Monthly delivery volume exceeds 30,000, and Lepin, which has also received an increase in shareholdings from its founders, has a more stable position

![]() 09/02 2024

09/02 2024

![]() 604

604

Produced by | Bullet Finance

Art Editor | Li Yufei

Reviewer | Song Wen

On September 1st, various new carmakers successively released their August sales data. Among them, Lepin Auto's performance was particularly astonishing. According to its latest delivery data: In August 2024, Lepin Auto delivered 30,305 vehicles, setting a new record high, with year-on-year growth exceeding 113% and month-on-month growth exceeding 37%; as a result, Lepin Auto became the third new carmaker to exceed 30,000 monthly sales. Market analysts believe that this milestone achievement not only demonstrates Lepin Auto's outstanding strength in quality and technological innovation but also provides consumers with greater confidence in purchasing vehicles, ensuring peace of mind for every user who chooses Lepin Auto.

In addition, Lepin Auto has been receiving good news recently.

On the evening of August 26th, Lepin Auto (9863.HK) announced that the company's founder, chairman, and CEO Mr. Zhu Jiangming, and his concerted action partner Mr. Fu Liquan and his wife plan to increase their holdings of the company's H shares within the next six months, with the increase not exceeding RMB 300 million.

This is the first time Lepin Auto's founder has increased their shareholding since they pledged not to reduce their shareholding for ten years at the end of last year, and it demonstrates the founder's optimism about the company's long-term development.

As a result, Lepin Auto's share price rose. On August 27th, Lepin Auto's share price opened higher, with an intraday high increase of over 6%, effectively boosting investor confidence.

On August 30th, reliable sources reported that Mr. Zhu Jiangming and his concerted action partner Mr. Fu Liquan and his wife had increased their holdings by 5,068,500 shares as of the previous trading day, amounting to approximately HK$102 million. This news further stimulated the share price to continue rising, and by the close, Lepin Auto's share price had increased by 4.61%, closing at HK$21.550 per share.

Coincidentally, on August 26th, Xpeng Motors announced that its Chairman and CEO, He Xiaopeng, had purchased a total of 1 million Class A ordinary shares and 1.4199 million ADSs from the open market from August 21st to August 23rd, 2024, amounting to an approximate increase of HK$107 million.

It seems that overnight, the founders of new energy vehicles have all started to increase their shareholdings.

It is worth noting how the news of Lepin Auto's shareholding increase will impact the market, given the company's steady growth in performance, significant sales increases, and market recognition of its popular models in the first half of this year.

1. Positive results and frequent highlights in the fiercely competitive market

In the first half of 2024, the automotive industry was particularly competitive. If there's a second place for fierce competition in new energy vehicles, it would be hard to find an industry that dares to claim the first.

With the rapid growth of the new energy vehicle market, many companies have resorted to price cuts to compete for market share. For example, Tesla adjusted the prices of the Model Y and Model 3 in early 2024, triggering a chain reaction in the industry, and domestic brands such as BYD and NIO had to follow suit to maintain competitiveness.

Price cuts for complete vehicles inevitably impact financial data. The profit data in the new energy vehicle sector has always been subject to intense scrutiny. In the past, relevant data was barely tolerable due to state subsidies, but as subsidy policies fade away, more automakers need to "rely on themselves."

Lepin Auto is no exception. Fortunately, the aspects that were widely questioned in the past have now become the focus of its turnaround. In the third quarter of 2023, Lepin Auto's gross margin turned positive for the first time, with a significant improvement. At the time, Lepin believed that this transformation was primarily due to the stable growth in sales, which drove the increase in financial indicators. This also indicated that Lepin Auto had begun to have the ability to generate its own revenue.

This positive momentum continued into the first half of this year. Judging from various performances in the first half of this year, Lepin Auto has delivered good news frequently.

In the first half of 2024, Lepin Auto achieved revenue of RMB 8.85 billion, a year-on-year increase of 52.2%; the gross margin in the second quarter reached 2.8%, a significant year-on-year increase. Cumulative sales in the first half of the year reached 86,696 units, setting a new record high.

In August, Lepin Auto's market performance was particularly noteworthy, with significant improvements in sales data and market ranking. According to the sales data of new force brands in the Chinese market from August 19th to August 25th, Lepin Auto ranked second in the industry with weekly sales of 6,200 units, setting a new weekly sales record, equivalent to the combined sales of NIO and Xiaomi. Lepin Auto's position as one of the top three automakers in the industry has been further consolidated.

