Behind 190 large models: Uncovering the "truth" of China's large model industry implementation after 600 days

![]() 08/26 2024

08/26 2024

![]() 623

623

If the evolution from mobile internet to cloud computing, and now to the era of large models, represents a macro narrative for enterprise development, then at a micro level, what is the narrative logic of the large model era that has just passed 600 days? And what trajectory will its lifecycle take?

Author | Si Hang

Editor | Piye

Produced by | Industry Insider

In August, according to the Cyberspace Administration of China, China has completed the registration and launch of over 190 generative AI service large models that can provide services to the public, with over 600 million registered users.

After 600 days of rapid development, domestic large models have not only flourished overall but have also begun to make their mark in seven major industries: transportation, education, manufacturing, healthcare, and more.

As the implementation and commercialization of large models become the focus, Industry Insider attempts to uncover the truth behind their implementation through bidding projects and publicly announced cooperation cases.

By reviewing large model implementation projects over 600 days, we have observed the following five points:

In the early stages of large model development, "basic model development" was the preferred choice for enterprises;

Compared to AI startups, enterprises preferred established cloud vendors for basic model development;

The industrialization of large models is progressing well and serves as an important transition for the next stage of Agent applications;

Agent applications are poised for growth and will change the competitive landscape of the large model sector;

In recent years, most large model procurement has come from state-owned enterprises (SOEs) and centrally-administered state-owned enterprises (CASOEs).

I. Basic Model Development Becomes the "Mainstream"

The development of anything follows a certain lifecycle. If the evolution from mobile internet to cloud computing, and now to the era of large models, represents a macro narrative for enterprise development, then at a micro level, what is the narrative logic of the large model era that has just passed 600 days? And what trajectory will its lifecycle take? Standing at the beginning of this era, can we glimpse the truth? To address this, Industry Insider attempts to narrate through some of the current bidding projects and cooperation cases of large model enterprises.

Today, the large model race has attracted various types of enterprises, from cloud vendors and telecom operators to traditional AI companies, new AI startups, and research institutions, all joining the ranks of large models. According to Smart Hyperparameter statistics, there were a total of 237 large model bidding projects in 2024, with Baidu, iFLYTEK, and Zhipu AI temporarily leading the industry.

Based on this data, Industry Insider selected representatives from cloud vendors and AI startups, namely Baidu and Zhipu AI, to analyze the current trend of large model implementation through their AI large model bidding projects in the past two years. The latter is an AI star company that has raised over 2.5 billion yuan in funding and is valued at over 20 billion yuan. Among AI startups targeting the B-end market, Zhipu stands out in bidding projects.

