European pure electric vehicles are struggling to sell

![]() 08/26 2024

08/26 2024

![]() 513

513

The outlook for the European pure electric vehicle market is clouded by new uncertainties.

Four years ago, Volkswagen embarked on a massive transformation of its Zwickau plant in Germany, the heart of its operations, to win the battle for the shift to pure electric vehicles.

With a total investment of $33 billion, approximately 9,000 tons of steel structures needed to be moved, and only one-third of the existing machinery could be reused. These measures were akin to a dramatic open-heart surgery.

This was Volkswagen's first large-scale automotive plant to convert from internal combustion engines to electric vehicles, and it was also the world's first large-scale automotive production base to seamlessly transition to electrification. From the technical architecture to the assembly methods to the materials used, all the top-level designs and underlying logic were fundamentally different from the past.

It's worth noting that the above-mentioned operations were merely the initial "bet" before the strategic model ID.3 officially went into production. In fact, over the past few years, Volkswagen has invested a cumulative total of €89 billion in its electric transformation and plans to invest an additional €180 billion from 2023 to 2027.

Volkswagen is not the only company investing heavily in pure electric vehicles. This year, as incentives in various parts of Europe have been phased out, electric vehicle sales have suddenly "cooled off," casting doubt on the previous significant investments made by European manufacturers and affecting current decision-making.

The "headwinds" in end-user sales have also impacted front-line production and new vehicle layouts. Manufacturers such as Audi, Porsche, Ford, Hyundai, and Stellantis have successively adjusted their strategies, shifting their focus away from the research and development and production of pure electric vehicles towards the development of hybrid systems.

Pure electric vehicles are losing their appeal

Various signs and research forecasts indicate that the outlook for the European pure electric vehicle market is indeed clouded by new uncertainties.

According to a survey by the European Automobile Manufacturers' Association (ACEA), less than 30% of European consumers choose to purchase electric vehicles, and more than half of consumers firmly stated that they would not buy electric vehicles costing more than €35,000.

A recent report by the investment research firm Jefferies predicts that by 2030, Europeans will purchase 2 million fewer electric vehicles annually than previously forecast. If sales continue to be sluggish, the EU's plan to ban the sale of new gasoline vehicles by 2035 could be affected.

According to another set of data from UBS, Europeans will purchase nearly 9 million fewer electric vehicles between 2024 and 2030 than expected.

In Europe, high vehicle prices, limited long-distance driving range, and immature charging infrastructure are the core factors that deter potential electric vehicle buyers.

An executive at French consulting firm Inovev once stated in an email that charging infrastructure is a thorny issue requiring significant public and private investment. However, in Europe, this is not a top priority for either national or regional public services.

Last year, the EU had approximately 630,000 public charging points, with 70% concentrated in Germany, France, and the Netherlands.

Jato Dynamics conducted a study in the first half of the year, revealing that the average selling price of electric vehicles in Europe was approximately €65,000, roughly double that of gasoline vehicles. On the other hand, private buyers are cautious about the uncertain residual value of pure electric vehicles, and price reductions by brands like Tesla have led to a collapse in the used car market.

Under such circumstances, many automakers, including the Volkswagen Group, have struggled with production in recent months, with their overall transformation failing to "take off" and encountering setbacks in sales and product layouts.

At the end of last year, Volkswagen announced that it would invest €4.2 billion in expanding two factories in Spain. In Spain, a significant portion of Volkswagen's production is exported to Germany, and electrified models have become the current production focus.

Wayne Griffiths, CEO of Volkswagen's SEAT brand, also told the media that he feels anxious every time he visits the Martorell factory outside Barcelona, where the company has invested €300 million in a battery assembly plant set to begin operations next year. However, the current market share of electric vehicles in Spain is only around 5%.

In the past few months, the pure electric vehicle market in some European countries has even shrunk. The European Automobile Manufacturers' Association estimates that across the EU, the market share of electric vehicles will decrease by one percentage point year-on-year as of June.

Taking Germany as an example, as the country with the largest share of the European automotive market, it abolished subsidies for electric vehicle purchases at the end of 2023. In July, electric vehicle sales fell by 37% year-on-year, and cumulative sales from January to July decreased by 20% year-on-year.

