Replacement crisis, a hurdle that Zeekr must overcome

![]() 08/22 2024

08/22 2024

![]() 587

587

“This year, we cannot afford any mistakes. If we make any, we will lose everything.”

Faced with the increasingly important role of intelligence in the automotive market, Zeekr Smart Technology CEO An Conghui reminded Zeekr (hereinafter referred to as Zeekr) at the beginning of this year.

Amid the transformation of the entire automotive industry through intelligence, the pressure of technological iteration has disrupted the slow pace of the previous era of gasoline-powered vehicles—where “mid-cycle updates occurred every three years and full model changes every six years.” Instead, smart cars are now experiencing rapid iteration with “monthly OTA updates, minor updates every six months, and full model changes every year.”

In this context, perhaps Zeekr was too eager to enhance its intelligence capabilities, and consumers have not yet adapted to the new iteration pace of products. Ultimately, during Zeekr's “six-month model update,” existing car owners felt “hurt.”

Zeekr's rapid model updates are necessary for survival in the automotive market competition.

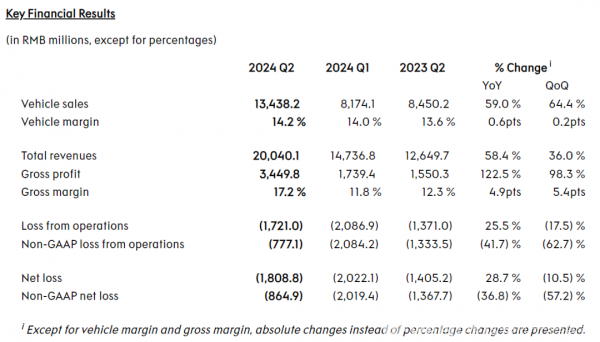

Just now, Zeekr released its second-quarter financial report for 2024. From the report, it is evident that despite the iteration of intelligence and competition in the automotive market, Zeekr has still achieved high-quality growth.

Data shows that Zeekr's operating revenue exceeded 20 billion yuan in this quarter, a year-on-year increase of 58% and a quarter-on-quarter increase of 36%. In terms of revenue quality, Zeekr's gross margin was 17.2% in this quarter, a significant quarter-on-quarter increase of 5.4 percentage points. Meanwhile, the operating loss narrowed from 2.087 billion in the previous quarter to 1.721 billion in this quarter. Focusing on the automotive business, Zeekr sold 54,811 vehicles in this quarter, a year-on-year increase of 100%. In the increasingly competitive automotive market in 2024, Zeekr has barely been affected by competition, with a stable average vehicle price of 245,000 yuan and an automotive sales gross margin of 14.2%.

More surprising than Zeekr's financial performance in this quarter is its evolution in automotive intelligence.

Zeekr has caught up with the trend of “nationwide drivability” in intelligent driving and has begun exploring AI functional design in the cockpit. These changes signify that Zeekr has finally entered the first tier of automotive intelligence.

For a long time, Zeekr's shortcoming in intelligence was not due to a lack of importance. Rather, it stemmed from the fact that Zeekr's previous blockbuster experience and manufacturing-oriented attributes made its self-developed intelligence appear to be starting from scratch, making the “shortcoming seem too short.”

An Conghui recently stated that there would be no more annual model iterations for the Zeekr 001, 007, and 009 within a year. This indicates that Zeekr's product iterations have passed the painful stage and are moving towards a more stable phase. With its intelligence capabilities improved, Zeekr has entered a phase of exploring long-term growth.

Zeekr's thirst for intelligence through three iterations in a year

Looking back on the entire “backstabbing” incident, it reveals Zeekr's difficult choice between ensuring sales and implementing intelligence.

Regarding this update, An Conghui explained, “The 2024 Zeekr 001 was already planned at the beginning of 2023, and Zeekr's plan was to launch the 2024 model in the second half of 2024. However, due to changes in the market situation, the iteration was carried out earlier this year. After the 2024 Zeekr 001 was launched in February, Zeekr learned from market research that users wanted to use self-developed intelligent driving, which is when Zeekr began self-developing the 2025 Zeekr 001 with intelligent driving capabilities.”

From An Conghui's explanation, it is evident that Zeekr's anxiety about intelligent driving capabilities was the main reason for the “hasty” model update. After this update, Zeekr's intelligent configuration has finally reached the mainstream level of the smart car market.

