Is the “Zhou” focused on the MPV market the last piece of the puzzle for BYD?

![]() 08/28 2024

08/28 2024

![]() 454

454

BYD's sales are driven by its Dynasty and Ocean series, with the Dynasty series serving as the “backbone” of sales. Models like Qin, Song, and Han have a significant presence in the market.

In recent years, both the Dynasty and Ocean families have introduced multiple powerful products. However, except for the Ocean series, new Dynasty models have been extensions of the existing five IPs: Qin, Song, Yuan, Tang, and Han. Consequently, Dynasty naming conventions are not as free as those of the Ocean series' Seal, Seagull, and Dolphin. This is not necessarily a flaw, but as the product matrix expands, consumers need to clearly understand the characteristics of each series. When a single series encompasses multiple body styles, it becomes difficult for them to quickly remember, which can hinder product promotion.

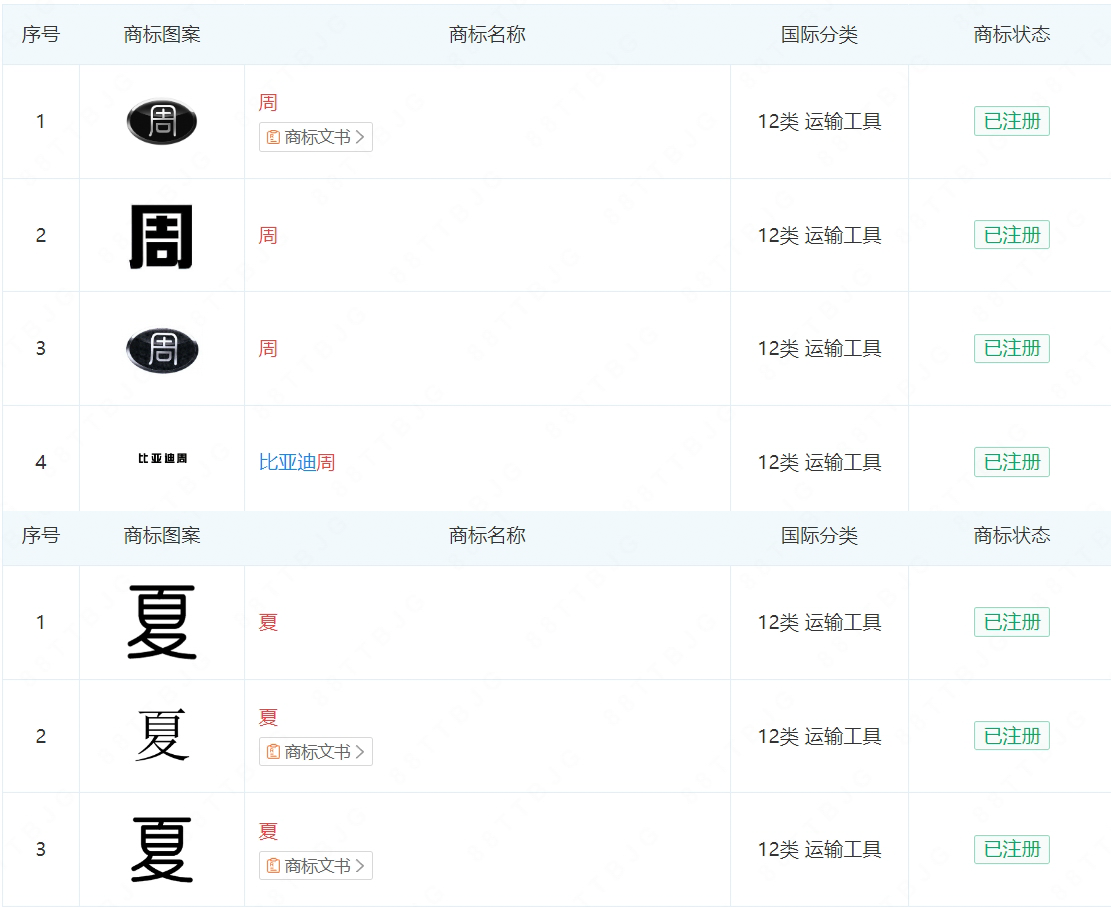

According to the latest news from “Xiaodi Express”, BYD will “initiate a new dynasty” during the Chengdu Auto Show opening on August 30th, in other words, launching the sixth Dynasty IP. Regarding this sixth IP, insiders had previously speculated it would be “Xia” or “Zhou”. Through a search on the Qichacha APP, we found that transport-related trademarks for both “Xia” and “Zhou” have been registered. However, the “Xia” trademark is still in a “pure font” state, while “Zhou” has undergone a LOGO design similar to those of the current Dynasty models.

(Source: Qichacha)

In summary, we believe the sixth IP is more likely to be “Zhou”.

