Meituan delivers second-quarter results, stability becomes a synonym

![]() 09/02 2024

09/02 2024

![]() 482

482

Since the beginning of this year, after undergoing drastic reforms internally, Meituan has broken its original organizational structure and integrated its two core businesses of in-store and home delivery into its core local commerce.

Amidst the changes and adjustments, Meituan has still achieved stable growth. On August 28, Meituan released its second-quarter results, reporting revenue of 82.25 billion yuan, a year-on-year increase of 21%, exceeding market expectations of 80.42 billion yuan, maintaining stable growth.

By looking beyond the surface, one can see the harmony and unity between the two. The reason lies in the transformation of local consumer behavior towards a focus on variety, speed, quality, and cost-effectiveness. The proactive organizational changes were undertaken to keep pace with shifting consumer trends.

In fact, it is precisely Meituan's proactive spirit of change that has enabled it to continuously advance in the local lifestyle sector and maintain stable growth.

[Innovation in Membership System, Embracing Users with Quality-Price Ratio]

Amidst economic shifts, consumer trends are also quietly evolving. People who once flocked to Hema to snap up Australian lobsters are now heading to Yonghui Supermarket to pick up eggs on special offer for 9.9 yuan per tray, and the same trend is evident in online consumption, with the GMV of Pinduoduo, a popular e-commerce platform in China's less developed regions, surging.

Behind these shifting consumer trends lies a growing sensitivity to price among consumers. These overt changes all point to one thing: the era of consumption upgrading that prevailed a few years ago is over, and consumers are now placing greater emphasis on quality-price ratio.

Sam's Club, a leading online retailer, has not only survived multiple economic cycles but also continued to grow thanks to its membership system. The core reason behind this success is that by offering consumers high-quality products at competitive prices, it has become a steadfast choice for a vast majority of them.

Deeply entrenched in the local lifestyle sector, Meituan has innovatively launched its God Membership system, which shares similarities with Sam's Club's membership system.

Firstly, users gain the right to choose products with a higher quality-price ratio. While Sam's Club offers bulk purchasing options at discounted prices, Meituan takes a more direct approach by issuing full-reduction coupons to users, effectively saving members more money.

Secondly, both systems reward frequent use with greater savings. Therefore, when users have a need, they tend to prioritize spending through the membership system, ultimately leading to rapid scale growth within the system. In the business world, economies of scale often go hand in hand with price advantages, so as the scale effect expands, members will enjoy an even stronger quality-price ratio experience.

In fact, when it comes to specific business scenarios, Meituan's membership system has two additional advantages over Sam's Club's.

Firstly, Sam's Club's products are typically sold in bulk, requiring a week or more to consume, resulting in relatively low consumption frequency. In contrast, Meituan's food delivery service combines both essential needs and high frequency, leading to faster scale growth that is directly tied to the quality-price ratio experience.

Secondly, through organizational changes, Meituan has enhanced the synergy between food delivery and in-store dining and travel services. Specifically, Meituan's God Coupons offer both food delivery and in-store discounts, with the latter often offering larger discounts.

For consumers, home delivery and in-store dining and travel services are not mutually exclusive but complementary. While the former satisfies physical hunger, the latter fulfills spiritual pursuits. The 60% year-on-year growth in in-store dining and travel orders reported in Meituan's second-quarter results is testament to this synergy.

In summary, Meituan's God Membership system shares a common spirit with Sam's Club's membership program, namely, providing users with products of a higher quality-price ratio. What sets Meituan's God Membership apart is that it is not limited to food and drink but encompasses all aspects of leisure and entertainment, thereby offering greater overall value.

The results speak for themselves. By embracing users with a higher quality-price ratio through its God Membership system, Meituan has won over users with higher order frequencies. As evidenced by the latest second-quarter disclosure, Meituan's annual average transaction frequency per user has reached a new high.

[Delving into the Supply Side and Partnering with Merchants]

In the web of local lifestyle connections, Meituan plays the role of a bridge between merchants and users. While offering users a higher quality-price ratio experience through its God Membership system, Meituan also delves into the supply side to better serve merchants with innovative services.

Whether operating a Lanzhou noodle shop or a New Prosperity Restaurant, restaurant owners must grapple with the challenges of raw materials, labor, and rent, with the latter two often proving the most formidable. Even when revenue declines, it can be difficult to cut costs in these areas.

In reality, the restaurant business has always been a low-margin endeavor. Even industry leaders like Haidilao, a popular hot pot chain in China, have seen their net profit margins dip into single digits at times. As consumers tighten their purse strings, restaurant owners are facing even greater pressure on labor and rent costs.

