How solid is Xiaomi's "lifeblood" smartphone business? Gross margin declines, but premiumization gains traction

![]() 08/23 2024

08/23 2024

![]() 511

511

Recently, Xiaomi released its financial report for the second quarter of 2024, revealing that despite the impressive performance of its automotive business, the company's most robust revenue source remains its three core businesses: smartphones, IoT, and internet services. As the spotlight shines on Xiaomi's SU7-powered automotive business, this article shifts focus back to Xiaomi's core operations, examining the stability of its foundation.

Smartphones: Local premiumization pays off, while overseas growth relies on cost-effectiveness

"Xiaomi's best quarterly report in history."

This is how Lei Jun, Xiaomi's Chairman and CEO, described the company's second-quarter financial results, brimming with joy. According to the report, Xiaomi's revenue reached 88.9 billion yuan in Q2 2024, up 32% year-on-year, setting a new quarterly record. Adjusted net profit increased by 20.1% to 6.2 billion yuan, while cash reserves stood at 141 billion yuan, up 24.5% year-on-year.

Amidst slowing revenue growth among internet companies like Alibaba, JD.com, and Tencent, Xiaomi has maintained its rapid momentum, a remarkable feat indeed.

Regarding specific business segments, Xiaomi's smartphone business generated 46.5 billion yuan in revenue, up 27.1% year-on-year, accounting for 52.31% of total revenue. Clearly, smartphones remain Xiaomi's pillar business, contributing over half of its revenue.

In the financial report, Xiaomi highlighted several market data points related to its smartphone business.

