Local life's new battle: Meituan's integration of scenarios and Douyin's improvement in timeliness

![]() 09/02 2024

09/02 2024

![]() 566

566

The local life battle has entered a new phase with the release of Meituan's Q2 financial report.

On August 28, Meituan released its financial results for the second quarter of 2024, reporting revenue of RMB 82.3 billion, a year-on-year increase of 21%, and a profit margin of 13.7%, an increase of 6.8 percentage points from the previous year.

The core local business revenue was RMB 60.7 billion, a year-on-year increase of 18.5%, with a profit margin of 25.1%, compared to 21.7% in the same period last year. As the main source of revenue for Meituan, the increased profit margin of its core local business also contributed to the overall profit margin for the quarter.

This is undoubtedly related to Meituan's major adjustment in the first half of this year, which merged its on-site and at-home services. In contrast, in April, Douyin shifted its food delivery business from local life to e-commerce, with one merging and one splitting, resulting in a nearly opposite performance trend over the past six months.

Last year, Douyin was considered the biggest competitor to Meituan in the local life business, with continuous chatter about Douyin encroaching on Meituan's turf. However, Douyin's recent moves suggest that doing well in local life requires patience and starting from its strengths in storytelling. While Meituan excels at connecting various scenarios, Douyin is focusing on building a multi-level, timely at-home service business.

01. Meituan's Integration of On-Site and At-Home Services Highlights Its Advantages

On February 2, 2024, Meituan announced that Wang Puchong would oversee its core local business operations, including the Meituan platform, on-site, and at-home services. In April, the company officially renamed its business units, eliminating the separate on-site and at-home business groups and consolidating them under the "Core Local Business" division.

From a macro perspective, the integration of on-site and at-home services is expected to promote synergetic business development and maximize the advantages of Meituan's instant fulfillment system. While the strategy is in place, its successful implementation will still need time to verify. However, the market has shown early recognition of Meituan's execution capabilities under this integrated strategy. After a year-long decline, Meituan's share price began to rebound from February 2, 2024, and surged by over 7% on the opening day following the release of this quarter's financial report.

Specifically, regarding at-home services, the second-quarter profit margin increased, with Meituan's low-margin "Pinhaofan" service continuing to gain momentum, achieving a record-high peak daily order volume of over 8 million. While Pinhaofan might seem to drag down the overall profit margin, its orders account for less than 10% of the total peak order volume mentioned in the financial report, which was 98 million.

Previous media reports indicated that Meituan intentionally controls the proportion of Pinhaofan orders, reduces food delivery subsidies, and optimizes delivery costs to increase profits.

The optimization of the delivery system is also reflected in the financial report. In the second quarter, Meituan's largest cost component, sales cost, narrowed by 3.8 percentage points to 58.8% of revenue. Meituan attributed this reduction to improved gross margins in its retail business, lower delivery-related costs for food delivery and Meituan Flash, and listed this as the primary reason for the increase in core local business profit margins.

In terms of on-site services, Meituan's hotel and travel orders grew by over 60% year-on-year in the second quarter, with record-high annual transaction users and active merchants. This growth is also attributed to the continued recovery of the hotel and travel industry. As evidenced by Ctrip's second-quarter financial report, both revenue and profit margins increased, with outbound hotel and flight bookings fully recovered to pre-pandemic levels in 2019.

Under these circumstances, Meituan's "God Member" system, which integrates on-site and at-home services, continues to play a role. In March, Meituan established a new S-level project team, which expanded the God Member system to more hotel and travel categories in pilot cities in the second quarter and nationwide in July. This means that the five-yuan expansion coupons commonly used for food delivery can also be applied to on-site hotel and travel orders, achieving a seamless integration of the member systems between on-site and at-home services for both users and merchants.

Furthermore, in July, Meituan launched its "Instant Pick-up" service, allowing customers to order online and pick up their food at the restaurant. While not a novel idea, this service further promotes the integration of on-site and at-home scenarios.

02. Douyin's Split of Food Delivery Business Appears Shaky but Strategically Aligned

Evidently, Meituan's integration of on-site and at-home services is a natural extension of its established business. In contrast, Douyin is still experimenting with its local life path.

After a comprehensive campaign against Meituan in 2023, rumors emerged at the end of last year that Douyin was abandoning its food delivery business. However, in April 2024, Douyin shifted its food delivery business from local life to e-commerce.

This move now seems justified, as Douyin lacks its own fulfillment system and its food delivery design more closely resembles e-commerce, collaborating with third-party service providers and fulfillment partners to serve merchants and customers.

However, in August, reports surfaced that Douyin's food delivery business had returned to the local life business line. While this back-and-forth adjustment might suggest indecisiveness, it aligns with Douyin's recent e-commerce strategy.

In fact, a key new entry point for Douyin's e-commerce business is its supermarket segment. Mu Qing, vice president of Douyin E-commerce, previously stated, "Platform services and logistics timeliness can meet the needs of specific users, effectively complementing our existing platform and merchants."

Similar to how Meituan found the "Instant Pick-up" solution to bridge on-site and at-home services, Douyin's apparent "swing" between local life and e-commerce in its food delivery business is actually paving the way for compromised solutions like supermarkets and hourly delivery services that balance timeliness and fulfillment.

