Lei Jun, has he finally made it?

![]() 08/23 2024

08/23 2024

![]() 588

588

Selling a car leads to a loss of over 60,000 yuan, but Mr. Lei "can afford it."

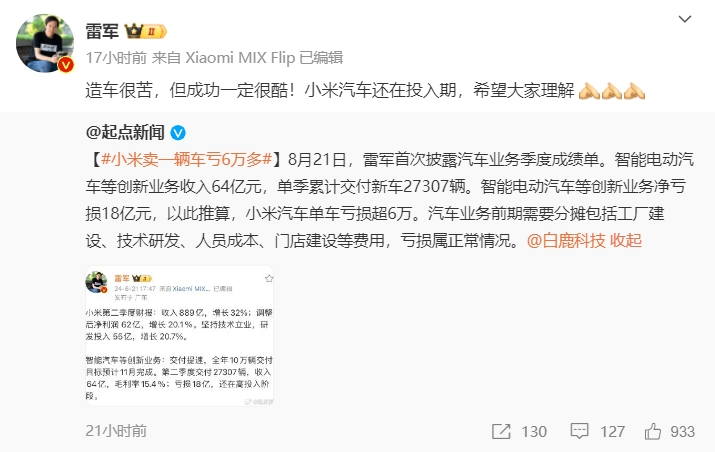

On August 21, Xiaomi Group (1810.HK) released its Q2 2024 financial report. Due to exceeding market expectations, Xiaomi's share price surged by over 9% on August 22.

However, while Xiaomi just delivered an impressive "exam paper" and received positive feedback, it was Jiyue Auto's PR team that was the first to "crack" under the pressure.

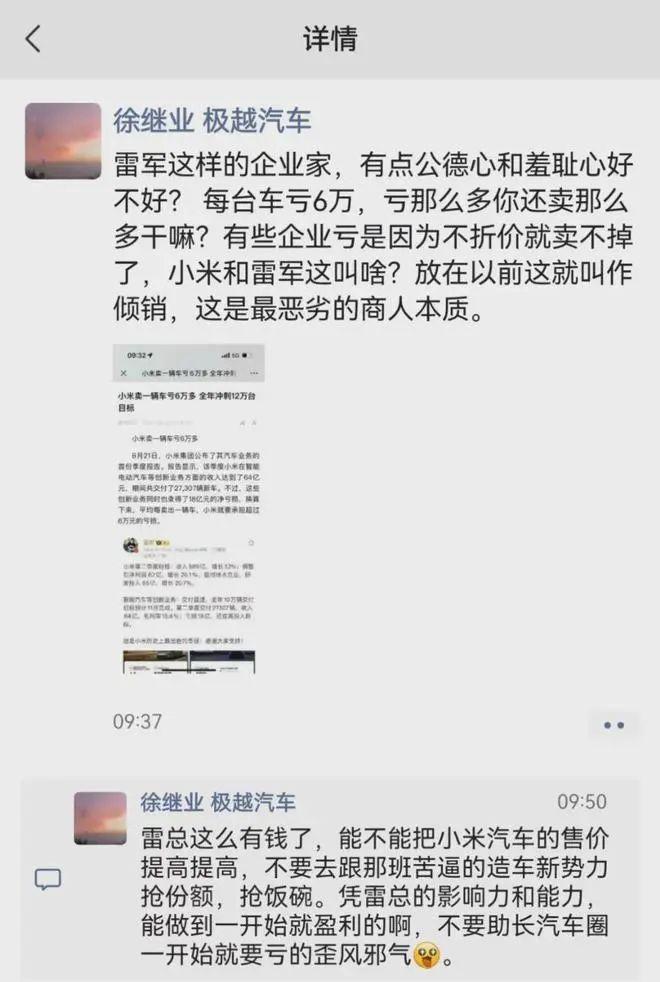

Due to Xiaomi Auto's Q2 loss of 1.8 billion yuan, some media outlets calculated that Xiaomi Auto loses over 60,000 yuan per vehicle sold. As a result, Xu Jiye, the head of Jiyue Auto's PR, commented sarcastically about Lei Jun on WeChat Moments on August 22, saying, "Losing 60,000 yuan per car, why bother selling so many if you're losing so much?"

Image source: WeChat Moments screenshot

Coincidentally, on the morning of August 22, Xia Yiping, CEO of Jiyue Auto, announced on Weibo that the first production vehicle of the Jiyue 07 had officially rolled off the assembly line.

