Bilibili: Xiaohongshu Competes for Users, Games Becoming the Key to Bilibili's Future?

![]() 08/23 2024

08/23 2024

![]() 605

605

Bilibili's second-quarter performance was decent, but it is currently in its "bonus period." Based on the cost reduction and efficiency improvement trends reflected in its financial reports, turning a profit in the next quarter is almost certain.

Detailed Analysis

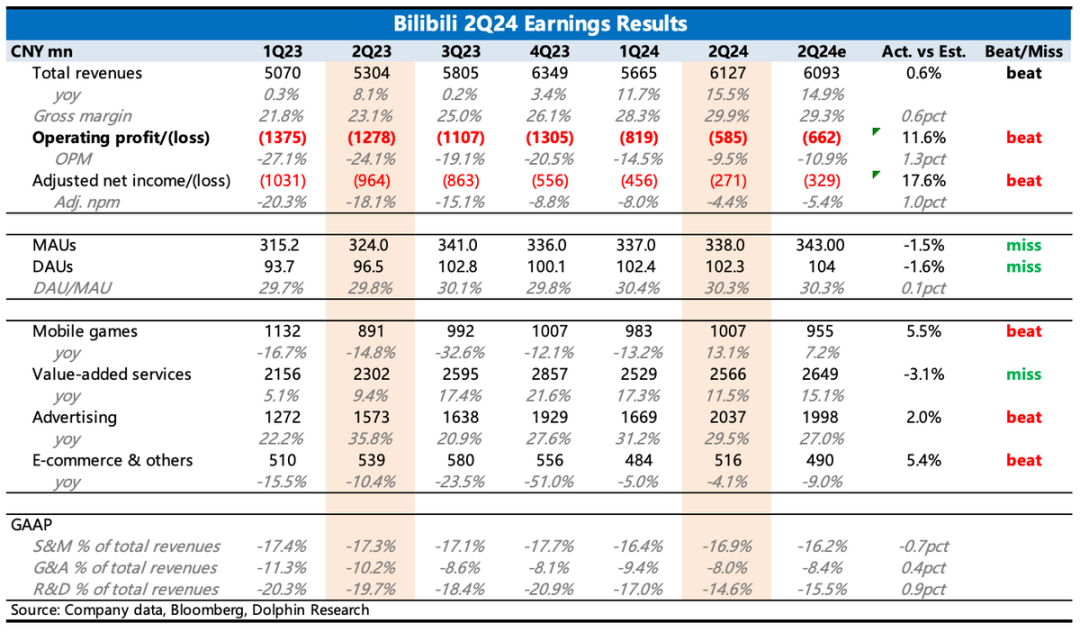

1. Accelerated Loss Reduction, Finally Turning a Profit?: The most surprising aspect of the second quarter was the accelerated loss reduction. The adjusted net loss was 270 million yuan, 50 million yuan less than market expectations, with a loss rate of 4.4%. The loss reduction was driven by two factors:

On the one hand, the increase in the proportion of gaming and advertising revenue drove up the overall gross margin. On the other hand, the company was downsizing, especially after strategically abandoning in-house game development, leading to a decrease in R&D personnel salaries.

In the third quarter, with "San Mou" contributing the majority of revenue and high advertising spending during the summer game season, Bilibili is almost certain to turn a profit. This aligns with the company's guidance from the previous quarter, and the market also expects a 1% profit margin in the third quarter.

