OPPO retires to the "Others" category and still needs to save itself

![]() 09/02 2024

09/02 2024

![]() 629

629

The recent sanctions against Huawei serve as a stark reminder that developing proprietary chips remains the cornerstone for sustainable growth in the smartphone industry.

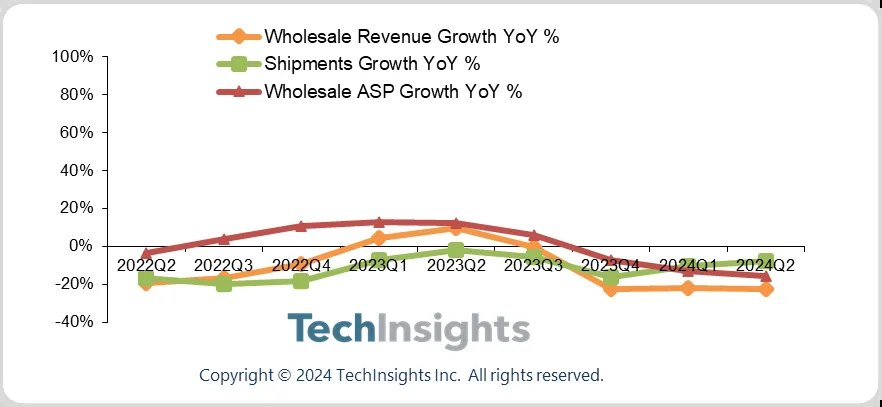

Amid economic pressures and sluggish consumer spending, the domestic and international smartphone markets have endured a prolonged downturn. However, as the industry navigates through challenging waters, the smartphone market is once again on an upward trajectory, ushering in a new phase of recovery and revitalization.

Recently, Xiaomi Group, already a hot topic, delivered its best quarterly report in its history. Apart from its automotive business, which recorded a high gross margin of 15.4%, Xiaomi's smartphone division also shone in the second quarter.

In the second quarter of 2024, Xiaomi's smartphone revenue reached 46.5 billion yuan, marking a year-on-year increase of 27.1%, with global shipments totaling 42.2 million units, up 28.1% year-on-year.

According to Canalys data, Xiaomi ranked third in global smartphone shipments in the second quarter, with a market share of 14.6%, making it the fastest-growing brand among the top five in terms of year-on-year shipment growth.

TechInsights' second-quarter 2024 global smartphone shipment report revealed that Samsung topped the list with a near-19% market share, while Apple secured the second spot with a 15% share. Xiaomi, vivo, and Transsion Holdings occupied the next three positions, while OPPO (including OnePlus) fell out of the top five, relegated to the "others" category.

Despite being a leading domestic smartphone manufacturer, OPPO's sales performance in the second quarter was somewhat disappointing. Data showed that OPPO and its subsidiary brand OnePlus combined for global shipments of 25 million units in the quarter, marking an 8% year-on-year decline, making OPPO the only top-10 brand to experience a shipment drop. Specifically, OPPO brand shipments decreased by 5% year-on-year, while OnePlus saw a more pronounced 22% decline.

The smartphone market is experiencing a resurgence, with domestic brands outpacing Apple and Samsung in shipments, reinstating their dominance. Among Huawei, Xiaomi, OPPO, and vivo, only OPPO has fallen behind.

Since the chip monopoly incident, Huawei has rebounded vigorously. Xiaomi, under the leadership of "Leibusi," has garnered significant attention with its new energy vehicle, the Su7. Vivo, OPPO's sister brand, even topped domestic sales in the second quarter. In contrast, OPPO, once a dominant player, has gradually lost its voice.

01 Abandoning proprietary chip and XR development

In 2019, Huawei was placed on the US Entity List, followed by severe chip sanctions from the US government. These sanctions significantly impacted Huawei's smartphone business, with Omdia data showing shipments plummeting from 190 million units in 2020 to 35 million in 2021, a year-on-year decline of 81.6%, further dropping to 28 million in 2022.

