Touching Douyin to cross the river, Kuaishou got its sleeves wet

![]() 08/22 2024

08/22 2024

![]() 521

521

Author | Wu Xianzhi, Wu Kunyan

Editor | Wang Pan

From Warren Buffett's "Buffalo Evening News" to today's popular short dramas and short videos, content forms evolve with changes in media, but regardless of the era, "grabbing eyeballs" has always been the starting point of all commercial value.

However, as live streaming e-commerce begins to seek shelf increment, the myth of short drama ad investment bursts, and as platforms reach their ceiling in terms of total user time spent, the commercial upper limit of content platforms is beginning to face rigorous scrutiny from the market.

As a domestic infrastructure-level short video platform, Kuaishou released its second-quarter 2024 financial report on August 20th, providing us with an excellent opportunity to reassess the content and traffic businesses.

The financial report shows that Kuaishou's revenue in the second quarter was 30.98 billion yuan, an increase of 11.6% year-on-year; adjusted net profit was 4.68 billion yuan, a substantial increase of 73.7% year-on-year, with adjusted profit margin reaching 15.1%.

Since reversing its first-ever net loss last year, Kuaishou has gradually shifted its focus from high growth to profitability amid increasingly fierce competition.

It is well known that changes in revenue structure are key to Kuaishou's entry into a period of healthy growth: the proportion of e-commerce revenue, excluding live streaming, has continued to increase, thereby raising the cash-in level of the high-margin advertising business.

However, Kuaishou's e-commerce GMV growth rate declined sequentially for two consecutive quarters this quarter. On the other hand, high-margin live streaming revenue, which had been a concern for the market, showed signs of stabilization, with a slight narrowing of the sequential decline.

Additionally, the internal and external cycles of advertising revenue were described in the financial report as "achieving steady growth" and "growing significantly," respectively, also corroborating that e-commerce has somewhat held back overall growth.

Kuaishou is increasingly resembling an e-commerce company, and its valuation by the market will largely be based on GMV indicators. However, for now, this mega-supermarket's daily sales are still insufficient to qualify as a "mall." As it explores shelf increment, how it narrates its second growth story will be a significant test in the coming period.

Kuaishou Explores the "Water Level"

"We believe that the penetration rate of a newspaper is an important indicator of the strength of the business." The reason why the "Buffalo Evening News" is one of Warren Buffett's "seven saints" stems from its high regional penetration rate, i.e., distribution rights and gateway effects.

However, in the current era where the internet has eliminated the marginal cost of accessing information and content, high penetration rates have long since disappeared. The key to the growth of platforms represented by Kuaishou lies in the aforementioned key "water levels" such as e-commerce GMV, users, and user hours.

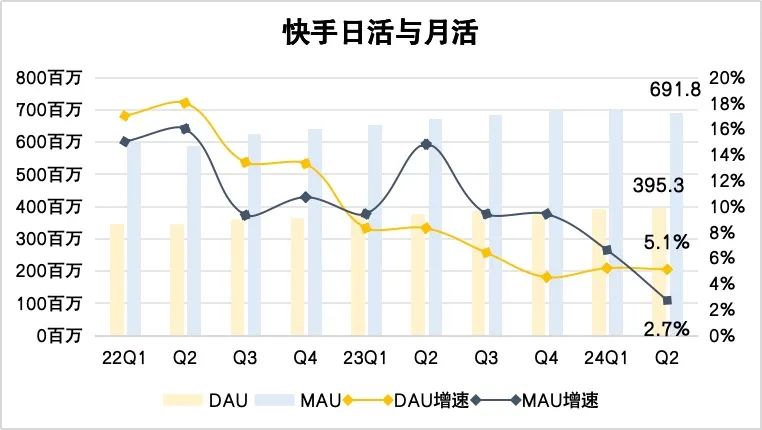

On the demand side, we can see that while Kuaishou's MAU in the second quarter increased by 2.7% year-on-year to 691 million, it declined slightly sequentially. On the other hand, Kuaishou's total user hours increased by 9.5% year-on-year, potentially due to the steady growth in its DAU. The financial report shows that Kuaishou's DAU increased by 5.1% year-on-year to 395 million in the quarter, with a slight sequential increase.

User numbers are the cornerstone of the platform, and trading investment for growth is a "traditional art" among content communities, including Kuaishou. This quarter, its marketing expenses increased by 7% from the previous quarter's 9.4 billion yuan to 10 billion yuan, accounting for 32.4% of total costs, roughly the same as in previous quarters.

Overall, there has been little change in the "water level," and the space for commercialization naturally depends on the performance of various businesses. For the second quarter, we can observe two positive changes on Kuaishou: the live streaming business, as the "infrastructure" of the short video platform, has largely transitioned through its adjustment phase, and the advertising business has maintained a high growth rate.