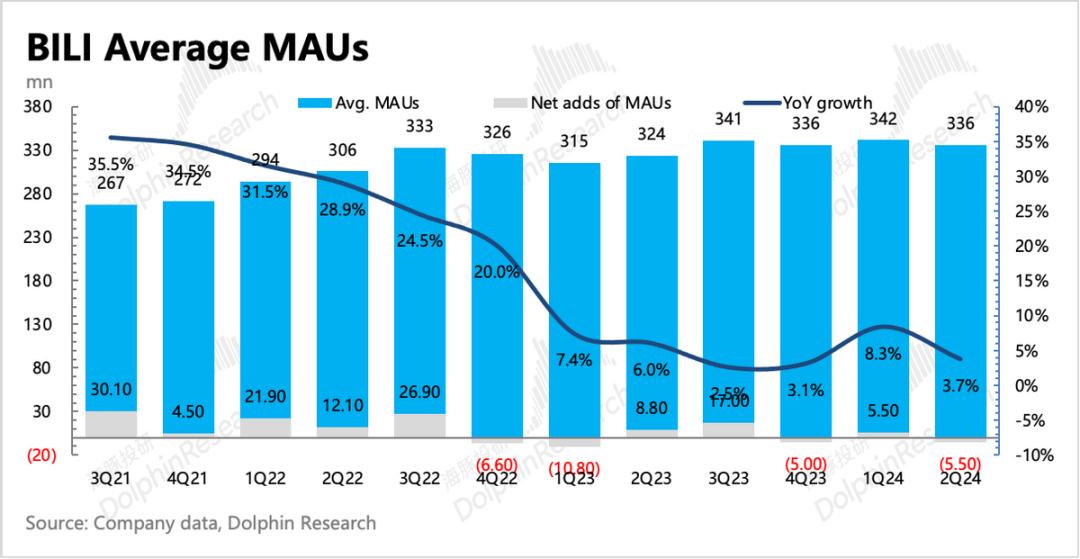

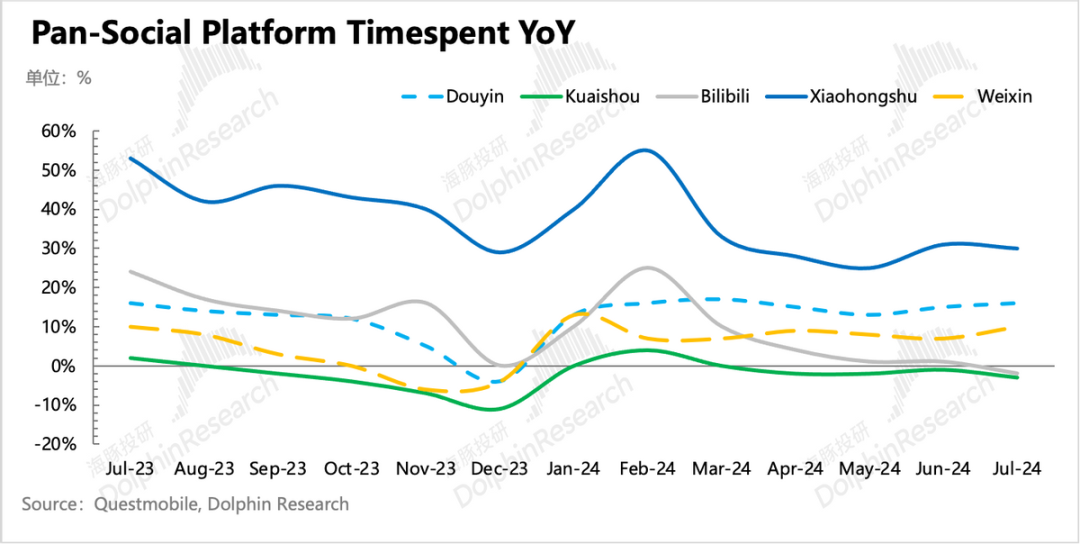

2. However, continued slowdown in user growth may undermine long-term potential?: Second-quarter user growth was below market expectations, with actual DAU at 102 million, a year-on-year growth rate of only 6%. Dolphin Insights also observed the struggle in Bilibili's user growth on third-party platforms. Meanwhile, Xiaohongshu, which targets a similar young audience but offers different content, is still growing rapidly, creating direct competition between the two platforms.

While Bilibili's short-term focus is on improving monetization, peaking traffic signals concerns about the sustainability of long-term growth. Bilibili's management rarely mentions the initial 400 million MAU target anymore, but how does the company plan to address the continuing slowdown in user growth? This may be a point of interest during the conference call.

3. Games are Essential to Bilibili's Monetization: As mentioned earlier, second-quarter revenue growth was primarily driven by advertising and gaming revenue. However, further analysis reveals that both are essentially fueled by gaming.

