Pinduoduo 'slashes' shareholders

![]() 08/28 2024

08/28 2024

![]() 473

473

Telling shareholders there will be no dividend payouts in the coming years while implicitly acknowledging future profit growth will slow down, these two bombshells from Pinduoduo's co-CEO scared away many shareholders.

Cover image source: Unsplash

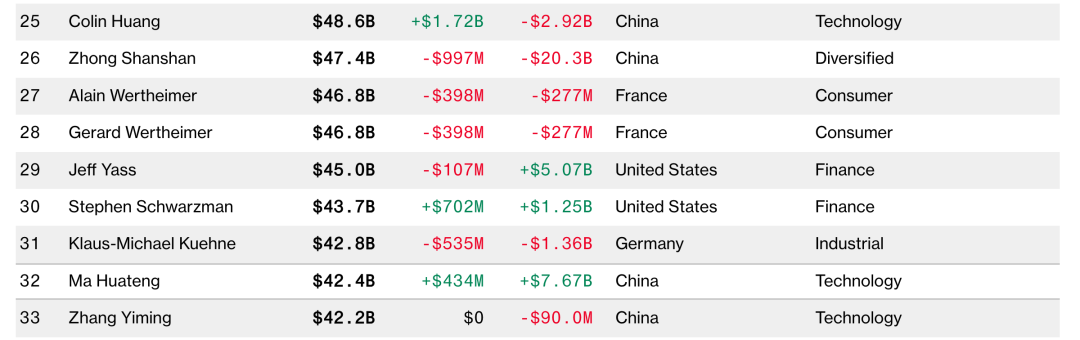

Huang Zheng, who has just been crowned China's richest man, soon encountered his biggest setback in nearly two years.

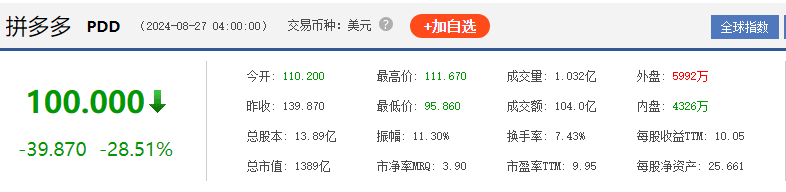

On August 26, Eastern Time, Pinduoduo saw a significant decline in the US stock market, with a stunning single-day drop of 28.51%. The intraday decline even exceeded 30%, setting a record for the largest single-day decline since its listing.

By the close of trading that day, Pinduoduo's daily trading volume reached $10.508 billion, with its overall market value evaporating by over $55 billion, dropping to $138.877 billion at the close, trailing Alibaba by nearly $53 billion in market value.

As one of the few outstanding Chinese stocks and internet companies in the US stock market over the past two years, Pinduoduo's sudden stock price plunge has had a significant impact. With a daily trading volume exceeding $10 billion, it ranked second only to NVIDIA and Tesla on Nasdaq.

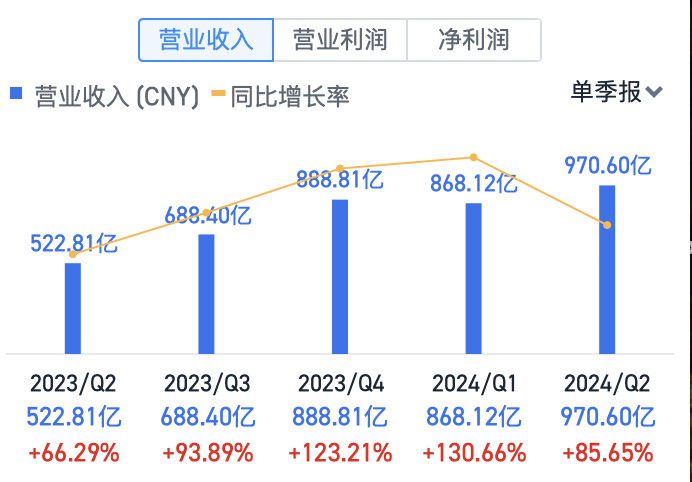

Coinciding with the earnings season, Pinduoduo's stock price collapse was also seen as related to the recently released second-quarter financial data. According to the financial report, Pinduoduo's total revenue in the second quarter of this year was 97.06 billion yuan, representing an 86% year-on-year growth, but still below market expectations of 99.99 billion yuan.

