Tencent remains stable and secure

![]() 08/23 2024

08/23 2024

![]() 558

558

This article is written based on public information and is intended solely for information exchange purposes and does not constitute any investment advice.

Time flies, and it's mid-year reporting season again.

As the opening chapter of large company mid-year reports, it is natural to focus on Tencent's overall performance in the second quarter, the "King of Stocks".

First, the conclusion:

● Tencent delivered its best performance in nearly a year, with positive year-on-year growth across all four business lines, driven primarily by games and video accounts.

● Video accounts not only drove advertising growth but also compensated for the lack of growth in payment and credit services during the downturn, and drove revenue growth in enterprise services and cloud computing. They are Tencent's current primary growth engine. However, relatively speaking, video accounts still have considerable room for improvement.

● Tencent's stability has been clearly demonstrated. However, the core issue is that almost all of Tencent's current growth comes from fluctuations within the foreseeable range of existing businesses, and the X-factor that could truly break through valuation ranges has yet to emerge.

The logic behind this is explained below.

01

Stable and Secure

(1) Overall financial performance: All business lines have improved significantly

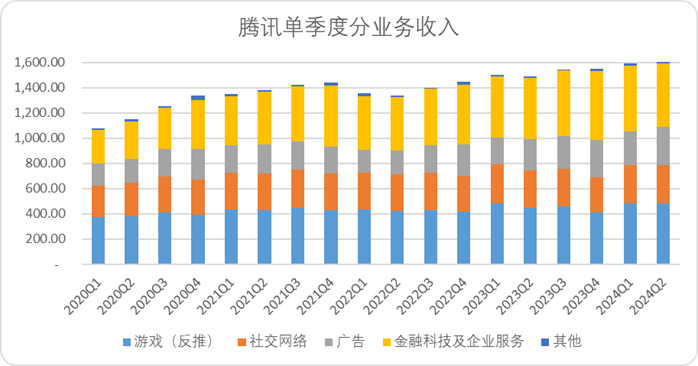

In terms of financial performance alone, Tencent's second-quarter results were impeccable: total revenue exceeded 160 billion yuan for the first time in a single quarter, reaching 161.117 billion yuan, an increase of over 8% year-on-year. Apart from FinTech and Business Services, gaming, social networking, and advertising businesses all showed significant improvement.

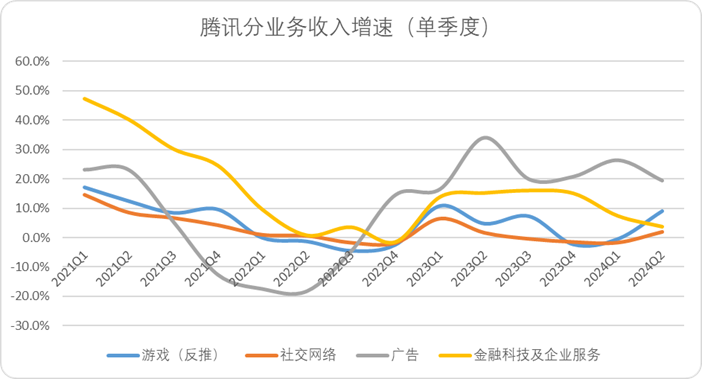

In terms of business lines, advertising and gaming grew at 19.5% and 9% year-on-year, respectively, both exceeding the overall growth rate and driving Tencent's second-quarter revenue growth. Gaming achieved its highest quarterly growth rate in nearly five quarters, while advertising maintained its high growth rate since Q4 2022.

