"Open Cooperation" + "Partnership": A Look at Changan's Methodology for Transitioning to New Energy Vehicles

![]() 08/28 2024

08/28 2024

![]() 602

602

"Even those who ride in carriages are not born with swift legs, yet they travel thousands of miles; even those who navigate boats are not adept at swimming, yet they cross vast rivers. The gentleman is not inherently different from others; he merely knows how to leverage things well."

Changan Automobile is a highly regarded automaker in the market. On the one hand, as a state-owned enterprise, Changan significantly outperforms other state-owned automakers in market performance, financial status, and growth momentum. On the other hand, Changan's market dynamics, partnerships, and strategic alliances are more frequent and high-profile than those of other automakers.

It is evident that Changan is not as rigid as the stereotypical state-owned enterprise and possesses a flexibility akin to a private enterprise, fostering higher market expectations. However, five years ago, Changan was a typical state-owned automaker struggling with development. During this period, rumors of mergers among state-owned automakers were rampant, and Changan was often mentioned as a potential merger candidate, reflecting limited market expectations for its transformation and competitiveness.

How did Changan reverse its situation within a tight timeframe and achieve favorable results in the transition to new energy technology? These questions will be the focus of this article.

By understanding Changan's methodology, we can comprehend the rationale behind AVATR investing RMB 11.5 billion for a 10% stake in Yinwang and speculate on the possibility of AVATR or Changan acquiring an additional 10% stake.

In the context of industry restructuring and mixed-ownership reform of state-owned enterprises, Changan's experiences and achievements are worthy of reference for other state-owned automakers, particularly when compared to GAC Aion's mixed-ownership reform. Changan's model offers more sustainability and controllability.

However, due to varying resource endowments, directly adopting Changan's methodology is unrealistic. Each automaker must leverage its unique strengths to complement development factors.

01

–

A State-Owned Automaker Battered by Setbacks

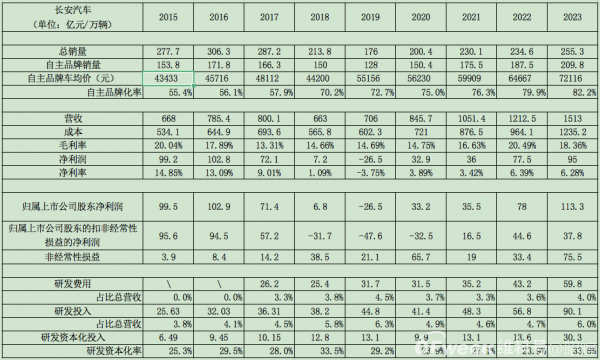

As evident from the table, Changan's sales and financial structure experienced significant declines starting in 2017 and 2018. After three years of negative net profit from 2018 to 2020, it regained positive business performance in 2021, marking a unique dynamic among Chinese automakers.

This transformation reflects Changan's shift from a typical joint venture state-owned automaker to a more market-oriented entity, albeit still retaining the operational characteristics of a large state-owned enterprise.

Therefore, Changan's path and experiences serve as valuable lessons for other state-owned automakers. However, the external industry/market pressures they face today differ significantly from those Changan encountered during its transformation.

Prior to 2018, Changan Ford contributed significantly to Changan's net profit, peaking at RMB 9 billion in 2016. However, due to various internal and external factors, Ford's sales in China plummeted, significantly impacting Changan's finances and forcing it to focus on developing its own brand's competitiveness.

Despite challenges, Changan's independent brand has grown substantially, with its CS, Yidong, and UNI series significantly enhancing its competitiveness, albeit primarily through cost-effectiveness. UNI, as Changan's premium offering, has achieved remarkable sales despite its lower price point compared to Geely's Lynk & Co and Great Wall's WEY.

Since 2019, Changan's independent brand sales have grown from 1.28 million to over 2 million vehicles in 2023, resulting in a 1:4 ratio between its joint venture and independent business structures, demonstrating Changan's potential for sustained growth among state-owned automakers.

