High-quality newcomer to Stock Connect, SF Express SameDay with dual drivers

![]() 08/30 2024

08/30 2024

![]() 684

684

Recently, a new batch of companies were added to the Stock Connect list. Among the companies added in this round, there were actually not many that could achieve high growth.

Upon closer inspection of the list, it was found that SF Express SameDay, which is commonly seen in daily life, has performed impressively, with revenue growth of 19.6% in the first half of the year, and net profit in just the first half exceeding the full-year net profit level in 2023.

Going forward, as the rate of chain store expansion among retail and catering brands increases, and internet platforms such as Douyin, Ali, and JD.com accelerate their layout in local life services, demand for instant delivery is expected to experience a new surge.

According to the financial report, SF Express SameDay has solidified its profitable model for instant delivery in the first half of the year. As the largest third-party instant delivery platform in China, it has both industry growth and profitability, and the improvement in liquidity after being added to Stock Connect is worth noting.

I. Achieving High Growth While Enhancing Services

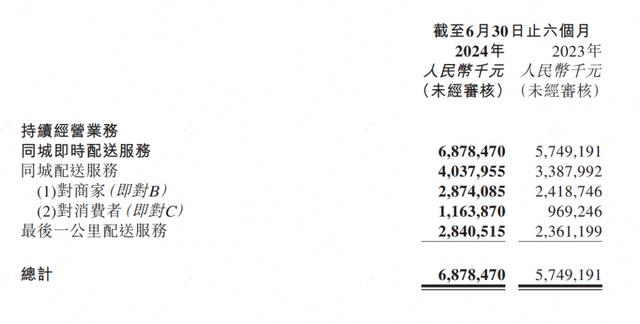

According to the financial report, SF Express SameDay's revenue in the first half of the year was RMB 6.878 billion, an increase of 19.6% from RMB 5.749 billion in the same period last year, with overall order volume increasing by more than 30% year-on-year. Net profit in the first half was RMB 62.17 million, an increase of 105.1% year-on-year, setting a new record high. As orders expand, profitability is gradually being unleashed.

To evaluate SF Express SameDay's performance, we can compare it with that of its competitors over the same period. Dada's revenue in the second quarter was RMB 2.35 billion, down 9.5% year-on-year, with a net loss of RMB 286 million, compared to a loss of RMB 159 million in the same period last year.

Due to high demand for instant delivery across society, JD.com's instant delivery orders increased by 100% year-on-year, but revenue declined, and losses continued to mount. The capital market is not impressed by this. This is because the delivery industry is no longer an era where simply having a large number of orders guarantees profits and market share. In an economic downturn, being able to achieve concurrent growth in revenue and profits is more in line with current market preferences. SF Express SameDay clearly outperforms Dada in both revenue and profitability.

Breaking down SF Express SameDay's revenue, the overall revenue from same-city delivery services in the first half of the year was RMB 4.038 billion, an increase of 19.2% from RMB 3.388 billion in the same period last year.

Among them, revenue from same-city delivery services for merchants was RMB 2.874 billion, an increase of 18.8% year-on-year. The main driver of growth came from the continuous increase in SF Express SameDay's cooperation share with top customers. While maintaining the highest market share in the industry, SF Express SameDay also added more than 6,000 new cooperating stores during the quarter.

In addition to the increase in market share from cooperation with top customers, there was also a notable increase in the overall merchant base. As of June 2024, the number of active merchants on the SF Express SameDay platform reached 550,000 over the past 12 months, an increase of 45% year-on-year. The revenue from new orders from key accounts (KA) also achieved high double-digit growth, with the proportion of chain customers continuously increasing, sidelining the recognition of SF Express SameDay's service quality by customers and bringing stability to SF Express SameDay's business.

It is worth mentioning that those who have not paid attention to SF Express SameDay may confuse instant delivery with food delivery services.

Although from the consumer's perspective, both involve a delivery person bringing the product to the consumer, the growth logics of the two are different. Chain store customers are the foundation of instant delivery, and the quality of customers is more important for instant delivery.

