Shuangdeng Co., Ltd., which was inquired twice, turned to the Hong Kong Stock Exchange, ranking first in the market share of energy storage equipment for communication and data centers

![]() 09/02 2024

09/02 2024

![]() 424

424

Figure: Radar chart of Shuangdeng Co., Ltd.'s competitiveness, Source: IPO Golden List

According to the Hong Kong Stock Exchange, Shuangdeng Co., Ltd., an energy storage enterprise, has submitted its prospectus to the Hong Kong Stock Exchange, with China International Capital Corporation, CCB International, and China International Capital as joint sponsors.

01

A small giant in batteries, with major clients including well-known telecommunication operators

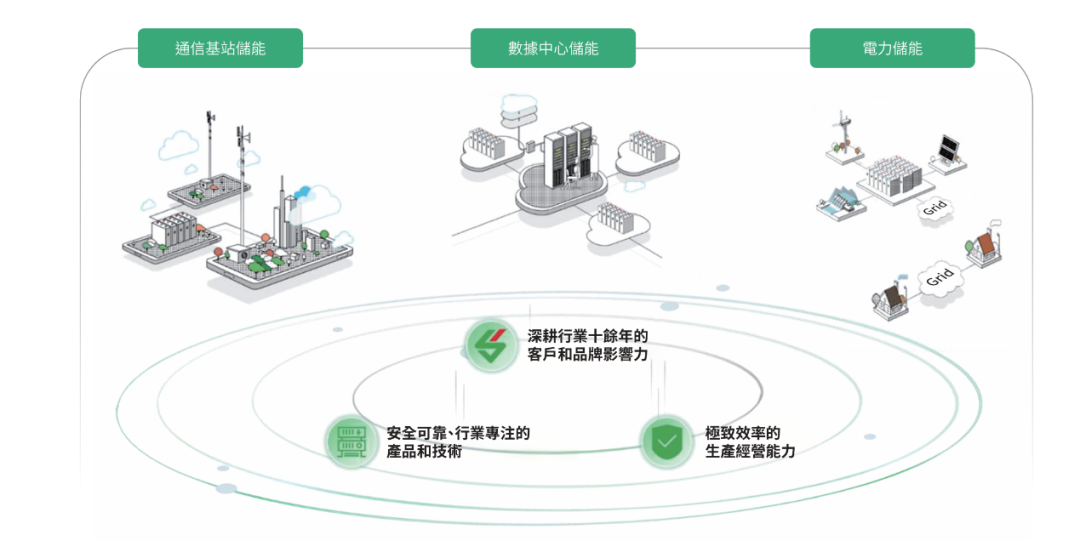

Shuangdeng Co., Ltd. is a supplier of new energy storage equipment engaged in communication support, power storage, transportation power, recycling, and other businesses. Its main products include lithium-ion batteries and lead-acid batteries. The main application scenarios of its products are communication base stations, data centers, and power storage.

In the business scenario of communication base stations, Shuangdeng Co., Ltd.'s battery products primarily ensure continuous power supply to prevent power outages from causing network paralysis or communication disruptions. Energy storage batteries can also help balance peak electricity prices. Their uses in data center operations and grid-side energy storage are relatively similar, but with different requirements in terms of specifications, density, and safety.

According to Shuangdeng Co., Ltd.'s prospectus, among the upstream equipment used in the manufacturing stage, all equipment has been domestically produced except for the lead-carbon wire stripping and binding equipment, which is imported from Italy. In terms of products, Shuangdeng Co., Ltd. has established a product layout that includes lithium-ion batteries (such as lithium iron phosphate batteries, pouch batteries, prismatic aluminum shell batteries, etc.) and lead-acid batteries (such as absorbed glass mat batteries, gel batteries, lead-carbon batteries, etc.).