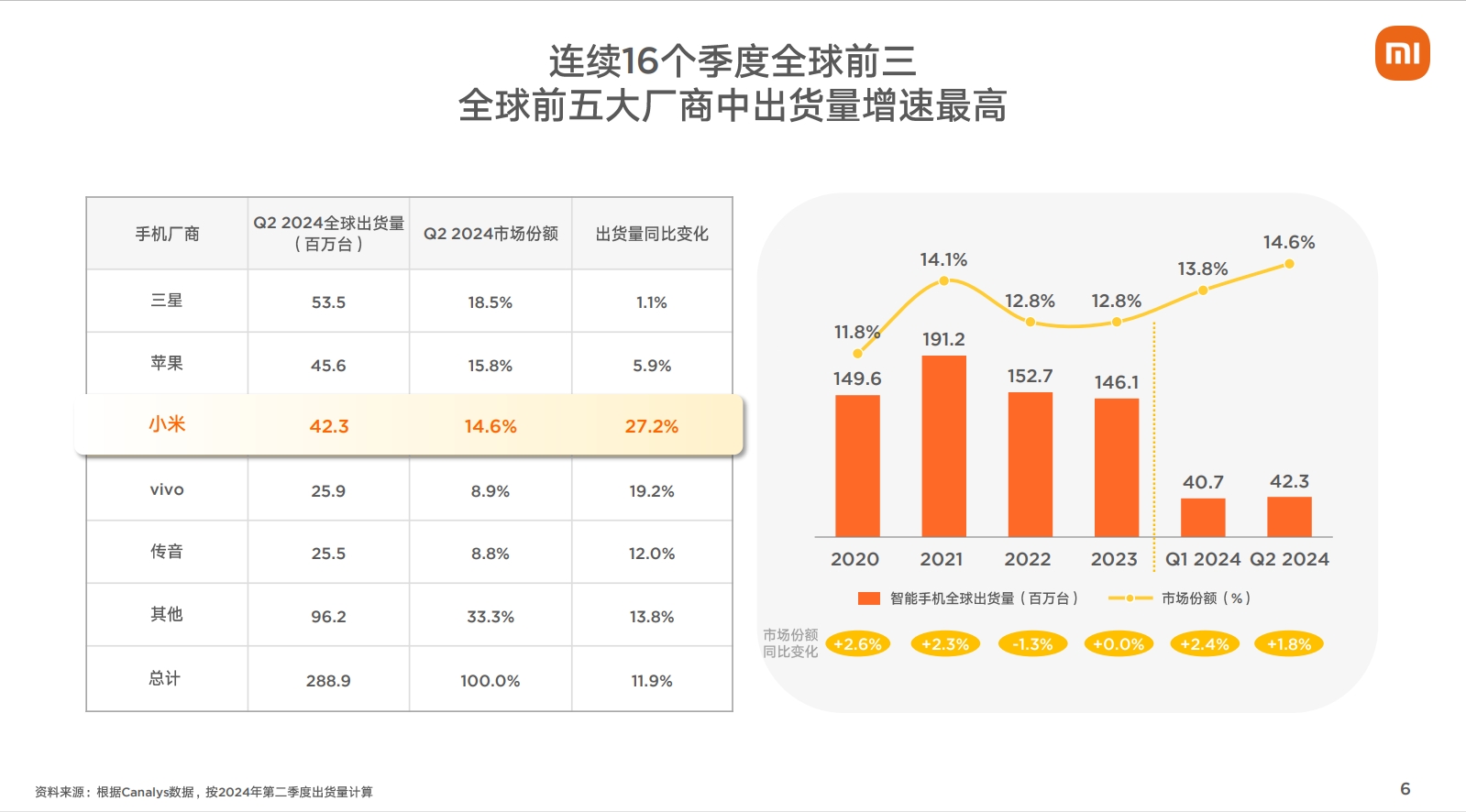

Firstly, global smartphone shipments reached 42.3 million units in Q2, up 27.2% year-on-year, according to Canalys. Xiaomi commanded a 14.6% market share, ranking third globally behind Samsung and Apple. Vivo and Transsion held the fourth and fifth positions, respectively. Undoubtedly, Xiaomi is the top-performing Chinese vendor in terms of shipment volume.

Source: Xiaomi

Xiaomi's growth in the global smartphone market is largely attributable to its continued expansion overseas. In contrast, its domestic performance was less outstanding. Xiaomi held a 14.2% market share in China, where the top five vendors in Q2 were Vivo, OPPO, Honor, Huawei, and Xiaomi itself. Vivo led with a 19% market share, while the others were closer in terms of market share.

Overall, Xiaomi has seen some improvement in the domestic market compared to previous years, but its performance hasn't been as striking as that of other domestic smartphone vendors. Lei Tech believes this is due to two reasons: 1) The domestic market is more competitive than overseas markets, with OPPO, Vivo, Huawei, and Honor all strong players; 2) Xiaomi's premiumization strategy has focused on value over volume, seeking higher profits. As a result, its presence in low-margin markets like the sub-1000 yuan segment has decreased, leading to a decline in market share (which is based on sales volume rather than revenue).