For different platform products, the contraction of live streaming businesses is an unstoppable trend, and Kuaishou is no exception. This quarter, Kuaishou's live streaming business remained tumultuous amidst regulatory adjustments, but showed signs of halting revenue declines.

The "establishment of regional teams and the introduction of high-quality new guilds" mentioned in the financial report has also become a crucial step for Kuaishou to optimize its live streaming business. As of the end of the second quarter of 2024, the number of its signed guild organizations increased by nearly 50% year-on-year, and the number of signed guild anchors increased by 60% year-on-year. The innovation in operating models is directly reflected in business profitability, with Kuaishou's live streaming operating profit increasing by 48.3% year-on-year to 4.5 billion yuan this quarter.

In terms of online marketing services, Kuaishou's revenue for the quarter increased by 22.1% year-on-year to 17.5 billion yuan, with a sequential increase of 5%. This is remarkable given that Kuaishou's user base is primarily distributed in new-tier cities, and the pre- and post-Spring Festival periods are typically peak seasons for information streams. Behind this lies the gradual release of traffic value and consumption potential in lower-tier markets represented by new-tier cities.

Kuaishou's rise was fueled by capturing the trend of small-town youth entering an era of personalization at the content consumption level. The flip side of this "Lao Tie" trend is that cultural elements such as human connections and rural curiosity, once overlooked by mainstream media, have entered the public domain, shaping the tone of Kuaishou's platform.

According to the National Development and Reform Commission, China's urbanization rate of permanent residents has reached 66.16%. A notable trend is that as villages and towns urbanize, small-town youth are becoming new elites in these areas. Moreover, under the influence of mobile internet, the "urbanization" of short videos is faster than that of cities.

It's also worth mentioning that AI took up a considerable portion of Kuaishou's earnings call that evening when the financial report was released. In fact, technology-driven growth represented by AI is also one of the main reasons for Kuaishou's significant growth in its advertising business.

For both external advertising and internal e-commerce traffic acquisition, AIGC's most notable effect is reducing advertisers' costs and accelerating material consumption in ad placements. The financial report reveals that the peak daily consumption of AIGC marketing materials by Kuaishou exceeded 20 million yuan this quarter, doubling from the previous quarter. This shows that large model tools, led by Keling and Ketu, are gradually deepening their penetration into the supply side.

Facing little change in the "water level," two of Kuaishou's three major business segments have made relatively successful attempts to explore upwards.

E-commerce Under Pressure, Local Life Seeks External Assistance

In addition to live streaming and online marketing services, other service businesses such as e-commerce and local life are the other two business segments driving Kuaishou's growth.

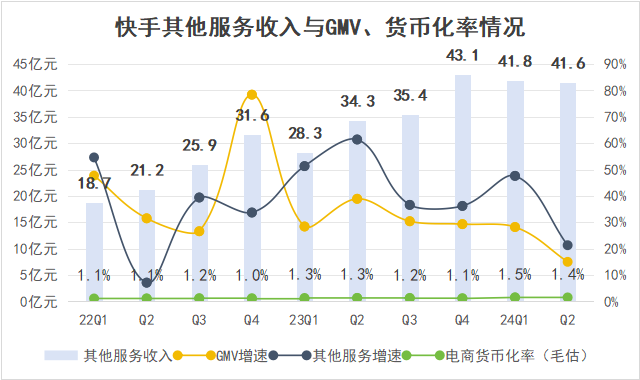

Kuaishou's other service businesses did not perform notably well this quarter, with quarterly revenue of 4.16 billion yuan, an increase of 21.3% year-on-year, a significant decline from the 61.4% growth rate in the previous quarter. This quarter's financial report covers 618, reflecting the state of the e-commerce segment. As of June 30, Kuaishou's quarterly GMV was 305.25 billion yuan, a year-on-year increase of 15%, compared to a growth rate of 38.9% in the previous quarter.

In a horizontal comparison, as a relatively inexperienced player in e-commerce, Kuaishou's GMV growth rate seems to be facing challenges this quarter.

Although this year's 618 was challenging, the industry still maintained decent growth. A Goldman Sachs report mentions that during the entire 618 promotion period from May 20th to June 18th, Taobao's GMV growth rate was between 10%-15%, JD.com's was below 10%, Pinduoduo's was between 15%-20%, and Douyin's exceeded 20%.

Considering that among the aforementioned platforms, Kuaishou's e-commerce GMV growth rate is lower than that of Douyin, which has a higher base, a growth rate of 15% can only be considered average. Compared vertically with previous quarters, the decline in both other service revenue and GMV growth rates is partly due to two supply-side challenges, in addition to macroeconomic factors.