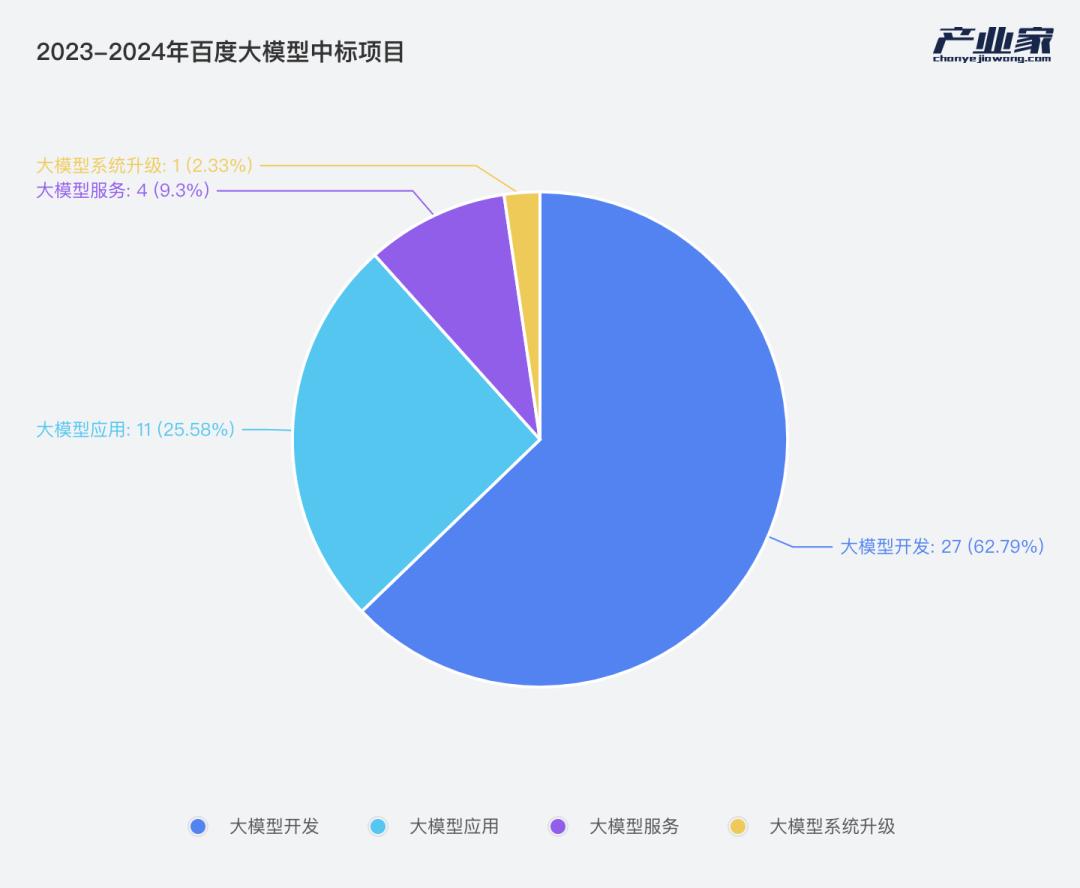

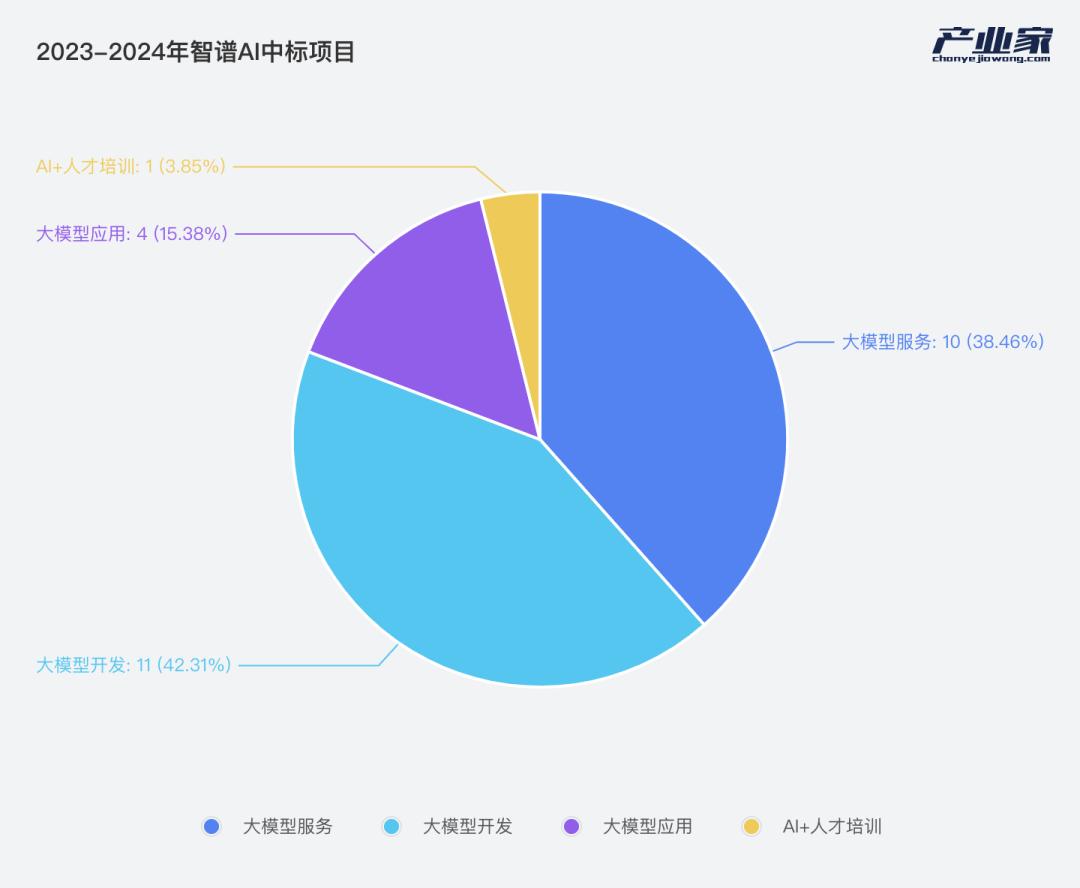

According to Industry Insider, from the inception of large models in 2023 to the present, Baidu has won 43 bidding projects related to large models, while Zhipu AI has won 26. These projects can be categorized into three types based on their nature: large model development or basic model development; large model/Agent applications; and large model-related services, including API interfaces and model training.

From the large model projects of Baidu and Zhipu AI in the past two years, we can observe two major trends: 1) In the early stages of large model development, "large model development" became the preferred choice for enterprises; 2) Compared to AI startups, enterprises still prefer established cloud vendors for basic model development.

Firstly, whether it's established cloud vendor Baidu or AI startup Zhipu, large model development projects accounted for the highest proportion. The reason behind this is simple: under the backdrop of the "new productivity" era, SOEs and CASOEs have an urgent need for digital transformation.