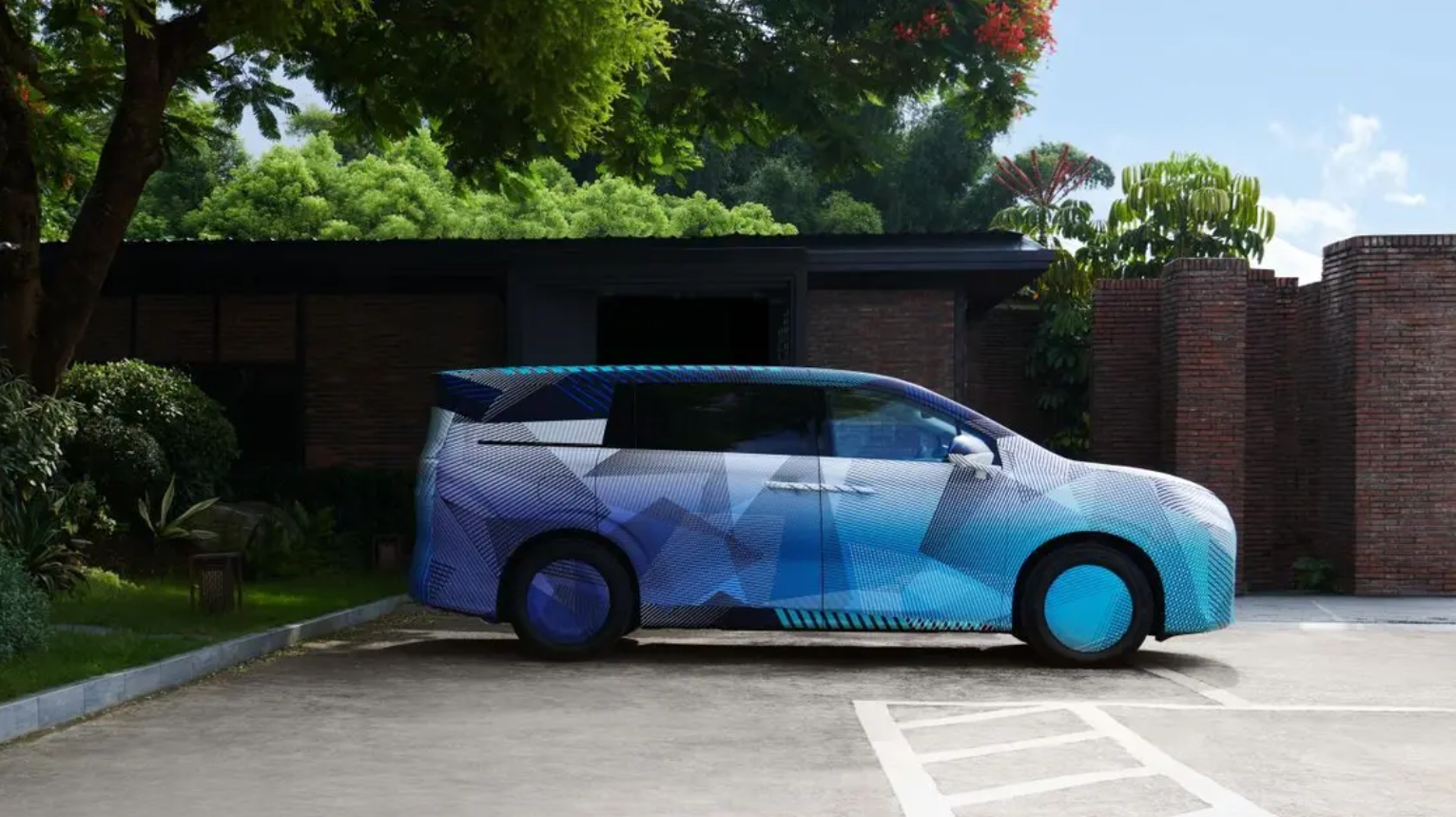

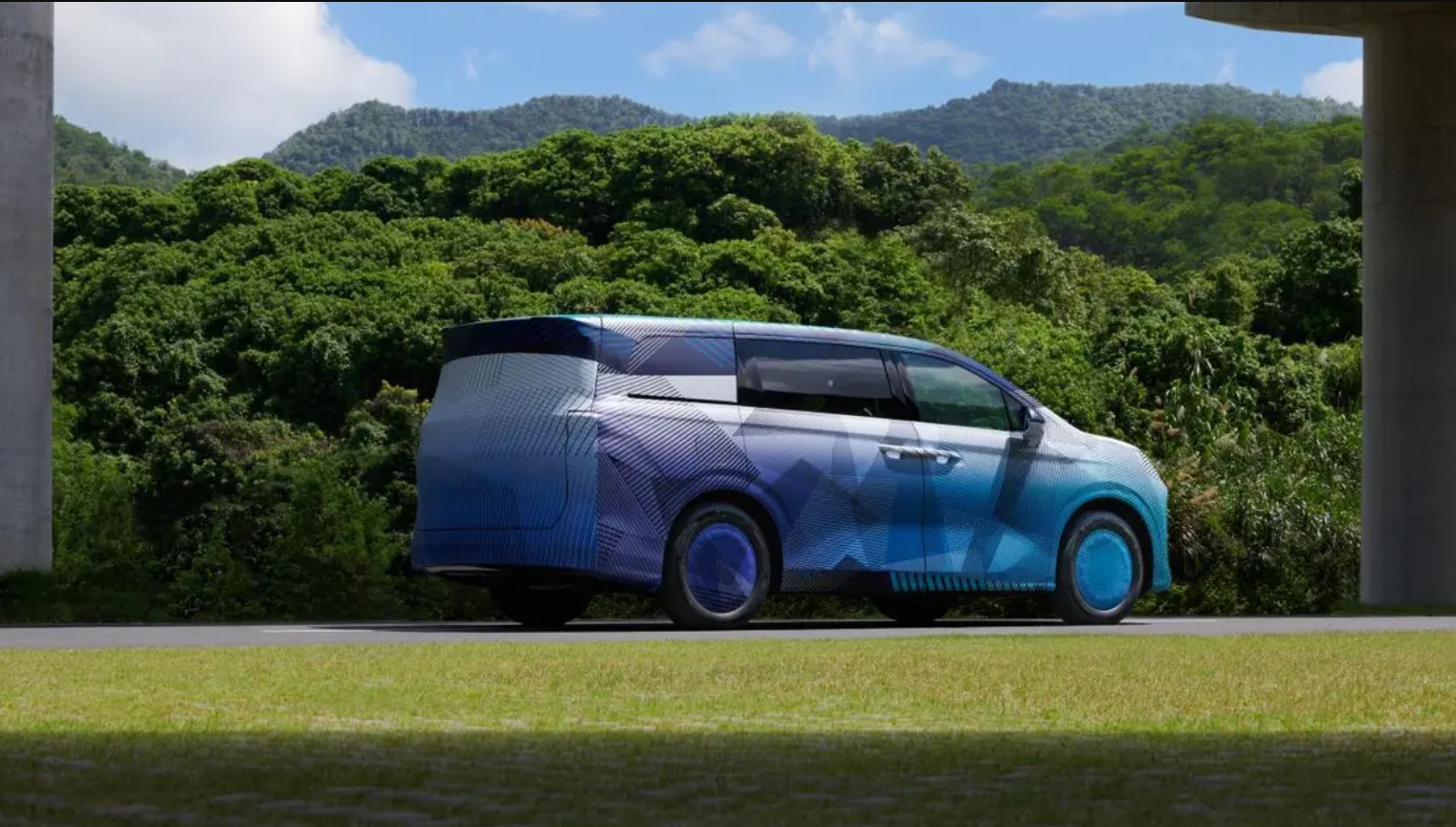

In addition, the first model of this new IP has also been revealed. Spy shots show that this new car is clearly an MPV with a large size. Although the Dynasty family has previously launched the MPV Song MAX, if consumers do not have a rigid need for seven seats, they may prefer SUVs that offer sufficient space and better off-road capability.

In our view, launching a large MPV as the first model under the sixth IP aligns with current market trends. By placing this large MPV under a new IP, BYD can make it easier for consumers to distinguish the characteristics of each Dynasty IP, which benefits product promotion.

Now that detailed information about this new MPV has been revealed, let's analyze its overall capabilities.

Large size, high configuration, built for families?

The entire first MPV is covered in protective film, and design details of its body lines are vague, leaving little visible information.

However, the overall shape is boxy, and a large front grille can be faintly discerned at the front, with a design reminiscent of the Denza D9 DM-i. Notably, the front engine compartment lines exhibit the classic “dragon beard” design language of Dragon Face 3.0, consistent with other Dynasty models.

