Pinduoduo deliberately allowed Alibaba to overtake it

![]() 08/30 2024

08/30 2024

![]() 628

628

Author: Taishi James Pinduoduo has slowed down, and the domestic e-commerce industry's internal competition seems to be coming to an end.

Overnight, Pinduoduo's market capitalization plummeted by nearly 30%, widening the gap with Alibaba once again. This appears to support Alibaba and Douyin's recent major strategic shift of "giving up on becoming Pinduoduo."

If the main player is struggling, those who tried to emulate but failed should stop trying.

But the main player isn't struggling at all.

Pinduoduo's revenue growth rate in the second quarter was still as high as 86%. Compared to Alibaba's 4% and JD.com's 1%, this is still impressive.

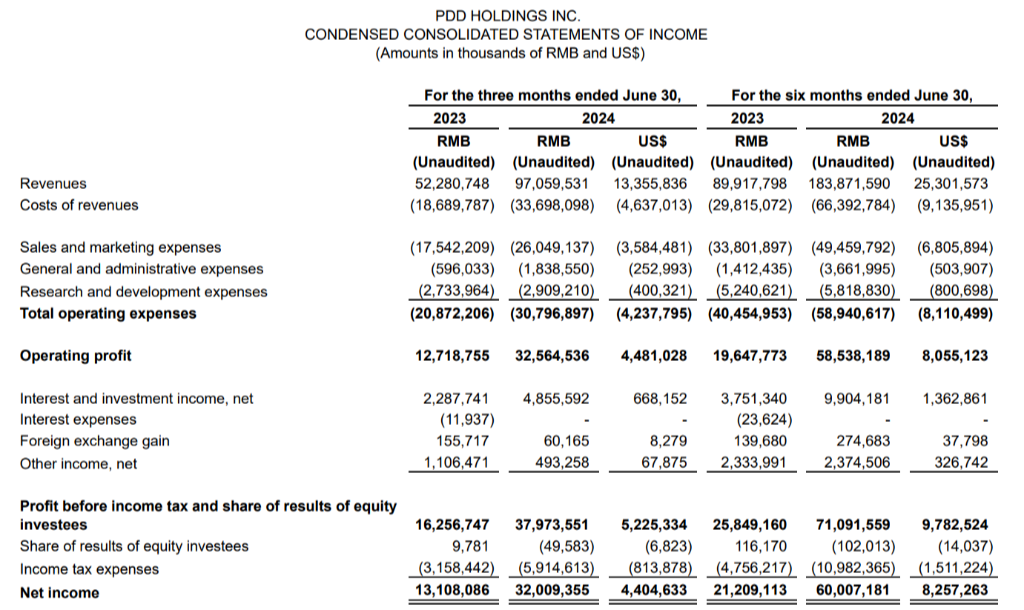

Pinduoduo Q2 2024 Financial Report

Interestingly, Pinduoduo, which had the best performance, suffered the steepest decline in share price.

JD.com's share price surged after its earnings exceeded expectations. However, due to a sell-off by Walmart, the share price has fallen consecutively, and is now lower than before the earnings announcement.

Alibaba, which is expected to emerge stronger after the weaken of competitive pressure, is the only one of the three companies whose share price has remained elevated since the earnings announcement.

Pinduoduo's domestic slowdown should have reassured its two main competitors, Alibaba and JD.com. After confirming that they are not in survival crisis, the competition in the e-commerce industry will soon become a "you do yours, I do mine" scenario. 01 Pinduoduo: Seeking a Bottom, Not the Top Performance soared, but share price plummeted. The blame lies with the market's overly high expectations for Pinduoduo. Before the earnings announcement, consensus estimates were for RMB 100 billion, higher than the final RMB 97.2 billion announced. This was the first time in over two years that Pinduoduo disappointed the market. Investors knew this would happen eventually. Pinduoduo is still in a period of rapid growth, making it significantly more difficult to predict its performance compared to Alibaba or JD.com, which have more stable growth. Moreover, Pinduoduo has never been fond of communicating with investors. Both of their CEOs even undermined their own company during the earnings call – Zhao Jiazhen said, "Pinduoduo's high revenue growth is unsustainable." Chen Lei added, "It is inevitable that Pinduoduo's profit margins will gradually decline."

