Gross margin exceeds Tesla! But how much further does Xiaomi have to go on its money-burning journey with its cars?

![]() 08/23 2024

08/23 2024

![]() 441

441

As everyone knows, the “price war” in the domestic automotive market is particularly fierce, and new forces with less market influence and volume are all trying to find ways to increase revenue and gross margin.

Among them, NIO Auto deepened its “high cost-performance” route in the second quarter, resulting in a 54% quarter-on-quarter increase in total revenue to 5.36 billion yuan, but net losses increased by 19% quarter-on-quarter to 1.2 billion yuan, and the gross margin for the first half of the year was only 1.1%. To further reduce losses, expanding the brand's sales scale along this route is necessary; XPeng Motors further controlled costs, narrowing its net loss in the second quarter, and its gross margin for the first half of the year was 13.5%. Although there is still a gap with Lixiang Auto in the first tier, it reversed the negative gross margin trend from the same period last year.

Leaping Motor “increases revenue through sales but not profit”, XPeng “increases gross margin through cost reduction”, while ZEEKR and Xiaomi’s financial reports present a completely different state from the first two.

Thanks to the increase in sales in the second quarter, ZEEKR achieved a remarkable transformation from loss to profit, with a gross margin exceeding 17%, and its net loss for the first half of the year narrowed significantly to 70 million yuan; Xiaomi delivered 27,307 new vehicles in the second quarter, with a total revenue of 6.4 billion yuan in the smart vehicle business segment and a gross margin of 15.4%, but still incurred a loss of 1.8 billion yuan, equivalent to “losing 66,000 yuan per vehicle sold”.

Like Leaping Motor, ZEEKR also increased revenue through increased sales, but its product positioning is more upmarket, resulting in a significant increase in gross margin; as one of Xiaomi Group's businesses, Xiaomi Automotive is still in the investment phase and has many expenses, and the revenue generated by increased sales is difficult to fill the gaps left by rapid “money-burning” across various areas such as revenue and research and development.

Xiaomi Automotive currently only has one pure electric sedan, the Xiaomi SU7, while ZEEKR's main models are also pure electric sedans such as the ZEEKR 001 and ZEEKR 007, and the competitive relationship between the two is particularly evident. However, it took the ZEEKR brand three years to barely achieve quarterly profitability, raising the question: when will Xiaomi Automotive transition from the investment phase to the revenue phase?

Relying solely on a single model, it is inevitable that Xiaomi Automotive will incur losses

ZEEKR was founded in March 2021 and has accumulated losses of 22.652 billion yuan over the past three years, finally achieving profitability in the second quarter of this year.

It is no exaggeration to say that all new energy vehicle companies do not make money in their early stages of development. The reasons are not complicated. The automotive industry has a long supply chain, and each area of raw materials, research and development, and design requires spending. Moreover, to ensure the formation of economies of scale, subsequent marketing and business models also require significant investments.

As a new force just entering the new energy market, even Xiaomi Automotive, with its substantial backing, inevitably encounters this hurdle.

Regarding this, Lu Weibing, President of Xiaomi Group, stated that the primary reason for Xiaomi Automotive's ongoing loss is that its first model, the Xiaomi SU7, is a pure electric sedan, which has higher input costs compared to new energy SUVs, and it takes time to absorb these costs. In addition, I believe that Xiaomi Automotive's current small scale is also a primary reason for its ongoing losses.

Unlike other new forces, Xiaomi Automotive currently only has one product, the Xiaomi SU7, and can only produce around 10,000 vehicles per month in terms of capacity. The direct impact of this insufficient scale is limited revenue generation capabilities.

Although Xiaomi Automotive is currently in a state of “losing 60,000 yuan per vehicle sold,” there is a noteworthy figure in Xiaomi's Q2 financial report: Xiaomi Group's gross margin for innovative businesses such as smart electric vehicles was 15.4%, with an average selling price per vehicle of 228,600 yuan.

It must be said that Xiaomi Automotive's gross margin level is already higher than that of many new energy vehicle brands such as Leaping Motor. Lu Weibing directly acknowledged this gross margin and attributed it to Xiaomi Automotive's efforts in supply chain and hardware manufacturing.