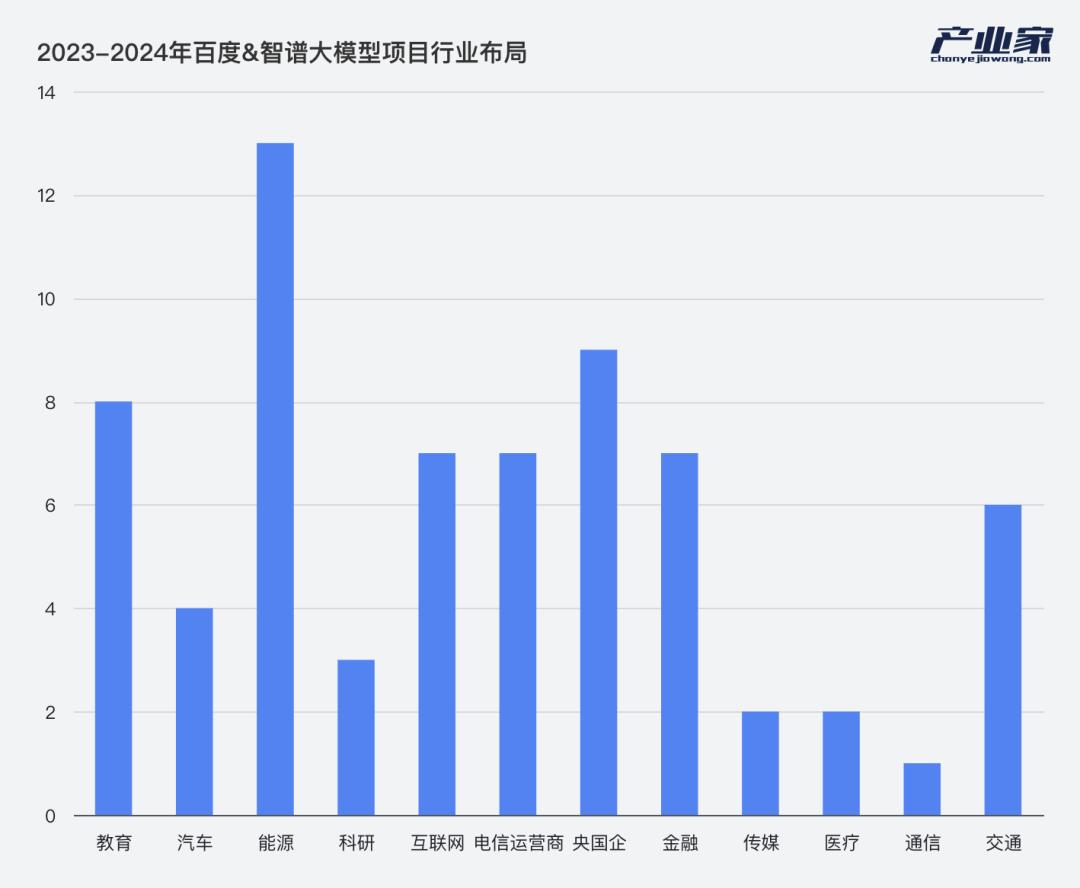

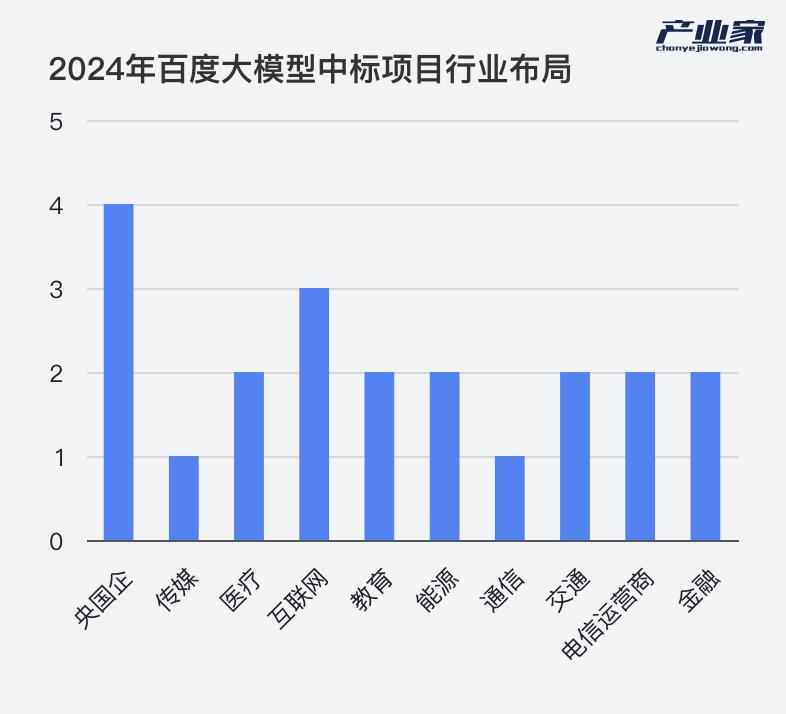

From the above industry distribution, it can be seen that the two industries with the highest procurement of large models are SOEs and CASOEs, as well as the energy sector, where most of the energy, finance, and transportation industries are actually SOEs and CASOEs. Before 2023, the digital transformation of many SOEs and CASOEs was not well-structured, and even in some enterprises, data silos caused more trouble than the problems they were trying to solve before digital transformation. The emergence and industrialization of large models, however, have brought hope to these large enterprises.

For example, China Tower's "Digital Tower" project significantly increased the sharing rate of newly built towers from 14.3% to 85%, equivalent to building 1.124 million fewer towers. Another example is China Tobacco's "Cloud + Middle Platform + Application + Data" model, which promotes the assetization of data. Behind the digital construction of these large enterprises, large models have played a crucial role. In February and August 2024, Baidu won the bidding for large model development projects from China Tower and Zhejiang Tobacco, respectively, with the latter being an AI middle platform construction project worth 4.06 million yuan.