The conversion method of live streaming e-commerce takes up a relatively high proportion of merchants' gross margins, and the high return and exchange rates further exacerbate this situation. Another challenge is the high proportion of white-label or non-brand-name products. In the context of brands regaining their voice during this year's 618, Kuaishou's e-commerce faces even more severe challenges than before.

Furthermore, the ongoing price competition in the external environment has significantly suppressed Kuaishou's e-commerce monetization rate. In the first two quarters of this year, Kuaishou's e-commerce monetization rates were 1.5% and 1.4%, respectively, compared to Pinduoduo, another player in the white-label market, which has maintained a monetization rate of roughly 4.5%-5% this year, with higher monetization rates during promotional periods than in off-peak quarters.

In contrast, during five of the past ten quarters with major promotions, Kuaishou's monetization rate remained flat or declined from the previous quarter.

A supply chain executive stated, "During promotional periods, only couriers lose money, platforms earn the most, and merchants can at least break even by reducing inventory, considering small losses as wins." In the context of Tmall and Pinduoduo successively shifting towards GMV orientation and increasing monetization rates, Kuaishou e-commerce is truly a "conscientious" platform.

Both Kuaishou and Douyin face pressure on live streaming e-commerce, and the former is also trying to follow Douyin e-commerce in complementing its general shelf capabilities. In the second quarter, Kuaishou's general shelf field accounted for approximately 25% of its overall e-commerce business, roughly the same as the previous quarter.

Beyond e-commerce, local life is another potential growth segment. Kuaishou has two business forms in this area: one is to introduce local life giants like Meituan, which can not only address short-term supply shortages, cultivate merchant and user habits, but also facilitate traffic and service connections through cooperation.

During the earnings call, Kuaishou stated that the average daily paying users for local life services maintained a growth trend in the second quarter, with a sequential growth rate of 37%. On the merchant side, the number of active merchants and average daily product offerings increased sequentially by 22% and 33%, respectively.

The influencer ecosystem is an essential vehicle for extending live streaming communities into local life services. As Meituan continues to consolidate its content ecosystem, Kuaishou primarily serves as an external traffic source in the short term. Considering this factor, Kuaishou's core task at present is to continue investing resources and exercising patience in guiding influencers to produce content that matches services.

Compared to the previously successful blue-collar recruitment, the biggest challenge for the influencer distribution model in dining-out lies not in effectiveness but in merchant gross margin space. Traditional dining establishments have lower gross margins and cannot increase them through price hikes, making the influencer distribution model more suitable for native restaurant chains. As for the more challenging home delivery segment, Kuaishou will have to rely on cooperation with Meituan in the short term.

Overseas Profitability Imminent?

In addition to live streaming and commercialization, Kuaishou has been attempting to chart a new growth trajectory, initially through e-commerce, then local life, and also through overseas markets.

Since taking charge of Kuaishou's overseas business in mid-2022, Ma Hongbin, head of Kuaishou's Commercial Business Department, has significantly narrowed its overseas losses. In the second quarter, revenue reached 1.08 billion yuan, an increase of 141.4% year-on-year. More importantly than revenue growth, operating losses narrowed to 277 million yuan, bringing profitability within reach.

Brazil and Indonesia are Kuaishou's two most critical overseas markets. According to third-party data, as of the end of last year, Kwai had over 60 million monthly active users in Brazil, and SnackVideo had 40 million in Indonesia. With a combined user base of 100 million in these two countries, Kwai aims to replicate Kuaishou's domestic business model, first through commercialization and later through e-commerce when the time is right.

To expand its influence in these markets, Kwai sponsored the Brazilian powerhouse Flamengo soccer team this year. Cheng Ji, head of Kuaishou's international operations, previously mentioned, "After our cooperation with Flamengo, some powerful local clubs came knocking, seeking partnerships and official accounts. The situation quickly opened up."

Compared to user growth, Kuaishou's overseas commercialization process is still in its early stages. Although it has launched the advertising business module Kwai for Business and tested e-commerce in Brazil, the high fulfillment costs in Brazil and Indonesia, Kuaishou's two largest user markets, hinder its replication of the domestic white-label e-commerce route.

High fulfillment costs in Brazil stem from institutional factors, with high costs for interstate logistics. In Indonesia, high fulfillment costs are due to geographical factors, with tropical archipelagoes leading to persistently high rigid costs.

As many domestic business segments face fierce competition, Kuaishou's overseas business is clearly its most important "triple-digit" growth segment at present. This means the pressure is now on Ma Hongbin's shoulders.