Bilibili makes money by "selling traffic"

![]() 08/26 2024

08/26 2024

![]() 529

529

Bilibili is "sprinting".

Since Bilibili prioritized cost reduction, efficiency enhancement, and accelerated commercialization as its strategic focus, when the platform will turn a profit has become a topic of significant external interest.

According to Bilibili's unaudited financial report for the second quarter of 2024 released on August 22, the platform generated revenue of 6.13 billion yuan in the quarter, marking a year-on-year increase of 16%. Among them, value-added services, games, and advertising businesses all experienced growth. Following the release of the financial report, Bilibili's US stock price surged by over 6% in pre-market trading.

However, Bilibili is still not profitable; the net loss for the second quarter was 608 million yuan, a 61% year-on-year narrowing. The good news is that the adjusted net loss narrowed year-on-year for the eighth consecutive quarter, and positive operating cash flow was achieved in the first half of the year. Is Bilibili getting closer to profitability?

01. Quarterly Report on "Increasing Revenue and Reducing Costs"

Bilibili continues to progress on the path of "increasing revenue and reducing costs".

In the second quarter of this year, Bilibili generated revenue of 6.13 billion yuan, a year-on-year increase of 16%. Among them, advertising revenue grew by 30% year-on-year, and value-added services revenue grew by 11% year-on-year. The net loss was 608 million yuan, a 61% year-on-year narrowing. The adjusted net loss was 271 million yuan, a 72% year-on-year narrowing.

Bilibili seems to be getting closer to its profitability target.

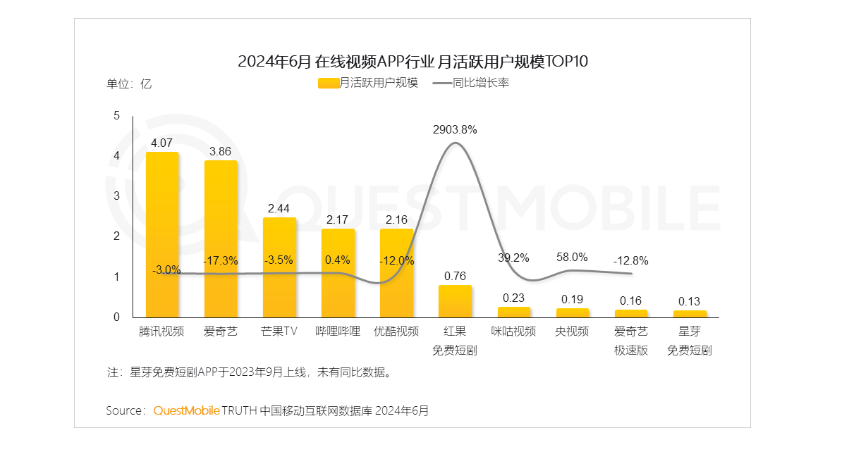

In terms of revenue growth, let's start with user growth. In the second quarter, Bilibili had 336 million monthly active users, a slight year-on-year increase of 3.7%. User volume has basically reached its ceiling. However, this is not unique to Bilibili; according to Questmobile's "China Mobile Internet Half-Year Report 2024," among multiple long-video platforms, including Tencent, only a few, such as Bilibili, have maintained positive growth in overall user scale, excluding popular free short drama apps and Olympics-driven platforms like Migu Video and CCTV Video.

Source: Questmobile

With the overall user growth rate slowing down, user stickiness has become a strong advantage for Bilibili; in the second quarter, Bilibili's DAU/MAU ratio was 30%, and the average daily user engagement time was 99 minutes, a 5-minute year-on-year increase.

High user stickiness brings opportunities for revenue growth to Bilibili.

