Yu Hao Acquires Jiamei Packaging for RMB 2.28 Billion, Paving the Way for Dreame's A-Share Market Entry?

![]() 12/18 2025

12/18 2025

![]() 670

670

Can Jiamei Packaging 'Package' Dreame's Path to the A-Share Market?

Yu Hao, the founder of Dreame Technology, aims to make his mark in the capital markets.

On the evening of December 16, A-share listed company Jiamei Packaging announced that Yu Hao, founder of Dreame Technology, through his controlled shareholding platform, Suzhou Zhuyue Hongzhi, has acquired the domestic metal can leader Jiamei Packaging for over RMB 2.282 billion using a 'protocol transfer + voluntary tender' approach.

One is a rising tech star with high ambitions, the other a traditional packaging giant with steady operations but limited growth potential. This seemingly 'cross-border' alliance has instantly ignited market imagination.

Why has Dreame Technology, a star company courted by capital in the primary market, suddenly turned its gaze to the seemingly 'outdated' packaging industry? Is this RMB 2.28 billion investment a personal financial move by Yu Hao or the prelude to a carefully orchestrated capital play?

The more direct question is whether this signals that after repeatedly denying IPO rumors, Yu Hao and his Dreame have finally decided to open the door to the A-share market in a more aggressive, albeit indirect, manner?

01

A Premeditated Battle for A-Share Market Entry?

This acquisition is characterized by its sharp tactics and clear objectives, resembling a well-prepared blitzkrieg rather than a spontaneous move.

According to Jiamei Packaging's announcement, the transaction unfolds in two steps.

First, Zhuyue Hongzhi will acquire 279 million shares (29.90% of the total share capital) held by the original controlling shareholder, China Can Packaging (Hong Kong) Co., Ltd., at RMB 4.45 per share, with a transaction value of approximately RMB 1.243 billion. This step secures controlling status.

Immediately following, Zhuyue Hongzhi will issue a partial tender offer to all other publicly traded shareholders of Jiamei Packaging, excluding China Can Packaging (Hong Kong) and Fuhui Investment, aiming to acquire approximately 233 million shares (25% of the total share capital) at the same tender price of RMB 4.45 per share.

Upon completion of these two steps, Yu Hao will hold approximately 54.9% of Jiamei Packaging's shares through Zhuyue Hongzhi, becoming the new de facto controller. The total transaction value reaches RMB 2.282 billion, with funds sourced from 'self-owned and self-raised capital.'

Notably, the transaction includes an 'earnout' clause: The original controlling shareholders, Chen Min and Li Cuiling, commit that Jiamei Packaging's cumulative net profit attributable to shareholders over the next five years (2025-2029) will be no less than RMB 600 million, averaging no less than RMB 120 million per year. Failure to meet this target will result in cash compensation.

This clause demonstrates the original shareholders' confidence in the company's future development while providing Yu Hao's substantial investment with a 'safety net' to ensure stability in the coming years.

Structurally, this is a classic A-share 'shell' transaction. Securing the majority stake through a protocol transfer and then consolidating control via a partial tender offer is a clean and efficient approach. The question remains: Among thousands of A-share listed companies, why did Yu Hao specifically choose Jiamei Packaging?

At first glance, Jiamei Packaging may not seem like an attractive investment target.

The company's primary business involves providing metal packaging containers such as three-piece and two-piece cans for food and beverage companies, along with contract filling services. While its client roster includes heavyweights like Yangyuan Beverage's 'Six Walnuts,' Wong Lo Kat, Yinlu, and Dali, its own performance has plateaued.

Financial data reveals sluggish revenue growth since Jiamei Packaging's IPO in 2019.

In 2024, the company reported revenue of RMB 3.2 billion, representing only a 22% increase from RMB 2.624 billion in 2019 over five years. The pressure intensified in 2025, with revenue for the first three quarters reaching RMB 2.039 billion, a 1.94% year-on-year decline, and net profit attributable to shareholders plummeting 47.25% year-on-year to just RMB 39.16 million.