In contrast, ZEEKR's sales gross margins were 1.8%, 4.7%, and 15.0% from 2021 to 2023, exceeding 17% in the second quarter of this year.

From ZEEKR's product planning, we can see that it launched one product each in 2021 and 2022—the ZEEKR 001 and ZEEKR 009, both positioned as upmarket, which inherently incur higher costs and do not generate higher revenue for the brand. It was not until 2023, when new volume-driven products such as the ZEEKR 001 and ZEEKR 007 were introduced, that ZEEKR's gross margin increased.

It must be said that Xiaomi Automotive, with a gross margin exceeding 15%, has already won at the starting line. For Xiaomi Automotive, the primary task to minimize losses is to expand its product scale as much as possible to enhance revenue generation capabilities.

In addition to increasing production capacity, enriching the product line is undoubtedly one of the main ways to expand the product scale. However, there are rumors that Xiaomi Automotive may launch its second pure electric vehicle in October, but these are for later. I tend to believe that Xiaomi Automotive will still rely solely on the Xiaomi SU7 this year and prioritize rapidly increasing production capacity.

Xiaomi still has much to spend in the future

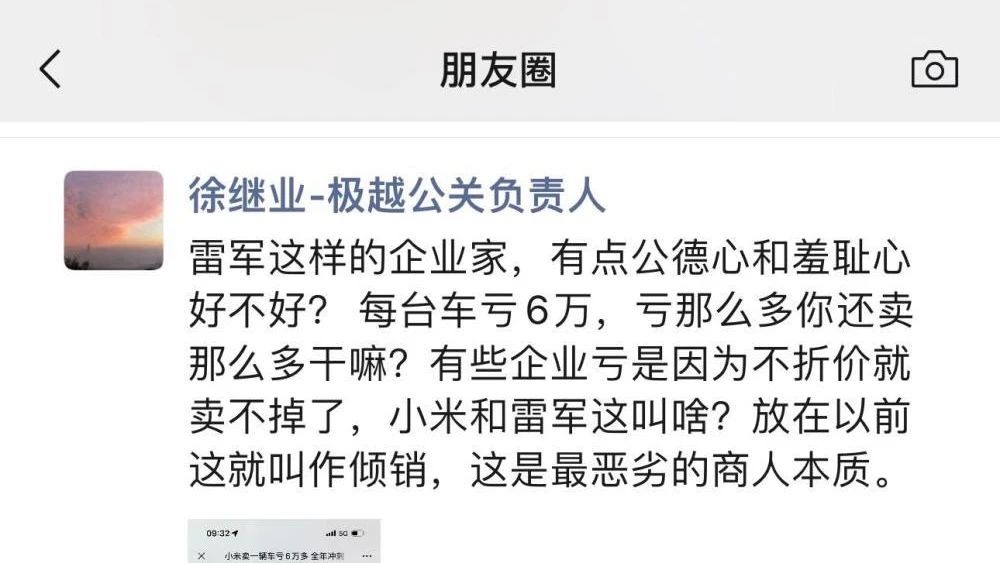

A screenshot circulating on social media shows Xu Jiye, the head of public relations for JiYue, saying, “Losing 60,000 yuan per car sold, why are you still selling so many if you're losing that much?” and even bluntly stating, “In the past, this would be called dumping.”

I do not know the authenticity of this screenshot, but I will analyze and discuss its content.

Dumping refers to the practice of exporting goods in large quantities to another country (or region) at prices below their normal value.

As a domestic new energy brand, Xiaomi Automotive sells the Xiaomi SU7 in the domestic market, which clearly does not meet the definition of dumping. Furthermore, Xiaomi Automotive incurs losses due to upfront investments and marketing demands, such as the construction of factories and stores, research and development, and labor costs. If prices were set below normal value, the gross margin exceeding 15% would be impossible to achieve.

Moreover, from my perspective, if we only look at net losses and not gross margins, Xiaomi Automotive may experience a situation where it “loses more money per vehicle sold” in the short term.

