Tesla Q2 Earnings Report Interpretation: Beyond Car Sales, Insights from Silicon Valley

![]() 07/29 2025

07/29 2025

![]() 546

546

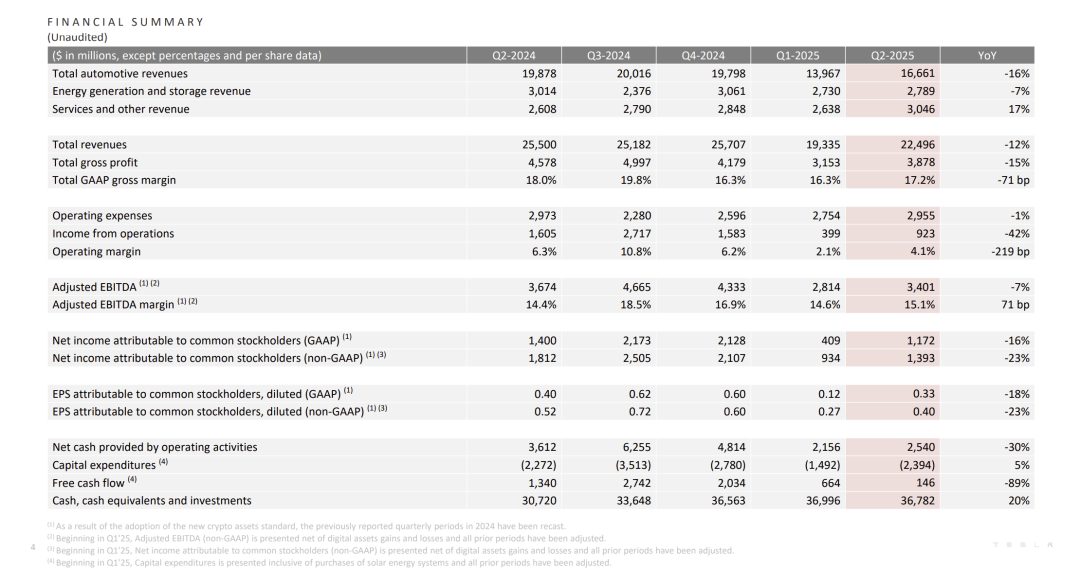

Recently, Tesla (TSLA) unveiled its earnings report for the second quarter of 2025. On the surface, the numbers present a challenging picture for bulls:

- Total Revenue: $22.5 billion, down 12% year-on-year

- Automotive Revenue: $16.7 billion, down 16% year-on-year

- GAAP Net Income: $1.17 billion, down 16% year-on-year

- Total Deliveries: 384,000 vehicles, down 13% year-on-year

Market sentiment immediately turned pessimistic upon the release of these figures. However, as investors, we must dig deeper than just following the herd. The true value of an earnings report lies in its fine details and the underlying implications of management commentary.

To gain deeper insights into Tesla's ongoing transformation, we convened a panel of four leading experts from Silicon Valley shortly after the report was released. They include:

- A former Waymo perception algorithms leader with deep knowledge of autonomous driving technology routes.

- A former Tesla executive responsible for global supply chains, who witnessed the Model 3 production challenges and the rise of the Shanghai Gigafactory.

- A data center energy strategy expert from a top-tier cloud service provider (AWS/Azure/GCP), focusing on future AI GPU cluster power supply solutions.

- An NVIDIA senior technical expert overseeing CUDA ecosystem cooperation, with a holistic view of AI computing hardware evolution and applications.

The experts unanimously agreed that this seemingly "disappointing" earnings report marks a historical turning point for Tesla, transitioning from an "electric vehicle company" to an "AI robotics company." The old valuation framework is being disrupted, paving the way for a new, larger, and riskier paradigm.

The Launch of Robotaxi

Is it a capital story or a catalyst for value reassessment?

