MONA M03 sells for less than 120,000 yuan! Can Xpeng turn around?

![]() 08/30 2024

08/30 2024

![]() 443

443

Author: Lushiming

Editor: Dafeng

On August 27, Xpeng Motors held a launch event for the Xpeng MONA M03, introducing three configurations with an official price range of just 119,800-155,800 yuan.

The day after the launch, media reported that He Xiaopeng, Chairman of Xpeng Motors, increased his shareholding in the company by approximately HK$107 million through public markets and wholly-owned Galaxy Dynasty Limited. Influenced by this news, Xpeng's share price surged by more than 6% shortly after opening on the Hong Kong stock market that day.

This clearly demonstrates He Xiaopeng's confidence in MONA's future sales, but it remains to be seen how MONA M03 will fare in the market.

Objectively speaking, MONA M03's lower pricing can alleviate Xpeng's immense sales pressure for a certain period. According to officials, Xpeng MONA M03 surpassed 10,000 bookings within 52 minutes of its launch.

However, in the long run, the model's competitiveness in the lower-tier and ride-hailing markets remains untested. Issues such as vehicle configuration shortcomings and misalignment with market demand restrict MONA M03's potential.

Intelligent Driving as the Major Highlight

On paper, Xpeng MONA M03, which is positioned to compete with Tesla's Model 3, appears highly competitive.

With a 600km range, 4,780mm length, 2,815mm wheelbase, standard LCC+ACC+automatic parking, 8155 chip+16GB RAM, ventilated and heated front seats, and a hatchback design, Xpeng's pride in its intelligent driving technology is undoubtedly the model's biggest selling point.

All MONA M03 variants come standard with Level 2 Advanced Driver Assistance Systems (ADAS), including automatic emergency braking, adaptive cruise control, and lane-keeping assist. The top-spec Max variant, priced at 155,800 yuan, features the XNGP advanced driving assistance system, utilizing visual perception technology for NoA capabilities in both city and highway driving scenarios.

Moreover, MONA M03 incorporates a full-scenario smart parking system and a 3D perception rendering map.

Source: Xpeng Motors Official Website

Admittedly, compared to other vehicles in the same price range, Xpeng's intelligent driving technology offers a significant advantage. However, to reduce costs, MONA M03 also has drawbacks, such as its torsion beam rear suspension instead of Xpeng's pride, the Fuyao Architecture.

The torsion beam suspension, a common non-independent setup, offers simplicity, compactness, reliability, and low cost. However, it falls short in handling and comfort compared to multi-link or independent suspensions. Despite He Xiaopeng's claims about driving experience comparable to vehicles priced over 200,000 yuan, and positive reviews from some automotive critics, the lack of an independent suspension remains a perceived weakness in the market.

In addition, MONA M03's range has raised questions.

Xpeng boasts impressive battery management and low energy consumption, and MONA M03 has a low drag coefficient. However, achieving a CLTC range of 515km/602km with 51kWh/60kWh batteries has surprised many netizens.

In comparison, the Roewe D7 EV with a 59.9kWh battery offers a CLTC range of 510km, while the NIO C01 EV with a 62.8kWh battery delivers 525km. Whether MONA M03's range claims are accurate remains to be seen.

Furthermore, issues such as a top speed of 155km/h, limited interior space, mediocre interior materials, and a sparse steering wheel control layout undoubtedly complicate Xpeng's recovery efforts.