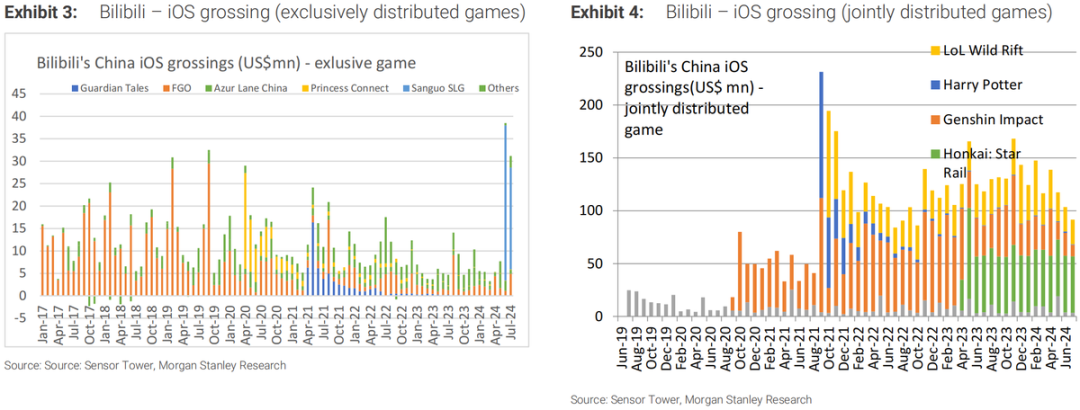

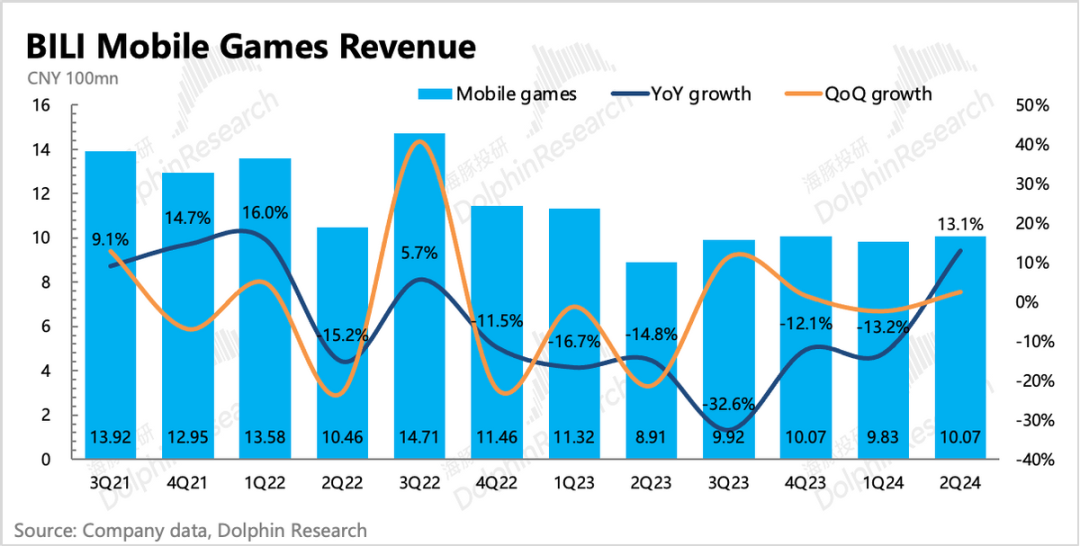

Gaming revenue increased by 13%, with "San Mou" contributing significantly despite being launched for less than a month. Additionally, the anniversary of "FGO" continued to boost growth.

Advertising revenue grew by 29%, also largely due to gaming. During the summer, nearly 100 domestic games were released, and developers typically begin promoting their games 1-2 months in advance. Therefore, the second quarter also reflected revenue from new game advertising. Of course, 618 e-commerce advertising also contributed to advertising revenue. This year's e-commerce competition was fierce, so the contribution to advertising revenue was likely significant.

Third-quarter revenue will continue this trend, with "San Mou" driving growth and advertising relying more heavily on gaming ads due to the e-commerce off-season. This underscores the importance of gaming to Bilibili's monetization.