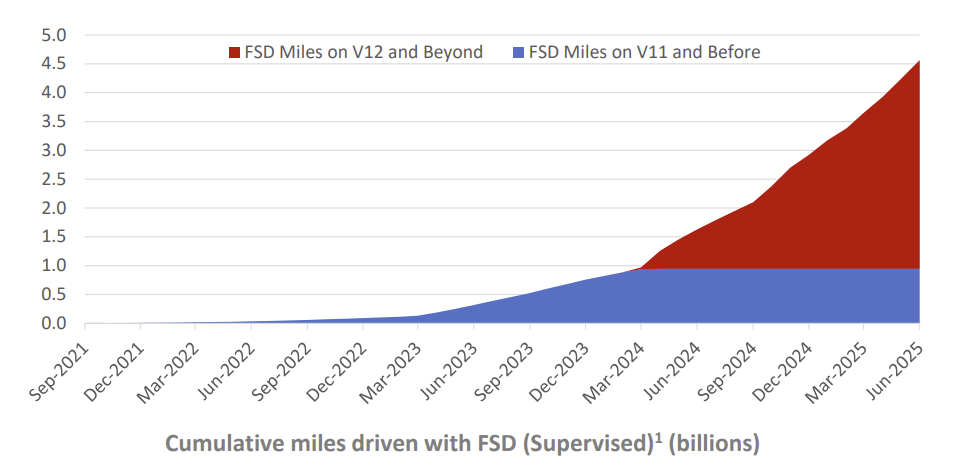

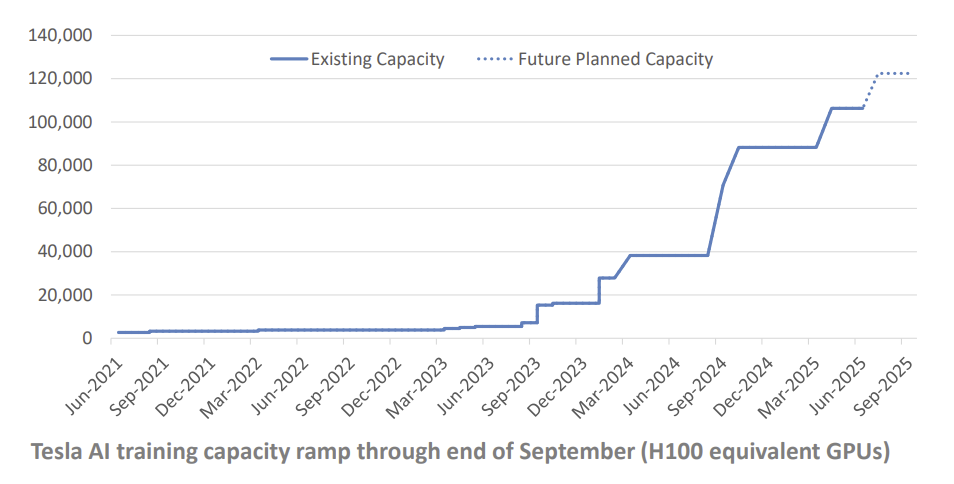

Tesla announced in its Q2 earnings report the official launch of its Robotaxi service in Austin, Texas, in June. Additionally, the cumulative mileage of its FSD (Full Self-Driving) system surpassed billions of miles, with the AI training computing power cluster expanding to 67,000 H100 equivalent GPUs.

This marks the first commercial chapter in Musk's "AI story" to Wall Street, posing significant valuation challenges for investors.

Market views on Robotaxi are divided. While acknowledging its trillion-dollar market potential to disrupt personal transportation, concerns linger over technical, legal, and commercial implementation challenges.

The former Waymo perception algorithms leader clarified, "The public and many analysts misunderstand the core competition between Tesla and Waymo. It's not just a route dispute between 'pure vision' and 'lidar'; it's a philosophical debate between 'probabilistic models' and 'deterministic models.'"

He explained further, "Waymo's model uses expensive lidars, high-definition maps, and redundant sensors to build a nearly 100% certain model of the physical world within a defined area. This model is safe but costly and difficult to scale. Every new city requires significant mapping and data collection efforts."

"Tesla, on the other hand, is leveraging 'probability' over 'certainty.' It relies on massive, diverse real-world driving data captured by cameras to train a powerful neural network capable of making high-probability decisions like humans, even without high-definition maps. The billions of miles of FSD mileage in this report are the fuel for training this 'world model,' a data barrier no competitor can match in the short term."