During the live broadcast on August 22, Lei Jun stated, "The trending topic about losing over 60,000 yuan per car is both right and wrong. We've just started, and once we reach a certain scale, I believe it will be easy to break even. Don't worry about us. Making cars is indeed difficult. Some people think we're losing too much, but personally, I think it's still a very good financial report."

In comparison, the loss margin of the newly launched Xiaomi SU7 is not significant. However, the question remains how to ramp up production and maintain strong sales. Additionally, how can Xiaomi innovate in its mobile phone business?

01. "The best quarterly report ever?"

"This is Xiaomi's best quarterly report in history! Thank you all for your support!" After Xiaomi released its Q2 2024 financial results, Lei Jun posted this message on Weibo.

Image source: Weibo screenshot

In terms of revenue, Xiaomi exceeded expectations both in terms of revenue and profitability in Q2, with the gross margin of its automotive business particularly impressive.

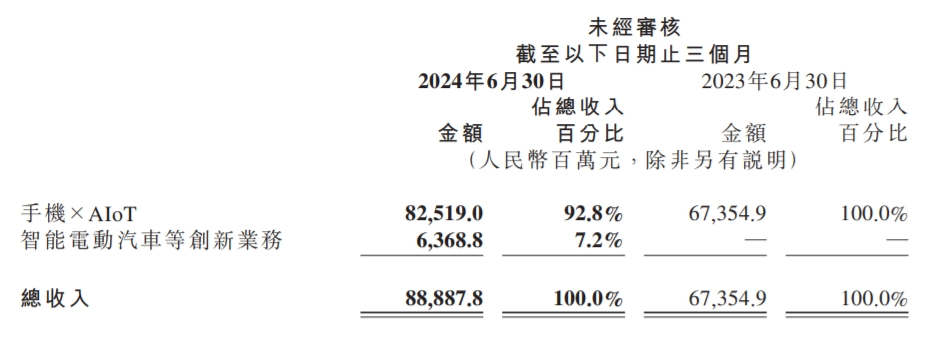

Xiaomi Group achieved revenue of 88.9 billion yuan in Q2, representing a year-on-year increase of 32%. Adjusted net profit reached 6.2 billion yuan, up 20.1% year-on-year. This growth was fueled by both traditional businesses and the automotive business. Specifically, the mobile phone + AIoT business generated revenue of 82.5 billion yuan, up 22.5% year-on-year, while the automotive and innovation business contributed 6.37 billion yuan, accounting for 7.2% of total revenue.

Image source: Xiaomi announcement screenshot

Despite the fact that vehicle deliveries have commenced, Xiaomi Group's overall gross margin remained above 20%, with the automotive business gross margin reaching 15.4%.

Regarding cost control in the automotive business, Xiaomi noted during the earnings call that suppliers remain optimistic about Xiaomi Auto's prospects and have provided significant support.

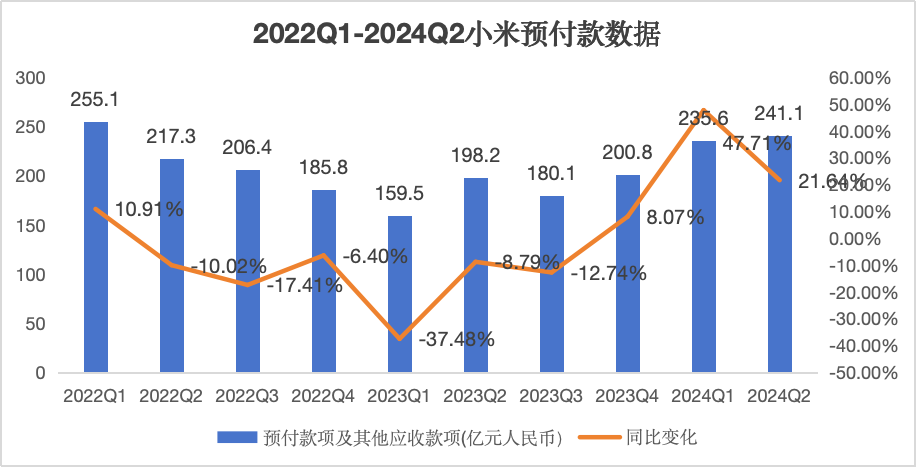

This statement is quite revealing, as suppliers are also profit-driven and unlikely to provide support out of sheer goodwill. It's possible that Xiaomi has reached some agreement with suppliers to reduce procurement costs, such as by providing larger advance payments, which can be inferred from the increase in Xiaomi's advance payments.

