RMB 2,000 lower than the RMB 247,000 in Q1. This was primarily due to changes in the model mix: The proportion of the highest-priced model, ZEEKR 009, continued to decline, from 4.3% in Q1 to 2.7% in Q2, dragging down the average vehicle price. However, the proportion of ZEEKR 001 increased from 46.7% in Q1 to 71.3% in Q2, partially offsetting the decline in the proportion of ZEEKR 009, resulting in a decrease of RMB 2,000 in the average vehicle price to RMB 245,000 this quarter.

b) Average vehicle cost: Decreased by RMB 3,000 quarter-over-quarter to RMB 210,000

The actual average vehicle cost was RMB 210,000 in Q2, a decrease of RMB 3,000 quarter-over-quarter. This was primarily due to the strong sales of the new ZEEKR 001 model, which drove a recovery in sales volumes (up 66% quarter-over-quarter), reducing the average cost per vehicle and releasing some economies of scale.

c) Average vehicle gross profit: Largely unchanged quarter-over-quarter

Each vehicle sold in Q2 generated a gross profit of RMB 35,000, largely unchanged quarter-over-quarter. The gross margin on vehicle sales increased slightly from 14% to 14.2% quarter-over-quarter due to the decrease in the average cost per vehicle.

II. Sales volumes increased by 66% quarter-over-quarter in Q2, primarily driven by the new ZEEKR 001 model

In Q2, after the launch and delivery of the new ZEEKR 001 model in March, ZEEKR's monthly sales volumes showed a rapid recovery trend. However, as the competition intensified and orders gradually declined, sales volumes fell back to around 10,000 units in July. To regain growth momentum (management previously guided for monthly deliveries of 20,000 units in Q3 and 30,000 units in Q4) and achieve the full-year sales target of 230,000 units, ZEEKR took several measures:

1) Rapidly launched new model variants with further price reductions: ZEEKR launched a new variant of the ZEEKR 009 in July and the 2025 model year variants of the ZEEKR 001 and ZEEKR 007 in August, all featuring further price reductions on top of the previous variants. For example, the starting price of the 2025 model year ZEEKR 001 was reduced by RMB 10,000 compared to the 2024 model year variant.

2) Addressed the shortcomings of the ZEEKR 001's autonomous driving capabilities and introduced the second-generation self-developed 'Golden Brick' battery for the ZEEKR 007: The 2024 model year ZEEKR 001 had significant shortcomings in autonomous driving, using an outdated Mobileye solution. However, the 2025 model year variant features an upgrade to dual Orin-X chips (except for the entry-level version), with a total computing power of 508 TOPS. The ZEEKR 007 also features standard lidar and dual Orin X chips, along with the second-generation 'Golden Brick' battery, which charges from 10% to 80% in just 10 minutes at a maximum charging rate of 5.5C.

3) Accelerated the launch of new models: ZEEKR's mid-sized SUV, the ZEEKR 7X, will be launched in September, and its compact MPV, the ZEEKR Mix, will be launched in October.

Assuming ZEEKR maintains its full-year delivery guidance of 230,000 units and its auto business gross margin guidance of 15%, this implies:

1) The auto business gross margin in H2 2024 will continue to increase compared to H1, primarily due to an increase in the proportion of the high-priced and high-margin ZEEKR 009 variants and contributions from overseas sales. In H1 2024, only 3,000 vehicles were exported, while management guidance is for 30,000 exports for the full year, implying that most exports will occur in H2.

2) Average monthly deliveries will reach 25,000 units over the next five months of 2024: This will be driven by contributions from exports (implying 5,000 monthly exports in H2 based on management's guidance of 30,000 exports for the full year) and new and updated models.

Now that we've covered ZEEKR's primary auto business, let's look at the performance of its other segments:

III. Substantial increase in gross margin of battery and components business

Revenue from the battery and components business was RMB 5.3 billion in Q2, approximately RMB 1 billion lower quarter-over-quarter, primarily due to a decrease in battery module sales in the domestic market. However, the gross margin of this business reached 20.3%, an increase of approximately 13.4% quarter-over-quarter from 6.9%, which also directly contributed to the increase in the company's overall gross margin from 11.8% in the previous quarter to 17.2% in this quarter. Dolphin Insights believes this may be due to an increase in the proportion of ZEEKR battery packs sold overseas, which typically command higher gross margins.