The expert concluded, "Investing in Tesla's Robotaxi is essentially betting on the success probability of a 'data-driven AI model.' If this model proves rapidly deployable globally, its unit economic benefits will far surpass Waymo's, eliminating expensive 'mapping' and 'hardware costs.' The Austin launch is the first small-scale stress test of this model's commercial viability."

Affordable Models: Sales Cure or Profit Poison?

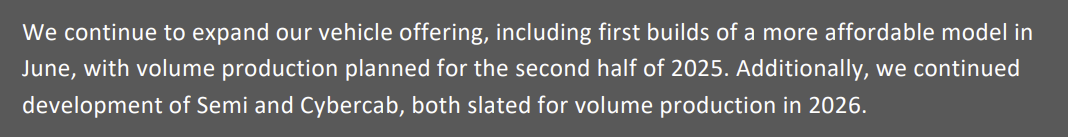

The earnings report confirmed the first trial production of a "more affordable model" in June, with plans for mass production in the second half of 2025. However, automotive business gross margins remained under pressure in Q2.

This seems like Tesla's prescription to cope with intensifying global market competition, particularly in China. The logic of trading lower prices for larger market share is straightforward.

While the market generally views "cheaper cars" as "sales growth" and "positive," deeper concerns arise about whether this strategy could erode profit margins, impact the Model 3/Y customer base through "consumption downgrading" and "brand dilution," especially before revolutionary cost control measures are implemented.

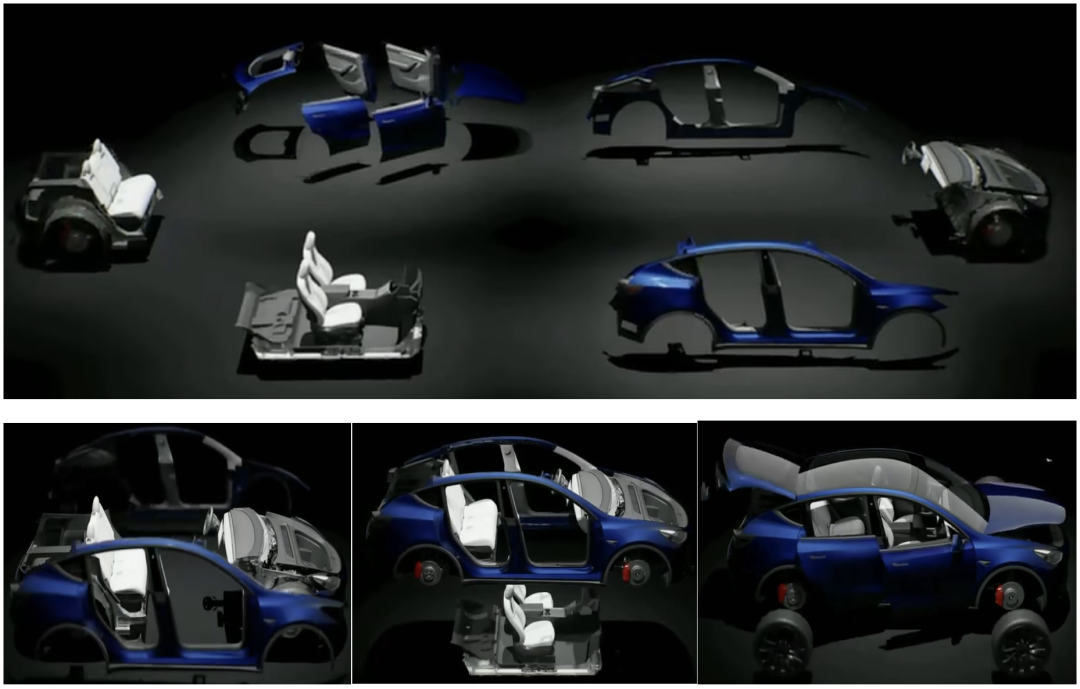

Experts focused on Musk's revolutionary "Unboxed" manufacturing process, not just the car itself.

The former Tesla supply chain executive revealed, "Many attribute Tesla's cost control to strong supply chain bargaining power and integrated casting technology, but that's outdated. The 'Unboxed' strategy is crucial for Tesla to achieve 'high sales' and 'high profits' in the affordable car market."