02

–

A Rare Solution Balancing Public Ownership and Market Mechanisms

From 2018 to 2023, Changan had to balance developing its independent brand's commercial scale and profitability while transitioning to new energy technology. As a less flexible state-owned automaker, how did it manage these dual tasks?

Changan successfully established its independent brand, achieving both scale and profitability. However, in the transition to new energy, its penetration rate lagged behind competitors like GAC Aion and Geely, indicating incomplete success in this area.

Undeniably, due to inherent issues in public asset management and innovation efficiency, state-owned enterprises generally lag behind private companies in technological innovation. This applies to new energy vehicles, where state-owned automakers struggle to lead the industry.

Longstanding issues persisted in Changan's new energy business. However, by leveraging minimal cost inputs and risk exposure, Changan achieved favorable results in its new energy transition strategy (Changan Qiyuan and SL03), illustrating an efficient path.

Changan's R&D investments have been relatively conservative, with capitalization rates between 20% and 30%. In 2022, its intangible assets totaled RMB 4.4 billion, significantly lower than competitors like Great Wall (RMB 8.2 billion) and GAC (RMB 14.5 billion). This reflects Changan's limited R&D conversions in new energy technology.

However, in 2023, Changan's intangible assets surged to RMB 15 billion after merging with SL Automobile, acquiring its new energy patents and technologies. This strategy prioritized independent brand development over new energy technology, recognizing the inefficiencies of state-owned enterprises in market-driven innovation and personnel adjustments.

Changan's core new energy strategy involved spinning off its new energy business to develop externally through market mechanisms. This required external resources, emphasizing partnership development, evident in SL Automobile's success. After merging with SL Automobile in Q1 2023, Changan rapidly launched the Qiyuan brand, achieving similar sales volumes in under a year, demonstrating the strategy's effectiveness.

This methodology, termed the "Changan Model," offers a reference for state-owned automakers transitioning to new energy. In contrast, GAC Aion's growth relied on sustained investment, reflecting GAC's commitment to new energy. The Changan Model differs in that it quickly introduced strategic investors, lost control, regained it through share repurchases, reflecting its resource constraints.

03

–

SL Automobile's Exit and Re-entry: Changan's 'Small Cost, Big Asset' Strategy

Changan's operations with SL Automobile not only introduced capital and market mechanisms but also contributed significantly to non-recurring gains. SL Automobile, founded in 2018 as "Chongqing Changan New Energy Automobile Technology Co., Ltd.," received RMB 2.84 billion in equity investments in 2020, reducing Changan's stake from 100% to 48.95% and resulting in a RMB 2.247 billion fair value gain, accounting for 34% of non-recurring gains that year.

In 2022, SL Automobile raised an additional RMB 1.36 billion, further diluting Changan's stake to 40.66%. In Q1 2023, Changan repurchased a 10.34% stake for RMB 1.332 billion, raising its ownership to 51% and recognizing a RMB 5.02 billion investment gain, accounting for 66% of non-recurring gains that year. In April 2023, SL Automobile was renamed SL Automobile.

Upon merging with SL Automobile, Changan gained approximately RMB 10 billion in intangible assets, primarily patents and technologies. Changan's total investment in establishing SL Automobile and subsequent share repurchases was less than RMB 2.6 billion, incurring a net loss of approximately RMB 5.5 billion over six years. However, the non-recurring gains totaled RMB 7.25 billion, resulting in a net book loss of less than RMB 1 billion.

Post-merger, Changan launched the Qiyuan brand, targeting the compact segment (RMB 70,000-150,000) to complement SL Automobile's (RMB 130,000-200,000) offerings. Qiyuan's lower costs and potential for scale suggest high commercial viability, enhancing Changan's financial structure. With SL Automobile's expected turnaround, its losses in 2024 may be lower than 2023's RMB 3 billion.

At present (the first seven months of this year), the sales volume of Qiyuan and Shenlan are basically at the 80,000-unit level. If we combine Shenlan and Qiyuan, their combined results may already be at the breakeven point.