In terms of intelligent driving, the most significant change in the Zeekr 001 is the abandonment of the original Mobileye solution and the adoption of an industry-proven hardware architecture with lidar and two NVIDIA Orin X chips. Although high-level intelligent driving capabilities are still “futures,” Zeekr's self-developed Hao Han intelligent driving system is expected to gradually roll out advanced parking and NZP navigation-assisted driving (city NOA) features starting in October this year.

Such progress is a leap forward for Zeekr Intelligent Driving, which was still limited to highway NOA deployments in April this year.

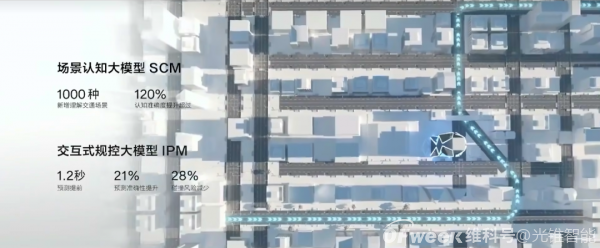

Moreover, amidst the evolving trend of end-to-end large models for intelligent driving, Zeekr's Hao Han Intelligent Driving 2.0 has also established a “segmented end-to-end” solution combining perception and control, aiming to deliver an intelligent driving experience similar to that of Huawei and Xpeng, enabling “parking space to parking space” navigation.

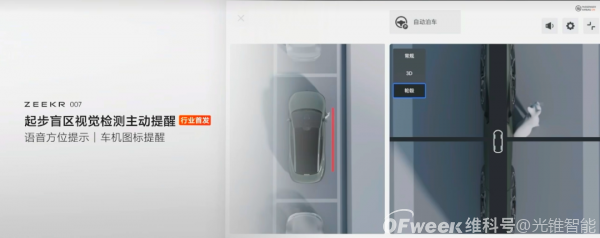

On the other side of the cockpit update, Zeekr has “finally” moved beyond the continuous enhancement phase and officially begun exploring intelligent functional design. In several major version updates over the past year, Zeekr has successively added features such as Sentry Mode, Door Open Warning, AI large model integration, customizable intelligent vehicle scenarios, and more. It has basically achieved the three goals set by Zeekr Vice President Jiang Jun for large model applications in the cockpit, proactive understanding of occupants' intentions, and customizable cockpit functions. Although the overall performance seems “somewhat patchwork,” for example, the cockpit OS supports mobile apps through a “second system” called JiTuo, effectively implementing app functionality through non-native means. However, in this updated version, Zeekr leverages the capabilities of the Kr AI large model to improve some existing functions in the smart car industry. For instance, while many smart cars display BEV images during startup, Zeekr's cockpit can proactively remind drivers of obstacles around the vehicle.

This “leapfrogging” upgrade in intelligence has allowed Zeekr to break free from the “encirclement” of competitors and fellow Geely brands that plagued its products six months ago. In 2024, as AI moves towards large-scale commercial applications, Zeekr has essentially achieved its goals of implementing high-level intelligent driving and AI large model applications in the cockpit.

However, during this over-one-year-long “catch-up” period in automotive intelligence, both Zeekr and its existing car owners have paid their respective “prices.”

In the era of smart cars, the traditional pricing model for gasoline-powered vehicles, which was purely manufacturing-based, has been split into two new dimensions: technology and manufacturing, by intelligence and new energy. From the development trend of the entire automotive market, ignoring the impact of price wars, the price of smart cars is expected to decrease with product iterations, following Wright's Law (every doubling of cumulative production leads to a roughly 15% reduction in costs) and the expansion of energy capacity. Higher cost-effectiveness of new products is a normal trend in industry development.

However, from a technological pricing perspective, Zeekr's intelligent iterations cannot offer equal rights to both new and existing car owners, amplifying the intelligence shortcomings of previous products.

Taking Huawei's HarmonyOS series as an example, Huawei's strategy is to equip different products with the same intelligent features. With the same HarmonyOS cockpit, Tuling chassis, and intelligent driving chips, new models have the privilege of obtaining the latest intelligent capabilities “first.” However, over time, as OTA updates are rolled out, all users of the HarmonyOS series will enjoy intelligent upgrades.