However, why do enterprises prefer cloud vendors over AI startups for basic model development? Even from the above chart, it is not difficult to see that the proportion of large model development projects in Zhipu AI's bidding wins is very close to that of large model services, which include API interfaces, model pre-training, data training, etc.

Although it may be too early to draw conclusions in the early stages of large model development, it is undeniable that cloud vendors have a strong genetic advantage, both in terms of industry solutions and computing power provision.

II. The Industrialization of Large Models: The Inevitable Path of AI

Starting in 2024, the signal for the industrialization of large models has become stronger, and cloud vendors have made high-profile layouts to secure deals.

At this year's HDC2024 Huawei Developer Conference, Huawei announced that the Pangu large model had entered various industries, expanding beyond the existing meteorological and mining large models to include steel, high-speed rail, and embodied intelligence large models.

Earlier at the 2024 Smart Economy Forum, Baidu Intelligent Cloud launched the "Thousand Sails Industry Enhanced Edition" and has already been implemented in government, transportation, and industrial sectors.

In April this year, Tencent also announced the "Omni-intelligent" solution for the automotive industry, providing a full-stack large model capability base ranging from models, computing power, AI engineering platforms, to AI applications.

At the 2024 Spring Volcano Engine FORCE Conference, Volcano Engine upgraded its financial large model service system and has reportedly collaborated with several institutions, including China Merchants Bank, Huatai Securities, and Haier Consumer Finance.

Specifically, it is not difficult to observe that after entering 2024, bidding projects for large model enterprises have become more industry-specific and targeted.

For example, at the beginning of the year, Baidu won the bidding for the large model development project of Shandong Port Technology Group, which required a large model platform to enhance standardized and refined operations at bulk cargo terminals and ensure a safe production environment.

Announcement on the Results of the Large Model Application and Equipment Procurement Project of Shandong Port Technology Group, Source: Qichacha