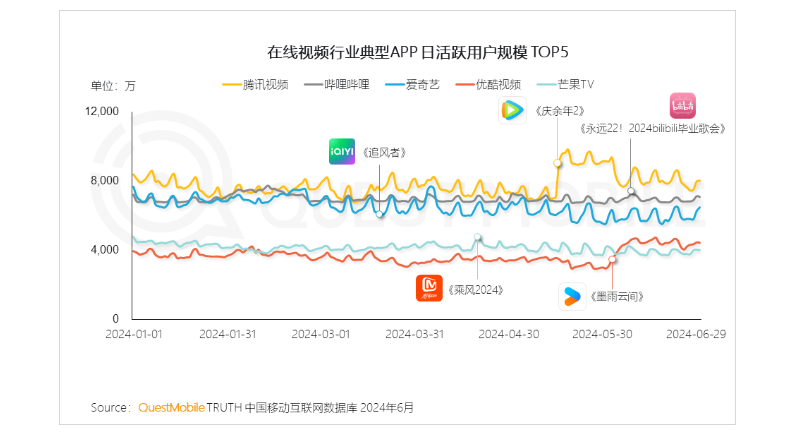

On the one hand, it comes from membership subscriptions, with value-added services growing by 11.5% year-on-year in the second quarter. However, the growth rate of value-added services is actually slowing down, mainly due to the current quarter being the off-season for long-form videos, and live-streaming tips not performing exceptionally well.

Source: Dolphin Research

On the other hand, Bilibili's youthful and sticky user base brings advantages to advertising conversions. Coinciding with the 618 e-commerce promotion period, advertising revenue grew by 30%, accounting for approximately 30% of total revenue, and for the first time, advertising revenue exceeded 2 billion yuan.

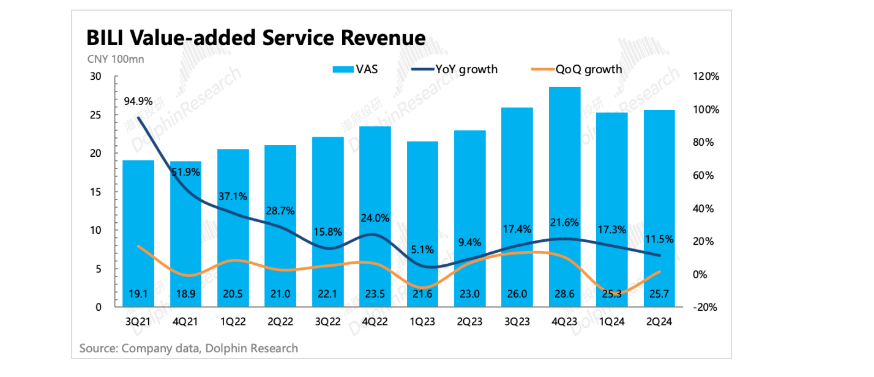

In terms of cost reduction, Bilibili mainly controls research and development expenses through a straightforward approach – layoffs. Research and development expenses for the quarter decreased by 15% year-on-year, primarily due to a decrease in the number of research department employees, according to the financial report.

Source: Financial Report Screenshot

According to "Fun Biz," as of June 30, Bilibili had a total of 8,137 employees; as of the end of 2023, the number was 8,801; and as of June 30, 2023, it was 10,354. In other words, Bilibili's workforce has decreased by 2,217 employees in a year.

It is worth mentioning that Bilibili's marketing expenses increased by 13%, primarily due to expenditures on promoting new games.

Source: Financial Report Screenshot

The heavily promoted new games did not disappoint Bilibili. The open beta of "Sanguo: Conquering the World" in June boosted Bilibili's game revenue for the quarter; game revenue reached 1.01 billion yuan, a 13% year-on-year increase, exceeding the generally expected single-digit growth.

However, games like "Sanguo: Conquering the World," which rely heavily on in-app purchases, tend to perform best upon release and may show weaker growth in revenue and cash flow thereafter.

Source: Bilibili Screenshot

With both revenue growth and cost reduction showing positive results, Bilibili's quarterly loss continued to narrow, and cash flow pressure eased. Operating cash flow shifted from an outflow in the same period last year to a net inflow of 1.75 billion yuan in the quarter, achieving a "positive" cash flow.

However, it is worth noting that as user growth slows significantly, Bilibili must ensure the growth of content and advertising revenue. Furthermore, while layoffs and pay cuts can save costs, they are unsustainable and require maintaining work efficiency post-layoffs.

02. Has Bilibili Changed Its Flavor?

With accelerated commercialization, Bilibili now generates revenue from users through increasingly diverse means.

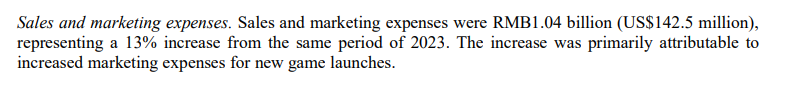

In terms of content, Bilibili has begun to charge fees for different categories.