If we focus solely on Shenlan and Qiyuan, Changan's transition to new energy is relatively successful.

04

—

Avita is a failed investment for Changan

However, Avita's development has not been as smooth as Shenlan's, and it has not brought much value addition to Changan so far.

This is because, firstly, Avita's sales volume is still relatively small; secondly, by the end of 2023, Avita had only formed 2.13 billion yuan in non-current assets, of which the scale of intangible assets must be much smaller; thirdly, Avita is still a joint venture of Changan, and it is expected that Changan will not consolidate it into its financial statements in the short to medium term.

In fact, Changan currently holds a 41% stake in Avita, a similar shareholding ratio to before it consolidated Shenlan, and there are also investment funds from Chongqing's state-owned assets among Avita's shareholders. It is likely that Avita will be consolidated into Changan's financial statements in the future, similar to Shenlan.

However, Avita is currently still incurring significant losses. In 2023, Avita sold 27,000 vehicles, generating revenue of 5.65 billion yuan, but incurred a net loss of 3.69 billion yuan, and did not generate many intangible assets.

Therefore, at this stage, Changan's consolidation of Avita would only have a negative impact on its financial statements.

In Changan's methodology, Avita's planned development path is similar to that of Shenlan, but Avita targets the new energy market above 300,000 yuan (i.e., mid-size and above vehicles). Changan still hopes to introduce "partnerships" to develop Avita.

Avita's predecessor was "Changan NIO New Energy Co., Ltd.", established in 2018, with Changan and NIO each investing 49 million yuan for a 50% stake. However, the two parties basically did not substantially promote the development of the joint venture. As a result, Changan recorded investment losses of 5 million yuan and 57 million yuan under the equity method in 2018 and 2019, respectively.

This may be related to NIO's situation at the time. In 2019, NIO was suffering from its darkest moment in the capital market. Therefore, in May 2020, Changan invested 90 million yuan to acquire a 45.38% stake in NIO, and Changan NIO New Energy became a subsidiary of Changan.

In this transaction, Changan NIO New Energy also formed goodwill of approximately 39 million yuan, indicating that Changan acquired NIO's stake at a premium, and Changan bore nearly 120 million yuan in losses that year.

In May 2021, Changan NIO New Energy was officially renamed Avita. As a subsidiary of Changan, Changan did not disclose more operational data about Avita that year, but invested an additional 95.38 million yuan in Avita.

In March 2022, Avita completed a capital increase and share expansion, introducing investors such as CATL, investment funds from Chongqing's state-owned assets, and China Southern Industries Asset Management. Changan and investors increased their investments by 500 million yuan and 1.92 billion yuan, respectively, reducing Changan's shareholding from 95.38% to 39.02%. Avita was deconsolidated, but this also brought 2.13 billion yuan in non-recurring income to Changan.

In May 2022, Avita launched the CHN platform with Huawei and CATL. Although Huawei did not take a stake in Avita, it committed to continuously supply core components to Avita.

In August 2022, Avita once again completed a capital increase and share expansion, introducing six investors including the National Green Development Fund, raising a total of 2.547 billion yuan in funds. Changan's shareholding slightly increased to 41%, and Avita's valuation was nearly 10 billion yuan at the time.

In 2022, Avita generated revenue of 28.34 million yuan and incurred a net loss of 2.02 billion yuan, resulting in an investment loss of 810 million yuan for Changan under the equity method.

In August 2023, Avita once again completed a capital increase and share expansion, with Changan, China Southern Industries Asset Management, and investment funds from Chongqing's state-owned assets continuing to invest, while also introducing state-owned capital such as Bank of Communications Investment and Guangkai Holdings, raising 3 billion yuan in funds and valuing Avita at nearly 20 billion yuan. Changan's shareholding remained unchanged.