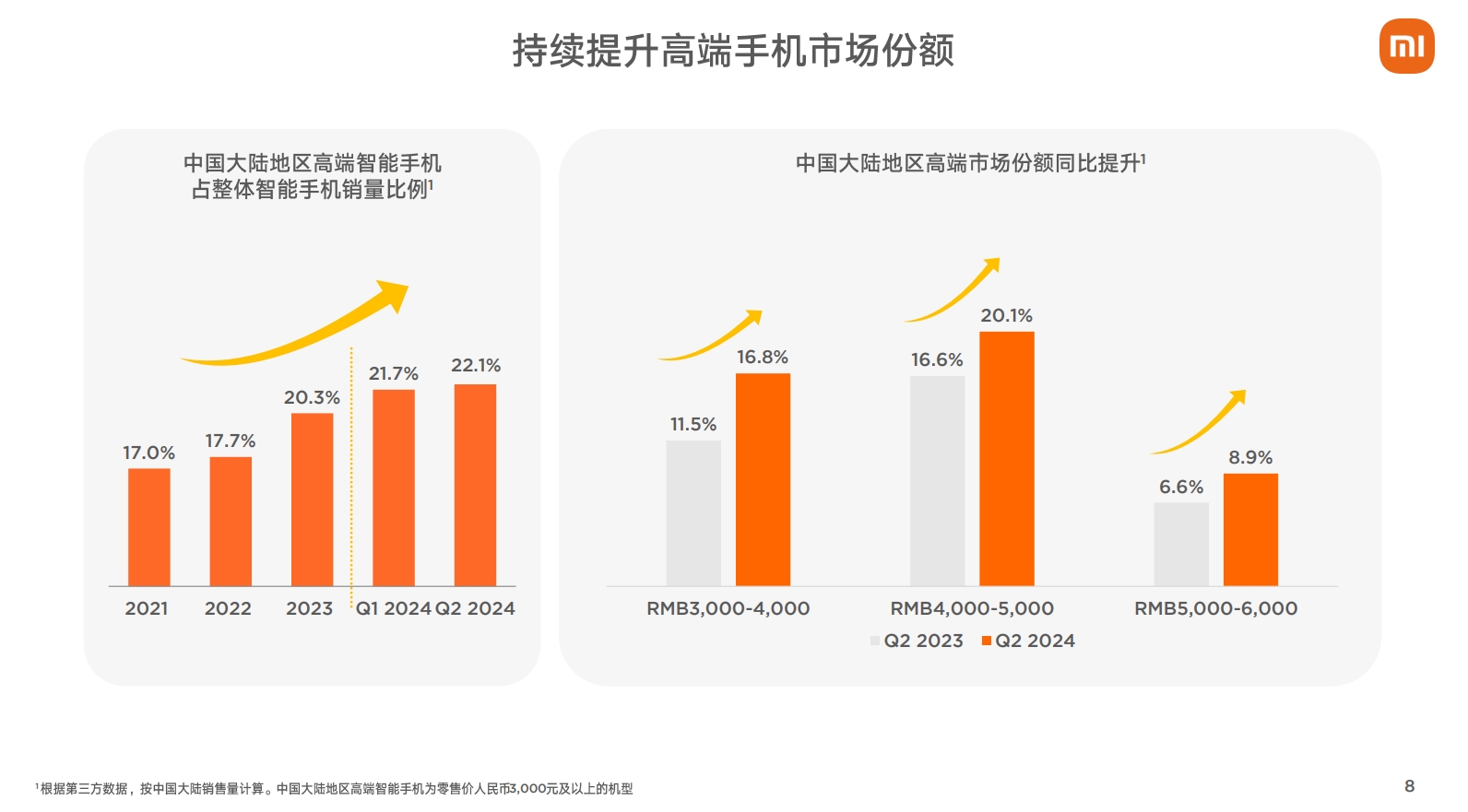

In the PPT accompanying the financial report analysis, Xiaomi emphasized improvements in high-end market share across three price segments, with the most significant gain in the 3000-4000 yuan range, up 5.3% year-on-year. Xiaomi's offline channel market share for smartphones was 10.4%, a figure that has been rising steadily over the past five years.

Source: Xiaomi

In overseas markets, Xiaomi has followed the "cost-effectiveness" strategy previously employed in China, leveraging its price advantage to gain market share. Xiaomi has seen share gains in emerging markets like Latin America, Africa, India, the Middle East, and Southeast Asia. In Latin America, Xiaomi ranked second for the first time. Xiaomi's overseas lineup skews toward entry-level devices. Despite progress in its premium strategy, the overall ASP (Average Selling Price) of Xiaomi's smartphones remained stable this quarter due to faster growth in overseas sales.

1. Xiaomi is currently competing with smaller players like Xpeng but will soon face fierce competition from giants like BYD and Tesla, making the path to market dominance more challenging.

2. The automotive industry is fiercely competitive, and Xiaomi's SU7, with its cost-effective but slightly loss-making model, must find a way to profit beyond relying on advertising like in the internet hardware industry.

Why did the smartphone gross margin decline despite premiumization efforts?

While it's exciting to envision Xiaomi's future, stabilizing its hardware foundation, led by smartphones, is crucial before the automotive business becomes profitable.