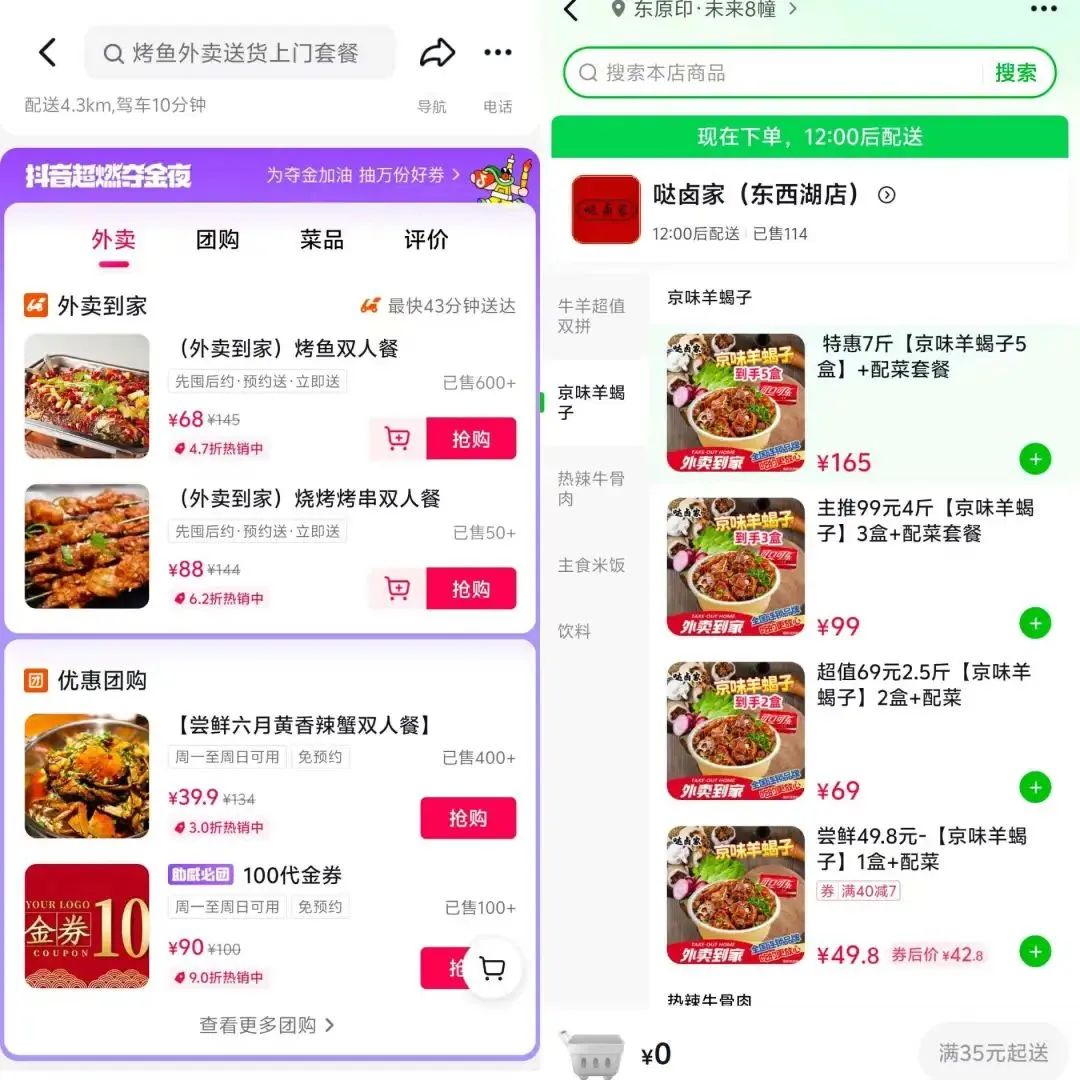

If we navigate to Douyin's "Mall" section, we find that hourly delivery and Douyin Supermarket are prominently featured in the main menu bar, while food delivery falls under the local life group-buying category.

It is reported that Douyin Supermarket has established warehouses in select locations for self-operated goods, such as the fully operational Guangzhou warehouse, which covers Zhuhai, Jiangmen, and Zhongshan. Orders within a 2-6 km radius of these warehouses can be delivered within an hour. It is not ruled out that Douyin Supermarket will further segment its warehouses into self-operated and merchant procurement warehouses, especially in areas with high order volumes, where leased supply warehouses may be used.

It is evident that Meituan, with its own fulfillment system, excels at connecting scenarios in local life. As a short video platform that first entered e-commerce and then local life and food delivery, Douyin is exploring a path that spans various levels of fulfillment timeliness, from building an e-commerce system to hourly delivery for food delivery and compromised next-day and hourly delivery for supermarkets.

In this process, the pre-positioned warehouses and merchant penetration rates become increasingly crucial.

03. Closing Thoughts

Undoubtedly, Meituan remains the undisputed leader in local life. After a tumultuous 2023, Douyin has shed its "dark horse" image and is steadily exploring its own path.

There was even an interesting saying: "The last thing Meituan fears is the collapse of Ele.me," implying that Meituan's further expansion could lead to a monopoly.

In this context, players like Douyin, Ele.me, Kuaishou, and Xiaohongshu are showing more patience and ingenuity, especially as Xiaohongshu opens up local life group-buying in 49 cities starting September 3.

Each player is honestly shedding the burden of rapid growth and exploring innovative solutions for local life.

*Images and illustrations in the article are sourced from the internet.