Such a traditional, slow-growing, and even declining company may, in Yu Hao's eyes, represent the 'perfect' platform for capital operations or an ideal 'shell.'

Firstly, the 'shell' is clean with stable cash flow. Despite declining profits, Jiamei Packaging's fundamentals are solid. As an industry leader, it boasts a nationwide production base and contract manufacturing network, deeply integrated with major downstream clients, ensuring stable operational cash flow.

The 2024 annual report shows net cash generated from operating activities at a robust RMB 503 million. For any tech company requiring sustained funding, this is a valuable 'cash cow' asset. Additionally, as of the end of 2024, its debt-to-asset ratio stood at 45.73%, relatively healthy for the manufacturing sector, without excessive historical burdens.

Secondly, the market capitalization is moderate, with controllable acquisition costs. Prior to the transaction's suspension, Jiamei Packaging's total market value hovered around RMB 3 billion. For a unicorn with annual revenue exceeding RMB 10 billion and a soaring valuation in the primary market, the RMB 2.282 billion control cost, while substantial, remains manageable.

Moreover, Jiamei Packaging's flat performance and growth prospects have made the original shareholders more inclined to sell. Since its IPO in 2019, the company's revenue growth has stalled, and net profit has fluctuated. The third-quarter report for 2024 even showed a year-on-year revenue decline. In the slow-growing metal packaging industry, the original controlling shareholders' decision to cash out and hand over the company to a new owner with greater growth potential is a rational business move.

Most importantly, acquiring Jiamei Packaging effectively circumvents strict regulatory scrutiny of 'backdoor listings.'

Industry insiders point out that since Dreame Technology's asset scale far exceeds that of Jiamei Packaging, any short-term asset injection would trigger the 'backdoor listing' threshold. By acquiring the company under his personal and shareholding platform names without immediately injecting Dreame's business into the listed entity, Yu Hao is seen as skillfully avoiding 'backdoor listing' regulations.

A valuable A-share listing platform may indeed be the ultimate target of Yu Hao's acquisition.

02

Dreame's Listing 'Anxiety' and 'Ambition'

Since its inception in 2017 as a Xiaomi OEM for vacuum cleaners, Dreame has rapidly emerged as a formidable competitor to Ecovacs and Roborock in the smart cleaning sector, including robotic vacuum cleaners and cordless vacuum cleaners, thanks to its core technological edge in high-speed digital motors.

The capital markets have shown strong favor, with Star institutions (translates as 'prominent institutions' but kept as is for context) like IDG Capital, Xiaomi Group, and Yunfeng Capital backing Dreame from its angel round to Series C+. In 2024, Dreame Technology's revenue reportedly reached RMB 15 billion, with the first half of 2025 alone surpassing the previous year's total.

Dreame's ambitions extend far beyond small home appliances. Its business portfolio now spans personal care, lifestyle, and other sectors. More astonishingly, in August 2025, Dreame boldly announced its foray into automobile manufacturing, planning to launch a ultra-luxury electric vehicle model rivaling Ferrari by 2027.

Both general-purpose humanoid robots and capital-intensive automobile manufacturing demand massive funding. For a growth company like Dreame, relying solely on primary market financing is insufficient to sustain such grand narratives.

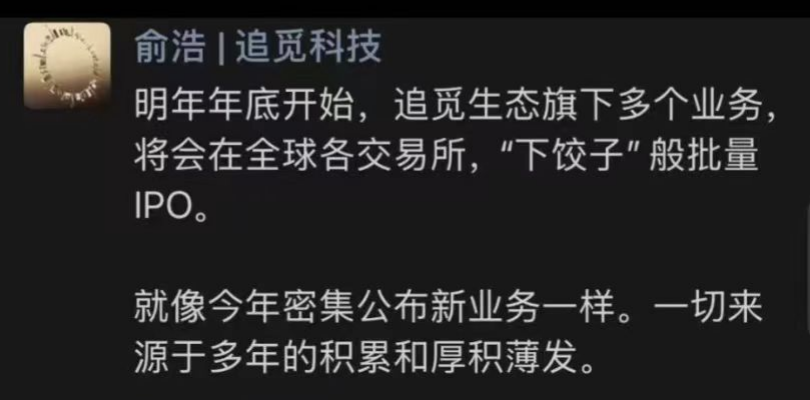

Yu Hao himself has been candid about his capital market aspirations. As early as September 2025, he proclaimed on WeChat Moments that multiple businesses under the Dreame ecosystem would commence global IPOs in batches across various exchanges starting from late 2026, resembling a flurry of listings.

