Xiaomi releases financial report, can Xiaomi phones still compete?

![]() 08/26 2024

08/26 2024

![]() 449

449

A financial report with many highlights

On August 21, Xiaomi announced its financial results for the second quarter of this year, with revenue growing 32% year-on-year to RMB 88.888 billion, and adjusted net profit growing 20.1% year-on-year to RMB 6.175 billion, both significantly exceeding market expectations. As of the end of the second quarter, Xiaomi's cash reserves reached RMB 141 billion, a record high. It is not difficult to see that Xiaomi has made significant improvements in financial management and operational efficiency during this quarter.

Lei Jun tweeted, "This is Xiaomi's best quarterly report in history!" It's no wonder Xiaomi has started rewarding its employees again. On the evening of August 22, Xiaomi Group announced that it had awarded a total of 41,019,000 reward shares to 1,510 selected participants, including group employees and service providers, under the 2023 Share Scheme on August 22. The closing price of the reward shares on the grant date was HK$19.1 per share.

According to media calculations, the value of the 41,019,000 reward shares is approximately HK$783 million (approximately RMB 717 million). This means that each of the 1,510 participants will receive share rewards valued at approximately RMB 474,800. It can be said that this reward is quite sincere.

Judging from the reaction of the capital market, capital is generally quite receptive. Xiaomi Group's share price surged by over 9% on the day, closing at HK$19.1 per share, with a market value of HK$476 billion.

Image source: iFinD

Currently, Xiaomi's core business remains its smartphone business, with revenue reaching RMB 46.5 billion during the period, an increase of 27.1% year-on-year. In terms of shipments, Xiaomi shipped 42.2 million smartphones globally in the second quarter, up 28.1% year-on-year, making it the fastest-growing brand among the top five globally in terms of year-on-year shipment growth. Xiaomi smartphones ranked among the top three in 58 global markets and among the top five in 70 markets. In addition to the Middle East, where Xiaomi consistently ranks second in shipments, the company has also risen to second place in Latin America and Southeast Asia.