"Previously, watching Bilibili required a premium membership, but later, some professional knowledge courses required separate payment. Recently, I noticed that some UP creators I follow have joined the 'Membership Charging Plan.' For example, several UP creators who I enjoy watching for real-life suspense case explanations have launched 'Exclusive Charging' series. These exclusive videos are subscription-based, with many channels charging around ten yuan per month," said Bilibili user Sasa (pseudonym).

Source: Bilibili Screenshot

However, when asked if she had contributed to her favorite UP creators' 'Charging Plans,' Sasa laughed and said, "Next time for sure." She explained that there are many similar UP creators on Bilibili, and while their videos are well-crafted, they primarily involve collecting information and storytelling. "I won't pay monthly to listen to a few stories; I'll just watch their free videos," she said.

Users like Sasa who say "next time for sure" are abundant. The most intuitive evidence is that free videos garner hundreds of thousands of views with thousands of comments, while paid videos only receive tens of thousands of views and a dozen or so comments.

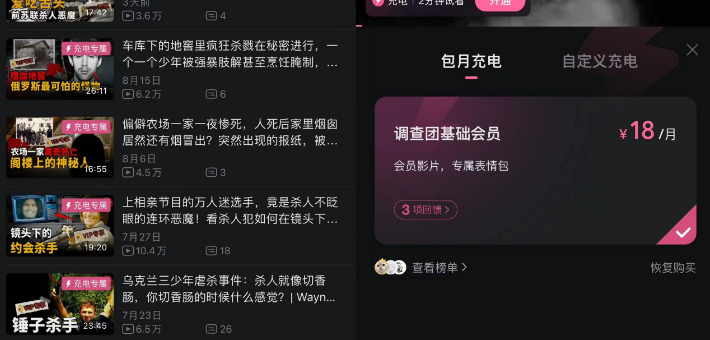

Regarding the 'Charging Plan,' Sasa is not opposed. "Both UP creators and the platform want to add a revenue channel, which I believe is similar to paying to unlock episodes early on long-video platforms. The choice is mine," she said. However, many netizens have criticized this practice on social media platforms.

Source: RED Screenshot

Furthermore, as Bilibili intensifies its commercialization efforts, the platform's content atmosphere has changed. "Previously, Bilibili had some exceptionally long and high-quality videos, but now the platform feels Impatience and restlessness . Each time I open it, there's nothing new, and there are many ads for paid content and vertical short videos. The overall tone of the platform has changed," said Bilibili user Yangyang (pseudonym).

On social media platforms, many Bilibili users share similar sentiments with Yangyang, complaining about "every third or fifth video having an ad" and "comment sections filled with misleading copy." Some netizens have even stated that they had paid for three consecutive years of annual premium memberships but "decided not to renew this year."

Source: RED Screenshot

Compared to traditional long-video platforms, Bilibili has always attracted Gen Z users with its unique positioning and content. As early as 2014, Chairman and CEO Rui Chen posted on Weibo, promising that Bilibili would "never add video overlay ads," aiming to balance content community characteristics with commercial monetization while ensuring a seamless user experience.

Today, Bilibili must strike a balance between maintaining healthy content ecosystem development, a positive community atmosphere, and user experience, while ensuring advertising revenue growth and customer satisfaction.

