Apple's supply chain expands production and hires new workers, but who will buy all this increased capacity?

![]() 09/02 2024

09/02 2024

![]() 433

433

The countdown to the launch of Apple's iPhone 16 series has begun. Perhaps this time, Apple is the most prepared in terms of production capacity. This means that after the launch event, Apple's official pre-sales and delivery period are expected to allow users who make reservations in the first round to receive their products on the delivery date.

The fruit chain is well-prepared this time, and supply chain sources indicate that several contract manufacturers are in full swing production and continuously recruiting staff. The goal is to ensure sufficient supply to the market during the first wave of sales. In particular, for the high-end models of the iPhone 16 series, the Pro/Max versions have increased some production capacity, which should meet demand during the peak market demand period.

One major concern is that various sources indicate that the upgrade space for the iPhone 16 series compared to the previous generation is very limited. How many users will actively purchase the iPhone 16 series? Both Gurman and Ming-Chi Kuo have hinted that the upgrade space for the iPhone 16 series is limited, implying that users may want to wait for the next-generation iPhone 17 series, which Apple considers a true game-changer, especially with the integration of AI technology. The iPhone 16 series still falls short in this regard.

Apple's demands on its supply chain and the preparation phase of contract manufacturers remain robust, indicating that Apple remains confident that the iPhone 16 series will achieve good sales performance. However, will reality align with Apple's expectations? It's unlikely to be easy. After all, Apple's current market share and user enthusiasm are not particularly high, and it is unrealistic to expect the next product generation to bring about a qualitative change.

Perhaps Apple has channels to absorb products, which is why contract manufacturers like Foxconn need to step up production. Of course, based on Apple's previous marketing strategies, making more concessions on pricing can stimulate sales to a certain extent. However, this comes at the expense of profit margins, which Apple surely does not want to see decline continuously. Apple could potentially offset some of these differences by generating more service revenue through Apple Store.

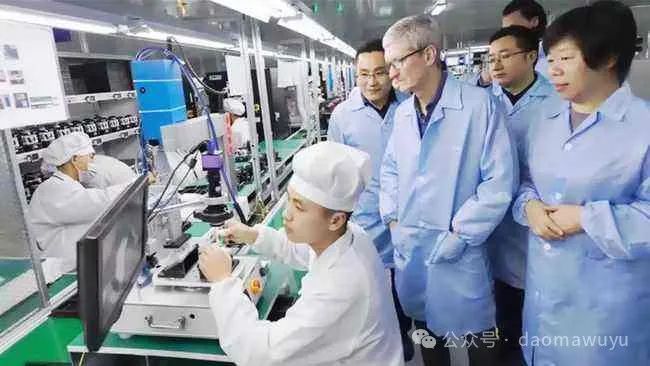

According to sources from China's domestic supply chain, fruit chain companies are working around the clock in two shifts. Media reports mention that outside Foxconn's recruitment center in Zhengzhou, workers waiting for interviews lined up for tens of meters, dragging suitcases and sacks, squatting or standing by the roadside. Job seekers continued to arrive by car. Foxconn employees in blue vests patrolled the area, with loudspeakers repeatedly warning about scams at the entrance and advising not to talk to strangers. The need for personnel drives continuous recruitment to make up for production capacity shortfalls, a scene repeated annually by fruit chain manufacturers.

In recent days, some intermediaries have offered new incentives: "Last week of high pay, hourly workers earn 27 yuan/hour, with a recruitment bonus of 8,500 yuan for dispatch workers!" to attract new recruits. This year, dispatch workers can earn up to 22,500 yuan if they work for three months. Hourly workers at high-paying factories on Bajie Street can earn up to 7,840 yuan if they work 280 hours a month. Compared to last year's recruitment announcement for the same period, Foxconn's Zhengzhou factory offered a maximum recruitment bonus of around 21,300 yuan, with a monthly salary of up to 6,440 yuan for high-paying hourly workers on Bajie Street. Despite the allure of high wages, demand remains unmet, highlighting the urgency of recruitment. This underscores the pressing demand for production capacity from Apple faced by the fruit chain.

In fact, this also illustrates from another angle that Apple relies heavily on Chinese manufacturing. Perhaps some of the production capacity originally allocated to other markets in previous years ultimately ended up with Chinese contract manufacturers due to insufficient quality control in other regions, leading to products that failed to meet demand. As a result, Apple had to once again allocate more production capacity to Chinese contract manufacturers.

Tim Cook also stated that Apple has continuously expanded its supply chain in China over the past 30 years and increased its investment there. In the future, Apple will continue to maintain a close and mutually beneficial partnership with its Chinese supply chain partners. According to media reports, there are two modes of employment at Foxconn's Zhengzhou Harbor Business Group A: high-paying hourly workers earning 24.5-26 yuan/hour, plus a 500 yuan job stability bonus and a 200 yuan transportation allowance for completing the month; and recruitment bonus workers earning a base salary of 2,100 yuan plus subsidies and overtime pay, with an additional recruitment bonus of up to 8,000 yuan for employees with over 90 days of service, along with a 500 yuan job stability bonus and a 500 yuan extra subsidy.

Beyond the demand for labor, the market is more concerned about whether the iPhone 16 series will achieve good sales expectations. Apple's market value fluctuates significantly, and to a large extent, it depends on the performance of the iPhone. Only by selling more products can Apple expect better outcomes, whether in terms of Apple Store services or AI integration. Although Apple has always aimed to transition to a service-oriented business model, the "Apple tax" issue has been questioned by various markets. Third-party content providers seek to avoid Apple's charging model, essentially due to the unpalatable 30% commission fee. This conflict also exists between Apple and platforms like WeChat and Douyin.

Regarding the latest iPhone 16, Apple is optimistic about its shipment expectations, which somewhat surprised the market. After all, the current market environment is not particularly favorable, so what gives Apple such confidence? According to the latest analysis from market research firm Counterpoint's "Monthly Flagship Smartphone Display Tracking," shipments of iPhone 16 series panels began in July. Panel shipments for the new series are 20% higher than those of the iPhone 15 series in June and July 2023. This indicates that Apple is well-stocked for the iPhone 16 series. The next step is to see if the market will meet Apple's sales expectations.