Dolphin Insights previously discussed the significance of this business for ZEEKR in our in-depth analysis 'ZEEKR: Is Geely's Overindulgence Toxic or Beneficial?'. While this business is primarily driven by related-party transactions, and the sustainability of the gross margin is uncertain, the ultimate success of this business depends on the performance of Geely's new energy vehicles and ZEEKR's sales volumes, which will ultimately be realized through the value of the auto manufacturing segment.

However, Dolphin Insights acknowledges that ZEEKR has been relatively fast in innovating and iterating its battery business. The production facility for the first-generation 'Golden Brick' battery, Quzhou Jidian, was completed in Q4 2023 and was integrated into the 2024 model year vehicles. However, the second-generation 'Golden Brick' battery was launched in August, featuring faster charging speeds (up to 5.5C, charging from 10% to 80% in just 10 minutes) and is integrated into the 2025 model year ZEEKR 007, enhancing the competitiveness of the model.

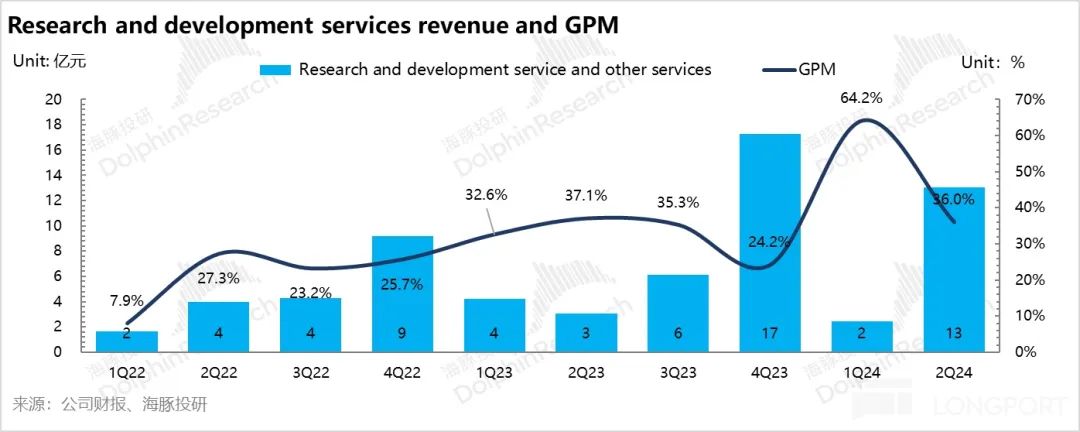

IV. High volatility in R&D service revenue and gross margin

In the second quarter, R&D service revenue reached 1.3 billion yuan, an increase of 1.15 billion yuan quarter-on-quarter, while the gross margin for R&D services was 36%, a significant decline from 64.2% in the previous quarter.

Similar to the battery and component business, Zeekr's R&D services are primarily provided to Zeekr's internal operations and affiliated companies within the Geely Group. However, unlike the battery and component business, which generally maintains steady growth alongside sales, R&D service revenue exhibits greater volatility. The quarterly increase in R&D service revenue was primarily driven by an increase in service revenue provided to affiliates.

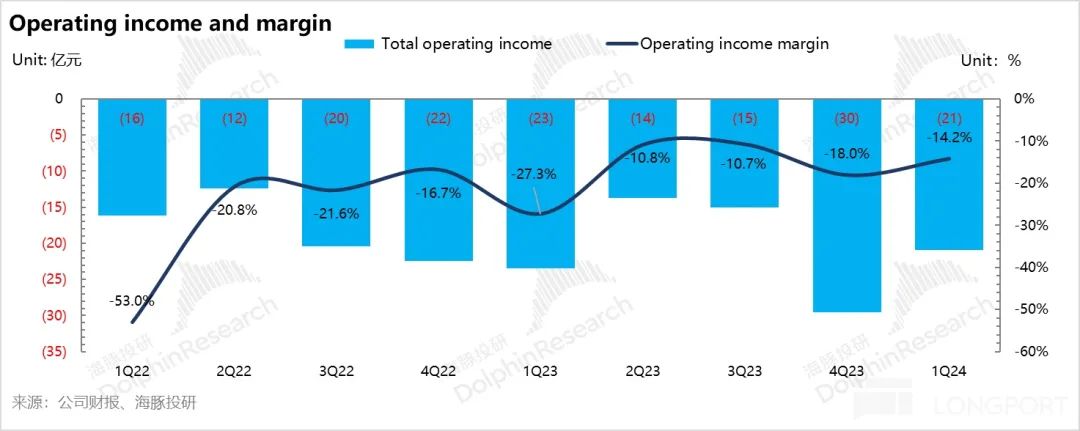

V. Substantial increase in operating expenses due to high SBC recognition related to IPO in the quarter

From an expense perspective, while operating expenses increased significantly quarter-on-quarter (up 1.35 billion yuan), this was primarily attributed to the recognition of 944 million yuan in SBC expenses related to the IPO in the quarter, an increase of 940 million yuan from the previous quarter's 3 million yuan. The actual operating expenses were -4.3 billion yuan, with a quarter-on-quarter increase of approximately 410 million yuan, which is considered manageable.

