Xiaopeng doesn't want to compete fiercely, but reality leaves no choice

![]() 08/29 2024

08/29 2024

![]() 577

577

Everyone's eyes are focused on Xiaopeng Motors' new product, the Xiaopeng MONA M03, because everyone knows that Xiaopeng's survival depends on whether the MONA M03 becomes a hit. On August 27, 2024, the launch event for the Xiaopeng MONA M03 was unprecedented, with dozens of industry leaders such as Lei Jun, Yu Chengdong, and Huang Renxun sending blessings for Xiaopeng Motors' 10th anniversary. Additionally, He Xiaopeng personally unveiled Xiaopeng's self-developed AI driving chip, showcasing the company's technological prowess and commitment to intelligent driving.

After the launch event, He Xiaopeng announced that the Xiaopeng MONA M03 had secured over 10,000 pre-orders within 52 minutes of its launch.

However, behind the glitz and glamour lies a severe crisis.

Long-time observers of the automotive market know that Xiaopeng Motors' sales have been concerning, with the company even absent from weekly sales rankings at times.

A telling example is Xiaopeng's second-quarter 2024 financial report, which seemingly presented a favorable outcome with slightly better-than-expected gross margins. However, this was primarily due to increased revenue from its partnership with Volkswagen, masking underlying issues.

Examining the vehicles themselves, it's evident that Xiaopeng's sales mix has deteriorated. Its best-selling model is the low-volume pure electric MPV, the Xiaopeng X9, while prices for its flagship models, the G6 and G9, continue to decline. However, due to significant cost reductions per vehicle, Xiaopeng's gross margin has increased sequentially.

Clearly, Xiaopeng MONA M03 represents Xiaopeng Motors' last hope for a turnaround, and its success or failure will determine the company's fate.

Xiaopeng MONA M03: Xiaopeng Motors' Desperate Counterattack

To analyze whether the Xiaopeng MONA M03 will be a hit, we must first understand the business logic of new-energy vehicle startups. Last year, I wrote an article titled "From Frenzy to Collapse: The Market Issues a 'Critical Condition Notice' to NEV Startups," which detailed the business logic behind their crises. Applying this framework to the Xiaopeng MONA M03, we can see that it remains relevant.

In summary, NEV startups have gone through four stages:

Stage 1: The ride-hailing market was initially the primary beneficiary of the NEV industry, but startups missed this opportunity due to regulatory hurdles and pivoted to the retail market.

Stage 2: Startups leveraged "software ecosystems," "technological innovation premiums," and "unique marketing strategies" to enter the premium segment (priced around RMB 300,000).

Stage 3: Over time, startups faced crises, including smart system failures and inflated marketing gimmicks. Market sentiment shifted, leading to price cuts and a move into the mainstream market.

Stage 4: With the success of BYD's DM-i system, larger Chinese brands entered the NEV market aggressively, compressing startups' growth space and time window for success.

For Xiaopeng Motors, its hallmark is autonomous driving, but few automakers specializing in this area have achieved significant sales. Tesla's FSD has low adoption rates, and Huawei's AITO series sells well due to cost-effectiveness, not its intelligent driving capabilities.

Xiaopeng's mainstream products have struggled. As prices dropped below RMB 200,000, sales plummeted. For instance, the urban SUV Xiaopeng G3 faced stiff competition from BYD's plug-in hybrids.

The most notable failure was the compact sedan Xiaopeng P5, which Xiaopeng had high hopes for entering the mainstream market. However, it struggled to sell more than 4,000 units per month since its launch in October 2021, dropping to 2,000 units by the second half of 2022.

This poor performance stemmed from flawed product strategy. Xiaopeng positioned P5's intelligent driving capabilities as its core selling point, misaligning it with the compact car market in terms of functionality and price. Consumers saw it as an overpriced product.

Xiaopeng G6 was another disappointment. Launched in July 2023, it offered superior range and autonomous driving capabilities compared to Tesla's Model Y at a lower price point. However, supply chain issues and competition from similar products led to disappointing sales.

Now, Xiaopeng Motors struggles in the RMB 200,000 price range, so the Xiaopeng MONA M03 enters the mainstream market priced between RMB 119,800 and RMB 159,800. Will its product strategy succeed in this segment?

Competing in the mainstream market is challenging, and Xiaopeng Motors faces immense pressure.

Let's examine the Xiaopeng MONA M03's product strategy.