Targeting the Lower-Tier Market to Boost Sales

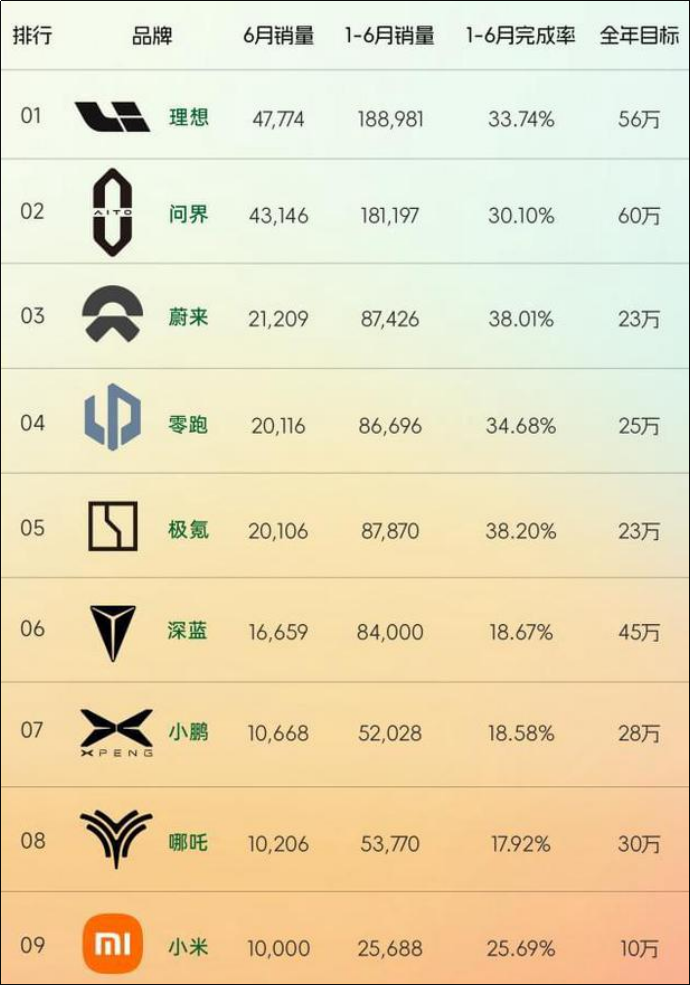

In the first half of 2023, Xpeng delivered 52,000 vehicles, a year-over-year increase of 25.6%. Sales of the higher-priced X9 model surged, contributing to the company's revenue growth.

Despite this growth, Xpeng's monthly average deliveries of 8,671 units lagged behind NIO (monthly average of 14,600 units) and Li Auto (monthly average of 31,500 units). With a full-year target of 280,000 deliveries, Xpeng achieved just 18.6% of this goal in the first half.

To meet its sales targets, Xpeng must deliver 228,000 vehicles in the remaining six months, averaging over 38,000 units per month—a nearly fivefold increase, which seems unlikely given the company's current performance.

Data Source: Official Reports of Automakers

Xpeng is under immense pressure and teetering on the brink. To address these challenges, the company is targeting the lower-tier market through MONA to boost sales.

He Xiaopeng expressed high confidence in MONA's sales competitiveness, aiming for annual sales exceeding 100,000 units, with aspirations far exceeding this figure. However, MONA faces stiff competition in the 100,000-150,000 yuan price range, where space, range, and charging speed are key factors, rather than intelligent driving technology.

Moreover, MONA M03's intelligent driving features are limited to the top-spec variant, priced over 150,000 yuan, which may not resonate with budget-conscious buyers.

Furthermore, Xpeng, as a mid-to-low-end brand, risks diluting its image by further descending into the lower market segment, traditionally dominated by traditional automakers that offer consumers a sense of security. New players in this space may face skepticism about their long-term viability.

On the positive side, Xpeng has a two-pronged strategy. MONA M03 targets both retail (to C) and ride-hailing (to B) markets, with He Xiaopeng expressing confidence in success across both sectors.

Will Ride-Hailing Tarnish the Brand?