However, lofty ideals clash with harsh realities. Despite repeated IPO rumors, Dreame's official stance remains 'untrue information.' No IPO counseling filings for Dreame Technology have appeared in public records from the China Securities Regulatory Commission or major exchanges.

Against the backdrop of stringent A-share IPO reviews and lengthy queuing periods, 'backdoor listing' presents an enticing shortcut for Dreame, which urgently needs financing channels.

By acquiring Jiamei Packaging, Yu Hao can bypass the prolonged IPO review process and swiftly secure an A-share financing platform. This platform not only facilitates refinancing to support core businesses but also serves as a base for future industrial chain mergers and acquisitions and asset injections.

From this perspective, the RMB 2.282 billion investment secures not just a canning factory but a 'ticket' to the A-share market and the future.

Of course, interpreting this acquisition solely as a 'shell purchase' may underestimate Yu Hao's vision. Beyond 'paving the way for listing,' there exists a parallel narrative of 'industrial empowerment.'

Dreame Technology emphasized in its response that the acquisition funds, sourced from Yu Hao and the core team's self-owned and self-raised capital, do not affect Dreame's normal operations and aim to establish a dual platform strategy of 'advanced manufacturing + capital.' Yu Hao also hopes to drive Jiamei Packaging's transformation from traditional manufacturing to 'intelligent manufacturing.'

This is no empty promise. China's packaging industry, a market exceeding RMB 1 trillion, has long been fragmented with low market concentration (CR10 below 5%). Simultaneously, the industry faces pressure to transition towards intelligence, greenness, and customization.

This aligns perfectly with Dreame's strengths. Dreame's core competitiveness lies in its self-developed high-speed motors, intelligent algorithms, and advanced robotics technologies—key elements for achieving 'intelligent manufacturing.' Applying these technologies to Jiamei Packaging's production lines for intelligent upgrades, enhancing production efficiency, and flexible manufacturing capabilities is entirely feasible.

From this angle, Yu Hao has acquired not just a 'shell' but a vast traditional manufacturing landscape ripe for transformation. He can use Jiamei Packaging as a testing ground to 'downscale' Dreame's intelligent manufacturing experience from the consumer electronics sector, creating a model for traditional industry upgrades.

If successful, this 'technology-empowered traditional manufacturing' narrative will offer greater imagination than a mere 'backdoor listing' and could secure a higher valuation for Jiamei Packaging in the capital markets.

However, the challenges of cross-sector integration are formidable. Significant cultural, managerial, and operational rhythm differences exist between tech companies and traditional manufacturing. Whether Yu Hao's team can 'parachute in' successfully and genuinely drive Jiamei Packaging towards intelligence and high-end transformation remains to be seen over time.

The RMB 120 million annual net profit earnout, while providing a short-term safety net for Yu Hao's investment, also imposes constraints on Jiamei Packaging's original management team.

Against the backdrop of macroeconomic fluctuations and downstream beverage market demand volatility, maintaining stable profitability for five consecutive years is no easy feat. Failure to meet profit commitments, while compensated in cash, could tarnish the listed company's market image and stock price performance, subsequently affecting Yu Hao's subsequent capital operation rhythm (translates as 'pace' but kept as is for context).

With only one year remaining until Yu Hao's self-proclaimed 'flurry of IPOs' in 2026, time will soon reveal whether he can navigate the refurbished 'Jiamei vessel' to carry Dreame's ambitions towards the vast capital ocean.

- THE END -