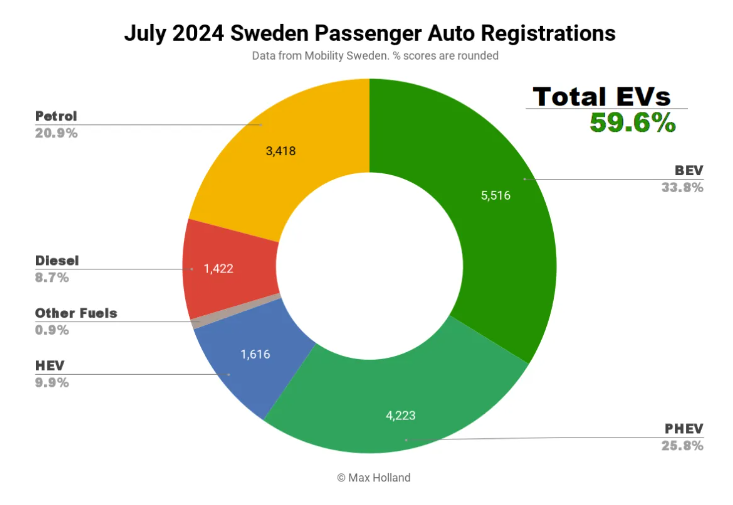

Sweden, a leader in pure electric vehicles in Europe, has also seen its electric vehicle sales decline. According to the latest data for July, the share of new energy vehicles in Sweden was 59%, roughly the same as the same period last year, but sales of pure electric models fell by 15% year-on-year, exacerbating the market downturn this year.

Weighing the pros and cons, adjusting the layout

The decline in electric vehicle sales in the European market is attributed to multiple factors, including weak overall consumption in the European market and the reduction of government incentives. Additionally, in July, the EU imposed temporary tariffs on China, further impacting sales.

Data shows that monthly electric vehicle sales in Europe fell by 7.8% year-on-year in July, with sales from January to July roughly flat compared to 2023. In contrast, traditional hybrid and mild hybrid vehicles have grown rapidly in Europe, with new vehicle registrations even exceeding those of gasoline vehicles in July.

At least so far, electric vehicle growth has proven unsustainable in the European market without government incentives. Not only has the expected growth momentum been lost, but end-user consumption has also lost its buying power, causing many consumers to doubt the future of pure electric vehicles.

A UBS report states that Volkswagen faces the greatest risk in the German pure electric vehicle market. If electric vehicle sales continue to be sluggish in Europe, the company's earnings next year could be impacted by €2 billion.

Considering the latest trends, Stellantis Group has updated its product plan for the European market, planning to launch 30 mild hybrid models in Europe this year and an additional 6 by 2026.

More and more automakers are choosing to revise their targets.

Porsche previously stated that it would abandon its goal of electric vehicles accounting for 80% of its sales by 2030 due to a slower-than-expected transition, with management unanimously agreeing that the previous target was too aggressive.

Audi has also stated that due to the higher-than-expected importance of PHEV models, the complete transition from gasoline vehicles to pure electric vehicles will take longer than anticipated. Therefore, the company will introduce more hybrid product lines based on market changes while abandoning aggressive pure electric targets. Key models must ensure a "dual-track" deployment of gasoline and pure electric, avoiding putting all future eggs in the pure electric basket.

In the past, Audi had high hopes for its pure electric models, the Q8 e-tron and Q8 Sportback e-tron. However, over the past few months, these two models have faced pressure from sharply declining orders. Amid this awkward market performance, Audi had to emphasize in a statement that it was "planning to restructure production focus in Brussels," and if no better solutions emerged, the possibility of closing the relevant factory could not be ruled out.

The Brussels factory currently employs about 3,000 permanent workers and 500 temporary workers. If a large-scale reorganization is carried out due to the electric strategy, a large number of workers will face the risk of unemployment.

Mercedes-Benz is also weighing the pros and cons.

Previously, Mercedes-Benz set a target of electric vehicles (including hybrids) accounting for 50% of its total sales by 2025. However, this plan has been revised, with the target deadline pushed back to 2030. Interestingly, Mercedes-Benz CEO Ola Källenius also pointed out in the first half of the year that the company has not abandoned gasoline vehicles and will continue to upgrade internal combustion engine technology over the next decade as planned.

Jean Dominique Senard, Chairman of Renault, directly called for government subsidies, arguing that while they should not be permanent, European manufacturers still need them at present. Taking Germany as an example, the decision to abolish subsidies at the end of last year directly led to a sharp fluctuation in demand for new pure electric vehicles in 2024, disrupting manufacturers' product plans.