Lixiang One has become more conservative

![]() 08/29 2024

08/29 2024

![]() 464

464

Author: Zhang Wen, Editor: Jiang Jiao, Cover: Unsplash

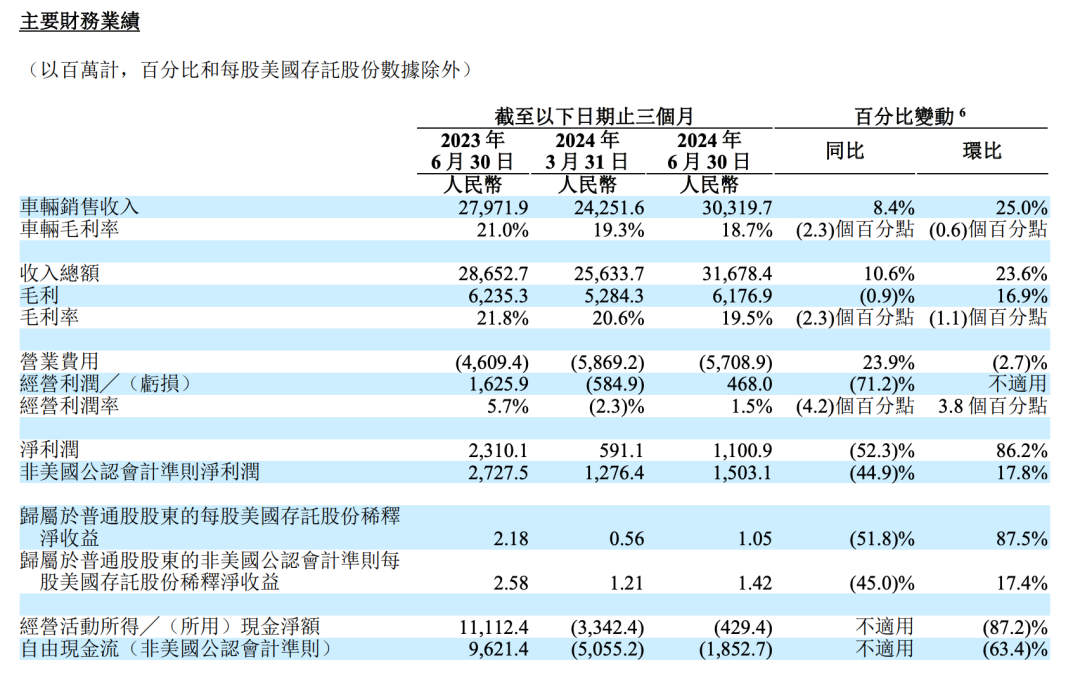

Relying on price cuts across the entire product line and the cheaper L6 model, Lixiang One stabilized its growth momentum in the second quarter, selling over 20,000 more vehicles than last year. However, total revenue increased by only 10.6%, and the average price per vehicle was 44,000 yuan lower than last year, resulting in a drop in automotive gross margin to 18.7%. Net profit was 1.1 billion yuan, more than halved compared to the same period last year. Free cash flow was negative for two consecutive quarters.

The market may not be satisfied with Lixiang One's financial performance. Yesterday, when U.S. stocks opened, Lixiang One's share price fell accordingly, with an intraday decline of over 17% and a closing decline of 16.12%.

Lixiang One has adjusted the launch cycle of its battery-electric vehicles (BEVs) to next year, and there will be no new car launches in the second half of the year. In the first seven months of this year, Lixiang One sold 240,000 vehicles, and management is confident that annual deliveries will exceed 500,000, corresponding to an average monthly sales volume of 52,000. This figure is still significantly lower than the company's earlier revised annual minimum sales expectation of 560,000.

Li Xiang spoke little during yesterday's earnings call, only discussing competition with Huawei's Hongmeng Intelligent Driving and confidence in BEVs, leaving more about market competition and future plans to other members of management and adopting a lower profile.

In the first half of this year, automakers' CEOs were keen on participating in product launches and filming short videos together. Li Xiang participated only in Xiaomi's SU7 launch in April. He also did not attend Xpeng's 10th-anniversary conference celebration. Recently, both He Xiaopeng and Li Bin publicly expressed dissatisfaction with Lixiang One's weekly sales rankings.