Figure: Business diagram of Shuangdeng Co., Ltd., Source: Prospectus

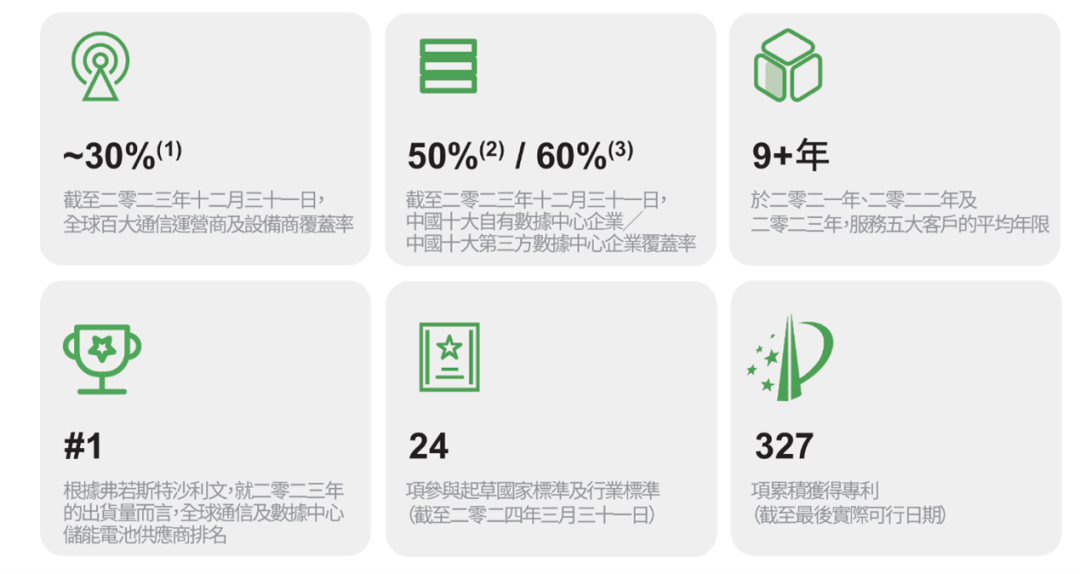

Shuangdeng Co., Ltd. has relatively advanced solutions in specific fields, which has helped it occupy a relatively high market share. According to Frost & Sullivan data, based on shipments, Shuangdeng Co., Ltd. ranks first globally among energy storage battery suppliers for communication and data centers, with a market share of 10.4%.

In terms of revenue, Shuangdeng Co., Ltd.'s business related to communication base stations generated revenue of RMB 2.464 billion in 2023, accounting for approximately 57.8% of total revenue. The data center business generated revenue of RMB 900 million, accounting for 21.1%, while the power storage business generated revenue of RMB 488 million, accounting for 11.5%.

Figure: Performance achievements of Shuangdeng Co., Ltd., Source: Prospectus

Shuangdeng Co., Ltd.'s major clients include the three major telecommunication operators in China (China Mobile, China Unicom, and China Telecom), as well as domestic and international telecommunication leaders such as China Tower, Huawei, ZTE, Ericsson, Nokia, and Vodafone.

02

Revenue doubled but growth rate is unstable; withdrew from Shenzhen Stock Exchange to turn to Hong Kong Stock Exchange

Financially, Shuangdeng Co., Ltd. recorded revenues of RMB 2.44 billion, RMB 4.072 billion, and RMB 4.26 billion in 2021, 2022, and 2023, respectively, with an average annual compound growth rate of 32.12%. However, the growth rate in 2022 was approximately 67%, while the growth rate at the end of 2023 was only 4.6%. In terms of profits, Shuangdeng Co., Ltd.'s gross margin also fluctuated significantly, with gross margins of 7.5%, 16.9%, and 20.3% in 2021, 2022, and 2023, respectively. Net profits for the same period recorded losses of RMB 53.65 million, profits of RMB 281 million, and profits of RMB 385 million.

From an industry perspective, whether in terms of revenue or profit margin, the primary reason for the fluctuations in Shuangdeng Co., Ltd.'s financial performance may lie in the significant fluctuations in raw material prices in the upstream of the lithium battery industry in recent years, which have rapidly fueled a wave of benefits in the lithium battery industry. As lithium battery prices stabilize, Shuangdeng Co., Ltd.'s gross margin level in the first quarter of this year was basically the same as that in the same period last year.

In terms of capital structure, Shuangdeng Co., Ltd.'s asset-liability ratio is 51.82%.

It is worth mentioning that Shuangdeng Co., Ltd. submitted an A-share listing application to the Shenzhen Stock Exchange in June 2023, intending to raise RMB 1.575 billion. After undergoing two rounds of inquiries, the listing application was withdrawn on April 9, 2024.

The core point of the first round of inquiries was that "assets may come from listed companies." Some of the assets acquired by Shuangdeng Co., Ltd. from Jiangsu Shuangdeng may have originated during the period when Longyuan Shuangdeng and Shuangdeng Power Supply were controlled by Longyuan Industry. Therefore, some of Shuangdeng Co., Ltd.'s assets may come from Longyuan Industry, a delisted listed company, and a letter was sent requesting clarification of the asset situation. The core controversy of the second round of inquiries was whether Shuangdeng Co., Ltd. possessed key technologies, to which Shuangdeng Co., Ltd. responded with technical explanations.

The actual controller of Shuangdeng Co., Ltd. is Yang Shanji, who can exercise approximately 78.29% of the voting rights.

The funds raised by Shuangdeng Co., Ltd. will primarily be used for the construction of lithium battery production facilities in Southeast Asia, funding the establishment of research and development centers, strengthening overseas sales, and supplementing working capital.

Comparable company P/E ratio TTM: NARI Technology (SZ:300068) incurred a loss, and Chilwee Power (HK:00951) has a P/E ratio of 4.7x.