Amidst Huawei's decline, new kings emerged in the domestic smartphone market. With access to Qualcomm chips during the supply disruption, vivo and OPPO entered a period of rapid growth. In 2021, OPPO topped the shipment charts with 64.4 million units sold, a 34.3% year-on-year increase.

However, OPPO's ascendancy proved fleeting, as it was surpassed by vivo in 2022 and has since seen its market share steadily decline.

OPPO's decline may be attributed to its frequent strategic shifts in recent years.

In 2019, OPPO announced the establishment of Zeku, a chip company focused on providing hardware and software support for high-end flagship smartphones. In 2021, OPPO officially unveiled its first proprietary 6nm image-specific NPU (Neural Processing Unit) chip, MariSilicon X.

At the time, OPPO CEO Chen Mingyong, a disciple of Duan Yongping, stated that MariSilicon X marked just the beginning of OPPO's proprietary chip journey, with plans to continuously invest resources and build a team of thousands to develop in-house chips.

In 2022, OPPO released its second proprietary chip, the MariSilicon Y, a Bluetooth audio SoC (System on Chip).

Despite these ambitious plans, OPPO abruptly announced in May 2023 that it would cease chip development and shut down Zeku operations, laying off nearly 3,000 employees involved. Market speculation suggests that the high costs associated with chip development may have played a role. Reports indicate that a single chip tape-out test alone cost OPPO up to 100 million yuan, with additional significant expenses for the R&D team.

Coupled with declining smartphone sales in the intelligent terminal market, OPPO's chip development efforts came to an abrupt halt.

Earlier this year, rumors emerged that OPPO had halted its XR (Extended Reality, encompassing VR, AR, and MR) project, which it had been exploring since 2019.

In response, the company stated that it would continue pre-research on AR while emphasizing AI as a strategic technology for the future. OPPO Research Institute will intensify efforts in breakthroughs and new opportunities in cutting-edge core technologies such as AI, AR, and 5G/6G. OPPO has once again shifted its focus, this time towards AI.

Opinions on OPPO's two strategic shifts are mixed. Some view them as prudent moves to protect the company and cut losses, while others criticize internal management chaos, accusing OPPO of chasing trendy concepts and wasting significant funds by abandoning projects halfway through.

02 Betting on AI and foldable phones

At the beginning of this year, OPPO CEO Chen Yongming designated 2024 as the inaugural year of AI phones in an internal letter. On February 20th, the company held an AI strategy conference, announcing its "1+N" AI agent ecosystem strategy, encompassing the OPPO AI Super Agent and the AI Pro Agent development platform.

Since the emergence of generative AI applications like ChatGPT, smartphone manufacturers have recognized the business opportunities and begun laying the groundwork for AI large models. Domestic and international players such as Huawei, vivo, Xiaomi, Honor, Samsung, and Apple have all ventured into this arena.

Vivo unveiled its self-developed general-purpose large model matrix, BlueMind, at its 2023 Developer Conference. The matrix comprises five large models with varying parameter sizes, ranging from one billion to 175 billion.

Recently, Xiaomi Group President Lu Bingwei shared on social media that Xiaomi's upcoming Penta OS 2.0 system will prioritize AI technology and be rebuilt around an AI large model. Earlier rumors suggested that the Xiaomi 15 series would be the first to ship with Penta OS 2.0.

Huawei also launched Pangu Large Model 5.0 this year, which has been integrated into the Huawei Mate 60 series.

OPPO released AndesGPT, its self-trained personalized large model and AI agent, at the end of 2023. Earlier this year, OPPO's flagship Find X7 series became the first to integrate AndesGPT.

In August 2024, OPPO Chief Product Officer Liu Zuohu announced that OPPO's international models would integrate Google's AI large model, Gemini.

As competition intensifies in the smartphone market, foldable phones have emerged as a new frontier. Since Samsung unveiled its first foldable phone, the Galaxy Fold, in 2019, the form factor has evolved rapidly, from small vertical folds to large horizontal folds and even tri-folds.

OPPO entered the foldable market in 2021 with the Find N series. From August to October last year, the company Intensively launched OPPO Find N3 Flip, OPPO Find N3, and the limited edition OPPO Find N3. Among them, the OPPO Find N3 Flip is a compact and portable small foldable phone.