Pinduoduo Share Price

If you covered their titles, you might think they were bearish investment bank analysts, heads of Alibaba or JD.com's e-commerce divisions, or former employees who were overworked and now trapped by non-compete clauses. But it's hard to imagine these words coming from the company's CEOs. Their statements were eerily coordinated, like a comedy routine. No one would believe it was just a coincidence if no one orchestrated it. Who could orchestrate Pinduoduo's two CEOs? It was Huang Zheng, the founder and largest shareholder of Pinduoduo, who recently became China's richest man. He has also relinquished his title as China's richest man on the Forbes Real-Time Billionaires List, falling behind Zhong Shanshan, Zhang Yiming, and Ma Huateng. Anyone who has seen Huang Zheng speak knows he is not eloquent and is a low-key person. Moreover, when he worked at Google, his Zhejiang University alumnus Duan Yongping arranged for him to have lunch with Warren Buffett. Since then, Huang Zheng has embraced Buffett's value investing philosophy.

Photo of Huang Zheng with Warren Buffett

Ignoring short-term share prices and focusing on long-term value is a key tenet of value investing. Buffett always gets excited when Berkshire Hathaway's share price plummets, as it gives him an opportunity to buy at a discount. Huang Zheng, aiming to shed his title as China's richest man, is unlikely to take advantage of this opportunity, but he may have advised Zhao Jiazhen and Chen Lei, who were aggressively bearish on the earnings call, on his strategy. Imagining these two stern-faced CEOs facing investment institutions and then buying Pinduoduo shares at a discount from fleeing institutions at home must be amusing to both you and me. 02 Alibaba: No Longer Tolerant, Confident in Profit-Making On the trading day after Pinduoduo's earnings announcement, Alibaba's share price also fell, with a market capitalization of US$194.4 billion. Before Pinduoduo's plunge, its market capitalization was US$194.3 billion. Of course, market capitalization is just a superficial indicator. The data that should reassure Alibaba CEO Wu Yongming the most is that the growth rate of "online marketing services and other revenue," which represents Pinduoduo's domestic e-commerce business, has declined to 29%, far below the previous quarter's 56%. This gives Alibaba a sense of security. Douyin's entry into shelf e-commerce has reassured Alibaba about the live-streaming e-commerce market, and now it seems that Pinduoduo's low-price strategy has stabilized.