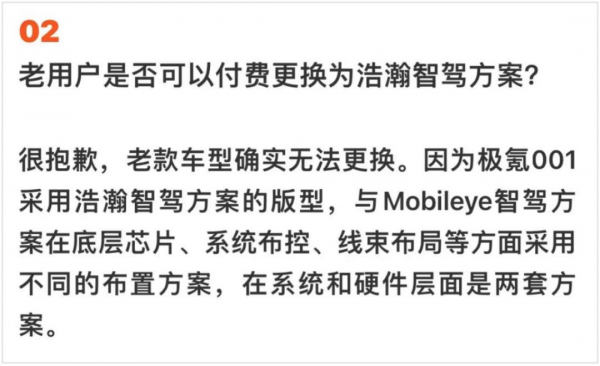

For Zeekr, the new Zeekr 001 model with the Hao Han intelligent driving solution differs from the Mobileye solution in terms of underlying chips, system deployment, and wiring harness layout, making them two separate systems at the software and hardware levels. This means that older models cannot obtain the same capabilities through OTA, leaving existing car owners feeling “inferior.”

Moreover, Zeekr did not notify existing car owners in advance of this iteration, which is not in line with the common practice of informing car owners before model updates in the automotive industry. Some car owners even found themselves with “same-price but different-quality previous-generation products” before receiving their license plates, ultimately triggering the “fuse” for this consumer rights protection issue.

So why did Zeekr proceed with this iteration despite the known risks? Ultimately, in the era of smart cars, lagging behind in product intelligence is tantamount to a “death sentence.” Under the dual pressures of current sales targets and the potential temporary sales decline triggered by iterations, Zeekr resorted to intelligence upgrades as a “turning point” strategy.

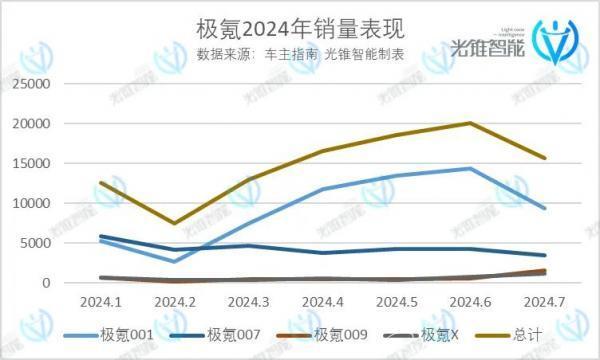

Sales data shows that Zeekr's sales have been unstable in 2024. In particular, sales of the flagship Zeekr 001, which underwent an update in March this year, only increased for four months. Meanwhile, the Zeekr 007, which directly competes with Xiaomi's SU7, the MPV Zeekr 009, and the Zeekr X, a SUV priced below 200,000 yuan, are all in a “downturn.”

At the company's overall strategic level, Zeekr plans to launch a “baby bus” and an SUV this year, in addition to its overseas expansion plans. This means that elevating the average capabilities of the company's current products has become Zeekr's top priority.

Perhaps, the “backstabbing” incident involving Zeekr's existing car owners will ultimately reach a mutually satisfactory resolution through coordination. However, through Zeekr's intelligent iterations, we can also see that even as a “rich second-generation” in the automotive industry, Zeekr has its own calculations.

Manufacturing relies on Geely, while Zeekr catches up on intelligence

Zeekr was not born as a “rich second-generation” in the automotive industry but emerged victorious in Geely's internal competition.

Chinese independent automotive brands have long believed in the theory of “more children, better fights.” Facing the need to improve the sales share of independent brands and bridge the gap with the vehicle ownership per capita of developed automotive countries, automotive brands have continuously created new brands based on product positioning, price ranges, and vehicle designs to occupy corresponding market spaces. Similar cases are abundant in the era of smart cars, such as XPeng's MONA, NIO's NIO Life, HarmonyOS's AITO, HiPhi, and EnjoyAuto, among others.

As a seasoned player in the multi-brand strategy competition during the gasoline-powered vehicle era, Geely had already made its plans when entering the new energy vehicle market.