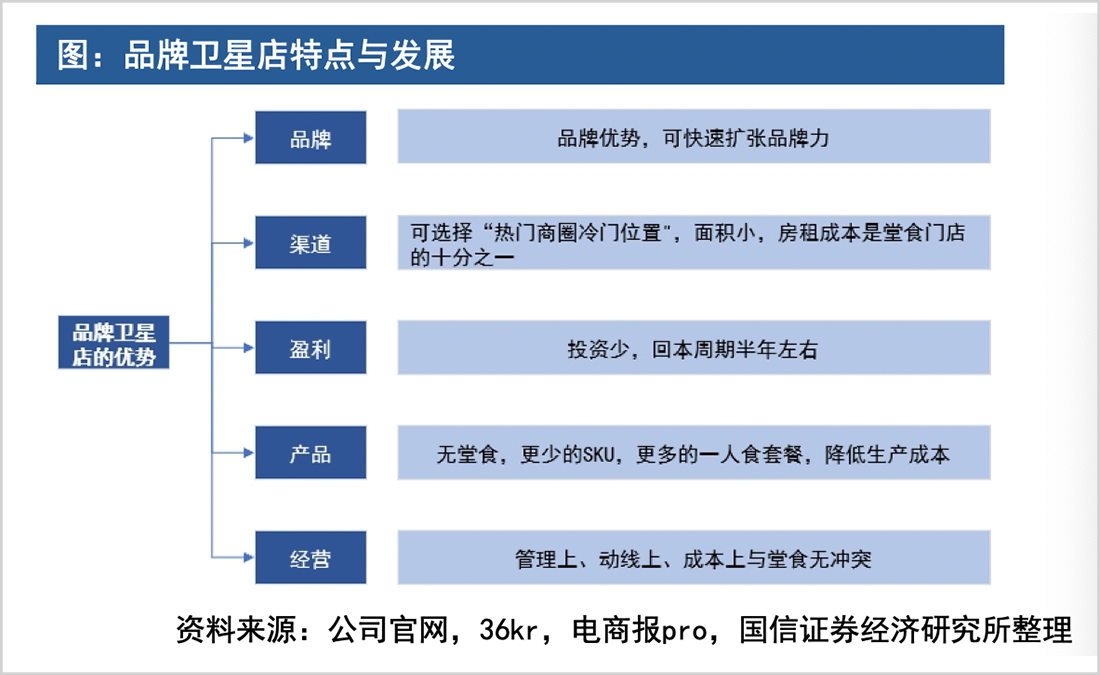

In response, Meituan has chosen to pilot satellite stores in collaboration with chain merchants such as Laoxiangji and Haidilao. As the name suggests, satellite stores are characterized by their small size, helping merchants save significantly on rent. Furthermore, by optimizing menus for food delivery scenarios and eliminating dine-in options, labor costs can also be reduced.

Overall, the satellite store model significantly alleviates the pressure of labor and rent costs. Another benefit is that chain restaurants can expand more efficiently. By the end of June, over 800 satellite stores had been opened by 120 brands nationwide.

In addition to serving restaurant merchants through satellite stores, Meituan has also invested more effort in the flash sale sector, initiating a series of innovations tailored to specific business scenarios.

Immediacy is a defining characteristic of the local lifestyle services offered by Meituan. In the second quarter, Meituan collaborated with more retail brands in fast-moving consumer goods, apparel, alcohol, and beverages, among others, to better match merchants with consumers across various scenarios such as festivals, travel, and camping events.

"Wai Ma Song Jiu" (a play on words in Chinese, meaning "Skewed Horse Delivering Alcohol") is a prime example, as alcohol products have stringent timeliness requirements. For instance, beer tastes best when served chilled, and liquor needs to arrive before the meal is served.

Meituan's solution lies in its front-end warehouses. The benefits are clear: on the one hand, Meituan can match the shortest warehouse to the user's order address, effortlessly resolving timeliness issues; on the other hand, merchants only need to deliver goods to Meituan's warehouses in advance, with the subsequent steps handled by Meituan, naturally improving their operational efficiency.

Precisely because of this, more and more merchants are actively embracing Meituan, setting a new record for annual active merchants on the Meituan platform in the second quarter.

Essentially, Meituan's explorations on the supply side are based on innovations driven by changes on the demand side. Therefore, merchants can often quickly perceive and respond to these changes with the help of Meituan, making it understandable why an increasing number of them are opening stores on the platform.

[A Robust Foundation, A Promising Future]

By continuously innovating around users and merchants, Meituan has firmly established itself as the largest service provider in the local lifestyle sector, transforming into an internet technology giant in the process.

In the tech industry, where technological changes are rapid, even industry leaders often need to worry about being disrupted by upstarts. A classic example comes from the mobile phone industry. When Steve Jobs swiped his finger to unlock the screen, the trend of smartphones took off, and former industry leader Nokia gradually declined due to a lack of relevant experience, eventually being forced out of the market competition as brands like Huawei and Xiaomi rose to prominence.

In reality, while Meituan is also driven by technological innovation, its most fundamental need stems from people's desire for food, drink, entertainment, and leisure, which are inherently stable and slowly evolving demands. In short, Meituan is not at risk of being disrupted like Nokia.