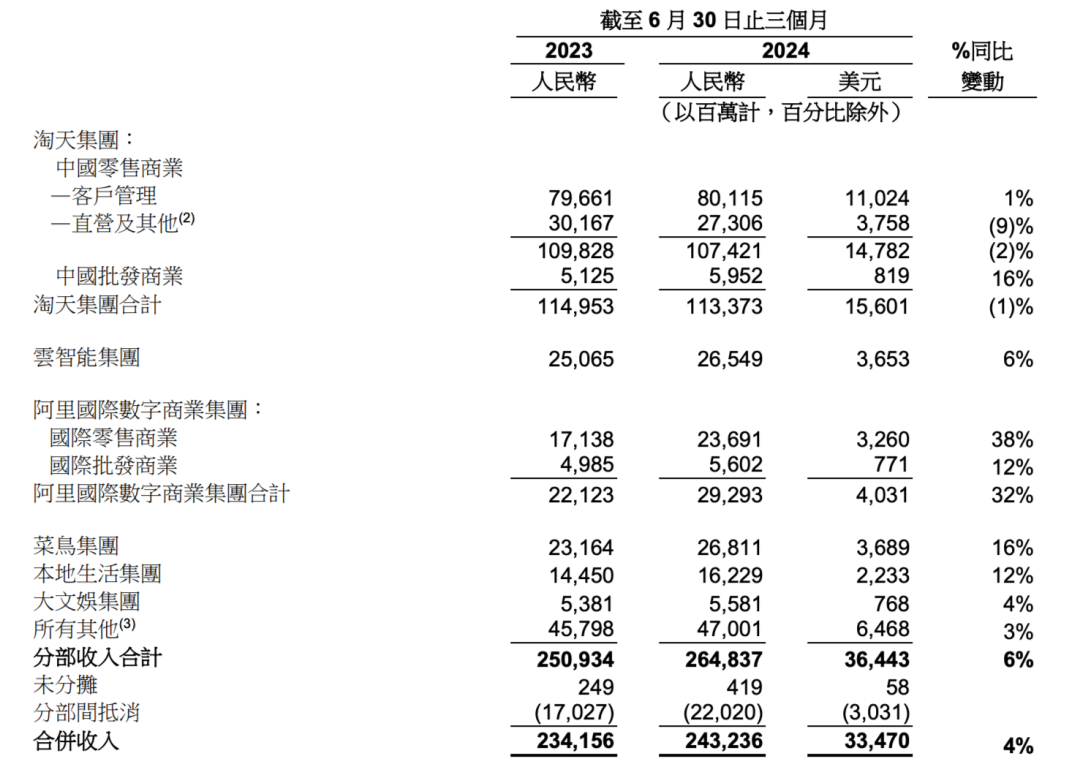

Image source: Internet

Alibaba can finally breathe a sigh of relief. They have endured considerable pain in recent quarters. In the second quarter of this year, Taobao and Tmall's revenue fell 1% year-on-year, making it the only declining business segment among Alibaba's seven major businesses. The "price power" strategy is the primary reason for this situation. Taking the second quarter as an example, Taobao and Tmall sacrificed revenue growth in exchange for double-digit order volume growth and high single-digit GMV growth. At an earlier earnings call, Alibaba announced that it would "continue to maintain a high level of capital expenditure" in the coming quarters. This is to continue consolidating market share across several businesses. Wu Yongming said, "Most of Alibaba's businesses will achieve break-even within 1-2 years." But if he had known about Pinduoduo's domestic slowdown in advance, he might have given a more aggressive profit outlook. Specifically for Taobao and Tmall, he said, "In the coming quarters, the growth rate of Taobao and Tmall's CMR will gradually match that of GMV." Taobao and Tmall's customer management revenue (CMR) increased by only 0.6% year-on-year in this quarter, significantly lagging behind GMV growth.

