Share price plummets after earnings report: What happened to Pinduoduo?

![]() 08/29 2024

08/29 2024

![]() 475

475

Pinduoduo's share price plummeted by nearly 30% on the day of its Q2 2024 earnings release, causing uproar in the market. Rumors flew thick and fast, especially when the company unusually guided expectations, stating that "profit decline is inevitable," leaving the market with endless speculation.

As value investors, what we should consider now is not the rumors themselves but rather the rationality of management's guidance and the uncertainties currently faced by Pinduoduo.

Core Points:

Firstly, in the new industry cycle, merchants' voices are becoming louder, while overall demand is relatively weak, posing dual challenges to Pinduoduo's main platform in terms of GMV and monetization rate.

Secondly, 'easing the burden' on merchants and supporting key merchants should be the focus of Pinduoduo's main platform operations going forward, at the cost of short-term profitability.

Thirdly, management's caution is objective and rational.

Entering a New Cycle

When interpreting Pinduoduo's Q1 2024 earnings report, I had the following views:

1) As macroeconomic destocking nears completion, Pinduoduo's domestic main platform benefits are in fact being diluted. Simply put, in the new industry cycle, merchants' focus will gradually shift to "profit-centered" operations, and Pinduoduo's high monetization rate will face challenges.

2) When upstream merchants demand profits and consumer demand is relatively low, the platform, as an intermediary, must pass on benefits. This involves 'tax cuts' (reducing monetization rates) for merchants and providing consumers with more convenient and affordable products.

3) Domestic mainstream e-commerce platforms are moving away from low prices and instead focusing on GMV growth. While this appears to signal an end to intense competition, it is actually a necessary requirement of the industry cycle and sector. Competition will not cease but will manifest in new ways.

4) TEMU's overseas expansion has alleviated the group's short-term growth pressure but may face geopolitical and other uncertainties in the medium term.

A quarter later, let's revisit these predictions in light of Pinduoduo's earnings report.

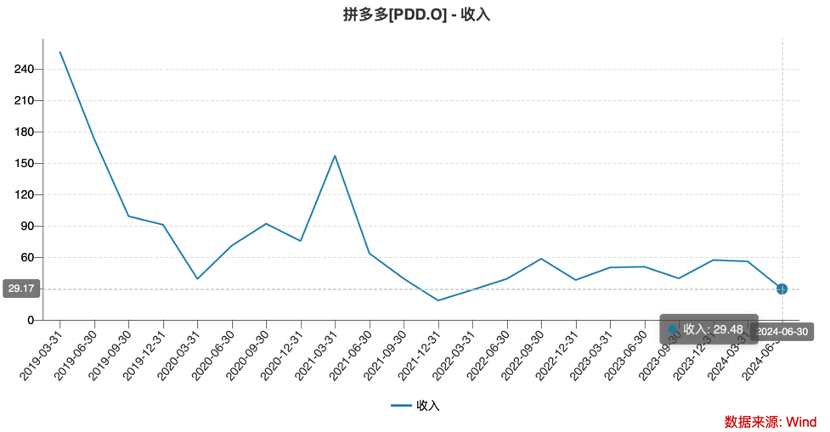

In Q2 2024, Pinduoduo's online marketing revenue increased by 29% year-on-year to RMB 37.9 billion. As TEMU does not have this business overseas, this figure serves as the most important indicator of Pinduoduo's main platform. Compared horizontally with similar companies, this number is still impressive, but it is the lowest in Pinduoduo's history when compared to its own past performance (excluding the special period in 2021).

After Q2 2022, Pinduoduo launched a new marketing tool called 'Omni-channel Marketing' (where merchants set ROI and the platform guarantees conversion rates, packaging free and paid traffic for sale to merchants), resulting in a significant increase in platform monetization rates. The slowdown in online marketing revenue growth now reflects a faster decline in GMV growth on the main platform (this model also helps create popular items and ensures equal traffic allocation regardless of merchant size).

According to BOCOM International estimates, Pinduoduo's main platform GMV grew by 15%-20% year-on-year in Q2 2024, down from over 30% in the previous quarter, which should concern management and the market.

For a platform with GMV exceeding RMB 4 trillion, operational efficiency is closely related to both its business model and strategy, as well as the macroeconomic cycle.

Summarizing the current macroeconomic situation is challenging. On the one hand, we see overall social demand remaining weak, and social sentiment is relatively low. On the other hand, if we look at the industry cycle, some signals are more optimistic.

