NetEase Q2 Financial Report Analysis: How will the long-distance runner NetEase cope with cyclical challenges?

![]() 08/23 2024

08/23 2024

![]() 498

498

The financial reporting season for Chinese companies listed overseas is still underway, and this week we have received NetEase's financial report. On August 22, NetEase released its financial results for the second quarter of 2024. Overall, given the continued macroeconomic pressures, NetEase's resilience against cyclical downturns remains solid, with Q2 revenue reaching 25.5 billion yuan, an increase of 6% year-on-year, and net profit of 7.8 billion yuan (Non-GAAP). Excluding the impact of exchange rates, operating profit increased by 15% year-on-year.

Games remain NetEase's primary driver, with revenue from games and related value-added services reaching 20.1 billion yuan (US$2.8 billion), an increase of 6.7% year-on-year. Among them, mobile games increased by 16% year-on-year, while PC games increased by 4%. Additionally, the official return of World of Warcraft, whose revenue has not yet been included in Q2 earnings, has led to a resurgence in PC game growth, exceeding market expectations. Youdao and music businesses are also trending towards health, with revenues of 1.3 billion yuan and 2 billion yuan, respectively. Notably, Youdao's operating cash flow also reached a record high.

It is worth noting that NetEase invested 4.5 billion yuan in R&D during this quarter, representing an R&D intensity of over 17%. According to financial reports over the past few years, NetEase has invested more than 15% of its revenue in R&D for eight consecutive quarters. This shows that even in a challenging macroeconomic environment, NetEase continues to invest heavily in research and development. After all, the gaming industry relies heavily on the accumulation of core technologies in the early stages, and only through continuous efforts can significant progress be achieved in the long run.

This financial report is not particularly outstanding compared to previous ones, and it implies some expectation gaps due to occasional factors. However, NetEase's fundamentals remain solid, and short-term pressures do not pose a significant problem. Diving into financial data can be precise but also lead to short-sightedness and overreaction to short-term performance fluctuations. Companies operate in a macroeconomic ocean and are constantly in competition, making it difficult to maintain a straight trajectory; fluctuations are the norm.

When viewed over a longer timeline, considering the macroeconomic environment, NetEase's strategic vision, and future marginal trends (such as product pipeline and cost optimization), these factors are more decisive in determining NetEase's long-term value than short-term fluctuations.

Comfort vs. Pain: When NetEase Decides to Leave Its Comfort Zone

In the past, NetEase's core games have lacked high daily active user (DAU) products. In the era of growth, this might have been manageable, but now, with the changing times and a sluggish consumer environment, the gaming industry is transitioning from growth to retention. NetEase must awaken from its comfort zone.

Regarding the broader consumer environment, in the first half of the year, total retail sales of consumer goods amounted to 23.5969 trillion yuan, an increase of 3.7% year-on-year, a decrease of 4.5 percentage points from the same period last year (8.2%). The growth rate of consumption has slowed significantly. The gaming industry has also been affected, with domestic game sales declining by 3.32% year-on-year in the second quarter of 2024, according to the "China Game Industry Report, January-June 2024."

With slowing revenue growth and a return to rational consumption, consumer confidence remains weak. Under these dual constraints, the gaming market for retention is seeing trends towards high DAUs and low average revenue per user (ARPU).

NetEase was the first to turn the gun on itself. The successful launch of "Party Animals" in the second half of 2022 is evidence of its transformation. As a party game, it has relatively low ARPU but extremely high user engagement. It maintained a top-10 ranking in Q1 2023 and achieved new heights in Q2 2024, with over 600 million cumulative registered users globally and over 40 million creators, pushing the DAU trajectory to new highs.

"Ni Shui Han" (a mobile game) also emphasizes a non-pay-to-win, non-aggressive monetization, and seasonal operation model. In traditional massively multiplayer online (MMO) games, character customization often involves significant in-game purchases. However, "Ni Shui Han" opts for a low-cost model, offering a vast array of free and affordable cosmetic options, including occasional $1 and $5 deals, fostering a sustainable monetization strategy. "Code Name: Wonderland," unveiled at the Gamescom, is rumored to be NetEase's next big DAU family-friendly game targeting players of all ages, genders, and cultural backgrounds. This suggests NetEase will continue with this strategy.

The painful self-criticism has rejuvenated older games. From this financial report, we see that older titles like "Identity V" and "Rate of Fire" have set new daily active user records, while "Naraka: Bladepoint" has also achieved a new DAU high on its third anniversary.