What is most noteworthy is that Lepin Auto's performance in the entire month of August was remarkable. Data shows that Lepin Auto delivered 30,305 units in August, becoming the third new carmaker to exceed 30,000 monthly deliveries, following Lixiang One and Wenjie M7.

What does this mean? The number 30,000 alone is already astonishing, but it's even more impressive to know that Lepin Auto achieved this goal in just three months. Data shows that Lepin Auto delivered 20,116 and 22,093 units in June and July this year, respectively. This growth rate has also been described by outsiders as "Lepin starting to accelerate."

Regarding popular models, Lepin C16, as Lepin Auto's flagship model launched in the first half of 2024, has also performed exceptionally well in the market. According to Lepin Auto's first-half 2024 financial report, the C16 has been a hot seller since its launch at the end of June, with over 10,000 confirmed orders in its first month.

Public information shows that the C16 is positioned as a mid-to-large 6-seat SUV, with a 2+2+2 seating layout, three-zone independent air conditioning, and a ceiling-mounted 15.6-inch rear entertainment screen, providing a more spacious and comfortable riding experience. With a price tag below RMB 200,000, it fills a gap in the domestic 6-seat SUV market. Its popularity not only drives the overall sales growth of Lepin Auto but also demonstrates Lepin's competitiveness in the RMB 150,000-200,000 price range.

In addition, according to Lepin Auto, it will unveil B10, the first product from its new platform, at the Paris Motor Show in the fourth quarter of this year. Targeting young consumers worldwide, B10 is expected to become the next popular model for Lepin Auto and the new energy industry.

With the release of financial report data, record-high sales figures, and popular models, Lepin Auto is truly on the move this year.

2. Why are founders increasing their shareholdings at this time?

Returning to the shareholding increase, Lepin Auto's founder team's move to increase their shareholdings actually had early indications.

Generally, founders increase their shareholdings in a company for two main reasons.

First, they have a firm belief in the company's long-term development. This confidence stems primarily from the company's strong performance, robust growth potential, and consolidated industry position.

Second, to stabilize market confidence, especially when the company's share price experiences fluctuations or there is uncertainty about the company's prospects in the market. Such an increase in shareholding can send a positive signal to investors, demonstrating insiders' recognition and support for the company's value.

Over the past decade, there have been many cases of founders increasing their shareholdings in the market. For example, Jack Ma and Joseph Tsai increased their shareholdings in Alibaba at different times, which subsequently led to positive fluctuations in the company's share price.

Judging from Lepin Auto's founders' shareholding increase, both of the above situations apply. That is, Lepin Auto's performance in the market continues to improve, and the founding team has a firm belief.

Crucially, this shareholding increase is seen by the industry as the practical implementation of Lepin Auto's commitment to "not reduce shareholdings for ten years."

At the end of 2023, Mr. Zhu Jiangming, his spouse Ms. Liu Yunzhen, Mr. Fu Liquan, and his spouse Ms. Chen Ailing voluntarily pledged not to transfer or reduce their shareholdings in any way within the next ten years from the announcement date. At the time, the outside world had already observed the positive signals emitted by Lepin Auto.

This shareholding increase also clearly demonstrates Lepin Auto's current sustainable, stable, and healthy development trend, as well as its confidence in safeguarding the interests of the vast majority of public investors.

The automotive industry is a field with rapid technological advancements and fierce competition, and such confidence and commitment are crucial for the company's stable development. Because the development of the industry has shown that only by consistently investing in products and technology can a company gain more influence in the market. In other words, confidence is the "steering wheel," and technology is the "engine."

Industry insiders analyze that as Lepin Auto's August delivery volume exceeded 30,000 units, its stock market performance has also attracted significant attention. With the formation of the new "Lixiang-Wenjie-Lepin" landscape, Lepin Auto's investment value is increasingly prominent, attracting the attention of many investors. Market analysts point out that Lepin Auto's strong development momentum brings stable growth potential to its stock, making it a trustworthy choice for investors seeking long-term value.

In the future, how much market share Lepin Auto can secure will depend not only on its continued belief in the company's growth potential but also on its efforts to enhance its core competitiveness.

3. A technological pioneer in the race, with technology as the key to victory

The stories in the capital market ultimately need to be reflected in real-world business operations. Ultimately, the automotive industry still relies on hard power to compete. From this perspective, Lepin Auto actually has inherent advantages.