Figure: Tencent's quarterly revenue by business line (in billions of yuan), Source: Company Financial Report, Silk Brocade Research

Figure: Tencent's revenue growth by business line, Source: Silk Brocade Research

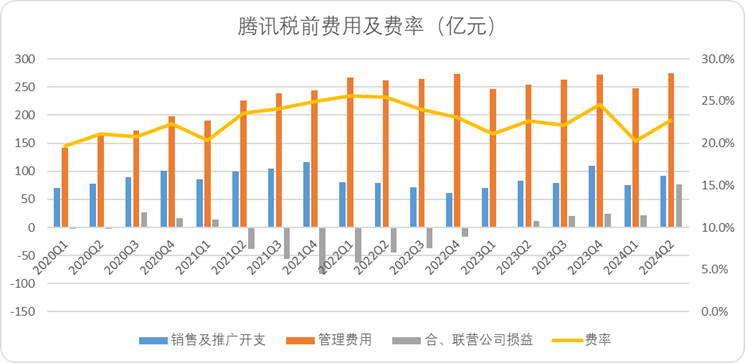

In terms of overall rates, Tencent remained relatively stable in the second quarter, with sales and administrative expenses stable at 22.7%, roughly the same as the same period last year and lower than the same period last year when video accounts were scaled up. Relatively speaking, the growth of video accounts and gaming businesses did not rely heavily on marketing expenses this time around.

Joint ventures and associates benefited from continued investment from Kuaishou and Pinduoduo, as well as the rise of EPIC, contributing a profit of 7.7 billion yuan, far exceeding the same period in history.

Figure: Tencent's expenses and expense ratios, Source: Company Financial Report, Silk Brocade Research

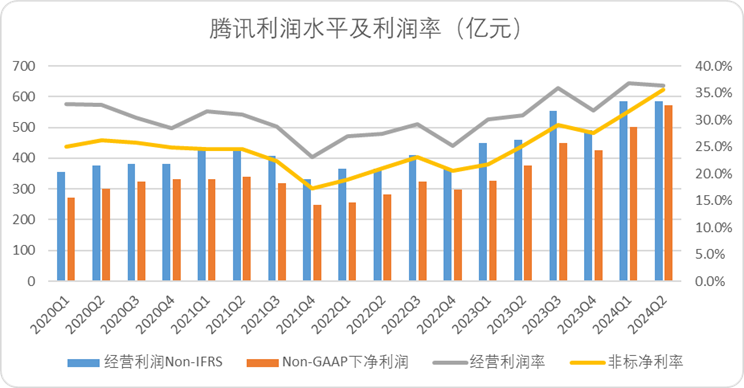

On the profit front, Tencent's second-quarter Non-IFRS operating profit reached 58.4 billion yuan, flat quarter-on-quarter and up 26.9% year-on-year. Net profit under Non-GAAP reached 57.3 billion yuan, setting a new high.

A closer look at operating profit reveals that excluding deferred tax adjustments (estimated at approximately 1.1 billion yuan based on a 9% decrease), operating profit margin decreased by 1.5% quarter-on-quarter, remaining at the same level as the third quarter of last year.

Figure: Tencent's profit levels and profit margins, Source: Company Financial Report, Silk Brocade Research

(2) Business performance by segment: Outstanding performance in advertising and gaming, with gaming particularly impressive.

Gaming: The most significant increase in the second quarter came from the combined effect of "one new and one old" game.

"DNFM" leveraged its long-established IP and surpassed 1 billion yuan in revenue in its first week. According to DianDian Data, from May to July, mobile game downloads and installations consistently ranked among the top, leading the pack by a wide margin. In less than three months, it occupied the second position in the revenue rankings, making it the core incremental pillar for Tencent Games this year.

Figure: Mobile game downloads and revenue rankings from May to July, Source: DianDian Data

Compared to "older games," Valorant was also a key growth point highlighted in Tencent's financial report. Since its global launch, Valorant has maintained a high monthly active user base and relied on Riot's operational capabilities to form a comprehensive competitive system, potentially becoming Riot's second evergreen phenomenon-level game after League of Legends.

However, the domestic version of Valorant, which launched last year, did not significantly drive performance, partly due to the nature of FPS games.

Moreover, unlike mobile games, Valorant does not offer long-term item sales. Generally, new "skins" are released every 1-2 weeks, and previously launched products cannot be purchased continuously, resulting in relatively stable and periodic revenue (content quality). Due to a later launch in China by about two years, the content inventory is relatively abundant, and it is likely to maintain a high revenue level for some time (with nearly one million concurrent users at present).

Meanwhile, mini-program games were also a highlight, with mini-game revenue growing by 30% year-on-year.