He explained, "Traditional automotive manufacturing is linear, with the body assembled step-by-step on a conveyor belt. 'Unboxed' aims to parallelize modular assembly, where different car parts (front, rear, sides, battery pack) are manufactured and assembled simultaneously, like Legos. Theoretically, this can increase production efficiency by over 30% and significantly reduce factory footprint and capital expenditure."

"The key question is whether this revolutionary process can be successfully implemented in the second half of 2025. If so, affordable models will become another 'cash cow' for Tesla. If not, they may become a 'profit poison,' dragging down overall profitability due to ineffective cost reduction. The earnings report's mention of 'utilizing existing capacity without new production lines' underscores this strategy's challenges."

For investors, the coming quarters should track not just affordable model orders but also improvements in 'Unboxed' process yield rates and efficiency.

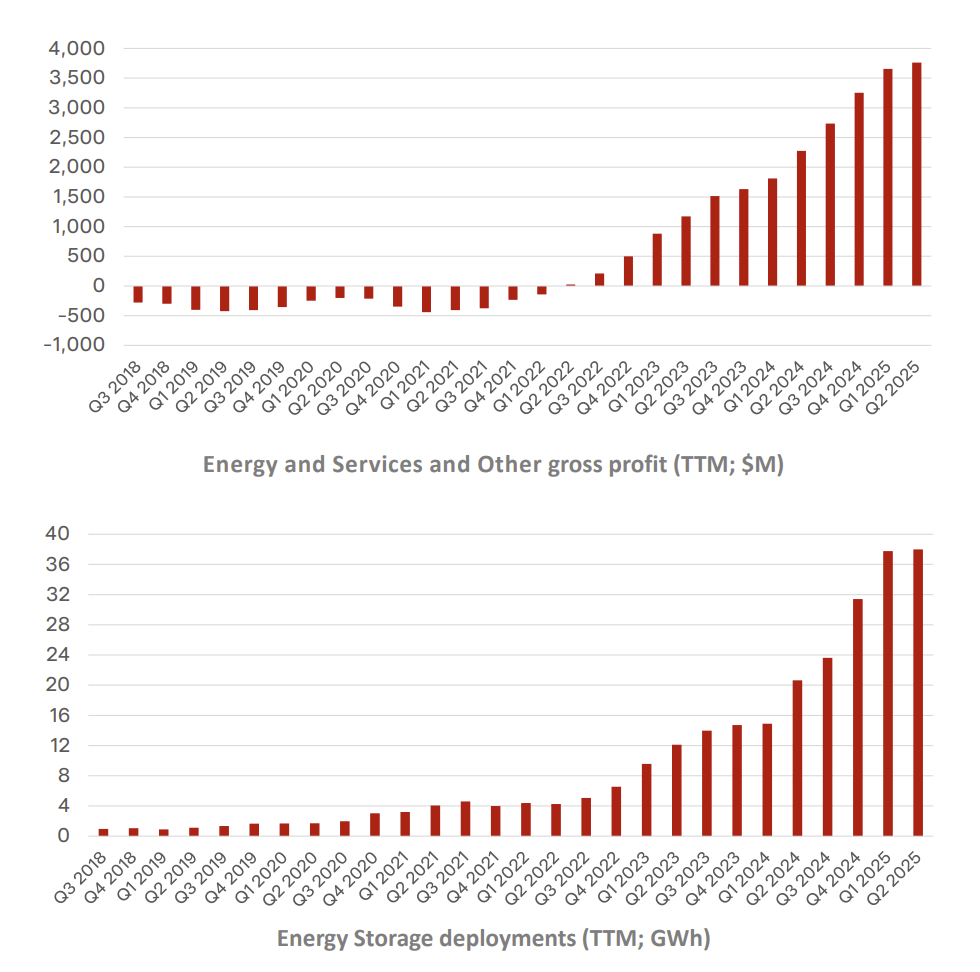

The Energy Business Leap: Marginal Role or Underestimated AI Infrastructure?

While the automotive business faced challenges, the energy business performed robustly. Energy storage product (Megapack and Powerwall) deployment set a new record high for the 12th consecutive quarter on a TTM (trailing twelve months) basis, with significant gross profit contribution growth.

