When the Apple supply chain begins to de-Appleize

![]() 08/30 2024

08/30 2024

![]() 534

534

Written by: Poetry and Starry Sky

ID: SingingUnderStars

Recently, news about Apple has been endless, sometimes Foxconn left, sometimes Foxconn returned, and sometimes Apple shifted focus entirely to India.

For capital, not putting all eggs in one basket is a normal operation. When China's market competitiveness is sufficient, capital will make the right choices.

Conversely, for Apple supply chain companies, while the relationship with Apple appears unequal on the surface, there is actually a choice: Apple is not the only basket.

Most Apple supply chain companies collaborate with domestic phone brands like Huawei, Xiaomi, vivo, OPPO, etc. When O-Film Tech was kicked out of the Apple supply chain, it didn't immediately collapse due to support from domestic phone orders.

If ranked by country of origin, Chinese phone brands are the world's first, far ahead of the United States and South Korea.

It is these powerful domestic phone brands that allow Apple supply chain companies to have other options.

With the rapid rise of new energy vehicles, the Apple supply chain has gained new options.

For example, Lens Technology achieved RMB 5 billion in sales in the new energy vehicle sector in 2023.

When Xiaomi's cars sell well, investors asked if Lens Technology was involved in Xiaomi's automotive supply chain.

Lens Technology stated that Xiaomi is an important strategic partner, and the two parties have conducted in-depth cooperation in various fields. Through the Xiaomi & Lens Joint R&D Center, they continuously develop new technologies, products, materials, and equipment to enhance product competitiveness. The company has established partnerships with over 30 domestic and international new energy vehicle brands and traditional luxury vehicle brands, with a continuously expanding customer base and product categories.

I. Lens Technology's Mid-Year Report

Among Apple supply chain companies, Lens Technology has a long-standing and representative partnership with Apple, having been excluded and then re-included.

From an individual company perspective, Apple's partnership with supply chain companies is purely profit-driven, requiring no analysis beyond business logic.

From a macro perspective, China is the most mature market for the global mobile phone supply chain. Even Apple's Foxconn factories in India source most of their components from Chinese companies.

Structural transformation within the industry is inevitable. Rather than worrying about capacity being shifted to India, the concern should be how to replace low-end capacity with high-end production.

Lens Technology provides a template.

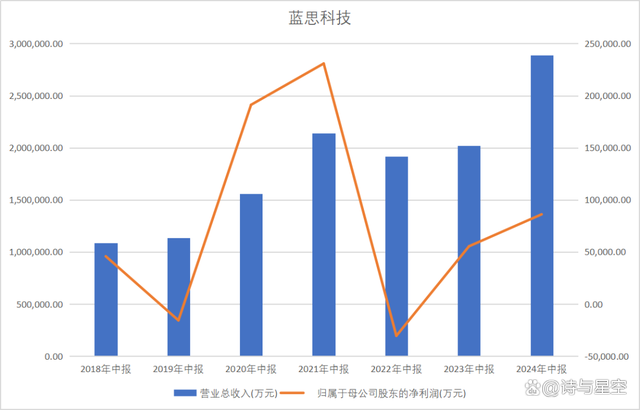

Data Source: iFind, Tonghuashun

Lens Technology's mid-year report shows revenue of RMB 28.867 billion in the first half of 2024, an increase of 43.07% from RMB 20.177 billion in the same period last year. Net profit attributable to shareholders of listed companies was RMB 861 million, up 55.38% from RMB 554 million in the same period last year. Excluding non-recurring gains and losses, net profit attributable to shareholders of listed companies was RMB 663 million, up 46.21% from RMB 453 million in the same period last year.

There are three reasons for this rapid growth in performance.

First, the consumer electronics market rebounded in the first half of 2024, with increased smartphone shipments, particularly the rapid development of foldable phones and the application of AI technology in smartphones and PCs, driving up industrial value.

Second, to remain competitive, the company maintains a leading position in structural components, modules, and other businesses across smartphones, computers, smart headsets, wearables, smart cars, and smart cockpits, while accelerating vertical integration within the supply chain.

Third, growth in the new energy vehicle market has driven the development of related industries.

The mid-year report shows that revenue from the new energy vehicle segment reached RMB 2.7 billion in the first half of 2024 (less than RMB 2.3 billion in the same period last year).