One detail is that the front windshield camera uses a dual-lens module. Although it does not have a “tower-style” lidar, it largely indicates that this new MPV is equipped with advanced driver assistance systems for urban roads.

Moving to the side, the new car adopts traditional door handles but includes sliding doors for easier access to the rear seats, with electric sliding doors likely available in higher trim levels.

Furthermore, the body shape is very similar to the Denza D9 DM-i, leading us to believe that this new car will also be positioned in the mid-to-large MPV segment, with a length likely exceeding 5 meters. Thanks to its boxy shape, headroom and cargo space should be ample.

At the rear, there is a slightly raised spoiler, but it is less aggressive than the Denza D9. The overall design is simplistic, with a flat line below the rear windshield. We expect the new car to feature the same “flowing light” taillights as other Dynasty models.

Interior spy shots reveal a familiar large, floating central touchscreen, digital instrument cluster, and gear selector. Notably, there is also an entertainment screen for the front passenger, not found in other Dynasty models, along with a camera mounted on the A-pillar. Given the inclusion of the front passenger entertainment screen, features like the DiLink infotainment system and wireless phone charging are likely to be present.

Additionally, the new car adopts a 7-seater layout with “2+2+3” seating. While it's difficult to discern features like heating, ventilation, and massage for the second-row seats from the spy shots, we noticed a smart cooler behind the center console and buttons behind the front seats, suggesting the inclusion of rear tables.

Finally, in terms of performance, official details are scarce. However, since this new car is a mid-to-large MPV similar to the Denza D9, we speculate it will likely offer BYD's fifth-generation DM-i plug-in hybrid and pure electric powertrains. Low energy consumption is expected to remain a key selling point.

Overall, “Zhou” continues the Dynasty family's recipe for success: familiar design and leading hybrid technology, likely accompanied by good value for money. As a mid-to-large MPV, it offers comprehensive comfort features that align well with the travel needs of most families. Considering the brand layout, “Zhou” and the Denza D9 will undoubtedly have distinct configurations and price points, appearing on the market as a complementary pair.

Is becoming a “budget alternative” to the Denza D9 inevitable?