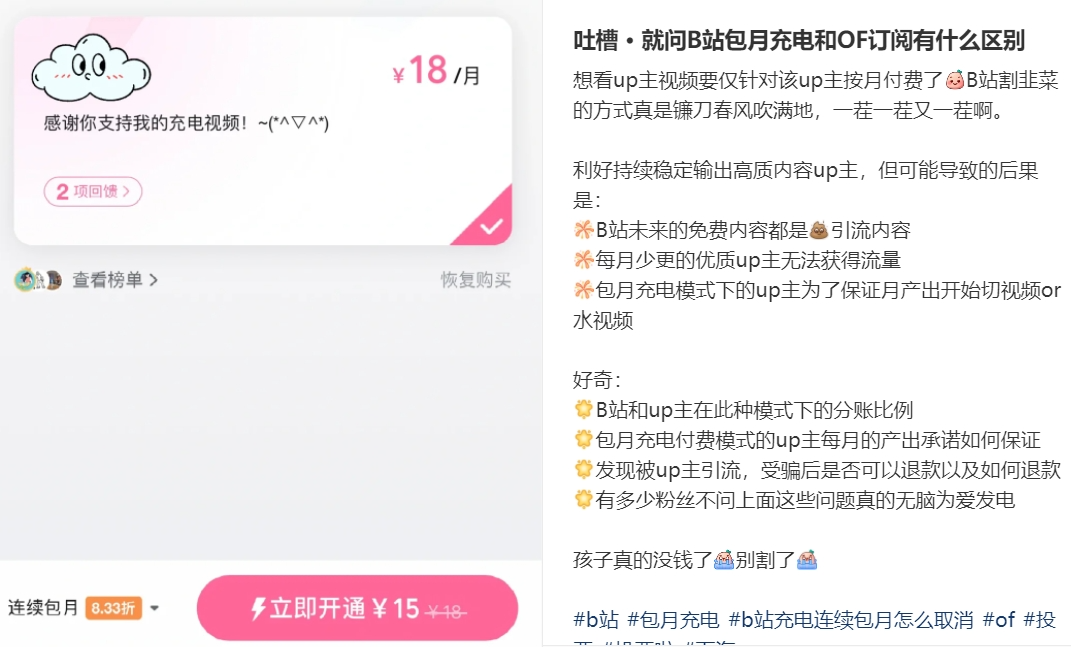

03. Continuously Investing in E-commerce

In terms of e-commerce, Bilibili has been continuously increasing its investments.

The platform's progress in e-commerce can be seen in its 618 performance report. During this year's 618, Bilibili's gross merchandise volume (GMV) grew by 146% year-on-year, with the number of product videos increasing by 359% year-on-year. Notably, Bilibili brought new customers to consumer brands such as maternity and childcare, pets, food and beverages at rates of 50-80%, indicating significant untapped consumer potential among its user base.

Source: Bilibili Screenshot

In exploring e-commerce, Bilibili initially attempted a traditional 'human-goods-market' model by selling merchandise related to user preferences. However, the results were underwhelming, prompting Bilibili to adopt an 'open-loop' e-commerce strategy. Essentially, this involves opening up traffic to leading e-commerce platforms, compensating for shortcomings in product inventory, supply chains, and user shopping habits. This strategy is personally driven by Rui Chen.

Pinduoduo may be Bilibili's biggest backer in its 'open-loop' strategy. Users across various channels on the platform have likely encountered Pinduoduo's "Billion Subsidy" ads, with some netizens joking that Pinduoduo's biggest contribution to Bilibili is "urging updates." In addition to Pinduoduo, Bilibili has also collaborated with Taobao and JD.com. During last year's Double 11 shopping festival, Bilibili temporarily renamed the "Member Purchase" entry at the bottom of its mobile app to "Double 11." Furthermore, Bilibili and JD.com jointly launched the "Jinhuo Plan," driving traffic from Bilibili to JD.com through product seeding videos for conversion.

Source: Bilibili Screenshot

While this open-loop e-commerce model appears mutually beneficial, it also resembles Bilibili's "concession." In this model, while Bilibili avoids the significant financial investment required to build a product pool, it also sacrifices pricing power, making its e-commerce efforts inevitably "dependent" on others.

Moreover, Bilibili's content creators can directly promote and sell products on the platform, leading to more ads and promotional messages for users, potentially impacting the user experience and platform atmosphere.

From another perspective, Bilibili's "concession" may be temporary. Following Douyin and Kuaishou, RED has built a closed-loop ecosystem. It remains to be seen if Bilibili will revisit closed-loop and self-operated products in the near future, reclaiming pricing power.

It is worth noting that during the earnings call, Bilibili revealed that an average of 73 million users watched automotive-related content each month in the first half of the year, presenting an opportunity to perfectly integrate content and advertising. Similarly, sectors like AI, fashion, home decor, and beauty have inherent monetization advantages. Exploring such content sectors may help Bilibili achieve a "three-birds-with-one-stone" effect for content, users, and commercialization.

Source: Bilibili Screenshot

In 2021, Bilibili set a goal of "achieving profitability by 2024." Today, with less than three months to go before Rui Chen's profitability timeline, Bilibili's management stated that with the growth of advertising and gaming businesses, there is significant room for gross margin improvement, expecting to achieve profitability in the third quarter.

As Bilibili accelerates its commercialization efforts with urgency, it must maintain its unique community atmosphere, knowing what to do and what not to do.