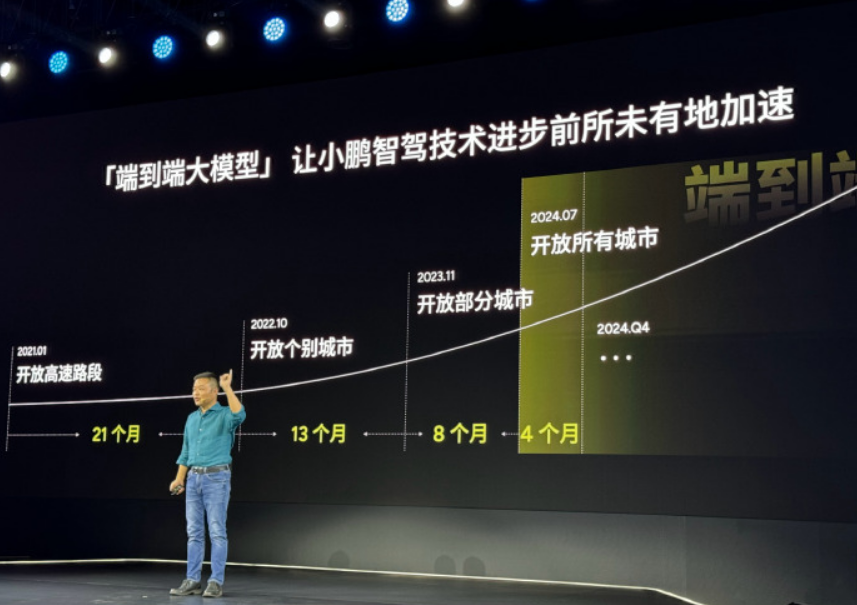

Firstly, it focuses on intelligence as its main selling point. Despite past struggles, the company has invested heavily and can't backtrack. He Xiaopeng claimed that the M03 Max is the best in its price range and the only high-end intelligent driving model in the market. Xiaopeng aims to provide an affordable "door-to-door" intelligent driving experience with its M03 models.

Secondly, it offers a stylish design and excellent range as alternatives to RMB 200,000 vehicles. The mid-range variant is popular due to its competitive pricing and better range. First-time buyers, mostly young adults around 23, make up a significant portion of sales, while repeat buyers, often women in their early 30s, tend to upgrade from mid-to-high-end vehicles priced between RMB 200,000 and RMB 300,000.

Lastly, ride-hailing could be a backup plan for the Xiaopeng MONA M03. At the launch event, Didi Chuxing's founder, Cheng Wei, attended as MONA's platform originated from Didi. In August 2023, Xiaopeng acquired Didi's vehicle manufacturing project, planning to sell MONA vehicles to consumers and ride-hailing fleets. However, in August 2024, Xiaopeng announced that the MONA M03 would not be offered as a ride-hailing version.

I speculate that Xiaopeng has a backup plan. By initially announcing no ride-hailing version, it can pivot to this segment if sales falter, ensuring a basic sales volume.

Can this product strategy survive in the mainstream market?

Success in the mainstream market requires comprehensive capabilities, and Xiaopeng struggles with delivery.

The "Diffusion of Innovations" theory, also known as the Bell Curve Theory, posits that new brands/products initially face skepticism before gaining early adopters and eventually declining in popularity, forming a bell-shaped lifecycle.

With NEV penetration exceeding 50%, mainstream buyers follow trends and prioritize brands they trust. Xiaopeng MONA M03 faces stiff competition from established players offering similar intelligent features. Meanwhile, BYD is rapidly expanding its intelligent driving capabilities, posing a significant threat to Xiaopeng.

BYD is known for its hybrid technology, battery-electric systems, and cost control, but often criticized for lacking in intelligence. However, BYD has been quietly strengthening its intelligent driving capabilities. In January 2024, Wang Chuanfu emphasized the importance of "vehicle-level intelligence" and announced plans to introduce 11 models with L2+ autonomous driving features by the end of 2024.

In June 2024, BYD established the Tianxuan Development Department, focusing on in-house intelligent driving technology to reduce costs. Combined with BYD's recent marketing efforts emphasizing intelligence, it's clear that BYD aims to win in the second half of the NEV race.

If BYD's plan succeeds, its mainstream models will offer intelligent features by year-end, posing a severe challenge for Xiaopeng.

In summary, as Xiaopeng MONA M03 enters the mainstream market, it must navigate delivery pressures and compete with BYD, Geely, and others. Xiaopeng faces an uphill battle for survival.