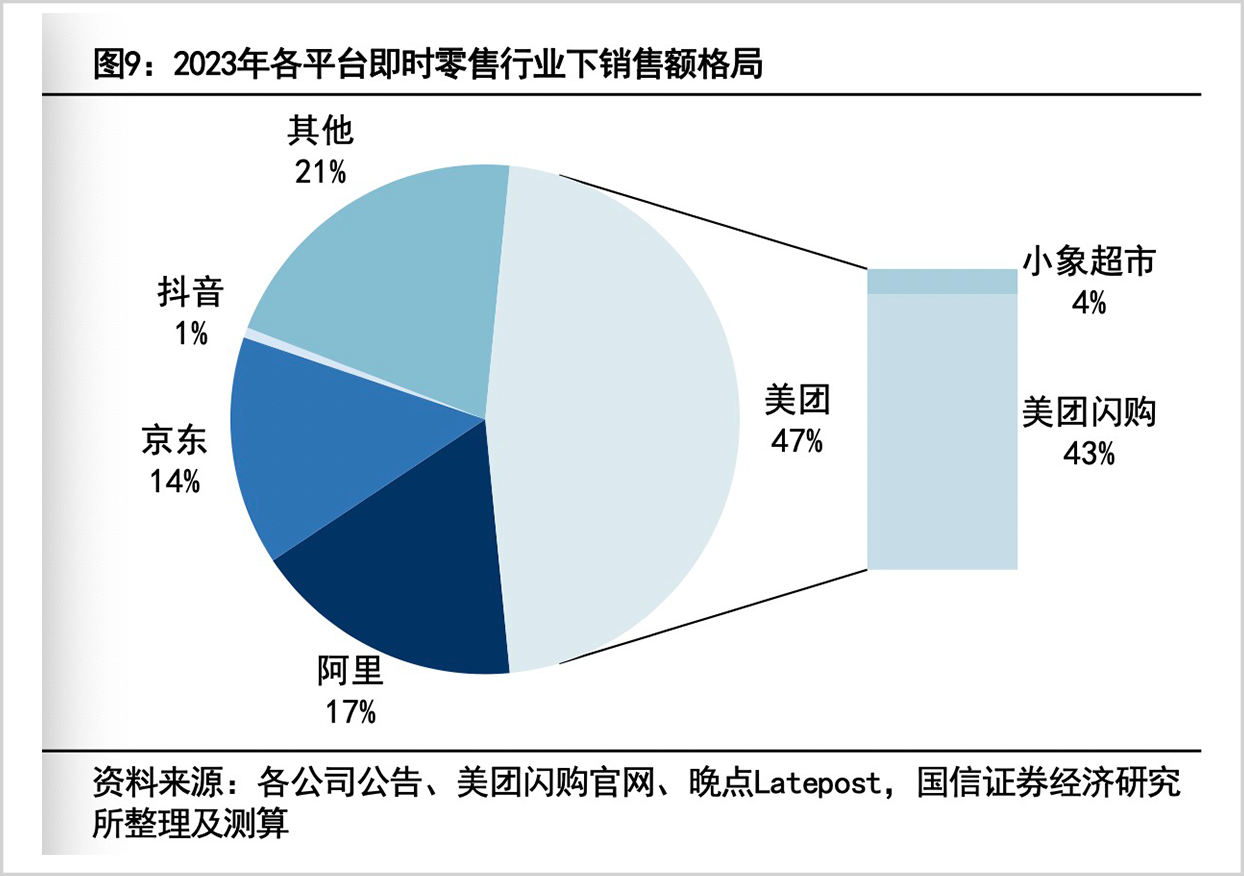

One piece of ironclad evidence is that throughout Meituan's development, giants like Alibaba and Douyin have attempted to make inroads into the local lifestyle sector, and platforms like Xiaohongshu, Kuaishou, and Pinduoduo have also sounded the battle cry, but in the end, Meituan has consistently secured the largest market share.

Apart from stable demand, the local lifestyle sector also boasts long-term growth potential with substantial upside, offering a stable growth outlook.

On the one hand, the industry's scale continues to expand. According to iResearch, the local lifestyle industry is expected to reach a size of 35.3 trillion yuan by 2025, with a compound annual growth rate of 12.6% from 2020 to 2025.

On the other hand, online penetration is also increasing. According to iResearch, the overall online penetration rate of the local lifestyle sector was only 12.7% in 2021, but it is expected to rise to 30.8% by 2025, presenting significant growth potential.

Against the backdrop of stable industry growth, Meituan, already a market leader, stands to be the biggest beneficiary.

The reason lies in the intricate coupling between users, merchants, and platforms in the local lifestyle sector. Newcomers cannot accumulate a comparable user and merchant base as Meituan in a short period. Therefore, driven by the "bilateral scale" effect, incremental merchants and users will naturally gravitate towards the largest platform, i.e., Meituan, which will capture the lion's share of market growth.

Business is like war, filled with obstacles and unexpected risks in the process of competition. However, what sets Meituan apart is that it not only occupies a sector with stable demand but also possesses the potential for stable growth. These two factors collectively explain the inevitability behind Meituan's current stable growth performance.

Disclaimer

This article involves content related to listed companies and is based on personal analysis and judgment by the author based on publicly disclosed information (including but not limited to interim announcements, periodic reports, and official interaction platforms) provided by listed companies in accordance with their legal obligations. The information or opinions expressed herein do not constitute any investment or other business advice. Market Value Watch shall not be liable for any actions taken as a result of adopting this article.

——END——