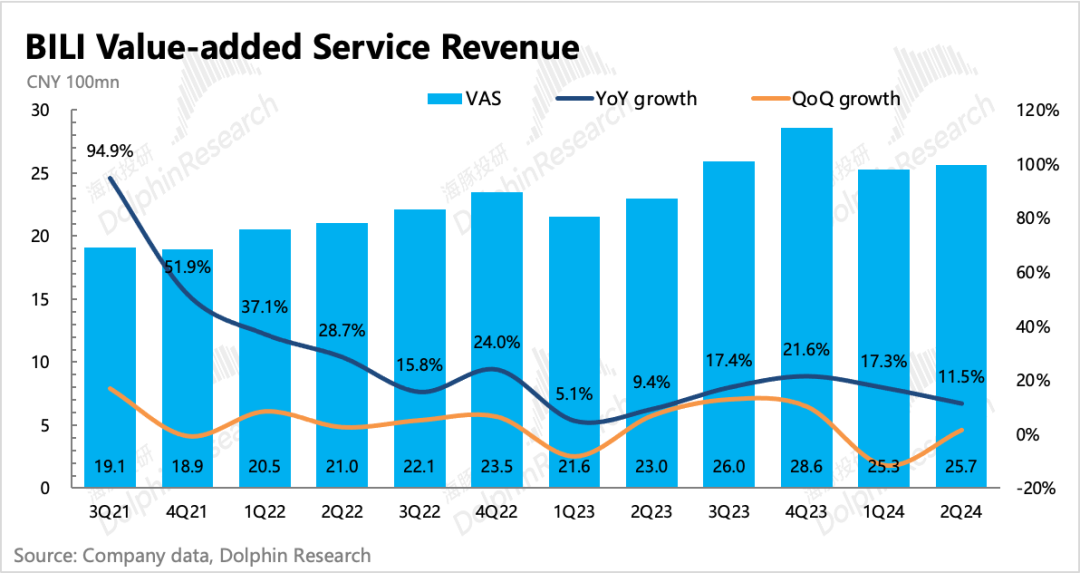

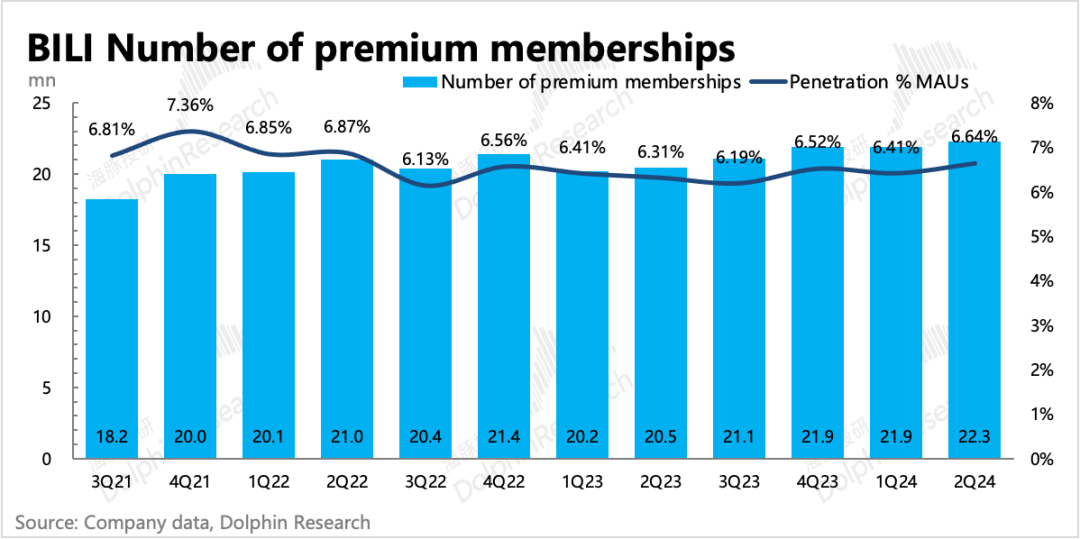

4. Environmental Pressures Make Pure Paid Services Increasingly Challenging: Live streaming and premium membership subscription revenue increased by 11.5% year-on-year in the second quarter, but showed significant sequential slowdown and was below market expectations.

Dolphin Insights believes that the slowdown is primarily due to weak performance in live streaming gifts, which is consistent with industry trends. Premium membership also faces competition from other long-form video platforms, with limited quarterly changes and slow growth.

Bilibili UP creators' "paid videos" and "charging" services, introduced in the past year, have become new monetization channels. During Bilibili's recent investor day, it was mentioned that revenue from UP creator subscriptions increased by 371% year-on-year, potentially becoming a major growth driver for value-added services in the coming years.

5. Increased Cash Reserves: As of the end of the second quarter, Bilibili had 13.9 billion yuan in cash, deposits, and short-term investments on its balance sheet. After deducting short-term debt of 4.6 billion yuan, net cash was 9.4 billion yuan, an increase of 1.4 billion yuan from the first quarter. This was primarily due to improved profitability, with net cash inflows from operating activities reaching 1.7 billion yuan, an increase of 1.1 billion yuan from the first quarter.

6. Performance Indicators Overview

Dolphin Insights Perspective

The second-quarter performance was solid, reflecting the company's efforts to cut costs and increase revenue. After more than a year of ups and downs, gaming revenue emerged as the key driver. The success of "San Mou" validated Bilibili's strategic transformation, and introducing the next hit game will be crucial to maintaining gaming revenue growth. However, competition is intensifying, and high-quality content is increasingly important for distribution channels, making this task challenging.

Dolphin Insights also notes that Bilibili may adjust its guidance during the conference call or in subsequent communications, which has been a common practice among Chinese companies facing market turbulence. Nevertheless, the second and third quarters are Bilibili's strong performance periods. Why did market funds start withdrawing a month ago? Although "San Mou's" ranking has fluctuated, it remains at the top, significantly driving Bilibili's revenue growth.

Dolphin Insights believes that Bilibili's market value fluctuations primarily stem from market uncertainty about its long-term growth and profitability targets. Given visible macroeconomic pressures and Bilibili's yet-to-stabilize profitability, investors may be concerned about potential disruptions to the company's growth trajectory. As a result, the market is in no hurry to lock in long-term gains.

Compared to other Chinese companies, Bilibili's strong fundamentals may justify some valuation premium in the short term. However, investors are more likely to trade around marginal changes and valuation ranges rather than committing to long-term investments. As Dolphin Insights suggested in the previous quarter's earnings review:

At present, Bilibili's market value of $5.9 billion corresponds to a 30x multiple of its 2025 Non-GAAP net profit, which is higher than its peers (typically 10x-20x). Even if Bilibili is still in the profit turnaround phase in 2025 (with a profit margin of 4-5%, which is unlikely to be its long-term stable level), this results in a seemingly high short-term valuation.

However, if Bilibili can achieve a profit margin similar to its peers (above 10%) in the long run, its current market value of $5.9 billion would imply a 2025 P/E ratio of less than 15x, aligning it with other struggling Chinese companies. In this scenario, Bilibili would offer better value.

But whether Bilibili can achieve a 10% profit margin is uncertain, especially given the current macroeconomic pressures that increase long-term uncertainty. After considering additional risk factors and comparing valuations with peers, it is challenging to attract long-term investments at this point.

Detailed Analysis Follows

I. Steady User Acquisition with Slight Improvement in User Engagement

Second-quarter user growth further slowed, with user engagement (DAU/MAU) remaining flat quarter-on-quarter, underperforming market expectations.

Specific User Data:

1. Bilibili's overall monthly active users (including App, PC, and TV) reached 338 million in the second quarter, up 3.7% year-on-year, with a seasonal net loss of 5.5 million users during the off-season.