To differentiate from the Denza D9, the new car may further downplay its business attributes and emphasize its family-oriented nature, with a projected price range of RMB 200,000 to 300,000.

In the domestic MPV market, high-end MPVs priced above RMB 300,000 are preferred by many consumers. Best-selling models like the Denza D9, Buick GL8 EV, Voyah Dreamer, ZEEKR 009, XPeng X9, and GAC Aion E9 are all new energy vehicles.

Currently, there are not many MPVs priced between RMB 200,000 and 300,000. The few options include the GAC Aion E8 PHEV, Xinghai V9, Refine RF8 PHEV, and the DACIA 7/9 series. Among these, only the GAC Aion E8 PHEV, with a monthly sales volume of around 3,000 units, can be considered relatively popular.

Upon reflection, why are the best-selling MPVs priced above RMB 300,000? The answer lies in the principle of “you get what you pay for.” Consumers willing to spend more on vehicles prioritize comfort, ride quality, and other aspects.

However, if presented with a new energy vehicle priced below RMB 300,000 but offering similar interior materials, quality, and features to a RMB 300,000 MPV, the low price point would undoubtedly attract their attention, even if it doesn't guarantee an immediate purchase.

BYD only has the Denza D9 MPV in the domestic market, but relying on the Denza D9's market reputation and BYD's brand influence, the launch of the new MPV “Zhou” is likely to generate significant buzz. Notably, as seen in the recent launches of the Qin L and Seal 06, BYD has consistently communicated its strong cost control capabilities. So far, only Wuling and BYD can produce new energy midsize sedans starting at RMB 99,800.

Therefore, it should not be difficult for “Zhou” to achieve popularity in principle, with configurations similar to the Denza D9 but at a more competitive price point of around RMB 200,000.

Since “Zhou” and the Denza D9 share similar market positioning but differ in brand tonality, “Zhou” can simply be considered a budget alternative to the Denza D9. Based on the Denza D9's market foundation, BYD understands what Chinese consumers want in a family-oriented MPV. Coupled with the group's cost control capabilities, BYD can create an affordable yet enjoyable family-oriented new energy MPV.

BYD focuses on the MPV segment to capture the last piece of the pie

Of course, the Dynasty family's first MPV was actually the Song MAX, which once achieved monthly sales of over 10,000 units at its launch. However, with the upgrading of consumer demands, the need for seven seats has gradually given way to higher expectations for in-car configurations and quality. The compact MPV market priced around RMB 150,000 has become less popular, and the Song MAX has not been updated. Given the development trend of the MPV market, the Song MAX's return in the short to medium term is unrealistic.

It is not difficult to speculate that after the launch of “Zhou”, the six IPs of the Dynasty family will each have their specific roles.

The “Zhou” series will focus on the MPV market, while “Qin” and “Han” will target the affordable and premium sedan markets, respectively. “Yuan”, “Song”, and “Tang” will hold down the personalized, family-oriented, and luxurious SUV markets, respectively.

However, unlike the Qin family's Qin PLUS and Qin L, the Yuan family's Yuan UP and Yuan PLUS, and the Song family's Song L and Song PLUS, “Zhou” may only have one product for a long time to come.

Admittedly, the MPV market covers compact to large MPVs, and BYD has the capability to offer a full product lineup. However, ultimately, only large MPVs are currently popular in the domestic MPV market. Sales figures for midsize and compact MPVs are generally low, and BYD has the opportunity to achieve positive returns with just the “Zhou” product.

If “Zhou” adopts a full-coverage strategy, it would be suicidal in the current context of generally low sales in the compact and midsize MPV segments. In other words, for a long time to come, we may rarely see differently positioned models like “Zhou L”, “Zhou PLUS”, or “Zhou MINI”.

Nevertheless, the MPV market is undergoing gradual innovation. ZEEKR has unveiled the ZEEKR MIX, a midsize MPV focusing on space. If its product gains user acceptance and opens up the midsize MPV market, BYD, with its capabilities, can easily keep up with the trend.

Source: Leitech