Starting from Q4 2023, Xiaomi's advance payments increased significantly compared to 2022 and 2023 levels, which aligns with the launch and delivery timeline of the Xiaomi SU7.

Data source: Xiaomi earnings report

Of course, it's a common practice in the industry to negotiate terms with suppliers by increasing advance payments. For a cash-rich company like Xiaomi, this poses little short-term pressure, as long as it can maintain strong sales of its vehicles and achieve a virtuous cycle in production capacity.

In addition to gross margin, Xiaomi has also done a good job controlling its marketing expenses.

With the launch of the Xiaomi SU7, the company's marketing expenses for Q2 were 5.899 billion yuan, up 31.76% year-on-year, roughly in line with revenue growth. Marketing expenses accounted for 6.6% of total revenue, almost unchanged from the same period last year, indicating that the new business segment did not require significant additional marketing spending.

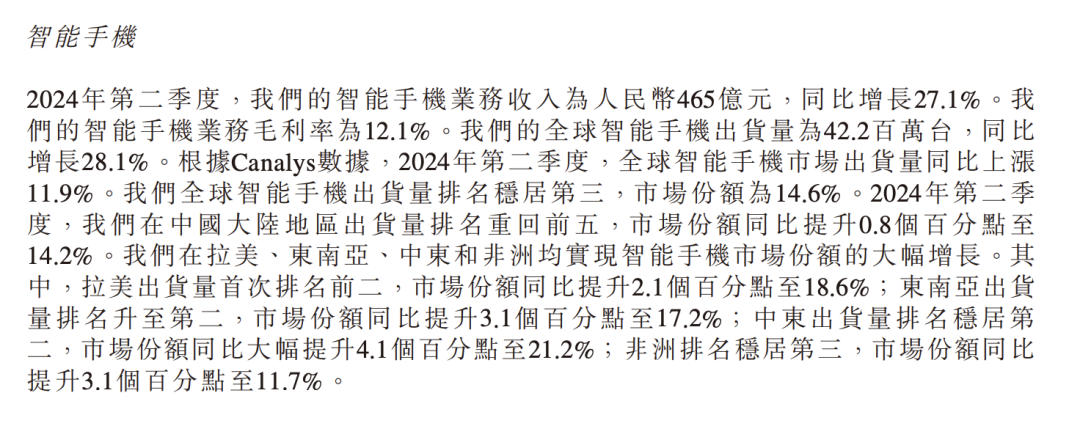

Looking at the mobile phone business, Xiaomi's phone segment also showed signs of recovery in Q2. Revenue from Xiaomi's smartphone business reached 46.5 billion yuan in Q2 2024, up 27.1% year-on-year.

It's worth noting that Xiaomi disclosed in its financial report that its domestic market share increased by only 0.8 percentage points year-on-year, while market shares in Latin America, Southeast Asia, and Africa increased significantly. The adjustment in shipment regions also led to a decrease in Xiaomi's average selling price (ASP) for smartphones. In Q2, Xiaomi's ASP for smartphones was 1,102 yuan, down 0.9% year-on-year, indicating that low- and mid-end smartphones remain the main driver of Xiaomi's shipments.

Image source: Xiaomi announcement screenshot

In recent years, Xiaomi has focused on premiumizing its smartphones. While Xiaomi's phone business has grown strongly, premiumization efforts have not yielded significant results.

According to QuJieShangYe, Xiaomi's shipments of high-end smartphones (retail price of 3,000 yuan and above) accounted for 22.1% of total shipments in mainland China in Q2, up 2 percentage points year-on-year. Specifically, Xiaomi had market shares of 16.8%, 20.1%, and 8.9% in the 3,000-4,000 yuan, 4,000-5,000 yuan, and 5,000-6,000 yuan price segments, respectively, all up year-on-year.

Lu Weibing, President of Xiaomi Group, also noted during the earnings call that "we are already very strong in the low-price segment, but we face pressure in the 6,000 yuan to 10,000 yuan and above price range."

Image source: Canned Stock Photo

In addition, Xiaomi Auto shares a common problem with most electric vehicle companies – losing money. Xiaomi Auto delivered 27,307 vehicles in Q2, incurring a loss of 1.8 billion yuan, which roughly translates to a loss of over 65,000 yuan per vehicle. However, given the significant upfront investments in the automotive business, such losses are normal, and Xiaomi Auto's loss margin is relatively small compared to the industry. Nevertheless, sustained losses are not welcomed by investors.