Simply put, in daily life, we should have noticed that with the fragmentation of traffic, more and more merchants, in addition to listing on multiple food delivery platforms, are also expanding their private domain traffic, such as through mini-programs and apps. The delivery partners for these merchants are not just food delivery platforms like Meituan, but third-party delivery services like SF Express SameDay, which can fulfill orders from multiple platforms, ensure delivery standards, and offer more competitive pricing.

For example, McDonald's, Heytea, and Luckin Coffee all use SF Express SameDay's instant delivery service, which gives consumers the most intuitive feeling of improved delivery rates and service quality. According to the financial report, SF Express SameDay's delivery success rate fluctuates by no more than 1% and 3% during holidays and inclement weather, with an overall delivery success rate of 95%. Orders within 3 kilometers take an average of 22 minutes to deliver, better than the industry average of 25-30 minutes.

For merchants, using third-party instant delivery services is indeed a better choice.

The most direct reason is that by allowing customers to order through the merchant's own channels, the merchant can reduce commission fees on food delivery platforms, retain customers within their own channels, reduce transaction fees, and better standardize the customer dining experience.

Comparing the data, additional costs for Chinese food delivery consumers account for less than 10% of the meal price, while the actual receipts for merchant food delivery are about 80-90% of the dine-in price.

In other words, most of the additional costs of food delivery are borne by merchants, but delivery rates and service quality are not guaranteed. This is the direct reason why chain restaurants continue to expand their own ordering channels. By using SF Express SameDay, merchants can reduce costs while improving service quality, a clear win-win situation.

Cost reduction is particularly important in the food and beverage price war. As the overall profit margins in the food and beverage industry decline, large chain restaurants must ensure consumer experience while maximizing cost savings and efficiency to control profits. This is why chain restaurants have recovered faster than independent restaurants after the pandemic.

Therefore, serving consumers well is not only the responsibility of SF Express SameDay but also the key to merchants doing good business in fierce competition. As service quality improves, the stickiness between delivery partners and merchants will increase, eventually leading to a stronger bond between chain merchants and delivery partners.

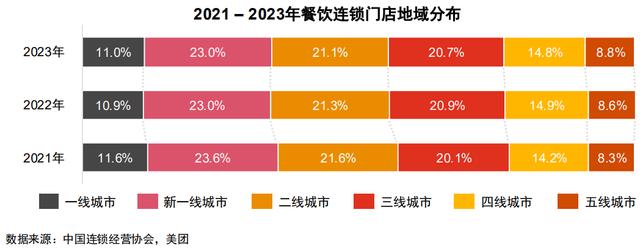

In addition, as the rate of brand chain expansion increases, more and more restaurants are expanding into lower-tier cities, and SF Express SameDay is also strengthening its service capabilities in these markets. During the reporting period, SF Express SameDay covered more than 1,200 counties nationwide, with a coverage rate of 68%, and county revenue grew by 51% year-on-year.

Of course, SF Express SameDay is not limited to food delivery. With the booming local retail market, SF Express SameDay also provides high-quality services to national chain supermarkets and covers consumption scenarios such as online pharmaceutical retail and internet hospitals. In the first half of 2024, tea beverage delivery revenue grew by 60% year-on-year, and retail categories such as supermarkets, bakeries, pharmaceuticals, and beauty products achieved high double-digit growth.

Looking at revenue from consumers, it was RMB 1.163 billion, an increase of 20% year-on-year. This growth came from repeat purchases driven by quality services and the expansion of SF Express SameDay's own channels, effectively meeting the needs of same-city users. In addition, SF Express SameDay performed well in business scenarios, especially in the fine operation of the CBD core business district, providing convenient services for efficient delivery of documents and invoices and building a high-end brand image.

Over the past 12 months ending June 30, 2024, the number of active consumers exceeded 21.9 million. During the reporting period, the number of orders for hourly delivery services doubled rapidly, driving strong year-on-year growth in revenue from this service.

Revenue from last-mile delivery services was RMB 2.84 billion, an increase of 20.3% year-on-year, mainly due to the continuous increase in the scale of cooperation and delivery share between SF Express SameDay and major customers. Revenue from parcel pickup and half-day delivery scenarios doubled year-on-year, achieving high growth. Since the beginning of this year, SF Express SameDay's daily average parcel pickup volume has exceeded one million orders.

