After a 50% drop in net profit in half a year, Alibaba delivered big news

![]() 08/26 2024

08/26 2024

![]() 449

449

Source | Shenlan Finance

Written by | Wu Ruixin

Alibaba, which has suffered a 50% drop in profit in half a year, has finally delivered exciting news for investors.

On August 23, Alibaba announced that it will voluntarily change its secondary listing on the Hong Kong Stock Exchange to a primary listing, with the change taking effect on August 28.

This means that Alibaba will add Hong Kong as its primary listing location, becoming a dual-primary listed company on both the Hong Kong Stock Exchange and the New York Stock Exchange.

Some people may wonder, hasn't Alibaba been listed in Hong Kong for a long time? What's the difference this time, and what's the significance?

Let me explain it to you carefully.

1

Alibaba may be included in the Stock Connect, and A-share investors have finally waited

Currently, although Alibaba is listed on both the US and Hong Kong stock exchanges, it is in a "secondary listing" status in Hong Kong. This means that the company lists the same type of shares on two exchanges and realizes cross-market circulation of shares through international custodians and securities brokers. This method mainly exists in the form of Depository Receipts (DRs).

Compared to a dual-primary listing, the secondary listing process is shorter, less time-consuming, and less difficult. However, the pricing power of the shares remains in the sole primary listing location, and the secondary listing location is essentially a "subsidiary market" of the primary listing location. Therefore, the company cannot raise funds through a secondary listing.

From an investor's perspective, a "secondary listing" is not eligible for inclusion in the Stock Connect index, and mainland capital cannot invest.

In simple terms, under the status of a "secondary listing," Alibaba's shares circulating in Hong Kong actually come from the US market, and the pricing power of Hong Kong shares is closely related to the price of US shares, making it essentially a "subsidiary market" of the US stock market.

A "dual-primary listing" means that both capital markets are the first listing locations, with equal status. They can independently raise funds, and share prices are also relatively independent. However, dual-primary listings require the company's share issuance to comply with the IPO rules of both locations and abide by all regulations of both jurisdictions, making the listing process more difficult.

This means that shares in the two markets will no longer circulate across markets, and prices will be relatively independent. However, according to the announcement, Alibaba's dual-primary listing in Hong Kong does not involve issuing new shares or raising funds.

For investors, the greater significance lies in the fact that if Alibaba dual-lists in Hong Kong, it has the opportunity to be included in the Stock Connect, allowing mainland A-share investors to invest in Alibaba directly.

In a recent report, Morgan Stanley predicted that Alibaba has a high likelihood of being included in the Stock Connect after completing its dual-primary listing conversion, potentially as early as September. If Alibaba completes its primary listing before the end of August, Morgan Stanley analyzed that inclusion in the Stock Connect is expected to be confirmed on September 4, announced on September 6, and take effect when the market opens on September 9.

Many investors are already eagerly awaiting this development.

2

Alibaba fulfills its dream, but its performance in the first half of the year is disappointing

Alibaba's dual-primary listing in Hong Kong has not been a secret.

In fact, since Alibaba's secondary listing in Hong Kong in 2019, the company announced its intention to seek a primary listing conversion in Hong Kong, but the process was not smooth.

In July 2022, Alibaba announced that its board of directors had authorized the group's management to submit an application to the Hong Kong Stock Exchange to add Hong Kong as a primary listing location. After completing the review process with the Hong Kong Stock Exchange, Alibaba would be dual-primary listed on both the Hong Kong Stock Exchange and the New York Stock Exchange. However, the situation changed quickly. In November 2022, Alibaba announced that it would not complete the primary listing by the end of 2022 as planned due to the need to develop a new employee stock ownership plan.

After that, there was no further news about Alibaba's primary listing conversion in Hong Kong.

It wasn't until May 14, 2024, a year and a half later, that Alibaba revealed new progress in its primary listing conversion in Hong Kong in its fiscal year 2024 earnings report: "We have been preparing for a primary listing in Hong Kong and currently expect to complete the conversion by the end of August 2024."

Data shows that since Alibaba's secondary listing in Hong Kong in 2019, most of its publicly traded shares have been transferred to Hong Kong, and Alibaba has consistently ranked among the top three in Hong Kong in terms of market value and trading volume.

If successfully included in the Stock Connect, it will further expand Alibaba's investor base from mainland China and other Asian regions, enhancing the liquidity of its Hong Kong shares.

Based on the situations of companies like Meituan, Xiaomi, Li Auto, and XPeng, Morgan Stanley predicts that after inclusion in the Stock Connect, southbound capital could potentially increase Alibaba's Hong Kong share liquidity by approximately $12 billion in the first six months. In the long run, the shareholding ratio of southbound capital may stably exceed 10%.

The flow of large funds has always been an indicator of market trends.

Previously, Michael Burry, the predictor of the subprime mortgage crisis and the prototype for "The Big Short," significantly increased his holdings in Alibaba in the second quarter, making it his largest holding.

The shareholding situation of HHLR Advisors, a fund management platform under Hillhouse Capital, also showed that Alibaba's share of its total holdings increased from 0.23% in the first quarter to 9.55%.

"China's Warren Buffett," Duan Yongping, also increased his holdings in Alibaba in the second quarter of H&H International, with an increase of 7.9%.

This undoubtedly raises Alibaba's investment value in the eyes of investors. After Alibaba achieves a dual-primary listing, a large number of A-share investors may embrace the company.

However, it is worth noting that Alibaba's performance in the first half of this year has been disappointing.

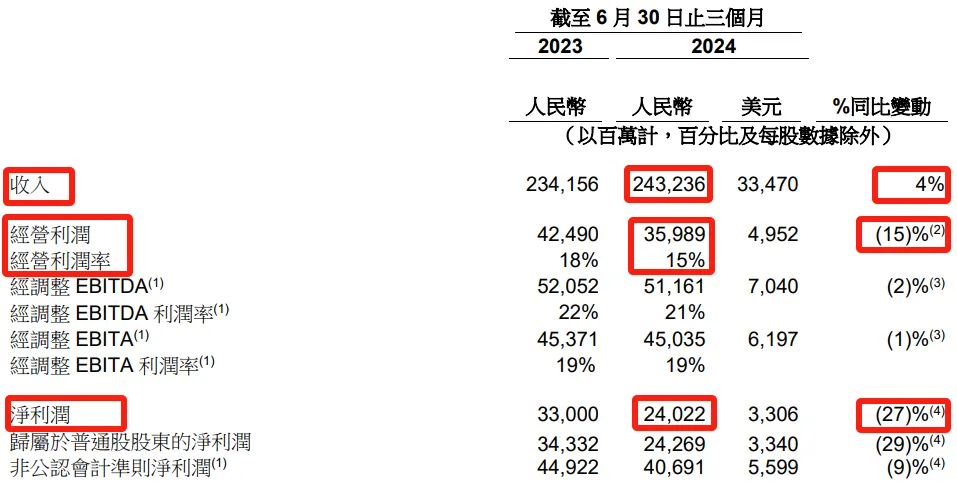

According to Alibaba's recent financial report, for the three months ended June 30, 2024, Alibaba achieved revenue of RMB 243.236 billion, a year-on-year increase of 4%. However, net profit was RMB 24.022 billion, a year-on-year decrease of 27%, and net profit attributable to shareholders decreased by 29%.

Adding the first quarter, Alibaba's net profit for the first half of the year was RMB 24.941 billion, a year-on-year decrease of 54.65%, marking a "halving" of profits.

Such disappointing performance may cause investors to hesitate.