Regarding when Xiaomi Auto will become profitable, Goldman Sachs previously predicted in a research report that Xiaomi Auto may achieve profitability in 2028.

Image source: Weibo screenshot

Overall, Xiaomi's financial performance in Q2 was indeed impressive. However, the company still needs to push forward with smartphone premiumization, vehicle deliveries, and profitability.

02. Lei Jun's "Production Hell"

The recent TikTok quote, "Everyone doubts you, but you're the one who proves them wrong," aptly describes Xiaomi's foray into the automotive industry.

From initial skepticism to strong sales, Xiaomi SU7's monthly sales volume has even surpassed that of Tesla.

Image source: Dongchedi screenshot

More than 100 days after its launch, the "best-selling" Xiaomi SU7 has experienced the sweetness of sales and the bitterness of production constraints.

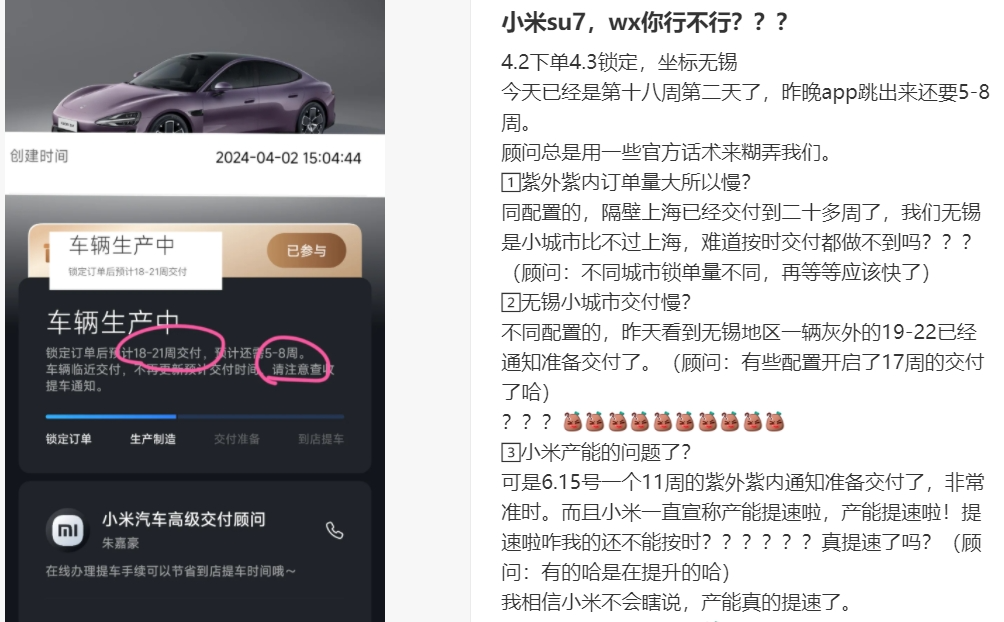

After the surge in sales came delivery backlogs. On social media platforms, discussions about Xiaomi SU7 have shifted from "is it worth buying?" to "how long do I have to wait?" One consumer in Wuxi shared that they had been waiting for 18 weeks after locking in their order on April 3, but the app still showed a wait time of 5-8 weeks, with little change in the sales consultant's response. Many other "waiting party" members commented that they had ordered their cars in early April but still had to wait another 5-8 weeks after four months.

Image source: Xiaohongshu screenshot

Xiaomi is also working to address production ramp-up issues. In late May, Xiaomi announced that its factory would adopt a "double-shift" model to ensure that deliveries would exceed 10,000 units starting in June. In late July, media reported that Xiaomi Group subsidiary Jingxi Technology Co., Ltd. successfully acquired the industrial project usage rights for a plot in Yizhuang New City, Beijing, for 842 million yuan. This plot is confirmed to be the location of Xiaomi's second factory.

However, insufficient production capacity is not a fatal problem for Xiaomi Auto at this stage. But for the next-generation Xiaomi vehicles, consumer expectations and demands will only increase. Many new energy vehicle brands have already overcome the toughest "production hell" period, with delivery cycles compressed to 4-8 weeks or even immediate delivery upon launch. As consumers' novelty with Xiaomi Auto wears off and they compare it with other brands, delivery times will inevitably become a factor in their purchasing decisions.