In 2021, Geely relaunched its Blue Geely Plan, laying out a multi-brand strategy system centered on all possible positionings for the next generation of vehicles. Among them, Zeekr was officially spun off from the Lynk & Co brand, which was originally responsible for exploring high-end vehicles, gaining independent status and entering both the internal competition within Geely and China's new energy vehicle market as a high-end pure electric brand.

Zeekr's performance in this competition is evident from our previous research (see “Rich Second-Generation” Zeekr: Growing Up Alone After Glory). With a clear pursuit of electric vehicle cost-effectiveness, Zeekr's first product, the Zeekr 001, “exploded” onto the market. Notably, 13 months after its initial delivery, the Zeekr 001 surpassed sales of “34C” (BMW 3 Series, Audi A4, and Mercedes-Benz C-Class) vehicles in the same price range, successfully validating that independent brands' pure electric vehicles can secure a high-end position even when the penetration rate of new energy vehicles is less than 30%.

Zeekr's impressive start was undoubtedly supported by the “big Geely system.” For instance, in automotive research and development, Geely provided the SEA Hao Han architecture. Similarly, in production, Zeekr did not need to fully build its own factories. With a focus on product development, Zeekr launched a product line comprising six models, including sedans, SUVs (including shooting brakes), and MPVs, within just four years.

However, precisely because of Zeekr's early insights into the new energy vehicle market and its unrestricted production capabilities, its intelligence, which started from scratch, could not keep pace with sales growth.

Zeekr's emphasis on intelligence may follow a long-term path similar to Huawei's model. In intelligent driving, Zeekr invited Chen Qi, the founder of Huawei's former autonomous driving team and former head of Huawei's Autonomous Driving R&D Department, to lead the effort from the beginning. In the cockpit, the team was successively led by Zhang Song, who previously led the definition of OPPO's first X imaging chip, and Jiang Jun, former COO & Map and Data Director of Huawei Autonomous Driving.

Chen Qi

The dual Huawei-affiliated executive structure has laid a solid foundation for Zeekr's long-term competition in intelligence. However, in the early stages of Zeekr's product operations, to rapidly integrate intelligence, the priority was placed on mass production.

In intelligent driving, Zeekr partnered with Zhixing Technology and collaborated with the closed Mobileye ecosystem, offering users basic L2-level driver assistance features with 48TOPS of computing power. In the cockpit, when the Zeekr 001 was first launched, it utilized the same 820A chip as the Lynk & Co Zero Concept (the predecessor of the Zeekr 001, unveiled at the Beijing Auto Show in April 2020).

An Conghui explained this choice in an interview: “The 8155 chip was not mature enough when we were developing the Hao Han architecture, so we chose the 820A chip.”

However, in the era of rapid automotive intelligence development, conservatism can lead to outdated performance. To avoid falling behind, Zeekr had to catch up quickly.

Facing ever-increasing cockpit function demands, in July 2022, Zeekr offered free upgrades to Qualcomm's 8155 chip for car owners and began a series of continuous “bug fixes,” functional logic improvements, and new feature additions. It wasn't until the combination of the system 6.0 version and Qualcomm's 8295 chip at the end of 2023 that Zeekr officially reached the forefront of the industry in deploying large models in cockpits. In intelligent driving, facing the pressure of gradually emerging high-level intelligent driving deployments in 2023, the Zeekr 007 transitioned to NVIDIA Orin X chips combined with self-developed solutions, “barely” standing at the forefront of high-level intelligent driving deployments.

Financial data also supports Zeekr's efforts to continuously “correct” and “catch up” in its intelligence capabilities.

In terms of R&D personnel allocation, Zeekr significantly outnumbers other smart car “competitors.” Relying on Geely for its pure electric platform, excluding NIO, which spreads its R&D efforts widely, Zeekr has a higher absolute number and percentage of R&D personnel compared to XPeng, Li Auto, and NIO among new-energy vehicle startups. Meanwhile, compared to XPeng, which has always prioritized R&D investments, Zeekr's R&D investment of 8.37 billion yuan in 2023 was significantly higher than XPeng's 5.38 billion yuan.

ZEEKR relies on self-research and development, achieving a rapid transformation from "just getting by" to "industry leader" in terms of intelligence in just four years. Moving forward, as ZEEKR continues to create popular models, coupled with its next steps in R&D and expansion of marketing channels, it has entered a virtuous circle of intelligent vehicle manufacturing.