Alibaba Q2 2024 Financial Report

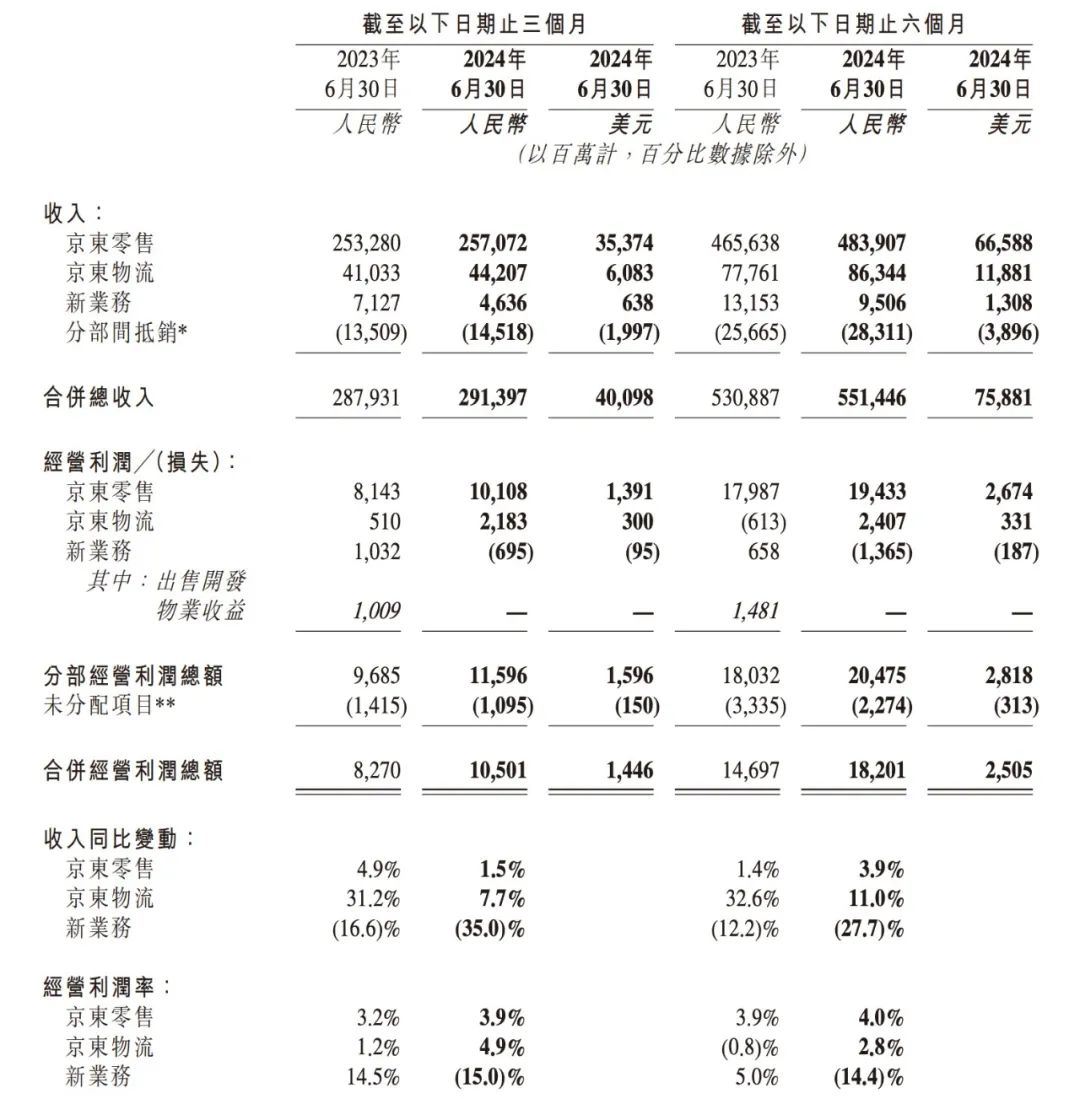

To achieve this goal, Alibaba will charge all Taobao and Tmall merchants a "basic software service fee" of 0.6% of transaction volume starting in September this year. It is the last e-commerce platform to implement this fee. Pinduoduo implemented this fee as early as 2020, while JD.com and Douyin did so in 2023, with rates not lower than 0.6%. Originally, Taobao was a platform that only charged advertising fees and did not take commissions, while Tmall charged both. Therefore, Taobao employees preferred to allocate traffic to large merchants, as small merchants were less willing to advertise. After implementing commissions, Taobao employees will focus more on GMV growth targets. Additionally, the full rollout of site-wide promotion in the second half of the year will also contribute to Taobao and Tmall's revenue growth. So, barring any unexpected events, it is likely that Taobao and Tmall's monetization rate will rise and profits will return to growth. 03 JD.com: Cost Reduction and Efficiency Enhancement, Welcoming New Partners JD.com was the pure e-commerce platform that performed the best in terms of profits this quarter. Pinduoduo's net profit margin of 125% is much higher than JD.com's 69%. However, JD.com's revenue growth rate was only 1.2%, positioning it firmly among platforms focused on cost reduction and efficiency enhancement. Tencent's revenue increased by 8% year-on-year, with net profit up 53%; Kuaishou's revenue increased by 12% year-on-year, with net profit up 74%… JD.com's gross profit margin of 10.9% is the root cause of its net profit exceeding expectations. According to its explanation on the earnings call, "As the largest single retailer, the company has optimized procurement processes and reduced procurement costs."

JD.com Q2 2024 Financial Report

In other words, profits come at the expense of merchants. It seems that this tactic is quite prevalent in today's e-commerce industry. Pinduoduo's "only refund" policy is the pinnacle of this approach. However, recently, the "only refund" policy has frequently sparked public outrage. Pinduoduo merchants have driven hundreds of miles to confront customers over orders worth just a few yuan, leading to court battles. Currently, starting from August 7, Pinduoduo has imposed restrictions on "only refunds." After a consumer initiates a "only refund" request, merchants have 36 hours to handle it themselves. During this period, Pinduoduo's customer service will not intervene. However, this measure may only inconvenience those looking to take advantage of the system. For consumers who are angry about faulty products, waiting 36 hours is inconsequential. Taobao has also revised its "only refund" policy. Starting from August 9, if a merchant's overall experience score is above 4.8 and encounters a "only refund" situation, platform customer service will not intervene. However, this small optimization has also drawn criticism from many small merchants. The reason is simple – it is difficult for small merchants to raise their experience scores above 4.8. In summary, e-commerce platforms targeting merchants has become a new trend. With this tool, Liu Qiangdong does not need to lay off his "brothers." JD.com has added over 20,000 employees in the past year, maintaining quarter-on-quarter growth.

Image source: Internet

However, this time, Pinduoduo plans to offer further concessions. It said it would "significantly reduce transaction fees for high-quality merchants in the coming year, with an expected reduction of RMB 10 billion." This indicates that Pinduoduo intends to continue pushing forward. Wu Yongming and Liu Qiangdong must have mixed feelings about this. On the one hand, it shows that Pinduoduo's low-price market is saturated, forcing it to expand outward. On the other hand, competition in the quality-focused low-price market will intensify. Regardless, the boundaries between the three players will become clearer. Future growth is likely to come from overseas markets. Compared to the other two, JD.com has little competitiveness overseas. This is evident even in the Southeast Asian market alone. JD.com closed its Indonesia and Thailand sites at the end of last year, completely exiting the Southeast Asian e-commerce market. Alibaba's Lazada turned profitable in July. Pinduoduo's Temu launched in Thailand on July 29, opening its third market in Southeast Asia. However, due to geopolitical risks, investors currently value Temu at zero.

Image source: Internet

Therefore, being aggressive overseas does not necessarily confer an advantage. TikTok probably understands this better. On the other hand, a steady and progressive approach like Alibaba International is more likely to reward investors. In terms of share prices, Alibaba, Pinduoduo, and JD.com are all highly attractive to value investors. Pinduoduo and JD.com both have P/E ratios of around 10, while Alibaba's expected dividend and buyback yields are as high as 12%. Is it time to take action? It depends on your view of the macro environment.

Can the Fed's interest rate cuts lead to a soft landing for the economy? If not, U.S. and Hong Kong stocks amid liquidity fears could face another wave of declines.

-END-