During the earnings call, Xiaomi also noted that rather than engaging in a "price war," it is currently more focused on improving delivery efficiency and production capacity. According to QuJieShangYe, Xiaomi Auto aims to deliver 120,000 vehicles within the year and reach 100,000 deliveries by November.

Image source: Canned Stock Photo

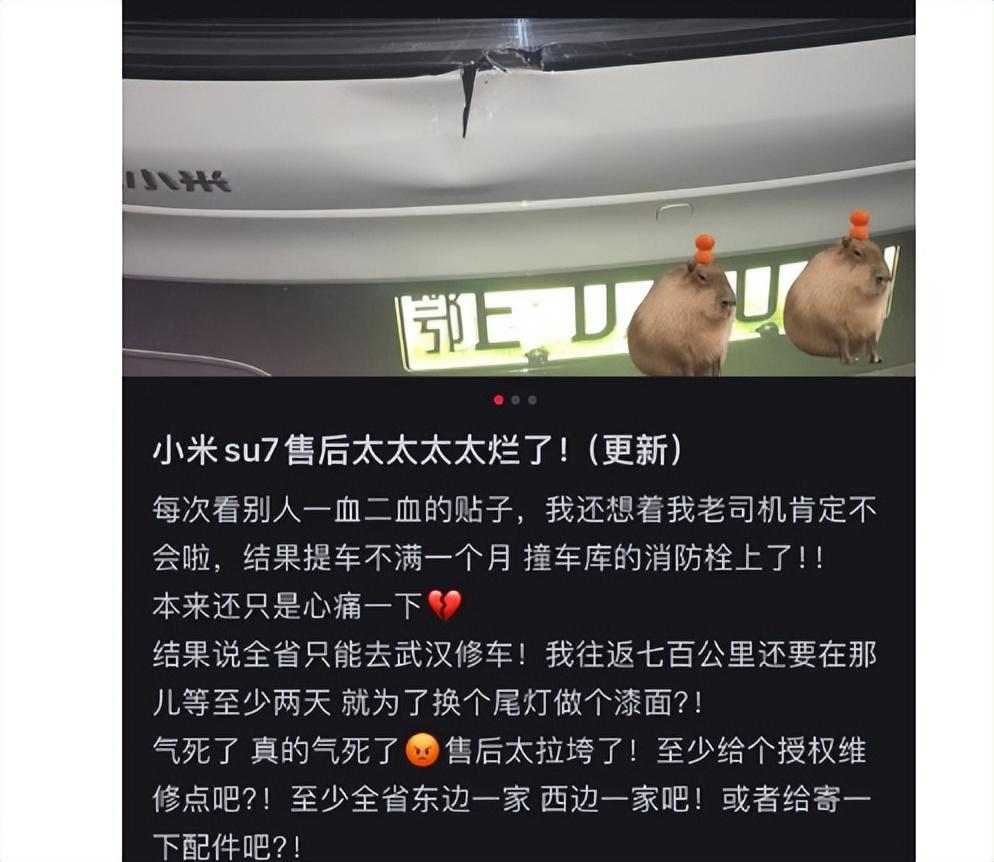

Apart from production capacity, after-sales service is another area where Xiaomi SU7 has received criticism from users.

One user complained on Xiaohongshu that they were told to travel over 700 kilometers to Wuhan to repair their car after hitting a fire hydrant. They expressed frustration at having to travel such a long distance just to replace a taillight and repaint the damaged area.

Image source: Xiaohongshu screenshot

Poor after-sales service is also a common problem among many new energy vehicle brands. For example, Zeekr's after-sales service is often criticized. One Zeekr owner in Shenyang shared that many of Zeekr's after-sales services are shared with Lynk & Co., and they had to visit the dealership four times over a month to replace faulty parts due to a rattling noise in their car.

However, Zeekr's after-sales system can rely on the Geely Group, allowing it to share service stations with its sibling brands. In contrast, Xiaomi Auto, which operates independently, has less experience and fewer service points.

Delivery and after-sales service are challenges that Xiaomi Auto needs to overcome from scratch, and they are crucial factors affecting future sales.

03. How to play the "human-car-home" strategy?

The integration of "human-car-home" is Xiaomi's strategic focus, which was frequently mentioned during the earnings call.

The so-called "human-car-home ecosystem" emphasizes seamless connection and real-time interaction between hardware devices, enabling data and information sharing, control coordination, and intelligent collaboration among devices to provide users with more intelligent and personalized services. Xiaomi has formed a comprehensive product matrix centered around the "human-car-home ecosystem," including smartphones focused on individuals, IoT devices centered around the home, and vehicles catering to mobile scenarios. The integration of hardware and software significantly enhances Xiaomi's smart ecosystem interconnectivity.