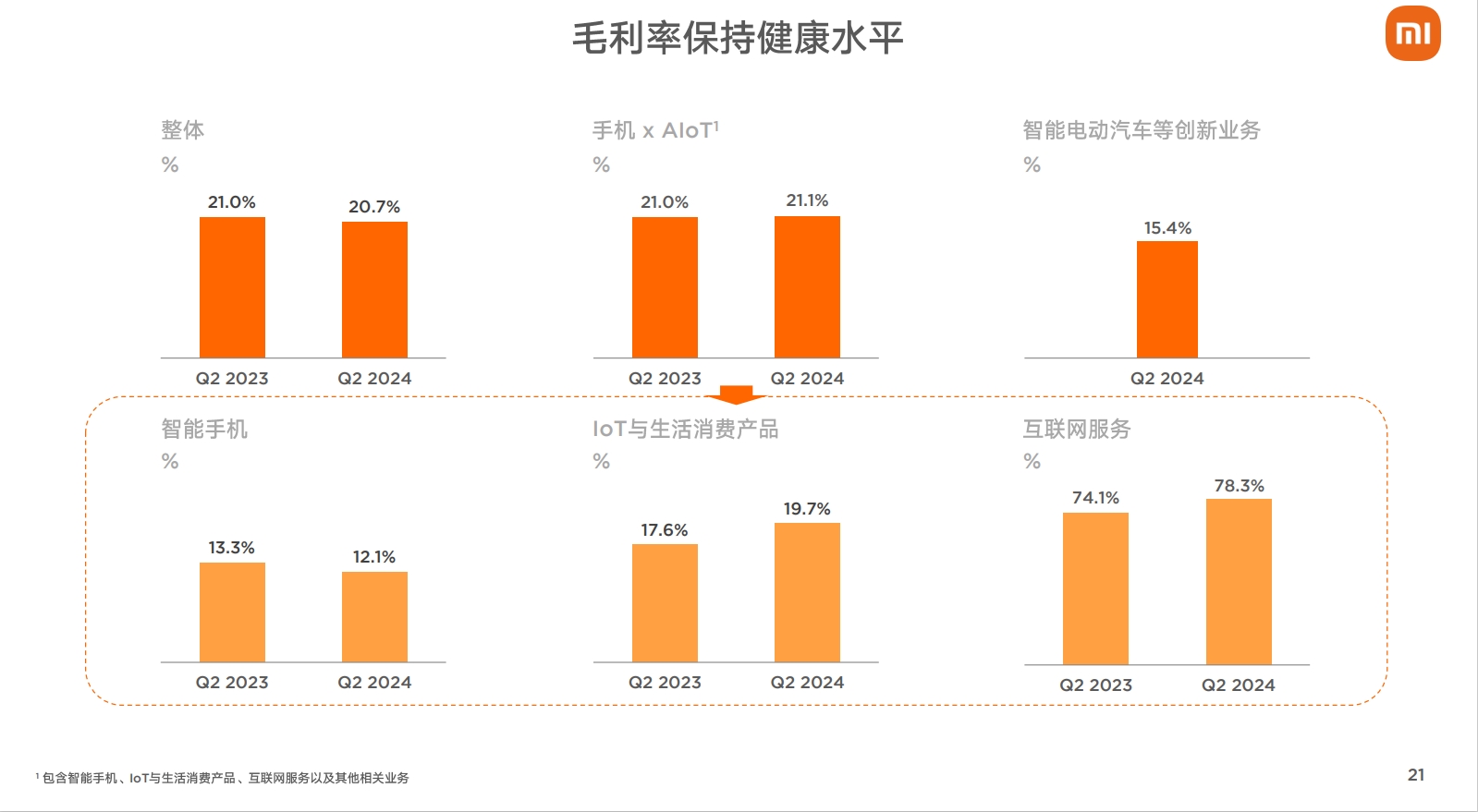

Looking back at Xiaomi's smartphone business in Q2, despite significant revenue and shipment growth, particularly in overseas markets, domestic performance was relatively average. While high-end market share increased, the smartphone gross margin declined: from 14.8% in Q1 and 13.3% in the same period last year to just 12.1% in Q2.

Source: Xiaomi

The goal of Xiaomi's smartphone premiumization strategy is to achieve higher prices and profits, thereby increasing profitability. So why has the gross margin declined? Lei Tech believes this is closely related to Xiaomi's flagship smartphone offerings during the quarter. From January to March, Xiaomi's high-end smartphones, such as the Xiaomi 13 Ultra and Xiaomi 14 series, exceeded market expectations. However, from April to June, the launch of the Redmi Turbo 3, a mid-range device, diluted some of the gross margin gains from high-end models.

It's worth noting that Xiaomi voluntarily sacrificed some profits to boost sales during the 618 shopping festival. The results were clear: Xiaomi achieved record sales across all channels during the 618 period, topping domestic smartphone sales and revenue. Sacrificing some gross margin was a strategic move given the declining willingness of users to upgrade their phones. Attracting users by offering more competitive prices was a pragmatic approach to securing sales.

