Who would have thought that Huawei has become BYD's strongest external support in its pursuit of high-end markets?

![]() 08/30 2024

08/30 2024

![]() 499

499

BYD and Huawei are two of the leading players in China's automotive industry.

BYD excels in its sheer size, with annual sales of new energy vehicles having reached 3 million units, making it a global leader in the field. Huawei, on the other hand, adheres to its principle of "not building cars" but plays the role of a supplier, showcasing impressive technological prowess in areas such as intelligent chassis, cockpits, and autonomous driving, particularly in advanced autonomous driving capabilities where it ranks among the top globally.

However, both of these industry leaders have their respective limitations. While BYD boasts impressive sales figures, it lacks depth and breadth in advanced autonomous driving capabilities. Huawei, despite its strong technological foundation, has limited partnerships with automakers. Theoretically, BYD and Huawei are a perfect match, and many users have imagined the perfect combination of BYD's vehicles equipped with Huawei's autonomous driving technology. This once-unrealistic dream became a reality on August 27.

Specifically, BYD's sub-brand "Equation Tortoise" announced a partnership with Huawei, and its upcoming model, the Equation Tortoise 8, will feature Huawei's Kunpeng ADS 3.0 autonomous driving system. As the latest generation of autonomous driving systems under Huawei's ecosystem, ADS 3.0 has been upgraded to an "end-to-end" architecture, enabling advanced features such as "door-to-door autonomous driving" and further enhancing its road coverage capabilities.

Following the partnership announcement, the Equation Tortoise 8 has emerged as BYD's most advanced autonomous driving vehicle within its group, raising high expectations. However, it's crucial to remember that BYD also has its in-house autonomous driving development plans, and the Equation Tortoise brand itself is relatively small in scale. It remains to be seen what kind of "butterfly effect" this partnership will trigger.

Will the introduction of Huawei's full-featured autonomous driving technology enable Equation Tortoise to overtake competitors on the curve?

Indeed, BYD is not the first automaker to partner with Huawei specifically for autonomous driving technology. Following Huawei's launch of the Kunpeng brand, several other automakers, including Lantu, Shenlan, and GAC Motor, have announced similar partnerships.

However, the depth of cooperation varies among these brands. For example, Lantu's partnership with Huawei is relatively deep, with the new model "New Dreamer" set to be equipped with ADS 3.0, offering capabilities on par with Huawei's HarmonyOS-powered products. On the other hand, Shenlan will use Huawei's Kunpeng ADS SE version, which can be considered a basic version offering features such as high-speed autonomous driving and automatic parking.

Evidently, the cooperation between Equation Tortoise and Huawei falls into the category of "deep" partnerships. Notably, my friends working at Equation Tortoise have described the partnership as a "powerful alliance between two strong players to create the first exclusive autonomous driving solution for rugged vehicles." My first impression is that this autonomous driving solution may include some customized features.

Given that the Equation Tortoise 8 is a "rugged SUV," in addition to daily highway and urban driving, off-roading and traversing challenging terrain are also expected to be common scenarios. If Equation Tortoise intends to collaborate with Huawei to create a customized autonomous driving solution, I speculate that the customized ADS 3.0 will be optimized for off-road scenarios, possibly focusing on vehicle control and active safety enhancements rather than navigation improvements.

BYD also places great emphasis on vehicle intelligence, particularly in its intelligent chassis technology. According to previous reports, the Equation Tortoise 8 is considered a "youthful version of the U8," featuring rugged-related configurations (such as three locking differentials) and the CloudRider-P chassis, providing a solid foundation.

However, for BYD's other models, in-vehicle hardware-related intelligence development is primarily handled in-house, relying on the "Celestial Eye" autonomous driving system. With the integration of Huawei's Kunpeng ADS, there's a high likelihood that BYD will require Huawei to adapt its software. Nevertheless, we shouldn't worry but rather anticipate the synergy that could arise from Huawei's software algorithms combined with BYD's advanced hardware, which will be a key highlight of the Equation Tortoise 8 equipped with Huawei's ADS 3.0.