However, considering Pinduoduo's explosive growth in the previous two quarters, the market's overly high expectations for its growth rate were understandable. Still, this reason alone was not enough to justify the loss of $55 billion in market value overnight.

The deeper reason lies in the investor conference following the financial report release, where Pinduoduo essentially bet against itself.

1

Financial Report: Not Explosive but Still Excellent

Looking at Pinduoduo's second-quarter financial report, while the overall performance was far from the "explosive" growth of the previous two quarters, it is still an excellent quarterly report in the global internet industry.

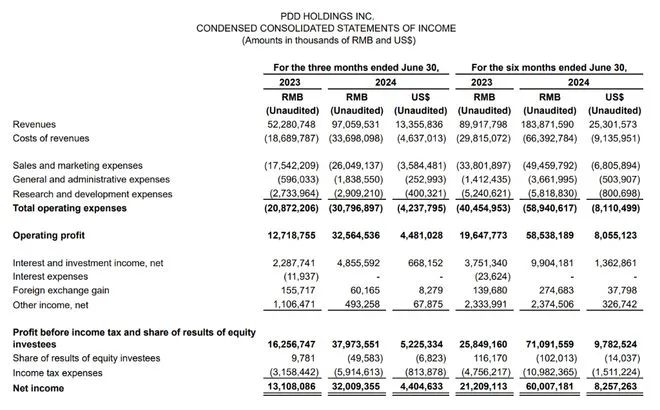

In terms of overall revenue, Pinduoduo achieved 97.06 billion yuan in the second quarter, an 86% increase from 52.281 billion yuan in the same period last year. Although this fell short of market expectations of 99.985 billion yuan, it still outpaced competitors in growth rate.

Especially when compared to JD.com and Alibaba, whose revenue growth rates in the most recent quarter were only 1.2% and 4%, respectively, essentially stagnant.

In the previous three quarters, Pinduoduo's year-on-year revenue growth rates were 94%, 123%, and 131%, respectively, essentially traversing the journey that took Alibaba and JD.com a decade in just one year. Although growth has slowed, it is still a decrease relative to its own previous performance.

In terms of net profit, Pinduoduo also enjoyed another fruitful quarter. Net profit attributable to ordinary shareholders of Pinduoduo was 32.0094 billion yuan, a year-on-year increase of 144%. Excluding non-GAAP items, net profit attributable to ordinary shareholders was 34.4321 billion yuan, up 125% year-on-year.

Looking specifically at individual business segments, Pinduoduo's main underperformer in the second quarter was its advertising business. According to the financial report, Pinduoduo's revenue from online marketing services and other services (advertising) was 49.1 billion yuan, up 29% year-on-year but below analysts' expectations of a 40% growth rate and significantly slower than the 56% and 57% year-on-year growth rates in the previous two quarters.

Considering that the second quarter included the crucial "618 Grand Promotion" e-commerce event, the slowdown in advertising revenue growth may reflect merchants' increasingly cautious approach to advertising on Pinduoduo.

Meanwhile, Temu (Pinduoduo's cross-border e-commerce platform), which has gained significant momentum in the past year, has seen its growth curve gradually flatten after an initial period of rapid expansion.

During the earnings call, Chen Lei, Chairman of the Board and Co-CEO of Pinduoduo, stated that the globalization business is facing a more severe and rapidly changing international environment, with more interference from abnormal commercial factors, significantly increasing the uncertainty of future business development. Gradual slowdown in revenue is an inevitable outcome.

While Chen Lei's remarks expressed concerns about future performance uncertainty, they do not, from a basic business logic perspective, constitute a significant negative factor causing Pinduoduo's stock price to plummet. What really unnerved investors was Chen Lei's stance on future dividends and investment returns.

2

No Dividends in the Coming Years

During the earnings call for Pinduoduo's second-quarter financial report, analysts asked the management about shareholder returns and whether there were plans for stock repurchases or dividends.