01 | More cars sold, less money earned

Lixiang One sold more vehicles in the second quarter, but revenue growth lagged behind sales growth. The company's total revenue for the quarter was 31.7 billion yuan, an increase of 10.6% year-on-year, trailing the 25.5% growth in sales volume.

The lower-priced L6 has emerged as Lixiang One's sales leader. This mid-to-large SUV, priced starting at 249,800 yuan, is the cheapest model launched by Lixiang One to date. It has been a huge success since its launch, with monthly sales exceeding 20,000 units, more than twice the monthly sales of the L7.

However, the L6 also contributed to a decline in Lixiang One's average vehicle price and automotive gross margin. In the quarter, the company's gross margin was slightly lower than the previous year at 0.9%, with an automotive gross margin of 18.7%, roughly the same level as in 2021. The company's net profit for the quarter was 1.1 billion yuan, a decrease of 52.3% from the 2.3 billion yuan in the same period last year.

Screenshot of Lixiang One's second-quarter financial report

Lixiang One CFO Li Tie said they expect the automotive gross margin to rebound in the third quarter, rising to 19%, and the company's overall gross margin will remain at the 20% level. This figure still leads most Chinese new-energy vehicle startups.

The first-quarter financial report, released after the failure of the MEGA launch, did not directly reflect Lixiang One's layoffs after April. The second-quarter report revealed more, with sales, general, and administrative expenses and research and development expenses both lower than the previous quarter, declining by 5.5% and 0.7% respectively on a quarter-over-quarter basis, resulting in a 2.7% decrease in overall operating expenses.

However, Lixiang One's free cash flow remained negative, with a negative 1.9 billion yuan in the second quarter, an improvement from the negative 5.1 billion yuan in the previous quarter but still significantly worse than the positive 9.6 billion yuan in the same period last year.

Li Tie said they achieved positive free cash flow in both June and July, and with optimized capital expenditures and improved operational efficiency, they are confident in maintaining positive free cash flow starting in the third quarter.

02 | No new car launches in the second half

During the earnings call, analysts were particularly concerned about how Lixiang One would maintain sales growth in the second half of the year without any new car launches. Lixiang One Senior Vice President Zou Liangjun explained that new models are only one factor driving sales growth, and he believes that efficient marketing operations are another way to boost sales, which is currently being promoted by the company.

Lixiang One began adjusting its offline strategy after the failure of the MEGA launch, planning to eliminate inefficient stores located in shopping malls and replace them with higher-performing central stores.

Central stores have larger showrooms that can display up to 11 cars, addressing the issue of insufficient showroom space after the MEGA launch. Compared to the end of last year, the proportion of their central stores increased from 24% to 31% in June, with plans to raise it to 50% by the end of the year.

These adjustments can be seen as preparations for the launch of BEVs next year. Li Xiang said during the earnings call that for BEV SUVs, they need to address issues related to product styling and the number of supercharging stations, and they are very confident in entering the first tier of high-end BEVs within two years.

In the quarter, Lixiang One had 701 supercharging stations in operation, equipped with 3,260 charging piles, an increase of over 300 from the end of the previous quarter. Lixiang One plans to build over 2,000 supercharging stations within the year, meaning that infrastructure layout will accelerate in the second half of the year.

However, this does not answer how Lixiang One will maintain sales growth in the second half of the year. Lixiang One's guidance for third-quarter deliveries is 145,000 to 155,000 units. Given that July sales were 51,000 units and August sales have not shown a significant decline (Lixiang One reported weekly sales of around 11,000 units this month), this implies that September sales will remain flat or even decline slightly.

The management's somewhat conservative sales expectations may be related to Huawei's relentless pressure. A few days ago, AITO's new M7 Pro was launched, equipped with the HUAWEI ADS Basic version and priced the same as the Lixiang One L6. Earlier, the AITO M9 had already encroached on the market share of the Lixiang One L9, with over 110,000 orders placed since its launch.

Li Xiang said during the earnings call that Hongmeng Intelligent Driving is their strongest competitor in the market, but they will coexist healthily in the long term.

©️ Copyright Shanshang, All Rights Reserved. Reproduction is prohibited without authorization.