The automotive industry is a manufacturing industry that typically relies on economies of scale. To generate greater revenue, automakers may need to invest heavily upfront. As seen in ZEEKR's second-quarter financial report, the brand invested 2.62 billion yuan in research and development, a 36% increase from the first quarter and a whopping 90% year-on-year increase.

For Xiaomi Automotive, it will undoubtedly not be satisfied with the status quo of producing around 10,000 vehicles per month. To achieve profitability and increase gross margin, the essence lies in expanding revenue generation capabilities, such as enriching the product line and increasing production capacity.

Recently, spy shots of Xiaomi's first SUV undergoing road tests were exposed, and it is expected to be previewed around the Spring Festival next year and potentially launched in the first quarter. Xiaomi Automotive has repeatedly stated that “building sedans is more difficult than building SUVs.” Although not much information has been revealed about this SUV, to compete with Lixiang Auto and Wenjie and have a say in the domestic new energy SUV market, Xiaomi Automotive must identify more differentiated advantages.

It can be imagined that product research and development and factory construction will be the primary areas of investment for Xiaomi Automotive in the future. However, in addition to this, Xiaomi Automotive will also invest heavily in high-level autonomous driving research and development.

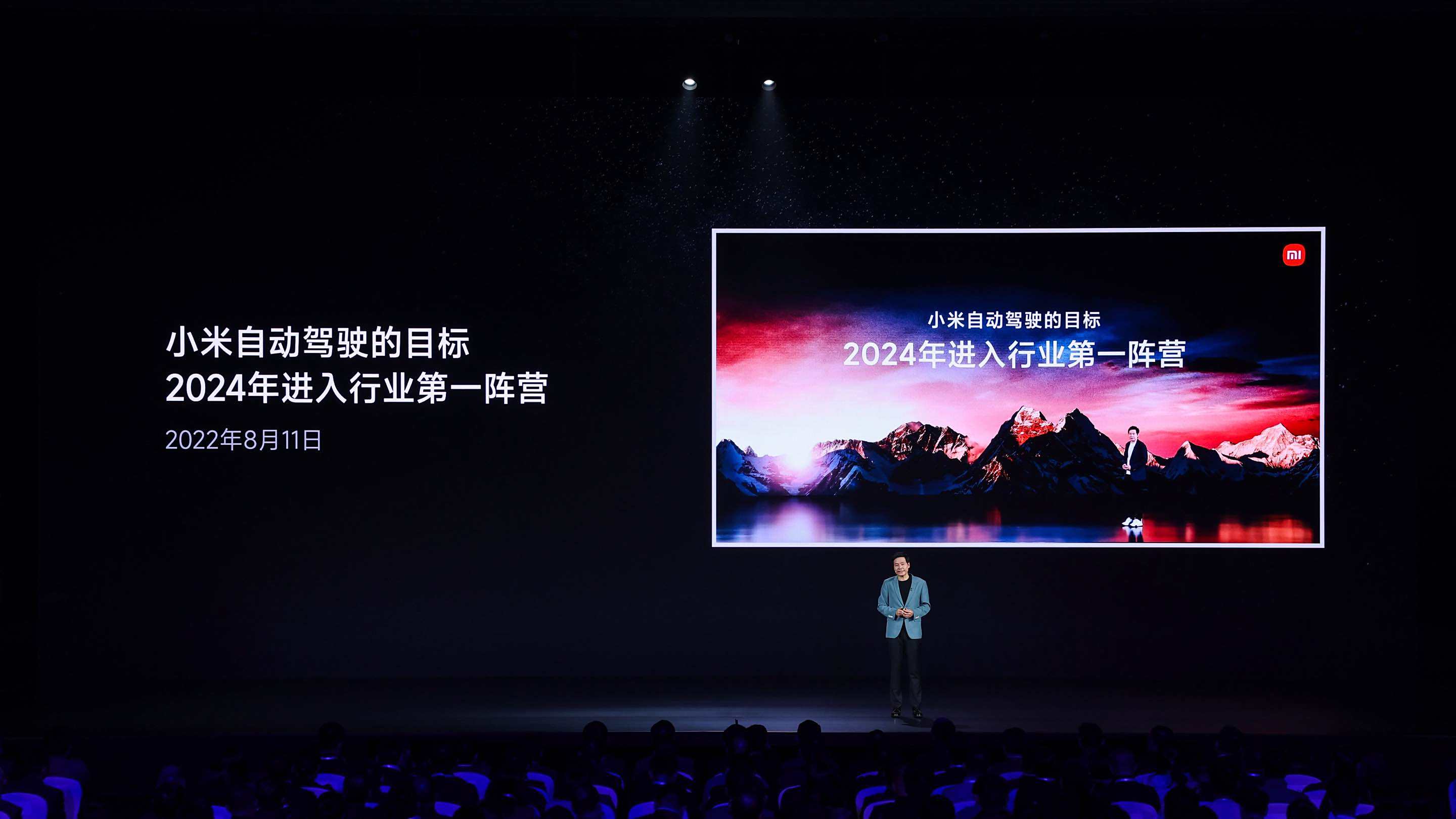

Lei Jun stated as early as 2022 that Xiaomi's goal for autonomous driving is to enter the industry's first tier by 2024. In a previous livestream, Lei Jun revealed that the annual cost for autonomous driving alone currently exceeds 2 billion yuan, and the team has grown to over 2,000 members. Even with its technological foundation, Xiaomi Automotive still needs to invest heavily in human resources and research and development costs to enter the first tier of autonomous driving this year.

Products and autonomous driving are Xiaomi Automotive's primary short-term projects, and the company also has a long-term project of building supercharging stations. According to plans, Xiaomi Automotive is preparing to construct 600kW liquid-cooled supercharging stations, with the first batch planned for Beijing, Shanghai, and Hangzhou.

While many automakers, including NIO, XPeng, Lixiang Auto, and ZEEKR, are actively building supercharging stations, Xiaomi Automotive may not achieve the same density and coverage as NIO, but to provide users with a sufficiently fast charging experience, it must have a presence in major first- and second-tier cities, which will require significant investment.