Image source: Canned Stock Photo

In essence, once users adopt Xiaomi hardware and software, the interoperability between them creates user stickiness. Once users become accustomed to Xiaomi's ecosystem, they tend to purchase more "Mi Home" hardware. This underlines Xiaomi's strategy of "surrounding hardware with software."

However, Xiaomi is not the only company capable of achieving smart hardware and software interoperability. While such strategies can increase user stickiness, they are not exclusive to Xiaomi, and users will still consider hardware quality and cost-effectiveness when purchasing new devices.

Image source: Canned Stock Photo

Behind the "human-car-home" strategy lies the extension of "software-defined hardware." As hardware innovation faces bottlenecks, the strategy of using multiple smart devices and a unified smart software platform to gradually "capture" all smart scenarios of users is a clever approach.

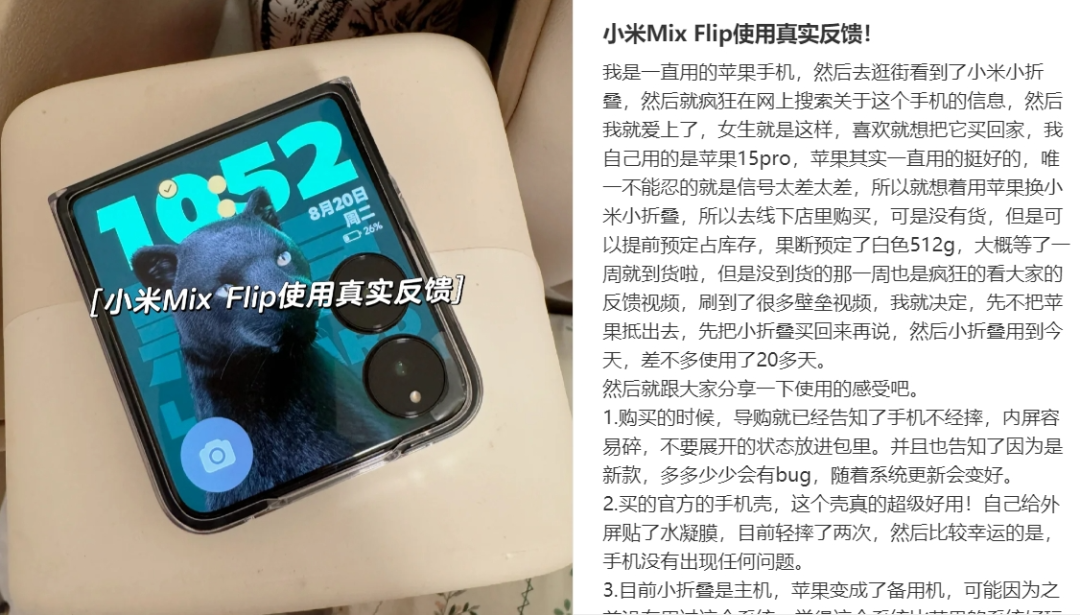

Of course, relying solely on "software-defined hardware" is not enough; hardware innovation is also crucial. For example, AI has become a popular innovation direction for smartphone manufacturers this year, including Apple, which is set to launch its "AI iPhone." In response, Lu Weibing, President of Xiaomi Group, noted during the earnings call that while they are unaware of Apple's specific new products, 42% of Xiaomi MIX FLIP users were previously iPhone users. Lu also argued that "to date, none of the so-called AI phones should be called AI phones. They simply utilize AI technology to develop some AI functions that run on the phone. They are AI-featured phones, not true AI phones."

Image source: Xiaohongshu screenshot

When Xiaomi released its Q1 2024 financial report, it included "AI smartphones" as a "core observation" area and stated that the group would focus on developing lightweight large language models for devices in 2024. However, with two-thirds of 2024 already passed, Xiaomi's large language model, MiLM, has yet to be officially launched.

However, Lu Weibing also said at this financial report meeting that a new product will be launched in the coming months, which will bring users a brand new experience.

In general, Xiaomi has come out of the darkest moment of "unable to make cars and sell mobile phones". In the next stage, how to break through the production capacity ramp-up of cars and how to make differentiated innovations by combining AI with mobile phones are the key issues that Lei Jun and Xiaomi team need to focus on solving.