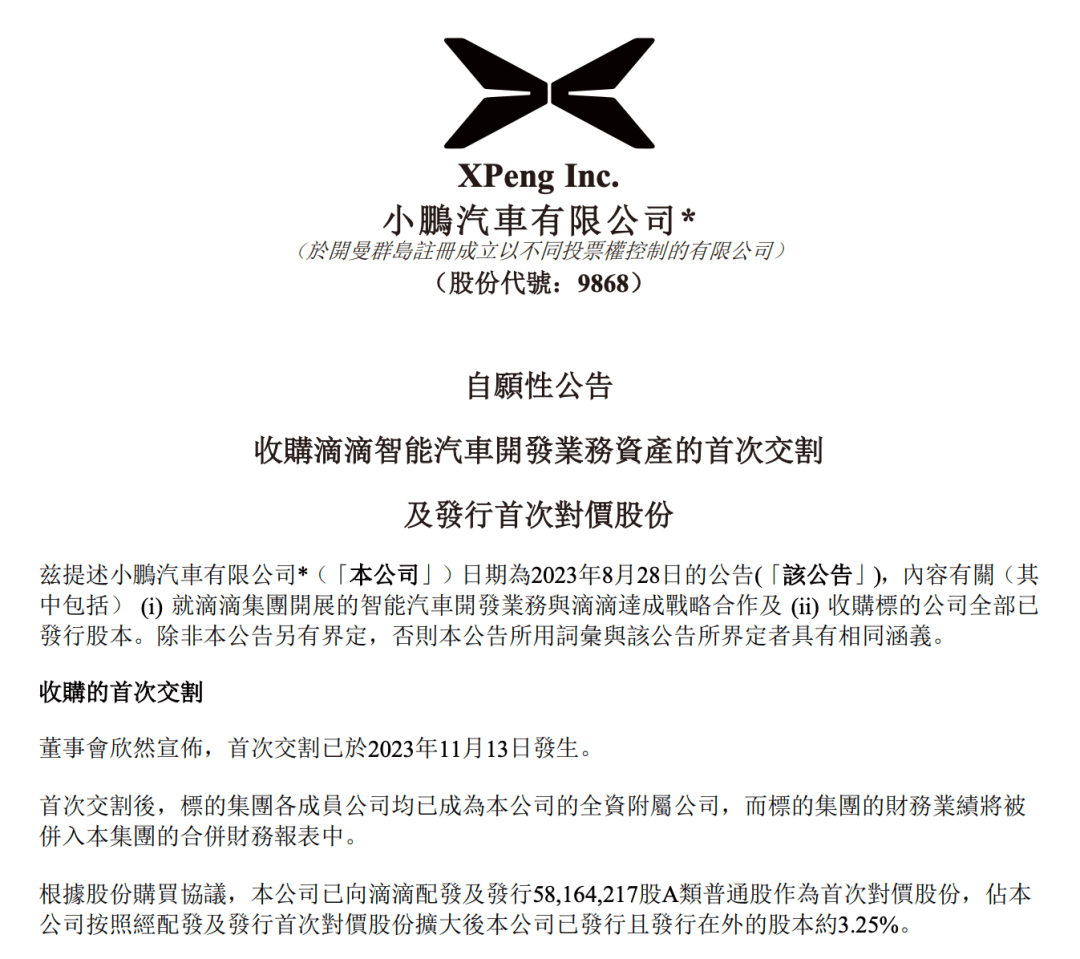

MONA originated from Didi's autonomous driving project, Da Vinci, launched in 2021 with over 1,000 team members. In August 2023, Xpeng acquired Didi's smart EV project assets and R&D capabilities for up to HK$5.835 billion, without involving cash transactions, funded through share issuance.

Source: Xpeng Motors Announcement

At the acquisition's outset, He Xiaopeng outlined MONA's strategic positioning as the beginning of Xpeng's second or even third brand, focusing on retail sales while also catering to the ride-hailing market with select SKUs for shared mobility.

According to the acquisition agreement, Xpeng will make four payments to Didi based on milestones, including the first closing, SOP (start of production), and two performance targets. Didi must help MONA achieve annual sales of at least 100,000 and up to 180,000 units for two consecutive years to earn more shares from Xpeng.

Consequently, many MONA M03 units are likely to enter the ride-hailing market post-launch. However, B2B products differ from B2C in terms of consumer preferences. Ride-hailing drivers prioritize affordability, spaciousness, and reliability over sporty designs, intelligent driving, or aerodynamic styling.

While Didi's demand and distribution channels can temporarily alleviate Xpeng's sales pressure, MONA M03's entry into the ride-hailing market may negatively impact its brand image.

Interestingly, when asked about a dedicated ride-hailing version of M03, Xpeng officials responded, "We won't launch a ride-hailing variant. But if customers buy our stylish smart hatchback coupe and use it for ride-hailing, that's fine too." This response may also aim to appease existing Xpeng owners concerned about MONA's B2B focus diluting their vehicle's exclusivity.

Overall, while Xpeng MONA M03 boasts competitive intelligent driving technology, its numerous drawbacks make it challenging to stand out in either the retail or ride-hailing markets. Whether it can drive a turnaround for Xpeng remains uncertain.