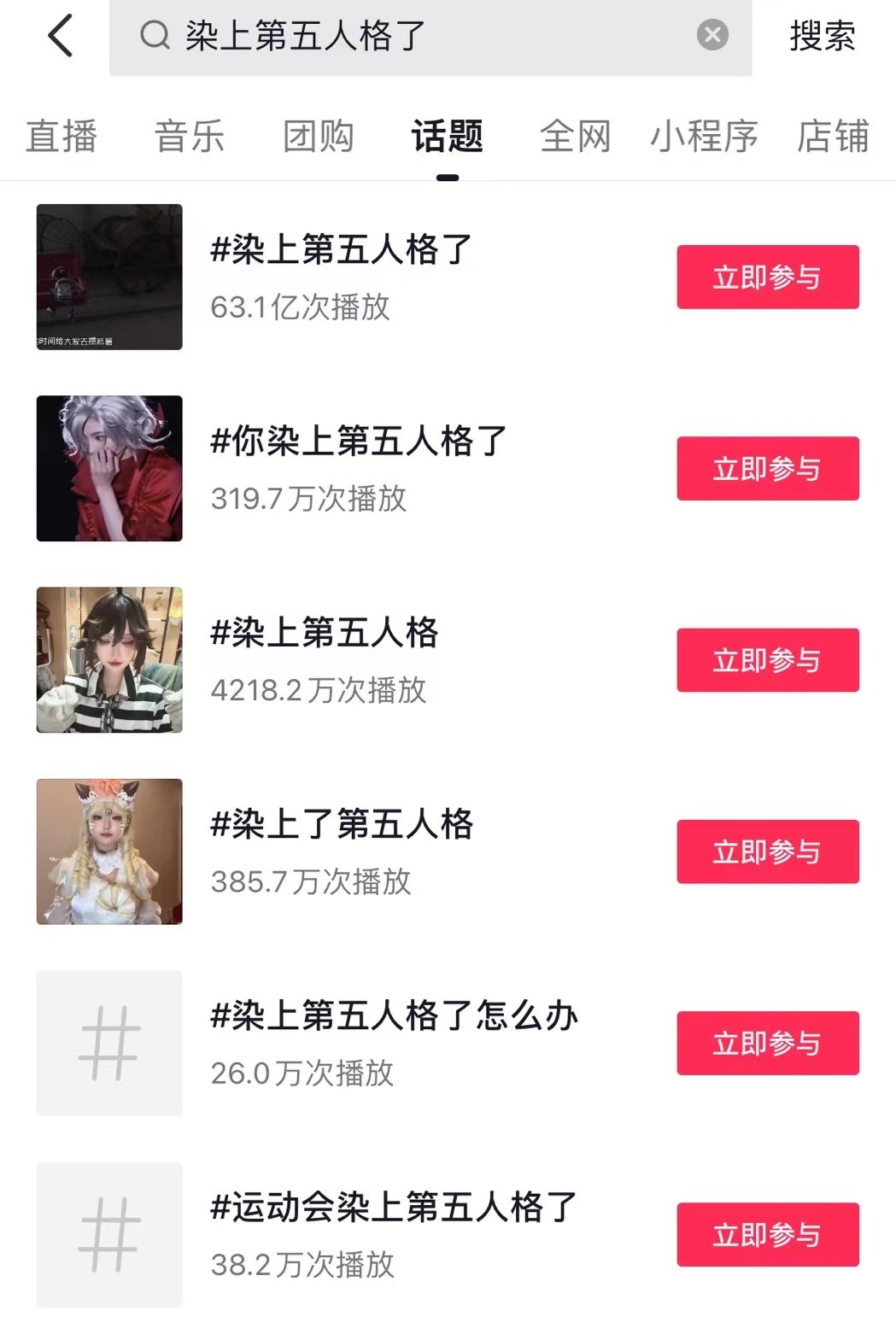

When "Identity V" first gained popularity, it was predicted that its asymmetric multiplayer gameplay would have a relatively short lifespan. However, its unique positioning and gothic visual style have appealed to many young people. The absurd and slightly neurotic content symbols in "Identity V" resonate with the internet culture of seeking novelty and individuality among young people. Players have spontaneously created derivative content, leading to viral memes like "#IdentityVLaunch" on social media platforms, with over 6 billion views on Douyin. This has activated the broader player community, showcased the game's core content to a wider audience, and revitalized "Identity V" in its sixth year, positioning it in a more unique niche.