While this represents less than one-tenth of total revenue of RMB 28.867 billion, it marks a milestone: industrial upgrading presents opportunities for diversification.

II. Gross Margin Crisis

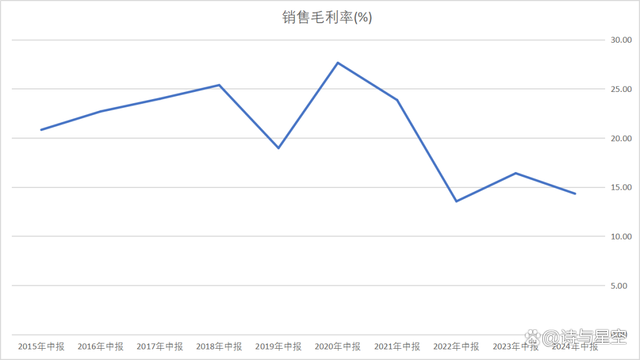

Over a ten-year period, Lens Technology's gross margin has continued to decline.

Data Source: iFind, Tonghuashun

The mid-year report for 2024 shows that sales to the company's largest customer accounted for 49.66% of revenue.

At present, this largest customer is undoubtedly Apple. Thus, the root cause of the declining gross margin lies with Apple.

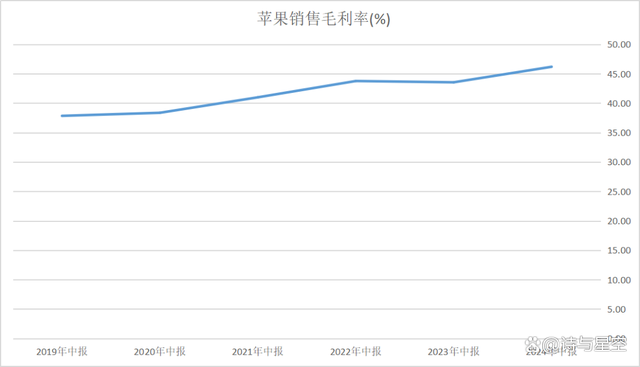

Meanwhile, Apple's gross margin is increasing.

Data Source: iFind, Tonghuashun

Not only Lens Technology but also most Apple supply chain companies face similar challenges with declining gross margins.

This indicates that Apple is increasing its own gross margin by squeezing that of its supply chain, thereby maintaining its valuation in the capital market.

Today's Apple is no longer the same as before. As American investors demand quicker returns, capital increasingly seeks fast profits.

Therefore, Apple's shift to India is fundamentally aimed at squeezing the supply chain to enhance competitiveness in the capital market.

III. Operational Risks and Coping Strategies

For Lens Technology (and all Apple supply chain companies), Apple has transformed from a source of wealth to a hot potato.

De-Appleization has become a consensus among Apple supply chain companies, but how to transform poses a significant challenge.

Half of the company's revenue comes from Apple, and premature or delayed severing ties can pose significant operational risks (indicating that concerns about Apple shifting to India are unfounded, as it's a two-way street).

New businesses are yet to mature, while old ones remain heavily dependent.

For existing customers (Apple), the company will continue to strengthen relationships by providing high-quality products and services.

For new customers, the company will actively explore new markets and resources to reduce reliance on a single or limited number of clients.

Behind new customer acquisition lies R&D and innovation. The company will offer a more diverse product range to meet varying customer needs and mitigate market fluctuations' impact on performance.

To this end, the company plans to enhance smart manufacturing capabilities, improving production efficiency and intelligence to reduce costs and strengthen market competitiveness. Through sustained R&D investment and innovation, the company will develop new technologies and products to attract and retain customers.

In the new energy vehicle sector, the company has developed various products for smart cockpits, including center consoles, dashboards, displays, B-pillars, C-pillars, charging piles, and power battery structural components, forging long-term strategic partnerships with leading automotive clients. Additionally, the company is collaborating with clients to innovate, optimize, and validate new products like large-sized automotive glass for side windows, windshields, and panoramic roofs.

- END -

Disclaimer: This article is based on public information disclosed by listed companies in accordance with legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strive for fairness in content and opinions but cannot guarantee their accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky assume no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is original to Poetry and Starry Sky and may not be reproduced without authorization.