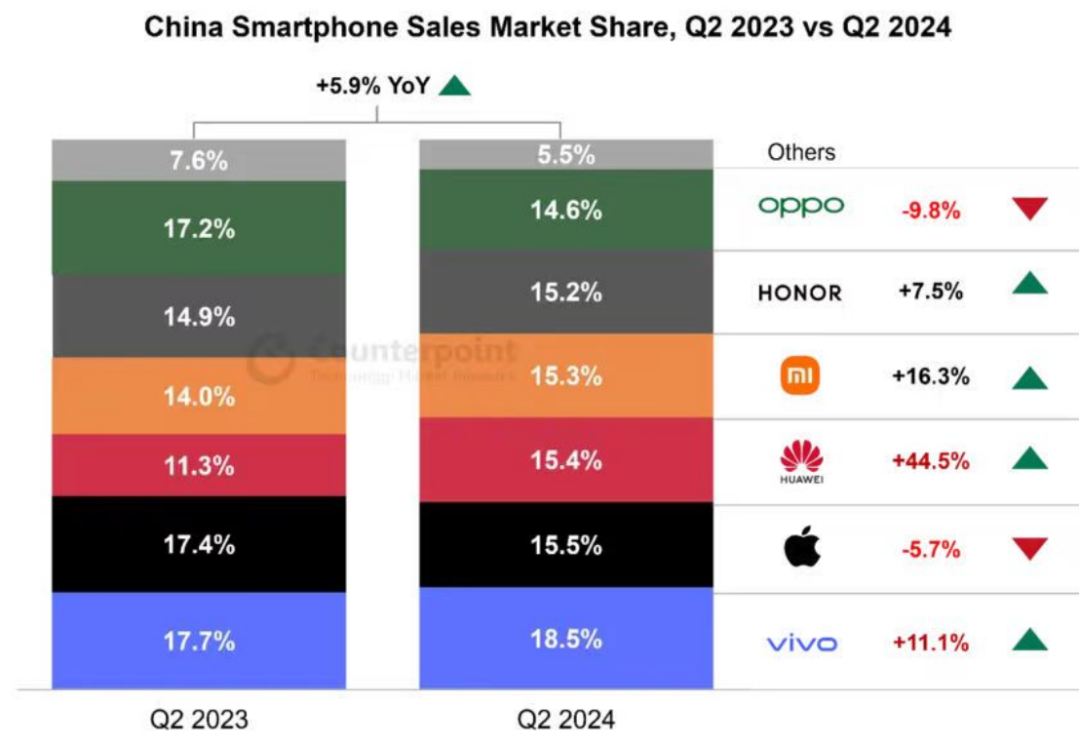

While Xiaomi has achieved remarkable success in the global smartphone market, its performance in China has been less impressive. In IDC's second-quarter shipment rankings for the Chinese market, Xiaomi ranked only fifth. Similarly, Canalys' second-quarter domestic shipment rankings also placed Xiaomi in fifth place. The survey report released by Counterpoint placed Xiaomi in fourth place in the second quarter of 2024, which is slightly better. Some may argue that shipments do not necessarily equal sales, as shipments include units given to agents and may include backlogs. Relatively speaking, activations are closer to actual sales, and under normal circumstances, activations should be less than sales. However, in the activation rankings, Xiaomi's smartphone activations were 10.6316 million units, while shipments in the second quarter were 10 million units, indicating a backlog in the first quarter, as shipments would not have been less than activations otherwise.

Objectively speaking, it is important to consider growth rates in addition to rankings. Xiaomi's smartphone shipments have grown by more than 10% in the past two quarters, which is close to that of its older sibling VIVO but lags behind Huawei's growth rates of over 40%. Many insiders believe that Huawei is likely to regain its position as the second-largest player in the domestic market within the next one or two years. This sets the stage for a renewed market battle between Huawei and Xiaomi in the domestic smartphone segment, with hopes that both companies will focus on enhancing product capabilities and technology to bring better products to consumers.

The core reason for Xiaomi's smartphone growth lies in price reductions. The financial report shows that Xiaomi's average selling price for smartphones fell from RMB 1,112.2 in the same period last year to RMB 1,103.5 in the current quarter. The gross margin for smartphones also declined to 12.1%, a year-on-year decrease of 1.2 percentage points and a quarter-on-quarter decrease of 2.7 percentage points.

Image source: Internet

I do not intend to be pessimistic about Xiaomi's smartphone business, as it has actually undergone some positive changes. The financial report shows that Xiaomi's warranty expenses fell significantly from RMB 1.895 billion in the same period in 2023 to RMB 1.14 billion in the second quarter of this year, a year-on-year decrease of nearly 40%. Over the past year, Xiaomi's revenue has grown by more than 30%, while the decrease in warranty expenses in the second-quarter and half-year reports reached 40% and 20%, respectively. This indicates that the quality of Xiaomi's smartphones has improved, possibly due to process improvements or material advancements. Either way, it represents a positive aspect of Xiaomi's progress.

Final Thoughts

During the earnings call, Xiaomi's President Lu Weibing candidly stated that the smartphone market is mature and stagnant, and Xiaomi does not have any special tricks. Instead, it must steadfastly implement its strategy. Xiaomi cannot afford to falter in terms of technological breakthroughs and continued premiumization. It must ensure that its products have no weaknesses while also possessing unique competitive characteristics. In a stagnant market, Xiaomi must take market share away from others to achieve its own growth.

References:

Xiaomi's Best Quarterly Report in History Source: Caijing Zaocan

Lei Jun Hides His Sharp Edges, Does Xiaomi Make a Big Profit? Source: DianDongXingQiu

Lei Jun's Car Venture Still Struggling to Reach Shore Source: QuanTianHouKeJi