Is Huawei's BU just worth 115 billion? Too cheap, AITO and SERES are rushing to buy

![]() 09/02 2024

09/02 2024

![]() 601

601

A while ago, Huawei's BU operation company, Yinwang Intelligence, introduced a second shareholder.

AITO acquired a 10% stake in Yinwang Intelligence for 11.5 billion yuan, equivalent to a valuation of 115 billion yuan for Yinwang Intelligence.

Subsequently, SERES also invested 11.5 billion yuan to acquire a 10% stake, becoming the third shareholder of Yinwang Intelligence.

Recently, there have been media reports that AITO plans to continue purchasing shares and may invest another 11.5 billion yuan to acquire an additional 10% stake, effectively controlling approximately 20% of the company. However, no official announcement has been made yet.

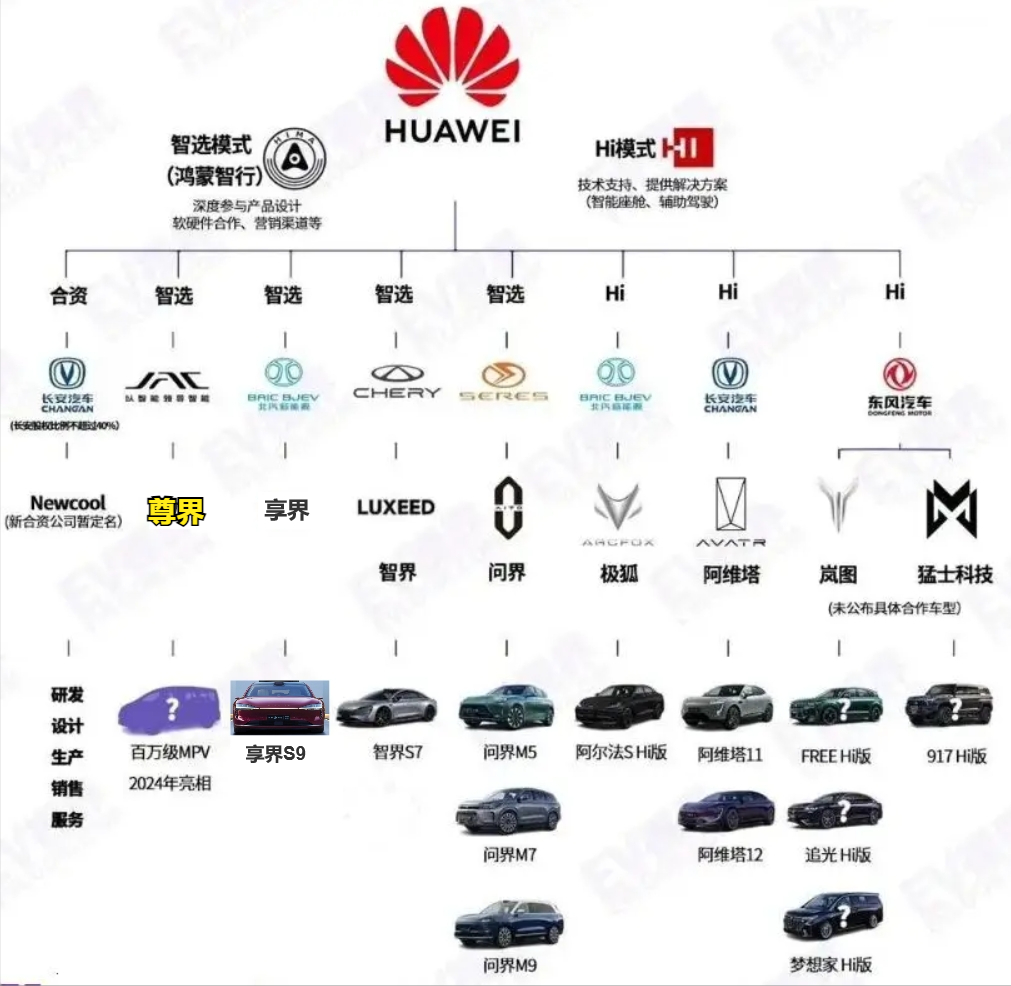

Other media reports suggest that automakers such as Beijing Automotive Group, Chery, and JAC Motor, which cooperate with Huawei on intelligent vehicle selection business, are highly likely to invest as well. However, Huawei will not release too many shares, as it intends to maintain absolute control over Yinwang Intelligence.