IDC data shows that in the second quarter of 2024, Huawei dominated the Chinese foldable phone market with a 41.7% share, followed by vivo and Honor, while OPPO ranked fourth.

In terms of foldable form factors, small folds are experiencing sluggish growth, while prices for large folds are gradually declining, making tri-folds the new battleground for top manufacturers.

On August 25th, a blogger revealed that Xiaomi had begun testing a tri-fold phone. Earlier this year, Huawei CEO Yu Chengdong was spotted using a prototype tri-fold phone on a flight. Honor has also indicated that it is ready to mass-produce tri-fold phones.

OPPO is actively deploying both AI large models on the software side and foldable phones on the hardware side. However, compared to its competitors, OPPO lacks a first-mover advantage and significant differentiation. With products becoming increasingly homogenized, consumer choice ultimately boils down to product quality and brand identity. To achieve growth, OPPO must continue to delve deeper into differentiation.

03 Pursuing high-end markets overseas

When OPPO was founded, its success was largely attributed to its marketing prowess and offline channel advantages. However, in today's market, high-end technology and brand reputation have become key factors in winning over customers. Overseas markets, therefore, seem to align better with OPPO's strengths.

To date, OPPO has expanded its operations to over 60 countries and regions worldwide, with over 400,000 sales outlets.

Compared to developed markets like Europe and the US, Southeast Asia has long been a goldmine for domestic companies looking to expand overseas. Since entering the region in 2009, OPPO has successfully positioned itself as a market leader through local factory establishment, advertising campaigns, and a focus on mid-to-low-end products.

Having secured a substantial market share, OPPO began targeting the high-end segment. In 2023, against the backdrop of smartphone market homogenization, OPPO introduced its "All-in Foldables" strategy in overseas markets, exporting the compact OPPO Find N2 Flip.

Data shows that in the second quarter of 2023, the OPPO Find N2 Flip captured over 50% market share in Indonesia, Malaysia, Thailand, and Singapore, with an impressive 81% share in Malaysia alone.

According to the latest Canalys research, OPPO (excluding OnePlus) regained its second-place position in the Southeast Asian market in the second quarter of 2024, with shipments reaching 4.2 million units and a market share of 17%.

The compact foldable model has significantly contributed to OPPO's leading position in the Southeast Asian market. However, recent rumors suggest that OPPO may discontinue the small foldable line and instead focus on mass-producing more foldable concepts. While the small foldable's limited battery life and performance have hindered growth, it remains unclear whether other foldable models can replicate its overseas success.

In addition to OPPO, domestic brands like Xiaomi, Huawei, and vivo have also achieved notable successes in emerging overseas markets. However, in the global context, Samsung and Apple continue to dominate the high-end segment. After establishing a market presence with mid-to-low-end products, domestic smartphone manufacturers must address the challenge of enhancing brand recognition in the high-end market.

Returning to the core issue, facing fierce competition at home and abroad, OPPO must introduce new initiatives to reverse its declining fortunes.

OPPO's Liu Zuohu once stated, "Competition will always exist, and the only way to navigate cycles is by making great products." To enhance its core competitiveness, OPPO may need to revisit its abandoned proprietary chip development, which the company had previously shelved.

On the same day OPPO unveiled the Find N3 Flip, Huawei launched the Mate 60 series on September 29th, 2023, stealing the spotlight. Equipped with the Kirin 9000S processor, this series marks Huawei's return to using its flagship Kirin chips three years after being blocked by the US. This launch is historic for domestic smartphone manufacturers seeking to break free from US restrictions. By gradually shaking off the shackles of sanctions through proprietary chip development, Huawei may soon reclaim its position as the domestic market leader.

Developing proprietary chips undoubtedly comes at a hefty cost, necessitating OPPO's current focus on boosting sales to accumulate capital. Both AI large models and foldable phones offer viable opportunities. Looking ahead, the Huawei sanctions serve as a stark reminder that proprietary chips remain the cornerstone for sustainable growth in the smartphone industry. To reverse its fortunes and maintain its leading position, OPPO must navigate this journey on its own.