Thus, the 1.8 billion yuan business loss in the second quarter is not yet Xiaomi Automotive's “ceiling.” As competition intensifies over time and users demand higher overall experiences after the novelty wears off, there will be many more scenarios where Xiaomi Automotive will need to spend money. In other words, Xiaomi's current “good results” are not enough to celebrate, and their “quest” has only just begun.

Final Thoughts

The second-quarter financial reports of ZEEKR and Xiaomi Automotive were decent, but neither brand can relax.

Xiaomi Automotive currently relies solely on the Xiaomi SU7, and customers currently need to wait until the end of the year to take delivery. It is undeniable that the Xiaomi SU7's performance indicates high product popularity, but for customers who need a car immediately, the Xiaomi SU7 may no longer be the first choice.

In the short term, it will be difficult for Xiaomi Automotive to address production capacity limitations, and whether it can consistently generate high order volumes in the second half of the year remains a question.

ZEEKR failed to fully consider the feelings of existing car owners during rapid model iterations, which undoubtedly affected the brand's reputation to a certain extent and may have put some potential customers in a wait-and-see mode, potentially impacting sales of the upcoming ZEEKR 7X and ZEEKR MIX.

In addition, both ZEEKR and Xiaomi, as new energy vehicle brands, have significant projects to complete this year, such as high-level autonomous driving and charging station construction. In particular, both companies claim to aim for the industry's first tier in high-level autonomous driving this year. However, with benchmarks set by HarmonyOS Intelligent Driving and XPeng, as well as plans from brands like JiYue and GAC in high-level autonomous driving, it will not be easy for ZEEKR and Xiaomi to become benchmarks.

From a financial perspective, ZEEKR's second-quarter performance exceeded expectations, and Xiaomi Automotive's losses were expected, but its gross margin was indeed surprising. It must be said that both automakers' financial data presented a positive growth trend.

However, competition in the new energy vehicle market will intensify further in the second half of the year, with multiple automakers introducing corresponding new energy products to compete with the Xiaomi SU7 and ZEEKR's electric vehicles. It can only be said that the challenges facing the new energy vehicle market will only increase in the future.

Source: Leitech