South African Auto Market | Ecuador: Kia Challenges Chevy's 30-Year Dominance, Chinese Brands Quietly Rise

![]() 07/29 2025

07/29 2025

![]() 501

501

In June 2025, sales in South American markets like Ecuador remained modest, with approximately 10,000 units sold per month.

Kia has emerged as a formidable contender, challenging Chevrolet's 30-year dominance by steadily increasing its market share. Simultaneously, Chinese auto brands have demonstrated strong upward momentum, with Great Wall Motors, BYD, and Chery experiencing continuous sales growth in the local market.

This article delves into the evolving dynamics of Ecuador's auto market, focusing on two key aspects: the overall market structure and the performance of Chinese brands.

01 Market Structure Changes: Ascendancy of Korean Brands and Decline of Traditional Powers

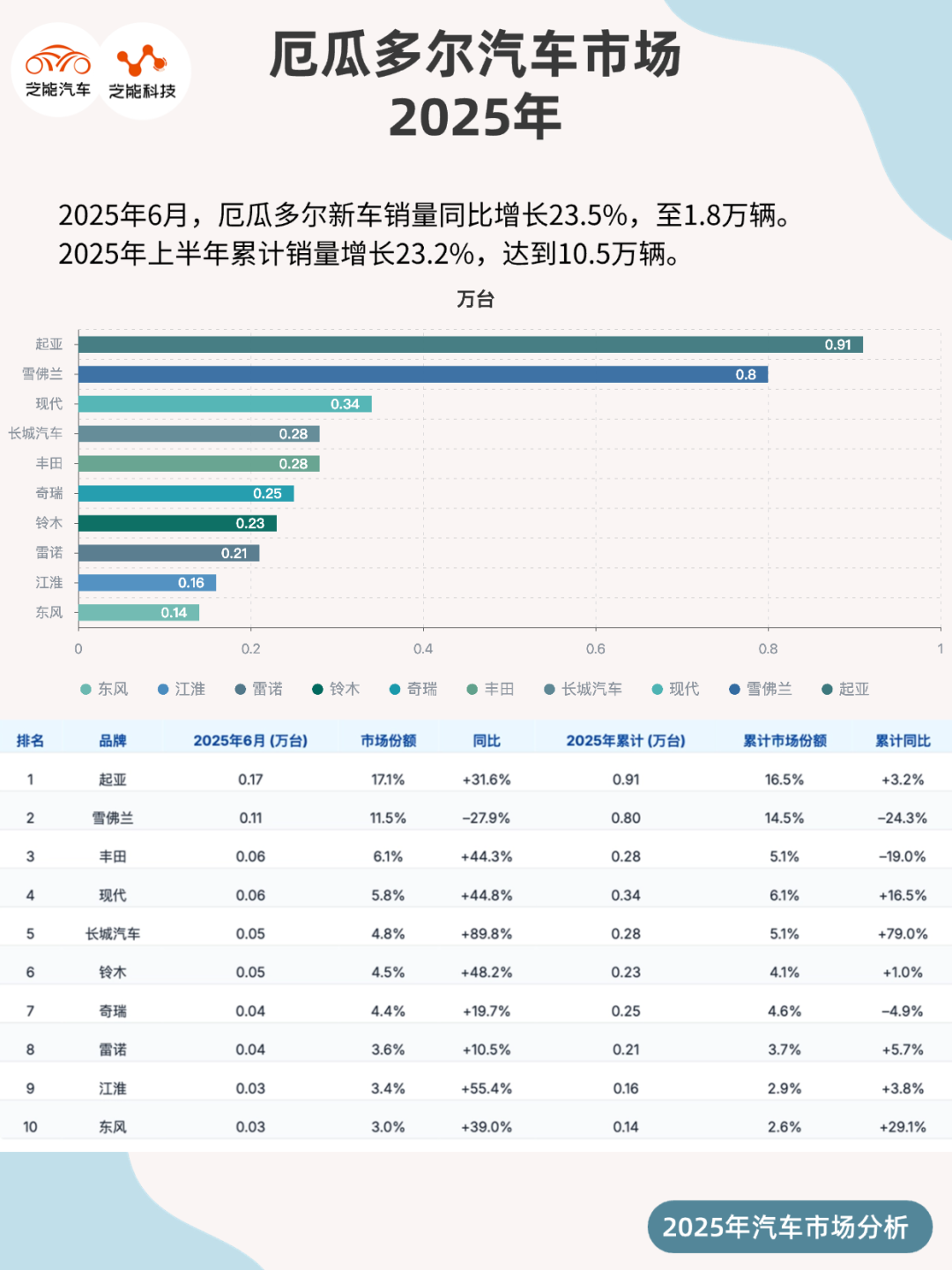

Ecuador's auto market recorded monthly sales of 10,019 units in June 2025, marking a 17.2% year-on-year increase. Despite a 3.3% cumulative sales decline in the first half compared to last year, consecutive growth in the second quarter indicates a gradual market recovery.