The automotive industry where Lepin Auto operates is an "old" industry, but it is also an "evergreen" industry that relies on technology to maintain its vitality.

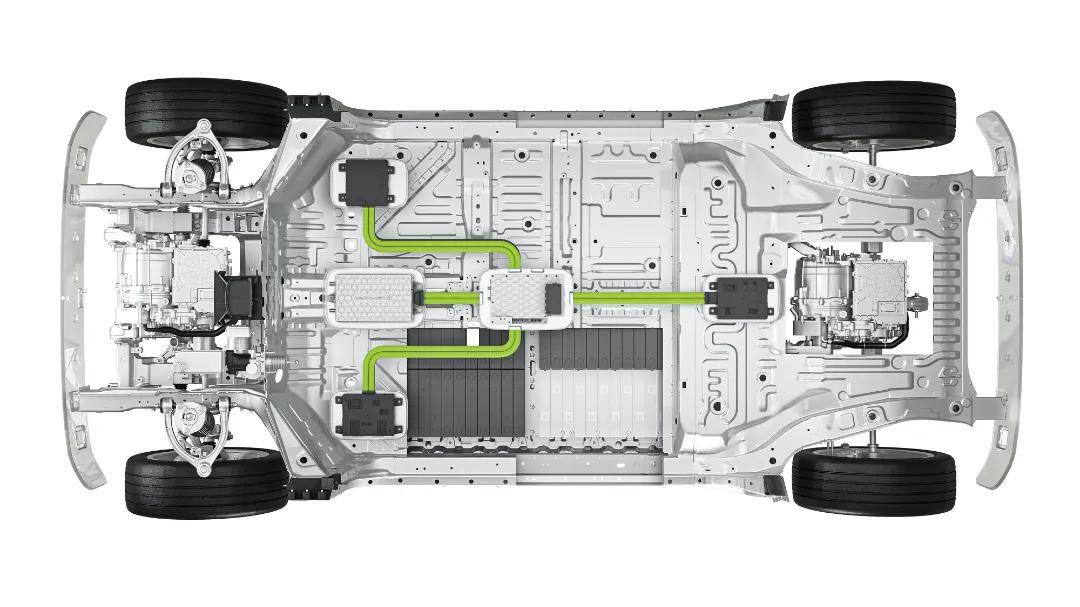

Since its inception, Lepin Auto has consistently pursued independent research and development across the entire vehicle, with self-developed and manufactured core components accounting for more than 60% of the vehicle's cost. Self-development and manufacturing imply greater investment in research and development expenses, which is more evident in Lepin Auto's financial reports. The first-half financial report this year shows that Lepin Auto's research and development expenses increased by nearly half compared to the same period last year.

Specifically, Lepin Auto's research and development expenses include investments in the development of future new models and intelligent driving technologies. Moreover, Lepin Auto has also ventured into "end-to-end large models" for the development of intelligent driving and applications.

According to Lepin Auto's disclosed timeline, it plans to introduce higher-level intelligent driving capabilities and further functional optimizations in the second half of 2024, including open-road point-to-point commuting capabilities and memory parking in parking lots. It also plans to introduce urban intelligent driving functions (CNAP) based on the end-to-end intelligent driving large model within 2025.

Lepin Auto believes that only products with higher configurations, better quality, and affordable prices can bring more happiness to users' travel and daily lives. Choosing Lepin Auto provides users with a new value proposition.

Compared to NIO, Xpeng, and Li Auto, Lepin Auto may not be the most prominent, but with its sales and technological breakthroughs, it has become a worthy "small ideal" and a formidable dark horse.

Of course, this is not the end for Lepin Auto.

Lepin Auto's future goal is to become one of the top eight automotive brands in the Chinese market next year, enter the top six the following year, and rank among the top five in the third year. The company hopes to achieve overall profitability by 2025.

This is undoubtedly a significant challenge in the fiercely competitive automotive industry.

Regarding this, Lepin Auto's founder and chairman, Mr. Zhu Jiangming, stated during the earnings call that the company would continue to increase investments in human resources, computing power, and equipment in the intelligent driving field over the next period. In his view, the next three years are crucial for Lepin Auto's development, including whether it can become one of the top five players in the market, which will depend on the company's ability to survive and thrive.

The shareholding increase, therefore, serves as a continuous offensive signal from the founders – Lepin Auto is accelerating towards its set goals.