Wall Street long viewed Tesla's energy business as a "sideshow" to its automotive business, believing its size and importance paled in comparison. However, experts see a significant opportunity for value reassessment. Tesla's energy business is transforming from a "clean energy" story to a "core AI era infrastructure" narrative.

The data center energy strategy expert from a top-tier cloud service provider noted, "One of our biggest challenges is the power gap caused by AI computing power. A large AI training center's power consumption is comparable to a medium-sized city. However, power grid construction can't keep up with GPU cluster growth.

What we need now isn't distant nuclear fusion but immediate, deployable, stable, and reliable power solutions to smooth out grid fluctuations."

He continued, "Tesla's Megapack addresses this pain point perfectly. The earnings report mentions its deployment speed is four times that of traditional fossil fuel power plants. For cloud vendors expanding AI computing power, 'time is money.' Megapack can be quickly deployed next to data centers, providing critical backup power and peak shaving capabilities to ensure uninterrupted GPU cluster operation. It's becoming the 'super power bank' for AI data centers."

The NVIDIA expert added, "The end of AI is energy. Future computing power competition is largely an energy competition. Companies with stable, scalable energy solutions will gain a strategic advantage in the AI race."

This means Tesla's energy business may no longer be benchmarked against traditional power companies but as an indispensable "water seller" in the AI industry chain. Its customer base is expanding from households and small utilities to Amazon, Google, Microsoft, and other global tech giants. The market clearly undervalues and underprices this segment's business potential.

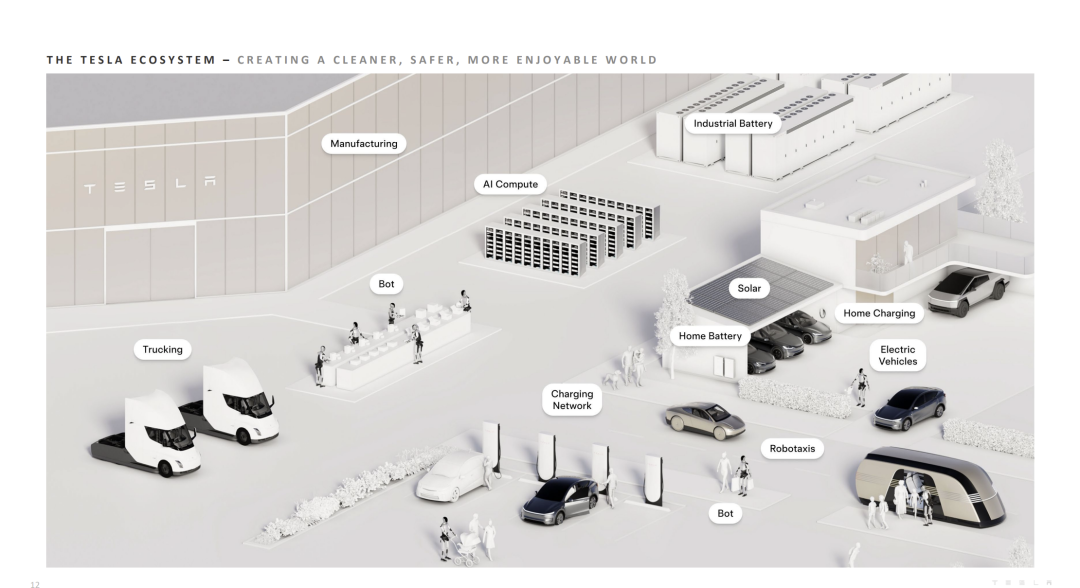

Returning to the original question, this earnings report indeed highlights Tesla's growth challenges as an "automaker." However, it also unveils a new chapter for the company in the next decade: an autonomous driving software-centric new species, with robotics and AI as its long-term vision and an energy business as its solid foundation.

Valuing this new species requires a new, composite, probability-based model. To build this model, we must answer:

- How confident are you in Tesla's FSD technology path success?

- To what extent do you believe the 'Unboxed' manufacturing process can reshape the automotive industry's cost curve?

- How do you quantify the growth potential of Tesla's energy business driven by the AI era's power gap?