Judging from the overall performance revenue changes in the first half of the year, SF Express SameDay's high-quality customer service and years of brand trust have enabled it to gradually establish a profitable model since its spin-off and listing in 2021. During the period of continuous high growth, SF Express SameDay has followed the general trend of share repurchases in Hong Kong stocks, providing substantial returns to shareholders.

SF Express SameDay's operating cash flow in the first half of the year was approximately RMB 99.2 million, an increase of 189% year-on-year. The company currently has RMB 2.37 billion in cash on hand and no interest-bearing loans, with nearly a quarter of its market value in cash.

From November 30, 2023, to July 26, 2024, SF Express SameDay repurchased a total of 18.9 million shares, with a shareholder return rate of 2% during this period. As the company's profitability improves, there will be ample capacity for shareholder returns in the future.

As for future growth potential, it goes beyond just the increase in brand chain rates; there are also new incremental surprises to look forward to.

II. Competition in E-commerce Local Life and New Increment in Instant Retail

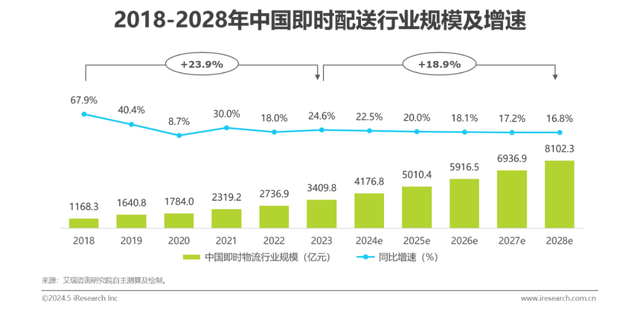

In 2024, the scale of China's instant delivery market reached RMB 417.68 billion, and by 2028, the market size is expected to double to RMB 810.23 billion, with a compound annual growth rate of 18.9% over five years. There is no need to worry about the overall market size.

1. One source of growth can be seen in the changing chain rate of the catering industry.

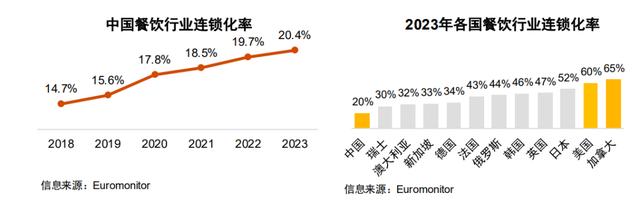

China's catering industry chain rate has increased from 14.7% in 2018 to 20.4% in 2023. This is still far behind other countries, with the chain rate in the United States reaching 60% and in Japan reaching 52%.

Based on the current price war in the catering industry, the increase in the catering chain rate is inevitable in the future.

This year, we can see that chain brands such as McDonald's, KFC, Pizza Hut, Luckin Coffee, and Starbucks are all accelerating their expansion into lower-tier cities by offering discounted products and franchise fees to enter these markets.

As the catering price war intensifies, small brands will find it difficult to compete with chain brands in terms of supply chain costs. With shrinking industry profits, we will see a new round of expansion by chain brands, as well as mergers and acquisitions or elimination of small brands.

As chain brands expand their store networks, SF Express SameDay, as their delivery partner, stands to benefit, which is one of the reasons for its rapid expansion in lower-tier markets.

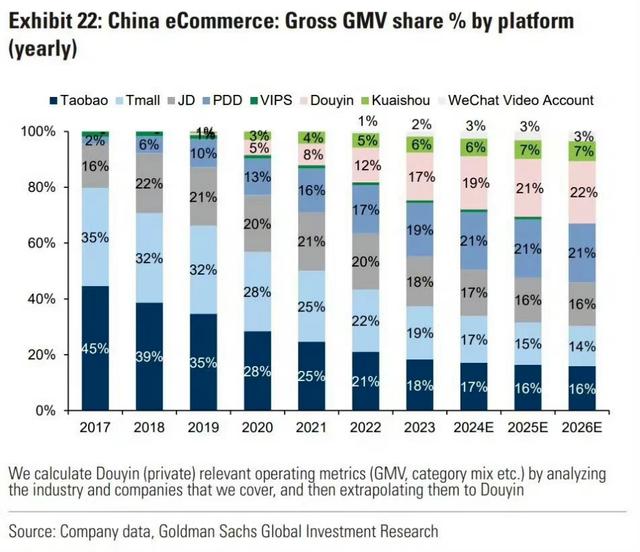

2. In addition to the growth brought about by industry scale expansion, the fierce competition among e-commerce platforms such as Douyin, Pinduoduo, Taobao, Sam's Club, and JD.com in localizing their services is also a source of incremental growth, and third-party delivery services like SF Express SameDay also benefit from this.