In response, Chen Lei said, "In terms of shareholder returns, the company is still in the investment phase and faces fierce competition on various fronts and uncertainties from external factors. Therefore, my management team and I agree that now is not the right time for stock repurchases or dividends. Moreover, we do not foresee such a need in the foreseeable future."

Furthermore, Chen Lei added, "The profit growth in the past few quarters is the result of a mismatch between short-term investment cycles and financial reporting cycles and should not be seen as a long-term trend."

Telling shareholders there will be no dividend payouts in the coming years while implicitly acknowledging future profit growth will slow down, these two bombshells from Pinduoduo's co-CEO scared away many shareholders.

After all, in the US stock market, the last e-commerce giant to announce no dividends was Amazon, and it has not paid dividends for two decades. However, this was based on Amazon not having book profits. Pinduoduo, on the other hand, has a net profit of over $5 billion in a single quarter. Such an attractive pie yet denying shareholders a share naturally led to a vote of no confidence.

Comparing Pinduoduo to technology companies like Tesla, Microsoft, and NVIDIA, while these companies have not paid dividends to shareholders for consecutive years, their underlying logic convinces the capital market. Due to the need for significant R&D investment each year to maintain product competitiveness, shareholders generally accept the company's approach of "investing in the future."

Returning to Pinduoduo, as a platform connecting consumers and merchants, once the infrastructure is in place, there is actually a diminishing marginal cost for annual R&D expenses.

Hoarding significant profits while merely stating that the company is still in the investment phase is bound to elicit a strong market reaction.

Currently, the only significant expenditure disclosed by Pinduoduo is a reduction in transaction fees for high-quality merchants over the next few years, totaling approximately $1.5 billion. However, considering that Pinduoduo's quarterly transaction service revenue (commission) is already approaching $7.2 billion, these fee reductions will not significantly impact its overall profitability.

3

Why Did Pinduoduo 'Slash' Itself?

According to the usual practice of listed companies, if financial performance falls short of expectations during earnings season, company executives must provide various reasons during the earnings call to boost investor confidence, even if it means making empty promises to prevent panic selling.

However, Pinduoduo seems to be going against the grain. Chairman Chen Lei's remarks during the earnings call seemed intent on bursting the bubble in Pinduoduo's stock price, even if it meant slashing shareholders' earnings.

It's hard to say whether this approach reflects a flaw in the executive's communication style or was intentional.

Considering that not long ago, Pinduoduo's founder Huang Zheng surpassed Nongfu Spring's Chairman Zhong Shanshan to become China's newest richest man, some netizens have joked that Huang Zheng didn't want to wear the crown of being the richest man, so he "actively" lowered Pinduoduo's stock price.

However, from Pinduoduo's competitors' perspective, the company's decision not to pay dividends or distributions in the coming years means it will hold more cash flow. For Pinduoduo, which has swept the market with low prices in recent years, this ample "ammunition" will help it face market challenges with a more aggressive stance.

Additionally, Pinduoduo's relationship with merchants has been delicate over the past year. On the domestic platform, the "refund only" policy has caused much suffering for many merchants, while on its overseas platform, there have been multiple incidents of merchants collectively protesting at Temu's offices.

Given the significant slowdown in Pinduoduo's advertising revenue growth in the second quarter of this year, merchants' distrust of Pinduoduo is gradually reflected in their reluctance to continue investing in the platform.

Starting from the second half of the year, platforms like Taobao and JD.com are also correcting their "refund only" policies. If Pinduoduo chooses to follow suit, it will mean overturning its long-standing platform rules, which will likely cost more than what JD.com and Alibaba have had to spend.

If Pinduoduo continues to adhere to the "refund only" policy, it will not only face the risk of merchants leaving but also potentially significant non-commercial pressure under current regulatory requirements.

It is foreseeable that if Pinduoduo continues to maintain high growth rates without paying dividends, it will likely become the new "cash king" in the e-commerce industry. As for where and for whom these funds will be spent, that is likely Chen Lei's current primary concern. As for shareholder sell-offs and stock price plunges, they were probably already planned for.