In the above process, Changan's actual investment in Avita amounted to approximately 3 billion yuan, with an annual net loss (under the equity method) totaling approximately 2.5 billion yuan and investment income of 2.13 billion yuan from the loss of control. As of 2023, Changan's book loss on Avita was 3.37 billion yuan.

Therefore, compared to Shenlan, Changan's investment in Avita has been relatively unsuccessful.

05

—

Increasing equity subscription in Yinwang is the optimal solution for Avita to overcome its difficulties

Positioned in the mid-to-high-end new energy market, Avita, as a brand-new player, relies on the high premium capabilities of CATL's new battery products (i.e., high-capacity Qilin batteries) and Huawei's electric drive systems and intelligent solutions for its brand premium. Changan primarily plays the role of vehicle manufacturer.

The core of Changan's methodology is that Changan and its "partners" must hold a majority stake in the target company (or project) to gain control, which creates a certain internal conflict with Huawei and CATL in Avita, but mainly with the former.

Avita's first model, the Avita 11, began deliveries in December 2022, at a time when battery prices were at their peak. Since then, battery prices have continued to decline significantly, diminishing the value addition from CATL to Avita.

Similarly, Huawei's cooperation with Seres deepened in December 2021, with the launch of the new AITO brand and the first M5 model. Subsequently, Huawei began to engage with multiple OEMs (including Changan) and introduced two cooperation modes: HI and Smart Selection, gradually revealing its ambitions and appetite, which weakened Avita's presence within Huawei's ecosystem.

In fact, Huawei participates in Avita as a supplier, providing solutions for Avita's electric drive systems and intelligent systems (which also explains Avita's small scale of intangible assets). This means that Avita's costs will be high, and without strong branding and channels (not simply converting direct sales channels to dealerships), it will be difficult for the high-priced Avita to achieve scale and profitability.

According to Changan's methodology, if Avita is to be re-consolidated into Changan's financial statements, either Avita must achieve profitability or it must bring other assets (such as patents and technologies) to Changan. Otherwise, there is no reason for Changan to re-consolidate Avita.

An important component of Avita's CHN platform is Huawei's technology system. If Huawei's influence is to be removed, Avita would need to redesign its technology platform, which would require significant capital investment, a long development timeline, and face market risks, making it an unlikely option.

Currently, the only and most likely way for Avita to increase sales is to join Huawei's Smart Selection mode (i.e., HarmonyOS Intelligent Driving). This is the logical reason behind Avita's acquisition of a 10% stake in Yinwang for 11.5 billion yuan. According to relevant information disclosure, Changan still has a preferential right to purchase an additional 10% stake in Yinwang, but it is not ruled out that Avita will purchase the entire stake.

In this way, Avita becomes a purely long-term equity investment project for Changan. It is unlikely that Changan will acquire additional shares in Avita in the future, and the only way for Changan and its partners to exit would be to take Avita public.

Based on Seres' operating conditions, Avita's breakeven sales volume would need to exceed 300,000 units, possibly even approaching 400,000 units.

To achieve scale quickly, Changan should exercise its preferential subscription right for an additional 10% stake in Yinwang. This would further strengthen its relationship with Huawei and is preferably purchased through Avita, in which case Changan's actual investment would only be 9.4 billion yuan. Of course, this would still require strong support from "partnerships."

The risks associated with this approach are relatively limited. From 2022 to 2024H1, Yinwang's revenue was 2.1 billion yuan, 4.7 billion yuan, and 10.4 billion yuan, respectively, with gross margins of 17.7%, 32.1%, and 55.4%, respectively, and net profits attributable to shareholders of -760 million yuan, -560 million yuan, and 2.2 billion yuan, respectively. Yinwang's financial structure can now achieve gross margins exceeding 50% and net margins exceeding 20%, with growth rates exceeding 100%.

Statically speaking, its valuation of 115 billion yuan is not overestimated, nor is it for a Tier 1 automotive supplier.