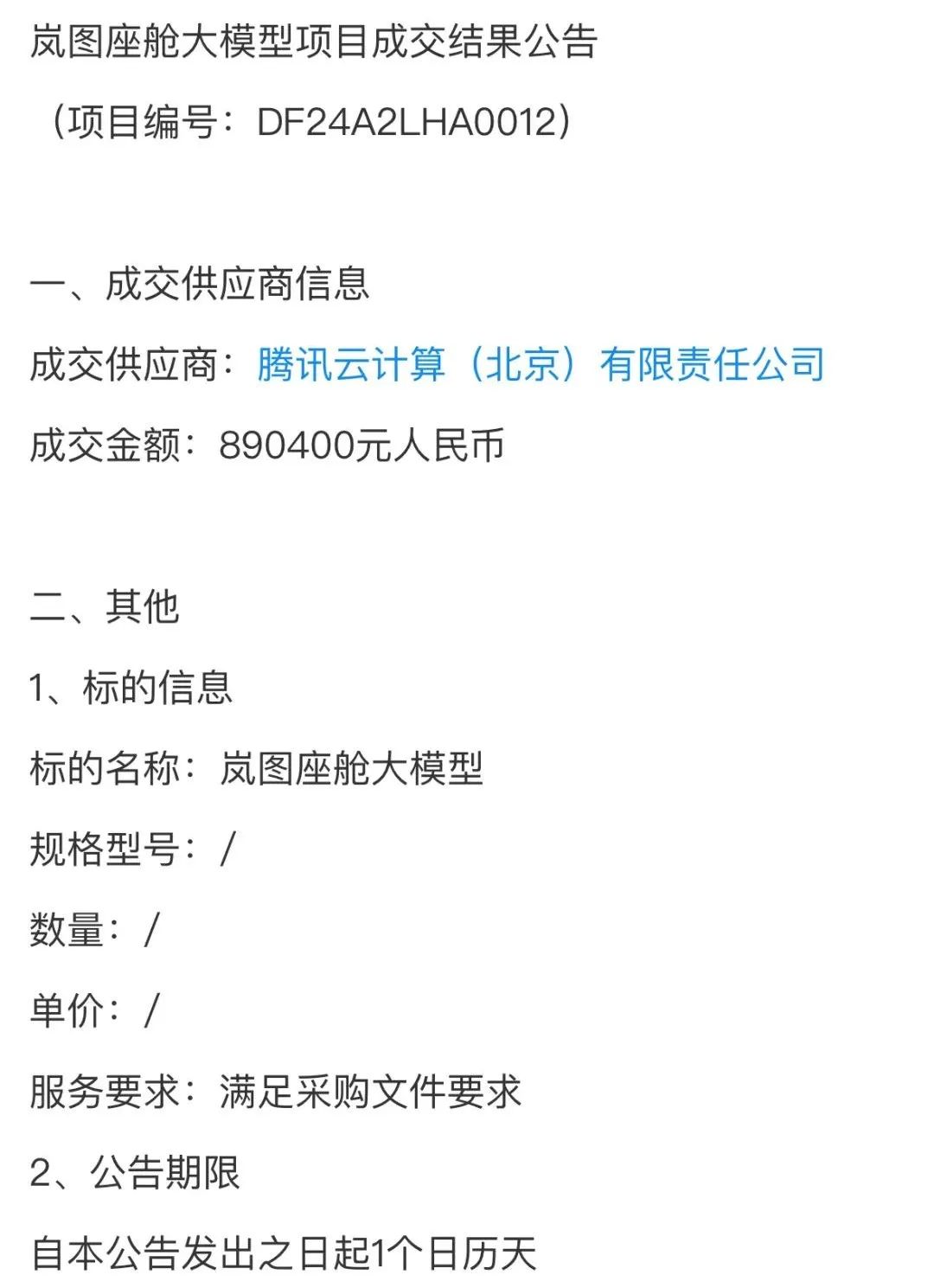

Another example is Tencent Cloud's winning bid for the Lantu bottom cabin large model project earlier this year. In fact, as early as September 2023, Tencent had signed a strategic cooperation agreement with Lantu Automobile, covering areas such as cockpits, maps, and cloud services.

Announcement on the Results of the Lantu bottom cabin Large Model Project, Source: Qichacha

Worth mentioning is that in addition to cloud vendors, AI startups are also not to be outdone in the industrialization of large models. From Zhipu AI's bidding wins in 2024, it can be seen that it has added many industry cases this year. Not only Zhipu but also "Mianbi Intelligence," which focuses on end-side models, recently launched its first large model for the vertical field of judicial trials.

However, from the industry cases of large model enterprises, it can be seen that behind the progress of large model industrialization, it is still a competition of genetic advantages. For example, when Huawei announced the entry of large models into various industries this year, it focused on manufacturing. In contrast, Baidu emphasized government affairs and transportation. Firstly, Huawei's manufacturing genetic advantage stems from its own "manufacturing" label, while Baidu's advantage in the transportation sector comes from the years of accumulation of Baidu Maps.