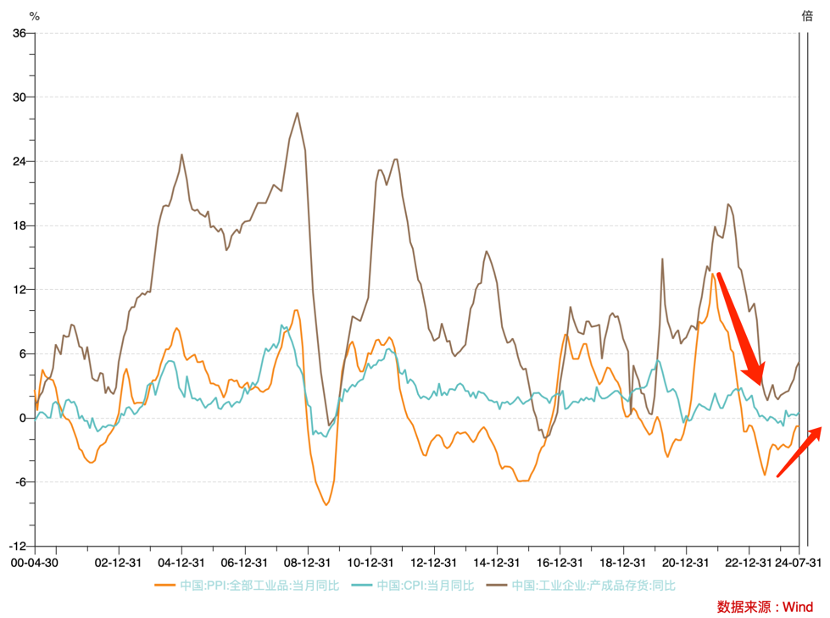

In the above figure, we use 'Year-on-Year Change in Industrial Finished Product Inventory,' 'PPI,' and 'CPI' to illustrate the industry cycle: Both CPI and PPI are positively correlated with inventory cycles.

Recent data shows significant improvement in the year-on-year change in industrial finished product inventory, accompanied by notable recovery in PPI, while consumer price index changes remain subtle.

In other words, the current economic cycle is characterized by a recovery in upstream and midstream industries (with increased inventory and rising raw material prices leading to higher PPI), but this has not yet translated to the consumer end, explaining the significant divergence in sentiment regarding the recovery.

If the pricing power in upstream and midstream industries continues to recover, it will alter the interest distribution among downstream retail channels, with merchants demanding greater bargaining power on Pinduoduo: rent reduction (lower monetization rates).

After analysis, we have a clearer picture of the current situation faced by Pinduoduo's main platform and the domestic e-commerce industry:

1) As a medium connecting consumers and merchants, the platform's benefits result from multiple factors. Now that upstream and midstream companies have greater bargaining power, and the platform cannot pass on costs to consumers, this poses a short-term risk.

2) With weak domestic demand and slowing aggregate growth, the high growth potential of Pinduoduo's main platform is indeed challenged.

3) Management's caution is rational and objective.

New Merchant Demands: Rent Reduction and Subsidies

With the external environment having changed and Pinduoduo's management expressing concerns about future growth, how might its operational strategy adjust in the medium term?

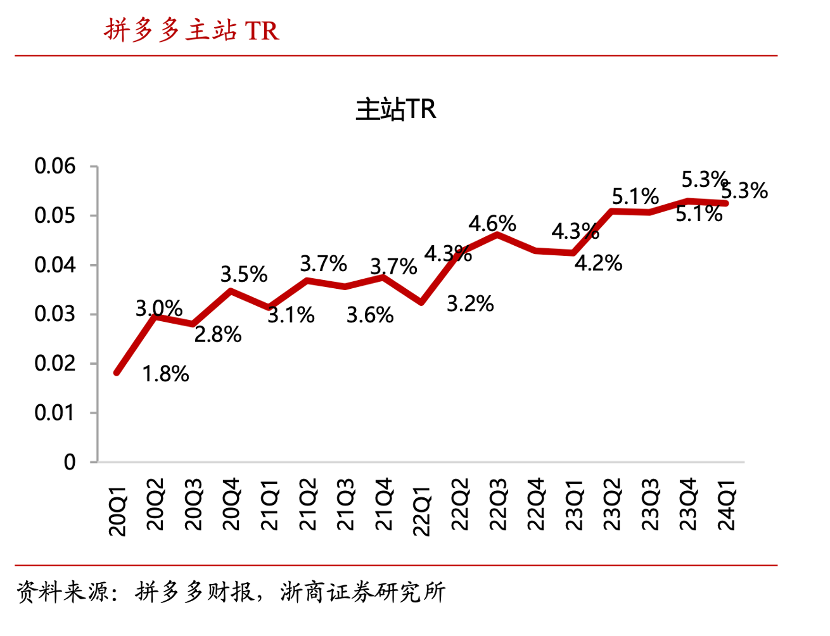

As mentioned earlier, after Q2 2022, Pinduoduo launched a new marketing tool called 'Omni-channel Marketing,' providing merchants with a one-stop marketing channel that packages free and paid traffic. Subsequently, the platform's monetization rate soared, strengthening its financial position.

The above figure shows Zhejiang Merchants Securities' estimates of Pinduoduo's main platform monetization rates, which underwent a fundamental shift after Q2 2022. With both GMV and profitability growing, Pinduoduo entered its golden age. In other words, Pinduoduo swiftly updated its merchant marketing tools after encountering a favorable external environment, seizing the opportunity to achieve its current success.