Although advertising and video accounts contributed more profit and growth, we still believe that gaming was Tencent's most surprising business performance in the second quarter.

The main reason is that in the first half of the year, the actual sales revenue of the domestic game market was 147.267 billion yuan, with a year-on-year growth rate of only 2.08%. Even the actual sales revenue growth of domestically developed games in the domestic market decreased by 3.32%. In comparison, Tencent demonstrated stronger content reserves and monetization capabilities as a gaming leader.

Advertising: The year-on-year growth rate reached 19.5% in the second quarter. Since online concerts in 2022 drove rapid growth in the user base of video accounts, Tencent's advertising business has maintained double-digit growth for seven consecutive quarters.

According to the earnings call, video account advertising revenue grew by nearly 80% year-on-year, a significant driver of advertising revenue growth.

Maintaining double-digit growth on a high base in the second quarter was no easy feat. Apart from the linear growth of video accounts, the financial report emphasized the contribution of Tencent Video's performance:

"Celebration of Life 2" and "Flying with Phoenix" ranked among the top two TV series on online video platforms in the first half of this year, alongside hits like "The Story of Roses" and "Flowers Blooming." Apart from driving paid memberships, they also generated significant advertising revenue.

The only issue is that although Tencent Entertainment has successfully streamlined the entire process from IP production to promotion through Yuedu+New Classics Media+Tencent Video, the level of industrialization is not high. Long production cycles inevitably lead to cost overruns, which can also affect long-term performance stability.

FinTech and Enterprise Services: One up, one down. The payment business is constrained by macroeconomic fluctuations, with both upstream credit and downstream payments under pressure, making declines an inevitable cyclical trend. On the enterprise services side, cloud computing revenue increased significantly (the financial report mentioned double-digit growth). Alibaba Cloud also grew by 6% in the second quarter. Overall, industry fee reductions have expanded market demand. Compared to external competitors, Tencent Cloud can rely on the growing video account and short video merchant base to boost growth space, potentially achieving sustained high growth for several quarters to come.

From a profit perspective, the growth rates of the three businesses were advertising > FinTech > gaming. While gaming has a large base, video accounts have significantly boosted both advertising and FinTech. Notably, even though FinTech's growth rate lagged behind other businesses, its gross profit margin has risen sharply since Q1 2023, thanks in part to the significant contribution from video account merchant technical service fees. The higher-margin wealth management business within the payment segment also grew impressively.

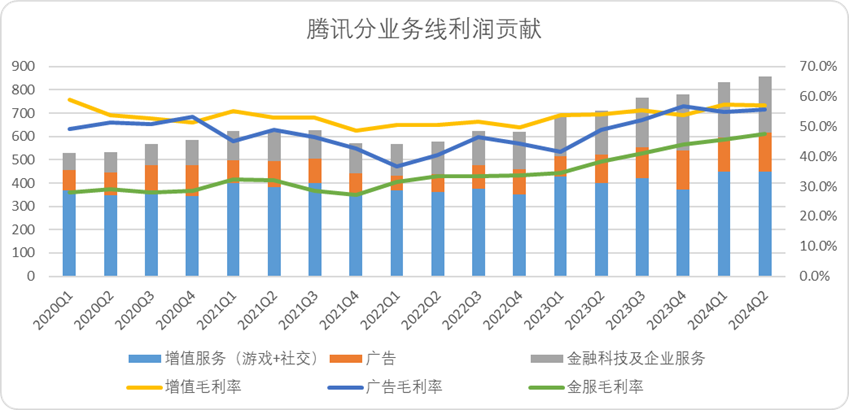

Figure: Tencent's profit and profit margins by business segment (in billions of yuan), Source: Company Financial Report, Silk Brocade Research

In summary, Tencent's overall performance in the second quarter slightly exceeded expectations, particularly as the gaming business, which had been sluggish, reached a new level with the launch of new games. The advertising business maintained its high growth rate for nearly a year and still achieved impressive results. Relying on video accounts, enterprise services filled the gap left by the credit business, overall resisting the downward pressure on growth during the downturn and demonstrating Tencent's solid foundation to the market.