As a highly mature market, Xiaomi finds it difficult to achieve explosive growth in smartphone sales. Therefore, the core strategy for its smartphone business is to continue pursuing premiumization, driving higher revenue and profits amidst stagnating sales volumes.

For instance, Xiaomi released the Xiaomi MIX Fold 4 and Xiaomi MIX Flip in July. While specific sales figures are not yet available, foldable phones are both a powerful tool for increasing high-end market share and a significant growth area within the smartphone market. Xiaomi's first small foldable, the Xiaomi MIX Flip, gained popularity through its unique accessory bundle, demonstrating strong competitiveness in the foldable market. These devices position Xiaomi favorably in this rapidly growing segment.

Source: Lei Tech

Last year, the Xiaomi 14 series secured the first shipment of Qualcomm's flagship chip, leveraging this advantage and robust hardware specifications to achieve sales of over one million units within ten days. The Xiaomi 15 series is expected to continue this strategy by securing the first shipment of the Qualcomm Snapdragon 8 Gen4, aiming for another blockbuster hit in Q4 2024 that will serve as Xiaomi's anchor flagship for 2025.

The launch of powerful high-end models is expected to boost Xiaomi's smartphone gross margin. Whether the Xiaomi 15 series has the strength to deliver remains to be seen, but Lei Tech will closely monitor this new product launch and provide professional, in-depth reviews to our readers. Stay tuned!

Which directions hold promise for Xiaomi's smartphone business?

At the product level, despite claims of smartphone homogenization, we've seen significant changes and innovations in recent years. Phone makers continue to push technological and functional boundaries, with innovation and product highlights emerging continuously—especially among domestic vendors.

Lei Tech believes that phone makers will continue to compete on materials, screens, fast charging, performance, cameras, and other dimensions. However, these are largely incremental improvements that compete for the same pie. To gain incremental growth, phone makers must successfully explore new categories. Lei Tech anticipates that the second half of the smartphone industry will focus on foldable phones, AI-powered phones, and camera-centric phones.

Source: Lei Tech

Today, almost every major brand is involved in foldable phones, including Samsung, Huawei, OPPO, Vivo, Honor, Motorola, Transsion, and Google. Small foldable devices are trending in 2024 due to their lower costs, smaller form factors, and higher aesthetics, making them more appealing to consumers. Meanwhile, large foldable phones continue to evolve towards flagship-level experiences, enhancing their camera and system capabilities.

As technology matures and costs decrease, foldable phones will become more affordable, leading to direct competition with similarly priced straight phones. Xiaomi's Xiaomi MIX series is already trending towards straight phone specifications in terms of chip performance, rear camera systems, and charging speeds. While they still lag behind straight phones at similar price points, they demonstrate the potential to become mainstream in the future.

The competition in AI-powered phones is not about apps but rather the underlying AI operating system or even the chip itself. Lei Tech observes that domestic brands are investing heavily in developing their own operating systems to create "black holes" in the OS space, such as HarmonyOS NEXT and Xiaomi's Penglai OS. These efforts aim to gain more autonomy and develop OSes better suited for the AI and IoT eras, as Android struggles to keep up. Since Xiaomi launched Penglai OS, it has integrated all products within its ecosystem, aligning with Lei Jun's vision of a "people-car-home" ecosystem.

Source: Xiaomi

The trend towards camera-centric phones is also undeniable. Many consumers seek a camera-equipped phone with internet capabilities, making imaging an ultra-high-frequency demand and a crucial differentiator for vendors. As a result, phone makers are enhancing their imaging capabilities, launching camera-centric flagships, and even claiming flagship-level imaging for mid-range devices. Xiaomi is a key player in this space, and its collaboration with Leica in the Xiaomi 14 Ultra was a resounding success. We eagerly anticipate Xiaomi's imaging performance in the Xiaomi 15 series.

In summary, Xiaomi's Q2 financial report demonstrates a strong performance in its smartphone business. Despite the momentum of its automotive business, Xiaomi remains a key player in the global smartphone market. This is where Xiaomi started and where its business roots lie. Smartphones will always be Xiaomi's "lifeblood," and Lei Tech will continue to closely follow its smartphone business developments.

Source: Lei Tech