Why are these companies so eager to buy shares in Yinwang Intelligence? Besides the desire to forge a deep partnership with Huawei, another crucial reason is the low valuation of just 115 billion yuan, making it a lucrative investment opportunity.

By selling shares at such a low price, Huawei is essentially ceding significant benefits to its automaker partners. Naturally, they would seize this opportunity as future chances to invest at such favorable terms may not arise.

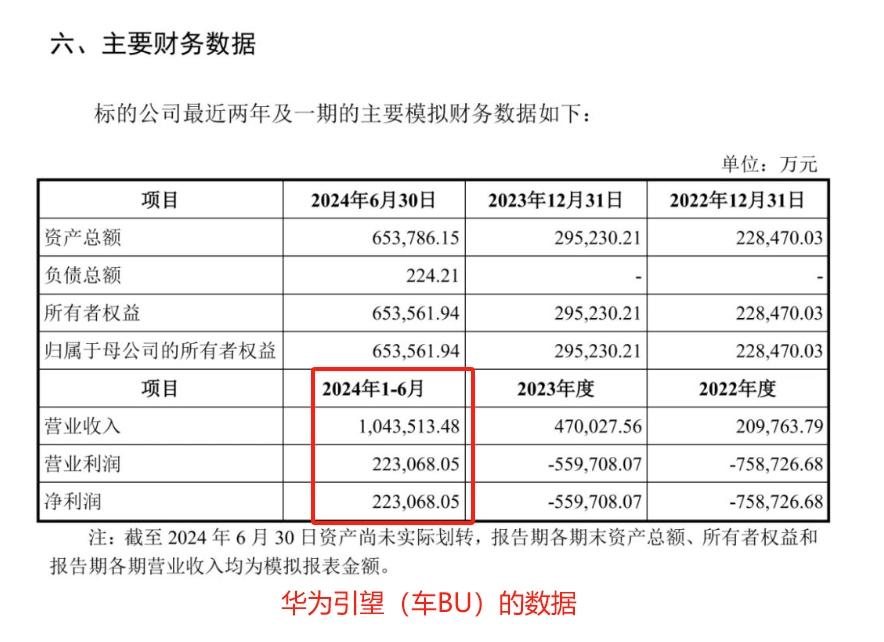

Data indicates that in the first half of 2024, Huawei's BU generated approximately 10.43 billion yuan in revenue and 2.23 billion yuan in profit.

Assuming similar performance in the second half, the annual revenue would be around 10.86 billion yuan with a profit of 4.46 billion yuan. Based on a valuation of 115 billion yuan, the P/E ratio would be approximately 25.8, which is relatively low compared to other global peers. For instance, Tesla has a P/E ratio of around 79, Mobileye exceeds 110, and some domestic companies have P/E ratios of over 30 to 40 times.

If we compare Huawei's P/E ratio with that of automakers, the figure of below 26 is also considered low.

It is evident that Huawei's BU valuation is theoretically lower than its global and domestic peers in the same industry. Considering Huawei's status and influence in China, if Huawei were to openly seek financing beyond automakers, its valuation could potentially increase by 50% or even double, making the current valuation of 115 billion yuan indeed modest.

Moreover, Huawei's BU is still in its infancy, with just the launch of Zhijie and Xiangjie models, while Zunjie remains unreleased. Given the performance of the Wenjie model alone, one can imagine the potential growth when all four models gain popularity, possibly resulting in severalfold increases in revenue.

This explains why AITO is eager to invest more, and why SERES is quickly snapping up shares without hesitation – opportunities like these don't come by often.