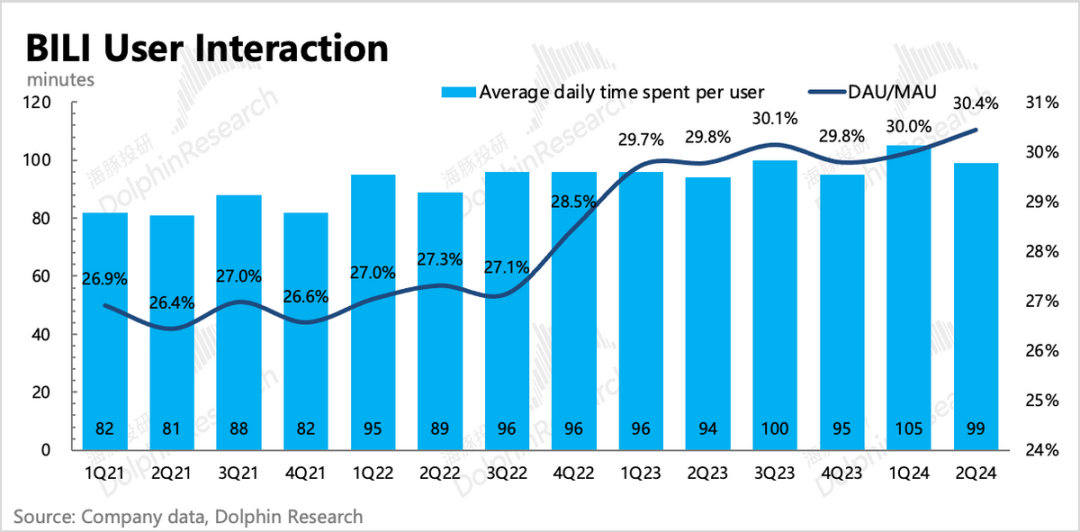

2. User engagement remained stable, with a DAU/MAU ratio of 30%. Average daily user time was 99 minutes, a natural decline during the off-season but still 5 minutes higher year-on-year. DAU was 102.3 million, with a net loss of 100,000 users quarter-on-quarter.

The slowdown in user growth is primarily due to competition. According to Questmobile data, among generalized social platforms with growing user bases, Bilibili's performance is only better than Kuaishou. During the summer peak season in July, Bilibili's total user time even declined.

II. E-commerce and Gaming Chaos Benefits Bilibili

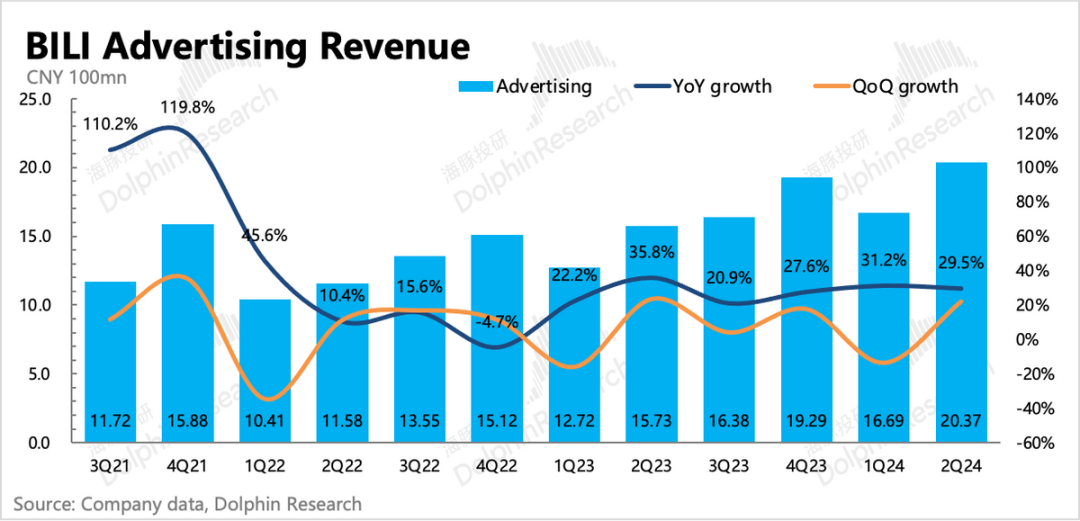

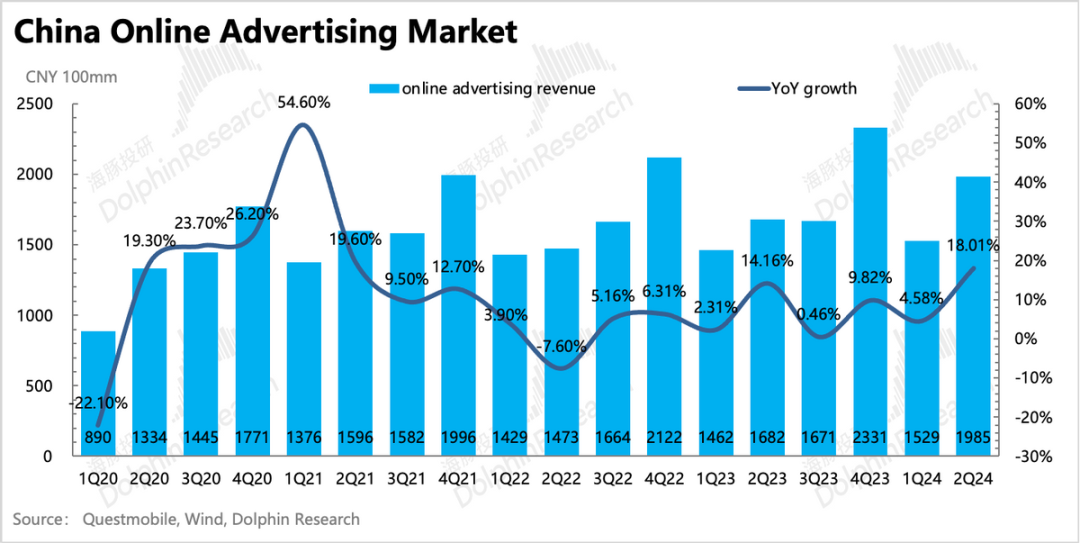

Bilibili's advertising revenue reached 2.04 billion yuan in the second quarter, up 29.5% year-on-year, slightly exceeding market expectations. This growth was fueled by the continued competition during the 618 e-commerce season, summer game previews, and increased educational content supply.