02

Lingering Concerns

Based on the second-quarter financial report, video accounts undoubtedly represent "the hope of the village."

First, let's discuss the highlights. In the second quarter, the monthly active users (MAU) of video accounts were roughly on par with those of leading short video platforms. However, in terms of advertising and e-commerce, they were far from the scale of leading short video platforms, leaving significant room for growth.

The growing video accounts have already driven impressive performance contributions for Tencent. The over 80% year-on-year growth in video account advertising revenue in the second quarter was widely reported in the media. Last quarter, video account advertising revenue was approximately 3 billion yuan, suggesting an estimated 5.4 billion yuan in Q2 this year, contributing roughly 50% of advertising revenue growth and 20% of overall actual growth.

Advertising, enterprise services (technical service fees), and cloud computing are the core growth drivers, all fueled by video accounts. Video accounts have largely filled the gap left by the inverse-cycle credit business and payment enterprise services. While performance looks impressive, as a growing business, it is far from exceeding investment expectations.

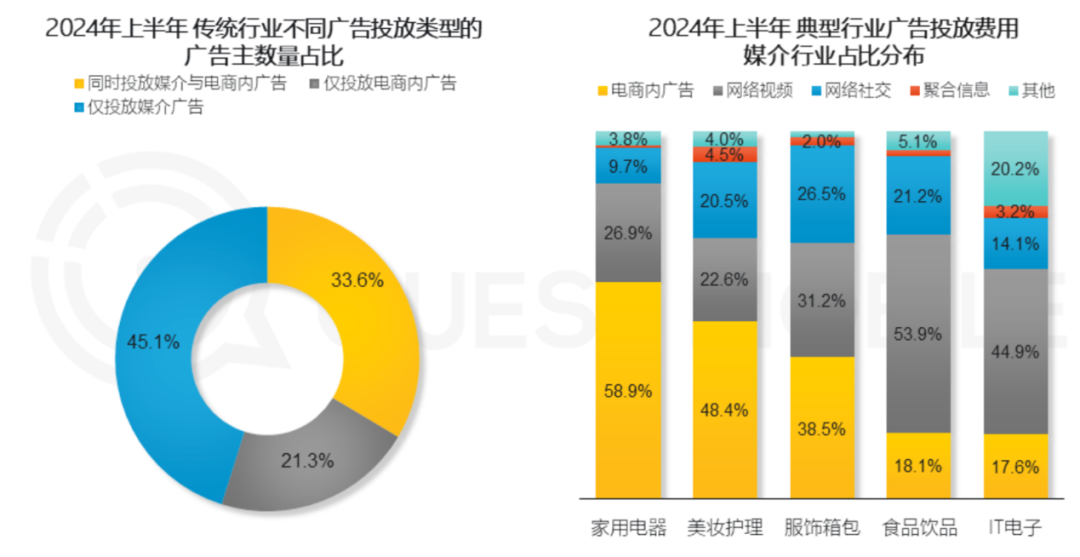

Comparing the advertising growth rates of other short video platforms, Kuaishou's external advertising revenue grew by 22.1% in Q2, with an actual increase of approximately 3.15 billion yuan. According to QuestMobile data, China's Internet advertising growth averaged 11.8% in H1 2024, confirming industry-wide growth.

Moreover, as two mainstream B-end media, e-commerce and short videos have benefited from price wars to some extent, helping weaker e-commerce-oriented short video platforms (like video accounts) increase their marketing revenue. Taobao's marketing revenue was flat year-on-year in the second quarter, with some of merchants' budgets spilling over to mainstream short video platforms. According to QuestMobile data from two years ago, the proportion of advertising spend solely on e-commerce platforms decreased by 3%.

Figure: Types and media share of Internet advertising in H1 2024, Source: QuestMobile

To some extent, video accounts have benefited from industry-wide growth and e-commerce price wars during their growth phase, but this does not mean they can rest easy or celebrate prematurely:

First, content supply: The content creation ecosystem of video accounts has not yet reached the level of competing short video platforms.