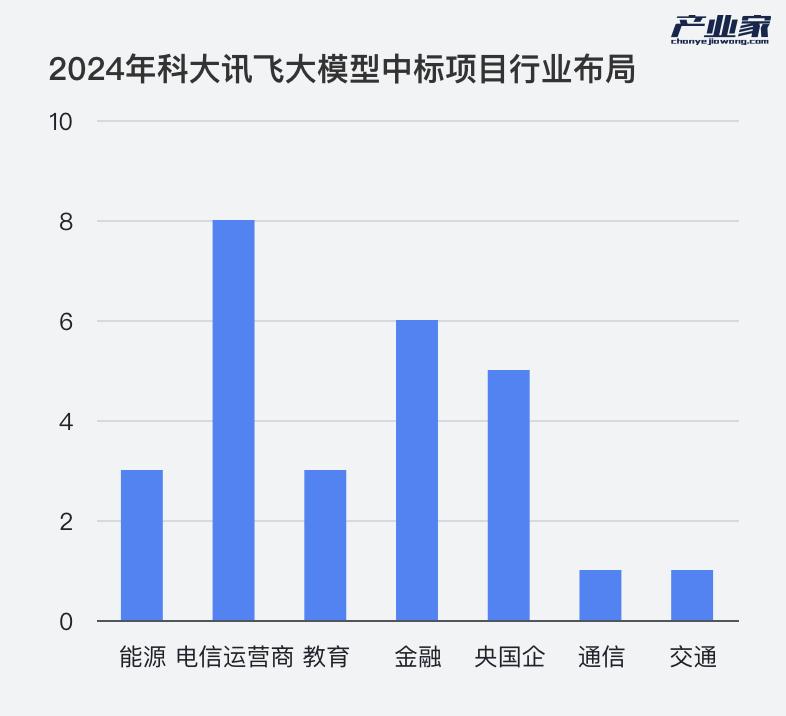

For iFLYTEK, on the one hand, it has an inherent advantage in speech recognition, and on the other hand, it has long-term toG experience. It is reported that iFLYTEK has even established a first-level organization, "Spark Corps," to tackle large deals from SOEs and CASOEs.

In fact, categorizing these large model industrialization cases by project type, they can be considered both "large model development" and the next stage of transition for large models entering industrialization.

III. Agent Applications: On the Verge of Launch

"Surged to 910,000, with a growth rate of up to 264%, 34 times," these figures come from a statistical comparison of AI open-source projects on GitHub. On the one hand, it reflects developers' enthusiasm for AI applications; on the other hand, it signals the next important mission for large models after entering industrialization - building Agent applications.

Unlike large models, which can be likened to "brains in a vat," Agent agents can follow predefined instructions or guidelines to complete prescribed procedures, achieving true intelligence. Currently, standardized Agent applications include Coze, Wenxin Agent Platform, Tencent Yuanqi, MetaGPT, and more.

However, for large enterprises, standardized Agents are difficult to meet their needs, requiring private deployment for specific scenarios. This is the next step after enterprises complete basic model development - building AI applications or Agent agents.

In this regard, iFLYTEK stands out among large model enterprises in winning bids for Agent or AI application projects in 2024. According to Industry Insider, as of August this year, iFLYTEK's winning bids for AI application projects accounted for over half of its total wins.",

However, behind these various real demands mentioned above, a more important reason lies in the urgent need for digital transformation among state-owned enterprises, especially under the current background of "new productive forces," which not only accelerates digital transformation but also provides more sufficient funding support for large model projects. The role of new productive forces in this cannot be overstated.

According to publicly available online data, there were 190 procurement demands for large models in the bidding market throughout 2023, with a procurement scale reaching 595 million yuan. Among them, most of the procurement requests exceeding one million yuan were from state-owned enterprises, and half of the procurement requests for projects valued at ten million yuan or more occurred in the fourth quarter.

So, what are the large model demands of these large enterprises? In addition to accelerating digital transformation and breaking data silos to achieve cost reduction and efficiency improvement, as mentioned above, a more hidden truth is that they want to enhance their R&D capabilities in this way.

It is important to note that today's large models differ from previous software in that they are not just an application for enterprises but also a "treasure trove" that can be operated by themselves. This is also an important prerequisite for large models to move towards AI applications/Agents, with the most convincing Agent being the AI code assistants already released by many cloud vendors. This also explains why basic model development is currently the "mainstream" trend.

Overall, from the past 600 days of large model implementation, although state-owned enterprises and those with genuine needs in the energy and transportation sectors have been the main buyers, a clear trend is that the industrialization of large models is gradually improving. As large models penetrate deeper into industries, the rise of Agent applications is a signal that cannot be ignored.