Naturally, many people are eager to see the Equation Tortoise 8's performance with Huawei's Kunpeng autonomous driving technology. Currently, Tencent's brand and its N7 and Z9GT models are considered the industry benchmarks in terms of advanced autonomous driving capabilities. However, N7's advanced autonomous driving features are limited to specific cities, and Z9GT is still in the pre-sale stage. This means that BYD's internal ranking of autonomous driving capabilities is poised to change with the arrival of the Equation Tortoise 8.

A more significant "clash" arises from the choice between the "in-house development" and "supplier" routes. BYD has invested heavily in in-house autonomous driving technology, boasting a team of thousands of engineers and incurring over 1 billion yuan in monthly salaries. The potential for Equation Tortoise to overtake with external support could not only elicit criticism from outsiders but also shake internal confidence.

However, optimistically, introducing external suppliers isn't necessarily a bad thing, as it could spur internal competition. Particularly with a company like Huawei, which boasts top-tier autonomous driving technology, such collaborations can undoubtedly benefit BYD's in-house autonomous driving development.

By introducing Huawei's autonomous driving technology, is BYD intentionally fostering internal competition?

Calls for BYD and Huawei to join forces and offer advanced autonomous driving capabilities have been heard for some time, and rumors of negotiations between the two have circulated. However, ultimately, BYD reportedly declined the partnership. I believe that, generally, BYD is unlikely to collaborate extensively with Huawei on autonomous driving technology.

The core reason stems from the so-called "soul theory," where autonomous driving, as the core competency of modern smart vehicles, is unlikely to be outsourced by major automakers with significant market share. The recent partnership is limited to BYD's sub-brand Equation Tortoise and even further to its premium model, the Tortoise 8, minimizing its broader impact.

Currently, Equation Tortoise seems ideally suited as a "testbed" for introducing third-party autonomous driving technology. Firstly, positioned as a "personalized brand," Equation Tortoise targets users more receptive to new technologies and with a higher interest in autonomous driving. Secondly, with a relatively small overall scale, the brand's monthly sales range from 2,000 to 5,000 units, and it recently announced a price reduction of 50,000 yuan for the Tortoise 5 model.

In other words, integrating Huawei's autonomous driving technology into the Equation Tortoise brand and the Tortoise 8 model will not compromise BYD's "soul," as its in-house autonomous driving system remains the backbone of the group's overall intelligence. If the Tortoise 8 achieves impressive sales figures with Huawei's autonomous driving technology, Equation Tortoise can then equip more of its models with Huawei's technology to boost baseline sales. Based on this partnership, BYD stands to gain in various ways.

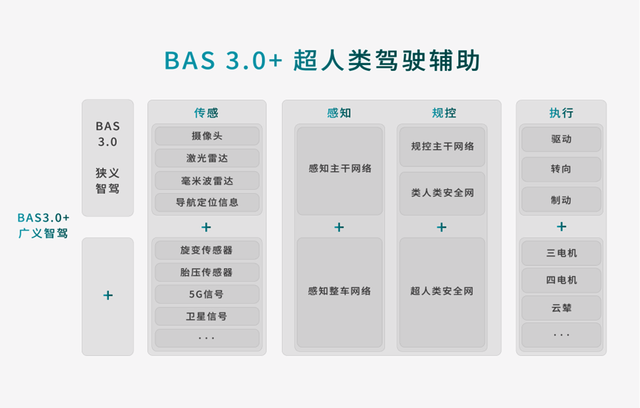

From another perspective, most companies have an "internal competition" mechanism, and introducing Huawei's autonomous driving technology could be seen as a means for BYD to foster such competition within its autonomous driving capabilities. While BYD's latest BAS 3.0+ autonomous driving system is conceptually advanced, Huawei's ADS 3.0, as an earlier implementation of the next-generation technology, still offers valuable lessons.

In our previous test drive experience, the XG Motors S9 equipped with ADS 3.0 demonstrated remarkable road coverage capabilities. For instance, the current test version can initiate autonomous driving from a parking space in an underground garage, navigate to the destination, and finally complete automatic parking. Under favorable conditions, the entire journey can be completed without driver intervention, even passing through parking garage barriers automatically, which is quite remarkable.