The worst-case scenario for Changan (or Avita) and its "partners" increasing their equity subscription in Yinwang is that Avita's sales do not increase significantly, resulting in a slight loss (or maintaining book value) in long-term equity investment income. However, the upper limit of the equity value of Yinwang will be relatively high, resulting in a higher upper limit for investment income under the equity method.

If no additional investment is made, Avita's relationship with Huawei will remain one of equal treatment, reducing the likelihood of significant sales growth for Avita and further exacerbating its operating environment, likely resulting in combined investment losses of at least 3 billion yuan annually for Changan and its "partners."

Therefore, having Changan enable Avita to increase its equity subscription in Yinwang would be the optimal solution for Avita to overcome its difficulties.

06

—

Changan will face financial pressure in the short term, but its mid- to long-term development logic is relatively smooth

Finally, let's focus on Changan's current operating situation.

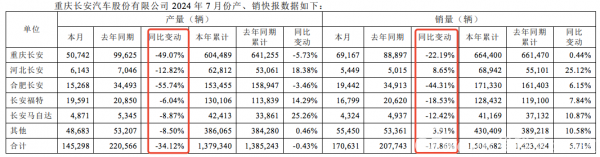

Undoubtedly, declining growth rates are the most apparent problem facing Changan today, with monthly production and sales data generally showing a contraction. This is due to the following reasons:

1. In recent months, the domestic auto market has undergone a significant structural change, with the new energy penetration rate exceeding 50% in July.

2. In recent years, Changan's absolute advantage has been its cost-effective independent brand fuel vehicle business, characterized by large-scale and high market share. However, as the domestic auto market transitioned from "same price for fuel and electric vehicles" in 2023 to "electric vehicles cheaper than fuel vehicles" in 2024, Changan's independent fuel vehicle business has been significantly impacted by market changes.

3. During this process, Changan's new energy business mainly focused on the second half of 2023 (primarily the launch of the Qiyuan brand). Although growth rates were impressive, the increase in absolute scale could not offset the decline in Changan's independent fuel vehicle sales, resulting in a structural gap within the company.

4. During this period, with the continuation of price wars, Changan's financial structure is likely to continue to be under pressure. In 2024H1, its expected net profit after deducting non-recurring items is between 800 million yuan and 1.5 billion yuan, which is relatively close to the 1.24 billion yuan in the same period last year. This is because cumulative production and sales in 2024H1 increased, but due to the above trends, it is expected that Changan's net profit after deducting non-recurring items for the full year 2024 will be under pressure.

However, from a medium-term perspective, there are more favorable factors for Changan. As the scale of Shenlan and Qiyuan grows, the positive business effects of Changan's new energy business will soon be reflected in its financial statements, which will offset the negative impact of declining sales of Changan's independent fuel vehicles.

If Avita can enter the HarmonyOS Intelligent Driving system soon, its operational improvement is also worth looking forward to.

Overall, Changan's development strategy is relatively clear, and its methodology for transitioning to new energy fully recognizes its strengths and weaknesses as a state-owned enterprise. Its strengths enable it to build strong and extensive "partnerships" and continuously introduce capital, the most critical production factor.

On the other hand, its weaknesses lie in the constraints imposed by its system/mechanism on efficiency and innovation. Without introducing market mechanisms through an "open cooperation" strategy, investing more capital and resources would likely lead to bottlenecks and internal friction, hindering the incubation of more market-oriented outcomes.

From a results-oriented perspective, Changan's model has performed better than GAC Motor's Aion model. The latter's over-reliance on internal capital and resource support from GAC Motor has prevented its system and mechanisms from fully transforming into a market-oriented model, affecting the subjectivity and initiative of GAC Motor and Aion's internal personnel, resulting in a sharp decline in Aion's operating performance this year after a promising situation last year.

Therefore, in the face of this round of structural adjustments in the domestic auto industry, Changan stands out among other state-owned automakers for its business continuity and autonomy, with relatively little constraint from the domestic market. This enables it to further advance its "all-inclusive" strategy (refer to the article "Adjusting the Structure: How Many Automakers Do We Really Need?").