Regarding powertrain structures, traditional fuel vehicles still dominate the market, but the penetration of plug-in hybrid and pure electric vehicles is on the rise, particularly for brands like BYD, which has experienced significant growth.

Brand Performance

◎ Kia emerged as the month's biggest winner, capturing a 17.1% market share with sales of 1,711 units, up 31.6% year-on-year. It also surpassed Chevrolet in cumulative sales for the first time (Kia: 9,118 units, Chevrolet: 8,042 units).

◎ Chevrolet is facing an unprecedented crisis, with June sales plummeting 27.9% year-on-year. Its market share dropped from over 18% in the same period last year to 11.5%. Its leading position is now in jeopardy, and its advantages are eroding rapidly. If the current trend continues, Kia could end Chevrolet's 30-year dominance by the end of the year.

◎ Besides Kia, brands such as Toyota, Hyundai, and Suzuki also demonstrated strong resilience. Toyota grew 44.3% year-on-year in June, Hyundai grew 44.8%, and Suzuki rose 48.2%. These brands primarily rely on practical models like pickup trucks and small SUVs to maintain their market share.

◎ In contrast, the German brand Volkswagen continued its downward trend, with June sales of only 207 units, down 11.2% year-on-year, and cumulative sales declining by 27.5%.

Model Performance

◎ Kia Soluto continued to lead the sales chart with an 8.2% market share, selling more than twice as many units as the second-placed Sonet.

◎ Chevrolet D-Max and Groove followed closely behind, but their market shares declined.

Notably, Kia occupied four spots in the top 10 best-selling models, further solidifying its brand recognition.

02 Chinese Brands Steadily Gain Ground, Competing with U.S., Japanese, and Korean Brands

Chinese brands' performance in Ecuador can be described as a collective surge.

Great Wall Motors, BYD, Chery, JAC, Dongfeng, and Sinotruk all achieved double-digit to triple-digit year-on-year sales growth in June, with some brands successfully entering the top 10.

◎ Great Wall Motors stood out with an 89.8% year-on-year sales increase in June, reaching 484 units and ranking fifth. Its cumulative sales were 2,818 units, up 79% year-on-year.

Its main sales models include pickup trucks such as Poer and Fengjun, which have garnered a stable customer base in Latin America due to their price and durability. In the model rankings, Great Wall Poer and Fengjun ranked fifth and tenth, respectively, reflecting their strong foundation in the commercial vehicle sector.

◎ BYD made significant breakthroughs in the electric vehicle segment, selling 280 units in June, up 288.9% year-on-year.

Its cumulative sales for the first six months of the year were 1,040 units, an increase of 198%. Amidst growing demand for new energy vehicles and improved charging infrastructure, BYD's growth potential cannot be overlooked. Especially in the segments of small pure electric sedans and plug-in hybrid SUVs, BYD is laying the groundwork for future expansion in the Latin American market.

◎ Chery maintained stable performance, selling 437 units in June, up 19.7% year-on-year, ranking seventh. Its main models, such as the Arrizo, are competitive in the entry-level sedan market, and their market acceptance is steadily improving.

◎ JAC also performed well in June, selling 345 units, up 55.4% year-on-year. Its main products are micro-trucks and small commercial vehicles, such as the HFC 1037 truck, which occupy a certain share in the logistics and urban distribution sectors.

◎ Dongfeng, JAC, and Foton also achieved significant growth. Among them, Dongfeng grew by 39%, with cumulative sales jumping to 1,425 units; JAC, as a newcomer to the top 10, sold 175 units in June, demonstrating the potential of new entrants to tap into niche markets.

From a product perspective, Chinese brands are primarily focused on the affordable segments of small SUVs, pickup trucks, and entry-level sedans, aligning with local consumers' budgets while offering relatively rich configurations.

Simultaneously, Chinese brands have gradually established a solid reputation through local channel expansion, after-sales system development, and product innovations tailored to local road conditions.

Summary

With Kia surpassing Chevrolet in sales for the first time in Ecuador, the overall auto market structure is undergoing fundamental shifts. Traditional joint venture brands seem to be grappling with the transition to new energy vehicles and price competition, whereas Chinese brands continue to gather momentum, leveraging their cost-effectiveness, electrification strategies, and global supply chain capabilities, gradually moving from the periphery to the core of the market.