Moreover, when driving on roads with roundabouts, unpaved sections, or well-marked lanes, the XG Motors S9 can navigate them quickly, demonstrating significant improvements in scene and road perception capabilities. It's no longer accurate to describe this as mere "mapless autonomous driving." In fact, many autonomous driving systems now claim to have adopted an "end-to-end" architecture, emphasizing enhanced perception and decision-making abilities, but few can back up these claims with convincing demonstrations.

Returning to BAS 3.0+, this autonomous driving system is essentially an extension of the "human-like driving" BAS 3.0, incorporating more sensors and enabling the system to harness more chassis capabilities. Thus, the capabilities of BAS 3.0 set the baseline for this autonomous driving solution.

BYD's in-house autonomous driving system urgently needs to expand its coverage scope before focusing on detailed improvements. Leveraging such an "internal competition" mechanism to rapidly enhance BYD's in-house autonomous driving capabilities and fully utilize the productivity of its 4,000-strong team would undoubtedly be welcomed by Wang Chuanfu.

Using Autonomous Driving as a Nuclear Weapon, BYD Strives for Higher Ground

As the global leader in new energy vehicle sales, BYD is not without challenges. For instance, although relatively weak autonomous driving capabilities don't necessarily hinder car sales, they can impact BYD's ability to sell premium vehicles.

An interesting statistic reveals that despite BYD's increasing sales of new energy vehicles over the past three years (2020-2023), the average selling price has declined. In 2020, the average selling price of BYD's new energy passenger vehicles was 156,000 yuan per unit, which dropped to 143,000 yuan in 2021, rose slightly to 153,000 yuan in 2022, but fell again to 135,000 yuan in 2023.

Based on these figures, one can infer that BYD's primary sales driver currently comes from vehicles priced at or below 150,000 yuan, such as the Qin PLUS family and Song Pro family. While BYD's relatively premium models like the Han and Tang series maintain stable monthly sales of around 10,000 units each, the brand and its sub-brands have a limited presence in the ultra-premium segment above 300,000 yuan.

Apart from Equation Tortoise, Tenza sales totaled 10,340 units in July, while premium brand Atto 3 sold 439 units. However, considering its ultra-high average selling price of over 1 million yuan, this performance is somewhat surprising.

Overall, like many Chinese companies (not just automakers), BYD faces the challenge of "going premium" after experiencing a sales explosion. Success through a cost-effective strategy can potentially lead to a path dependency. Nevertheless, BYD's actions, particularly the launch of multiple premium brands to form a product matrix, indicate that Wang Chuanfu is determined to break free from the price trap and venture into the premium market.

It's crucial to recognize that mere luxury is insufficient for premium new energy vehicles today. Intelligence, especially autonomous driving, offers a significant value proposition. The popularity of models like Wenjie M9 further underscores the potential of autonomous driving as a ticket to the premium market.

Li Yunfei, a BYD executive, stated on social media, "In terms of overall planning for autonomous driving, BYD adopts a dual-track approach of both open collaboration and independent in-house development." I believe that in the face of the core mission of "going premium," as Li mentioned, BYD is not overly concerned with whether to "borrow strength" or "develop in-house." The crux lies in catching up with the front-runners as soon as possible and even becoming the brand with the strongest autonomous driving capabilities in China and globally.

However, I also want to emphasize that the "soul theory" remains a crucial barrier preventing traditional automakers from seeking third-party collaborations, especially for a brand like BYD that delivers millions of vehicles annually. The in-house autonomous driving system must become the backbone. Regarding the partnership between Equation Tortoise and Huawei, I believe there are two reasonable expectations.

Firstly, the autonomous driving collaboration should remain within the Equation Tortoise brand, with BYD, Tenza, and even Atto 3 continuing to utilize the BAS autonomous driving system. Secondly, Huawei's role can be understood as "technical support," unlikely to impact BYD's autonomous driving in-house development roadmap. Perhaps we can anticipate that Huawei's autonomous driving technology will significantly and rapidly elevate BYD's overall autonomous driving capabilities, and we eagerly await whether this will further boost sales of BYD's premium models.

Source: Lei Tech