Bilibili's commercialization is still in its early to mid-stage, resulting in significantly higher growth rates than the industry average. Among listed pan-entertainment platforms, Bilibili recorded the highest advertising revenue growth. Dolphin Insights believes that Bilibili's short-term commercialization strength or the ability to generate revenue even with low conversion rates stems from the platform's unique positioning and the "free rider" benefit amidst fierce competition in gaming and e-commerce.

Bilibili is also working to improve advertising conversion rates by upgrading its ad delivery system. Recently, it tested a fully managed ad delivery mode, which could attract more advertising budgets. In the first half of the year, Bilibili's advertiser base increased by 50% year-on-year, with notable growth in sectors like internet services and education.

However, given the increasing macroeconomic pressures, although the third quarter is expected to be stronger, the fourth quarter, including events like Singles' Day, may see impacted advertiser budgets. With limited marketing budgets, e-commerce platforms offering higher conversion rates and closer to the point of sale will be preferred.

Currently, Bilibili's public feed ad load rate is around 7-8%, lower than other platforms' 10%+ rates, indicating room for improvement. However, for users, both public feed ads and UP creators' private ads are ads, and excessive ads can negatively impact user experience. Simply increasing ad inventory to match other platforms' 10%+ public feed ad load rates could harm user experience. Currently, Douyin (TikTok's Chinese version) is no longer increasing its ad load rate, while WeChat Video Accounts (WVA) operates at a lower 5% rate, but Tencent is considering user experience.

Therefore, blindly increasing ad inventory is not a sustainable strategy. Instead, improving ad conversion ROI through more precise recommendation algorithms is crucial. This has been a relatively weak point for Bilibili, but the company announced during its investor day that AI is enhancing ad content recommendation, which warrants continued attention.

III. Initial Success of Strategic Adjustment Awaits the Next "San Mou"

At the end of the second quarter, "Sanguo: Conquering the World" debuted, contributing to revenue for only 20 days but significantly boosting growth. Meanwhile, the afterglow of "Fate/Grand Order"'s anniversary continued into the second quarter, and "Honkai: Star Rail" maintained stable revenue, further supporting gaming revenue growth.

Ultimately, gaming revenue grew by 13% year-on-year, exceeding the guidance of "high single-digit" growth. Deferred revenue increased by 25% quarter-on-quarter, highlighting "San Mou"'s strong performance.

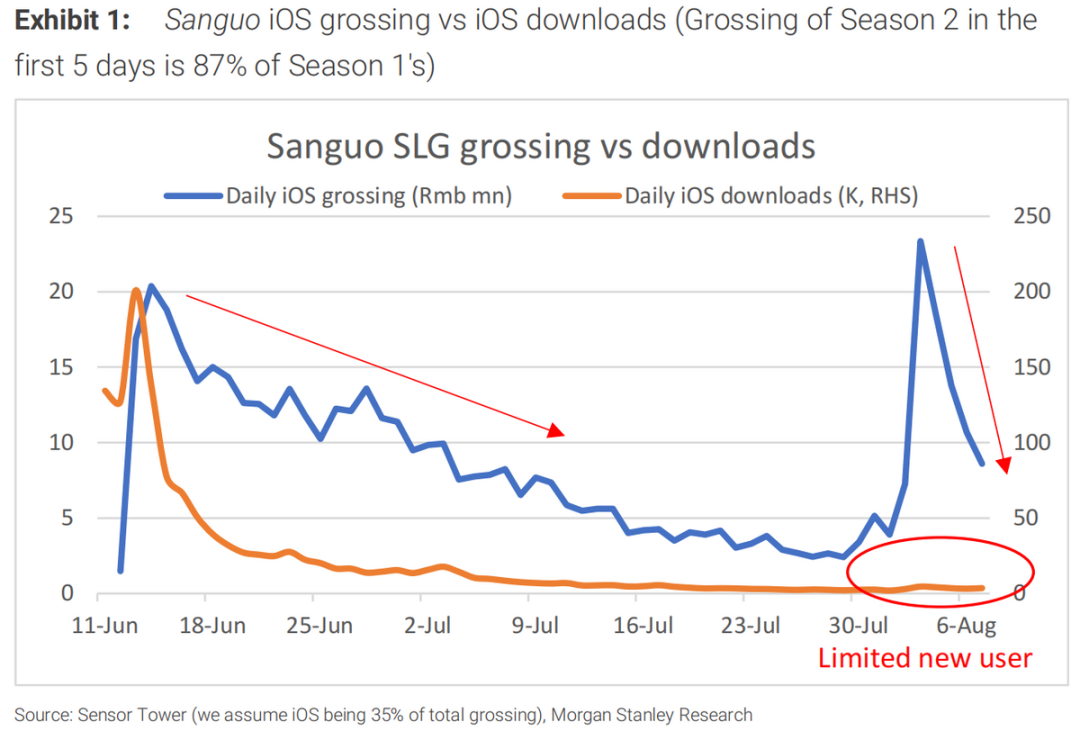

One "San Mou" ensures Bilibili's gaming growth is secure this year and into the first half of next year. However, as "San Mou" is essentially a heavy pay-to-win, niche SLG game, its revenue typically peaks early and declines later, necessitating ongoing attention to sustainability. The start of Season 2 in early August saw some user churn compared to Season 1, with revenue declining faster, hinting at potential challenges.