Currently, Douyin Supermarket and other home delivery services have integrated SF Express SameDay's instant delivery service. The reason is simple: platforms like Taobao, JD.com, and Tmall have their own delivery partners, while e-commerce platforms like Douyin and Pinduoduo, which do not have logistics systems, find it more convenient and cost-effective to adopt third-party delivery models. Moreover, when Taobao and Tmall face insufficient local delivery capacity, SF Express SameDay supplements their logistics capabilities.

Judging from the fierce competition among e-commerce platforms, it is clear that Douyin is expanding its market share the fastest. As attackers, Douyin and Pinduoduo are taking on defensive players like Taobao and JD.com.

Whether serving as a delivery capacity provider for platforms without their own delivery capabilities or supplementing delivery capacity for platforms with proprietary delivery services, SF Express SameDay stands to benefit significantly from both the overall industry growth (Beta) and the incremental growth brought about by the expansion of Douyin and Pinduoduo (Alpha).

SF Express SameDay is also continuously exploring the application of smart logistics and unmanned delivery technologies in commercial scenarios. During the reporting period, SF Express SameDay conducted trials and launched unmanned vehicle delivery in multiple cities. Both SF Express and SF Express SameDay are ahead of the industry in the implementation of unmanned vehicles. In the future, it is expected to combine the advantages of unmanned delivery to supplement the delivery capacity of existing riders, further enhancing efficiency.

In addition, in July, SF Express SameDay officially entered the Hong Kong market under the "SoFast" brand. Currently, it offers pick-up services in districts such as Yau Tsim Mong, Kwun Tong, Sham Shui Po, and Kowloon City, with delivery coverage across the entire territory. It is expected to cover the entire territory by the end of the year.

What is the success rate of mainland enterprises entering the Hong Kong market? We can refer to the competitive landscape after Meituan Dianping entered the Hong Kong market. In just over a year, Keeta captured a 40% market share, demonstrating a significant advantage. SF Express SameDay and Meituan Dianping are not direct competitors, as SF Express SameDay focuses on a wide range of scenarios, particularly in non-food categories such as business and retail. The differentiation in competition leaves room for profit in the Hong Kong market.

According to estimates, the total revenue of Hong Kong's online delivery market is expected to increase by 12.2% to RMB 28.7 billion in 2024, with online delivery revenue from non-food categories reaching RMB 22.18 billion and maintaining an 11% growth rate in 2025. Overall revenue in the online delivery market is expected to reach RMB 40.89 billion by 2029.

These figures are very attractive, especially for the significant untapped potential in the non-food market, which undoubtedly presents growth opportunities for SF Express SameDay in Hong Kong.

The future growth potential is promising, and another crucial aspect of ensuring long-term service efficiency improvements is employee benefits.

As of June 30, 2024, the platform's annual active riders had further expanded to 970,000, with the number of riders earning middle-to-high incomes increasing by 20% year-on-year. In the first half of this year, the accident rate among riders declined by 16% year-on-year.

SF Express SameDay has also established a "Grievance Care Special Fund" for riders, with a scale of RMB 5 million, and has held over 5,000 offline care activities. By increasing rider income and fostering a culture of growth and care, SF Express SameDay has further enhanced rider activity and retention rates.

III. Conclusion

In summary, based on future industry growth, the increase in brand chain rates, and the optimization of e-commerce competition, SF Express SameDay is gradually becoming a touchstone in instant delivery, with sufficient certainty for future performance breakouts.

With the catalyst of entering Stock Connect in September and sufficient cash on hand to support share repurchases, assuming the repurchase intensity is maintained in the second half of the year, the annual shareholder return rate is expected to reach 4%. Coupled with its own high growth and improved liquidity, the stock price is expected to experience a double boost.