According to the latest estimates from Orient Securities, the ratio of monthly active creators to monthly active users on video accounts is 7.5%, significantly lower than that of Xiaohongshu (21.5%), Douyin (22.2%), and Kuaishou (24.9%). The main reasons for this phenomenon are twofold:

● The content tone of video accounts still favors PUGC logic, with insufficient motivation for individual creators. As a later entrant, they lack independent and non-duplicate content supply.

Tencent is aware of this issue. The ability to share 30-second long videos on video accounts as Moments is undoubtedly a key to connecting private traffic to video accounts. In April this year, video account's follow list was updated to automatically add official account authors, essentially a necessary means to mutually elevate both video accounts and official accounts as content creation platforms.

● The red dot navigation and sharing of video content via WeChat bring non-short video users into the platform, diluting the quality of video account's monthly active user base. In reality, their vertical users are far fewer than those of Douyin and Kuaishou.

According to research data from Guohai Securities, the average daily usage time of video accounts is around 54 minutes, compared to 120-130 minutes for Douyin and Kuaishou with similar monthly active users. Under similar monthly active user counts, video accounts' actual screen time share is still far less than that of vertical platforms like Douyin and Kuaishou.

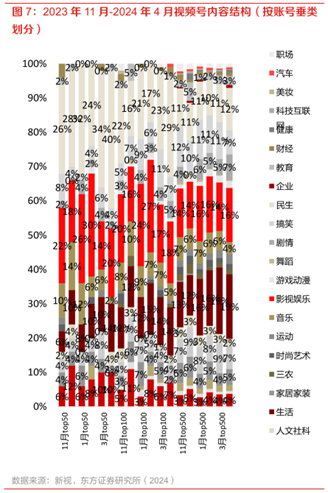

Second, content structure: It's still a matter of tone. Currently, the verticality and richness of video account content are not high.

From February to April this year, the content structure was dominated by lifestyle and entertainment, with relatively few high-monetization categories such as beauty, automobiles, and games. Even in the lifestyle category, which has higher advertising capacity, video accounts lagged behind Douyin (around 50%). Surprisingly, video accounts, centered around social apps, are not highly correlated with lifestyle content.

Figure: Illustration of video account content structure, Source: Orient Securities Research Institute

Another counterintuitive point is that everyone believes Douyin's algorithm mechanism ensures the fluidity of top streamers, with the leaderboard changing rapidly. However, the turnover rate of top streamers on video accounts exceeds that of Douyin by about 10%-20% (according to Orient Securities data), which may discourage creators from focusing on video accounts or lead to significant diversion of original content.

Of course, the critical significance of video accounts lies in reclaiming traffic value from Douyin and Kuaishou. Current deficiencies may represent future growth potential, and we remain relatively optimistic about the development of video accounts.

03

When Will AI Arrive?

Undoubtedly, Tencent's financial performance during the reporting season was impressive, with strong contributions across all business lines, both in terms of profit and revenue growth, and no apparent balance sheet contraction (with no reduction in R&D spending or expense ratios).

However, the market has not fully recognized Tencent's performance, with the stock price even falling by about 1% since the financial report was released a week ago.

Expectations for Tencent may not lie in its financial performance alone. After all, whether in social networking, gaming, or even payment and enterprise services, Tencent's business lines have already accumulated significant barriers to entry. We can see that all of Tencent's business lines still follow the logic from five years ago, gradually expanding and strengthening to achieve growth.

After reading Tencent's entire financial report, we feel that Tencent is the "honest man in the city." As a simple example, consider its presentation of AI capabilities.

If Douyin, Kuaishou, Baidu, or Ali had achieved such an exaggerated advertising growth rate in Tencent's second quarter, they would undoubtedly boast about it in their financial reports, attributing it to the improved AI capabilities driving business growth (in fact, everyone talks about AI except for Tencent, regardless of growth rate). However, Tencent only briefly mentioned AI (though it was promoted during the conference call, it's unclear why it wasn't included in the financial report), along with product introductions and annotations, and focused more on the future outlook:

Suddenly hearing of a fairy mountain in the sea, floating in the misty void. For Tencent, the king of stocks, merely following the existing main path and developing steadily is far from enough. Whether there are unexpected growth avenues is the top priority for valuation repair.