Popularity of "Identity V"-related topics on Douyin

In the past, the market has often criticized NetEase for its strength in originality but weakness in operations. However, the success of rejuvenating older games in Q2 2024 Breaking the stereotype of NetEase in the past 。

Secondly, NetEase's bets on new games have also become a formidable force that cannot be ignored.

Among the new games, "Naraka: Bladepoint Mobile," an action-packed competitive title, debuted in mid-to-late July and quickly rose to the third spot on the domestic iOS bestseller list, topping the iOS download chart for over a week and breaking NetEase's record for daily new users in its 27-year history. In other genres, "The Seven Days," a multiplayer open-world survival game, achieved a peak concurrent Steam player count of over 230,000 upon launch, ranking second among Steam's global bestsellers. Meanwhile, "Lost Light," a treasure-hunting shooter, immediately topped the iOS download chart upon release.

No company can rely solely on one trick to succeed indefinitely; growth is fundamentally a strategic issue, not just a matter of traffic. For NetEase, it has launched a dual-engine strategy: continuously pushing new games to the forefront of their respective genres while maintaining the vitality of classic titles to achieve high DAUs. For any company, self-awareness is essential, but it's precisely because of this that it's challenging to leave one's comfort zone. NetEase has commendably taken the initiative to break out of its comfort zone.

Visible and Invisible: Where Are the Lighthouses of the Next Era?

The phenomenal success of "Black Myth: Wukong" has been widely recognized, setting new benchmarks for standalone games in China. Behind every record set by domestic games is a growing demand from players for high-quality, blockbuster experiences. While this process is undoubtedly positive for China's gaming industry, the emergence of critically acclaimed and commercially successful products will take a long time. "Black Myth: Wukong" took six years to develop, offering insights for future game-changers: surprising slow-burn products require patience.

For today's gaming companies, only continuous investment will yield results. NetEase's commitment to this path is evident, with R&D investment intensity exceeding 15% for eight consecutive quarters as of Q2 2024, and R&D investment reaching 4.5 billion yuan in Q2, representing an intensity of over 17%.

With these achievements solidified, NetEase remains committed to investing in self-developed blockbusters. Blockbusters naturally attract traffic and buzz, allowing for longer development cycles while delving into innovative gameplay. Additionally, R&D achievements help NetEase delve deeper into niche genres and maintain its competitive edge.

One notable feature of "Naraka: Bladepoint Mobile," launched in July, compared to its PC counterpart, is the inclusion of AI teammates with real-time voice communication. These AI teammates offer various personalities and comply with player commands, enhancing gameplay engagement and emotional interaction with players. Games like "Ni Shui Han" and "Party Animals" have also embraced AIGC+UGC playstyles earlier, stimulating player creativity, enriching gameplay, and increasing user retention.

The gaming industry has always been an innovator of new technologies and trends. To satisfy increasingly discerning players, a dual approach of R&D and preservation is necessary. R&D intensity reflects a company's innovative capabilities, and over time, this translates into an upward trend: more than 15% R&D investment for eight consecutive quarters... increasing annually. This trend embodies NetEase's efforts to build a solid foundation and accumulate energy.

Regarding the immediate pipeline, NetEase boasts a rich reserve of new games. "Sixteen Sounds of Yan Cloud" and "Marvel Rivals" have announced their console release plans, with "Sixteen Sounds of Yan Cloud" set for cross-platform testing on August 28, and "Marvel Rivals" scheduled for Steam, Epic Games, PS5, and Xbox Series X/S on December 6. At the Nintendo Direct, "Party Animals" also announced its global release plan for Switch. Following the return of "World of Warcraft," "Hearthstone" will officially return on September 25.

Furthermore, NetEase's product release strategy in recent years has implicitly outlined a clear path: expanding across multiple gaming platforms and enhancing global reach and influence. Continuing down this path will undoubtedly carve out a new trajectory among global gamers.

At present, NetEase still has some resistance to cyclical challenges. Unfortunately, the macroeconomic environment shows little sign of rebound, which means that if consumption continues to weaken, investments may not immediately translate into assets.

In the red ocean, we can only grasp some established betas and wait for the day when alphas arrive. Like investing, given time, a company passionate about gaming will inevitably produce the next blockbuster. Be a friend of time; don't just talk about it.