However, with changes in the external environment, Pinduoduo first faces pressure from its high monetization rate.

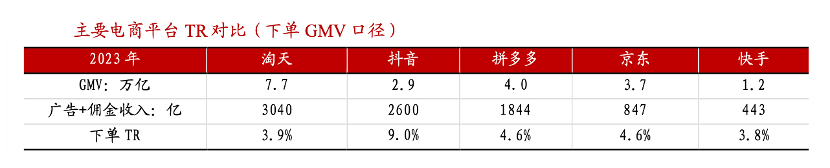

According to Zhejiang Merchants Securities estimates, Pinduoduo's 2023 monetization rate was approximately 4.6%, comparable to JD.com, higher than Taobao and Kuaishou, but lower than Douyin.

Given Pinduoduo's past growth, merchants were not overly concerned about this monetization rate, as marketing costs could be diluted by expanding scale. Many merchants' initial goals were to 'destock' and 'maintain scale,' making them less sensitive to operating costs.

With this interest distribution shifting, Pinduoduo must confront the issue: its monetization rate has peaked and may be adjusted downward in the short term to adapt to new merchant-platform relationships.

From a sustainable operation perspective, Pinduoduo will likely increase support for quality merchants in the short term, including but not limited to traffic subsidies.

We know that total online marketing revenue = GMV * monetization rate. Affected by insufficient domestic demand, GMV growth is slowing. If the monetization rate also declines, it will naturally impact Pinduoduo's main platform revenue and profitability. However, these are necessary steps in the new cycle.

During the analyst conference call, management also emphasized industry competition pressures. Recently, many players have shifted from low-price-driven strategies to GMV growth as the core, with some believing that the industry is no longer 'competitive.' This significantly underestimates the brutality of industry competition.

The low-price strategy has always been a hallmark of Pinduoduo, rapidly attracting traffic and prioritizing resources for low-priced and heavily subsidized items in subsequent traffic allocation, fostering a positive cycle of the low-price model. In this model, merchants can quickly achieve scale effects, incubating new low-priced, high-frequency business formats, while consumers gain excess purchasing power, satisfying multiple interests. Incidentally, Pinduoduo's model differs from that of its e-commerce predecessors, who prioritized high-priced, high-margin products in traffic allocation, marking a significant innovation in business models.

For platforms, pricing power depends on:

1) Merchants' willingness, closely related to the aforementioned cyclical factors.

2) Industry competition pressures. When Pinduoduo first adopted a low-price strategy, it disrupted established e-commerce players' operations. Despite initiating varying degrees of low-price strategies, competitors' efforts were ineffective, failing to significantly impact Pinduoduo. Most platforms have now completed internal reforms, adopting more sophisticated low-price strategies, such as Taobao's 1688 factory stores and JD.com's strict price controls, underpinned by systemic innovations.

These developments also put some pressure on Pinduoduo's low-price branding, as seen below.

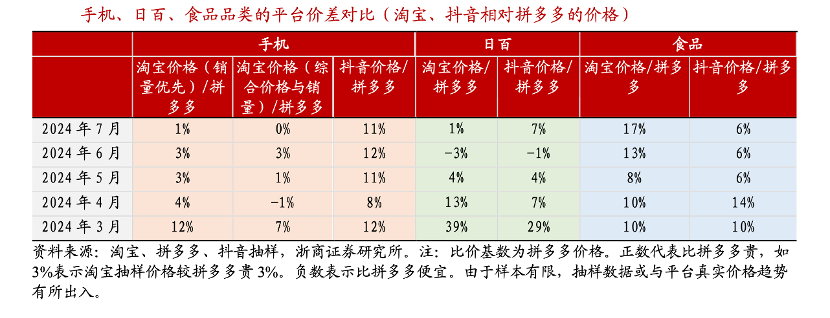

Zhejiang Merchants Securities sampled products from Taobao, Pinduoduo, and Douyin, revealing that Taobao's prices have become very close to Pinduoduo's since March 2024. While Douyin's prices are still slightly higher, the price gap is narrowing.

Given recent announcements by platforms to move away from low prices, the essence is not to end competition but to align with Pinduoduo, as their low-price goals have largely been achieved.

This poses a question for Pinduoduo: how should it respond to this new situation, given its origins in low prices and the subsequent evolution of its business model?

1) The platform can offset the impact of weakened low-price branding by providing traffic subsidies, heavily subsidizing, and supporting mid-to-high-end quality brands and merchants.

2) Support cost-effective merchants to maintain the low-price brand.

Regardless of the path chosen, the platform must reposition itself, premised on continued concessions to merchants.

In business history, there are few one-size-fits-all strategies, and the same is true for Pinduoduo. Its previously proud business model and operational efficiency resulted from early strategic planning and adaptability. Now, with changing internal and external environments, Pinduoduo must reassess its operational logic to adapt to the new landscape.

During the transition period, uncertainty risks increase, and profitability declines, causing management concerns. The sharp share price adjustment results from a combination of expectations, sentiment, liquidity, and other factors, which we will discuss in detail later.