1. R&D expenses increased to 2.62 billion yuan in the quarter

Zeekr's R&D expenses in the second quarter reached 2.6 billion yuan, an increase of 700 million yuan quarter-on-quarter, mainly due to the increased recognition of SBC expenses related to the IPO and the expansion of the R&D team.

Compared to other emerging automakers, Zeekr boasts comprehensive self-research and production capabilities in batteries, motors, and controllers. Since 2023, Zeekr has focused on developing the core battery cells and 800V electric control systems, giving its vehicles an advantage in long-range driving and powerful performance (including faster charging speeds with the second-generation Golden Brick battery, featured in select versions of the 007 model).

In terms of autonomous driving, Zeekr's previous flagship model, the Zeekr 001, had noticeable shortcomings in hardware, using a Mobileye solution with only 48 Tops of computing power and being delivered in black. However, Zeekr has addressed this issue by upgrading the autonomous driving hardware in the Zeekr 001 models launched in August. Except for the entry-level version, all other models now feature dual Orin-X chips instead of two Mobileye EyeQ5H chips, boosting total computing power to 508 TOPS and including standard lidar.

Regarding the rollout of autonomous driving capabilities, Zeekr has accelerated the deployment of Navigated Zone Pilot (NZP) on highways, with a cumulative total of 169 cities enabled as of June (an increase of 104 cities since April). It is expected that NZP will be available in unmapped cities by the end of the year. While Zeekr lags behind some emerging automakers and Huawei in this area, it is working to catch up.

Furthermore, Zeekr plans to equip its next-generation vehicles, set to launch in 2025, with NVIDIA's Driver Thor chip, offering 2000 TOPS of computing power. This year, Zeekr is expected to increase investment in its self-developed autonomous driving algorithms, with an annual R&D budget of approximately 8 billion yuan.

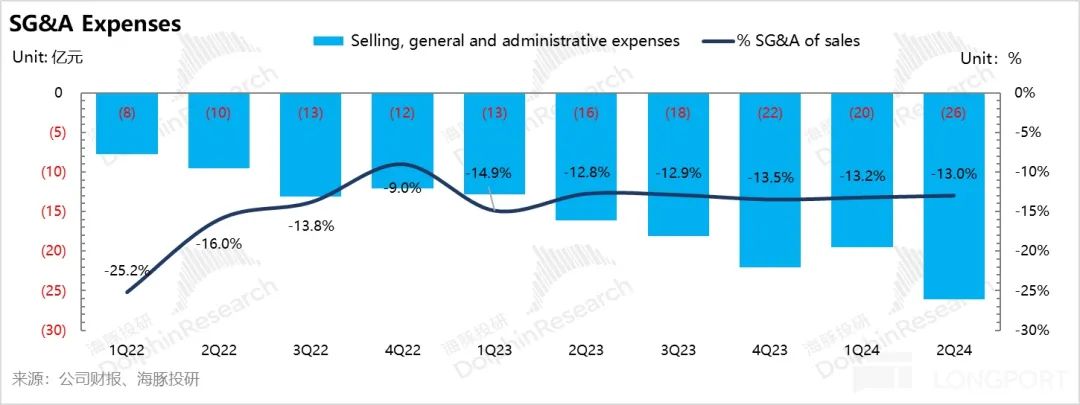

2. Sales and administrative expenses increased to 2.6 billion yuan in the quarter

Sales and administrative expenses for the second quarter amounted to 2.6 billion yuan, an increase of approximately 600 million yuan from the previous quarter's 2 billion yuan. This growth was primarily driven by increased SBC expenses related to the IPO and the expansion of sales channels.

The operating loss for the quarter was -1.7 billion yuan. However, after excluding the 940 million yuan in SBC expenses related to the IPO, the adjusted operating profit and operating profit margin showed significant improvement. This improvement was primarily driven by the quarter-on-quarter increase in Zeekr's gross margin, which was in turn fueled by the improvement in the gross margin of Zeekr's battery and component business (from 6.9% in the previous quarter to 20.3% in the current quarter).