Once this virtuous circle is successfully established, ZEEKR's second phase of tasks will soon arrive.

When will the intelligent popular model emerge

"The launch of the ZEEKR brand is actually a transformation of the entire Geely system."

When he first took office at ZEEKR, An Conghui explained his responsibilities in this way: "For Geely, ZEEKR represents the future of electric vehicles." This statement implies that ZEEKR is more than just "another fighting child" for Geely. Perhaps, ZEEKR embodies the future of Geely.

It also explains why Li Shufu chose An Conghui, a man who has been by his side since the establishment of the automobile factory. In the era of smart cars, Geely hopes to replicate the success of popular models like the Volkswagen Beetle, Toyota Corolla, and Nissan Sylphy through ZEEKR, allowing the automobile brand to ultimately dominate the global market.

ZEEKR's previous approach to creating popular models has primarily focused on the vehicle itself, with a strong emphasis on cost-effectiveness as a factor. With this latest upgrade, ZEEKR is truly exploring how to create a hit in the world of smart cars.

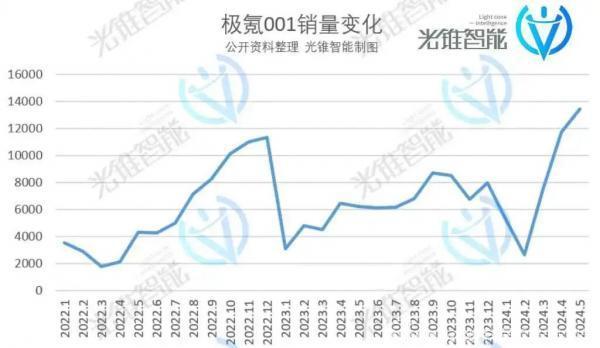

Taking the sales of the ZEEKR 001 as a reference point, we can see from the changes in sales trends that ZEEKR has made the ZEEKR 001 a popular model twice. The first time was shortly after its initial delivery, when it became a hit in 2022 by selling over 10,000 units per month, leveraging its price point and electric configuration (300,000 RMB price range + 100kWh battery pack).

In 2023, as vehicle intelligence became a certainty and lithium prices declined, the ZEEKR 001 began to face competitive pressure in its product niche. However, with a price reduction in August, sales quickly rebounded, and the regained cost-effectiveness "held up" product sales.

Nonetheless, amidst the price wars and intelligent upgrades in the smart car market, ZEEKR's rebound in 2023 did not last long. Therefore, during the mid-cycle upgrade in March 2024, the ZEEKR 001 underwent significant changes to its original configuration. This upgrade focused primarily on electrification. In terms of intelligence, the standard inclusion of LiDAR and an upgraded Qualcomm 8295 chip in the cockpit were the main highlights.

Perhaps the decline in ZEEKR's July sales was due to hitting the sales ceiling of "low intelligence" once again. In this ZEEKR update, intelligence iterations occupied two-thirds of the entire press conference. Although many current features are still "futures," and the exploration of AI cockpits is not yet deep enough, for ZEEKR, the direction of intelligence is more crucial than anything else, as its new products and costs can gradually be released along with upgrades to the HAOHAN platform.

As Lin Jinwen, Vice President of ZEEKR Intelligent Technology, mentioned in an interview in March of this year, "The SEA HAOHAN architecture not only enhances product competitiveness but also reduces costs. As products on the same platform continue to grow, integration costs will be shared. Based on the SEA HAOHAN architecture, ZEEKR will launch multiple new models this year."

As a pioneer in Geely's transformation, ZEEKR has ample safety margins in terms of funding, costs, and infrastructure development.

"In the past, our channel layout was slower than the growth rate of vehicle ownership, but this year, that situation will be completely reversed. In fact, we will complete the service network layout for one million vehicles ahead of schedule," said Lin Jinwen.

In the process of continuously and rapidly iterating intelligence, ZEEKR's current focus remains on channel development. Meanwhile, targeting the global market, "ZEEKR has signed agreements with approximately 58 countries and regions and is currently in the stage of channel development and preparation. We believe that starting from the second half of the year, ZEEKR will begin selling in many of these markets," said An Conghui.

However, in today's era where intelligence is increasingly valued over performance, if ZEEKR wants to continue replicating the legend of popular models, it must now provide more intelligent solutions.