Bilibili's decision to abandon in-house game development and instead focus on exclusive agency deals for high-quality games aligned with Bilibili's user preferences has been validated by "San Mou's" success (guaranteed revenue and low user acquisition costs). Thus, timely introduction of the next "San Mou" is crucial for sustained gaming revenue growth. Currently, there are no updates on the game pipeline, so the conference call will be closely watched for any updates.

IV. Environmental Challenges Make Pure Paid Services Increasingly Difficult

Value-added services revenue grew by 11.5% year-on-year in the second quarter, but the growth rate further slowed down significantly. Dolphin Insights believes that the slowdown is primarily due to poor performance in live streaming gifts, consistent with industry trends.

Premium membership also faces competition from other long-form video platforms, with limited quarterly changes and a net increase of 400,000 paid members in the second quarter. However, compared to other platforms, Bilibili mainly introduces proven high-quality historical and film content, along with a small amount of self-produced variety content tailored to platform discussions (more likely to attract attention).

Therefore, while Bilibili's paid user base lags behind iQIYI, Tencent Video, and Youku, its profitability pressure may be relatively lower. Currently, Bilibili's premium membership penetration rate is still low, but it has the potential to increase as more differentiated high-quality content is introduced.

Bilibili UP creators' "paid videos" and "charging" services, introduced in the past year, have become new monetization channels. During Bilibili's recent investor day, it was mentioned that revenue from UP creator subscriptions increased by 371% year-on-year, potentially becoming a major growth driver for value-added services in the coming years.

V. Open source + thrift, Bilibili's profit is imminent

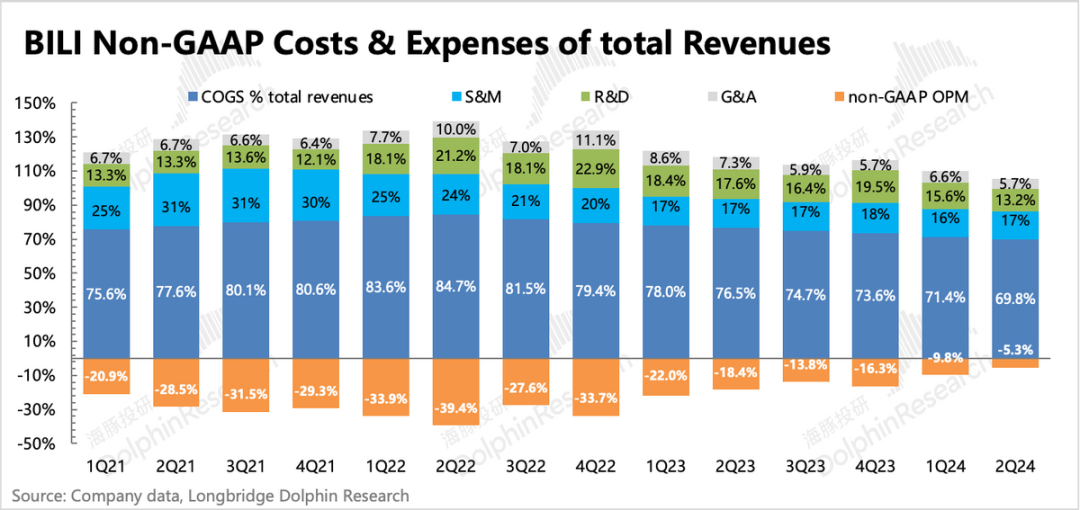

In the second quarter, Bilibili's adjusted net loss was 270 million yuan, with a loss rate of 4.4%, which continued to improve significantly from the previous quarter. The reduction in losses comes from two drivers:

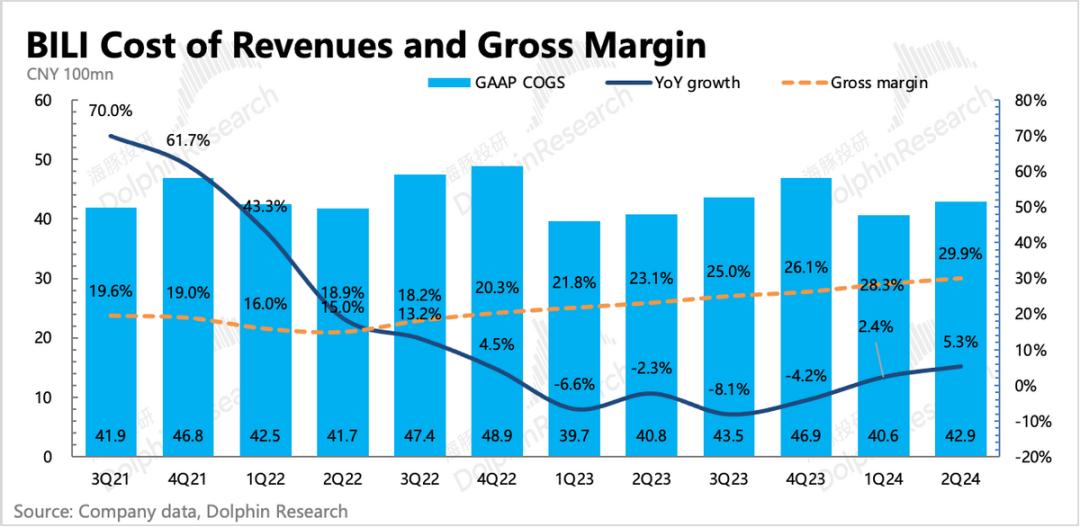

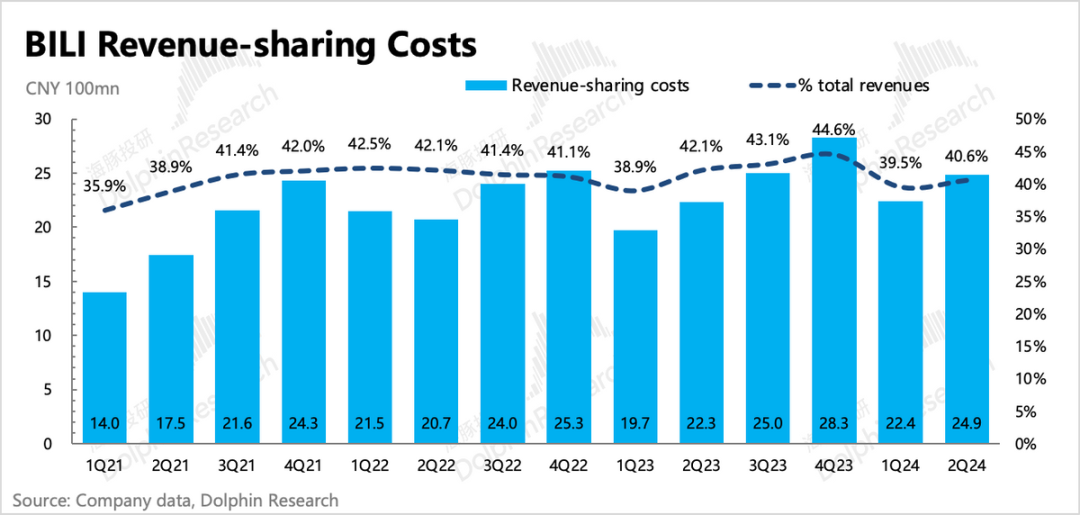

(1) On the one hand, the increase in the proportion of game and advertising revenue drives up the overall gross profit margin;

It is worth mentioning that the absolute value of revenue-sharing costs has grown again from the previous quarter, and Dolphin predicts that this may be mainly due to the high revenue sharing of game revenue and Up host Huahuo advertisements (Bilibili only takes 5%, while the remaining 95% goes to Up hosts).

(2) On the other hand, the company is still laying off employees, especially after strategically abandoning in-house research and development, resulting in a decrease in R&D personnel salaries (R&D SBC expenses decreased by 23% year-on-year).

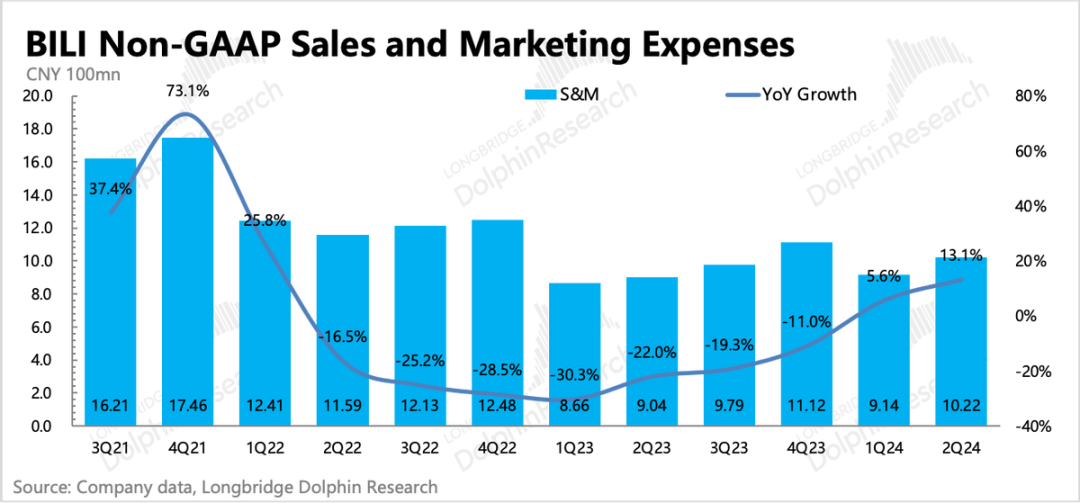

Although marketing expenses increased year-on-year due to the launch of "Three Strategies," Bilibili is almost certain to turn a profit in the third quarter, given the significant revenue contribution from "Three Strategies" and the high advertising investment during the summer game season. This is in line with the guidance given by the company in the previous quarter, and the market also expects the profit margin to reach 1% in the third quarter.