Xiaomi surges into the top three! Will it shake up Japan's 'Apple faith'?

![]() 09/03 2024

09/03 2024

![]() 599

599

Author | Lushiming

Editor | Dafeng

Recently, Xiaomi's official account in the Japanese market announced that in the second quarter of 2024, Xiaomi's shipments in the Japanese market significantly increased, successfully entering the top three in the market.

If we only look at the rankings, this is undoubtedly a shocking news, especially considering Japan's large population, where being in the "top three" carries significant meaning. However, the reality is that Xiaomi only accounts for 6% of the Japanese mobile phone market share.

Source: Xiaomi Japan

Although it's only 6%, given the unique landscape of the Japanese mobile phone market, Xiaomi's achievement is already remarkable.

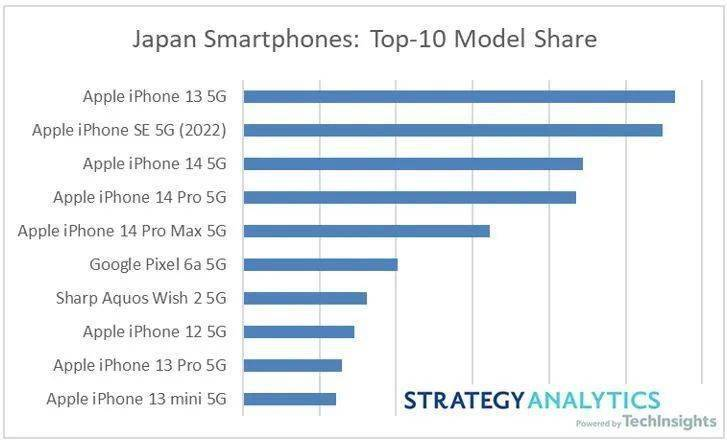

For over two decades, the Japanese mobile phone market has been dominated by carriers. Apple, with its advantages and close cooperation with carriers, has consistently held half of the market share in Japan. The remaining dozens of brands "share" the remaining share, but none has surpassed 10%.

China's mobile phone industry is indeed robust, but facing carriers with significant influence, it has been difficult to leverage China's strengths in "cost-effectiveness" and "customized systems," despite years of efforts.

Xiaomi's current achievement is a significant milestone for the company and marks substantial progress for Chinese mobile phones in the Japanese market.

01

Carriers Hold the Power

Japan is undoubtedly one of the earliest countries to develop mobile communications.

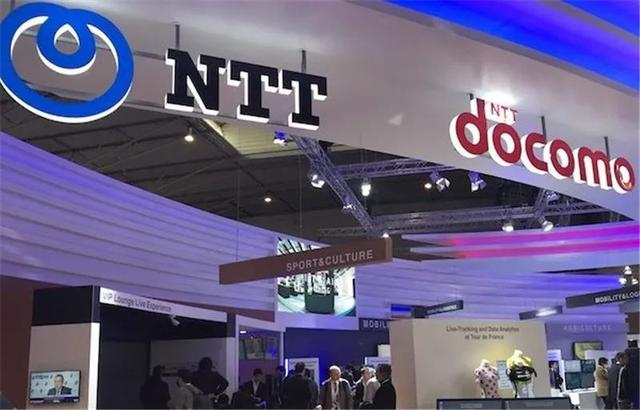

As early as 1989, Japan introduced the first generation of analog mobile phones. Subsequently, Japan pioneered the era of second-generation digital mobile phones, led by NTT DOCOMO, Japan's largest mobile carrier, which established a closed system called i-mode.

In simple terms, i-mode allowed users to enjoy various rich mobile internet services on their phones, including email, news, banking transactions, ticket bookings, online shopping, etc., all charged based on data usage at low rates.

At that time, mobile phones were still considered primarily for voice calls and text messaging. The emergence of i-mode directly met the needs of Japan's advanced mobile internet environment.

With i-mode's closed system, NTT DOCOMO controlled nearly 50 million users during its heyday, effectively taking over the entire Japanese mobile phone market, controlling sales channels and even dictating changes to phone features.

As time passed, Japanese mobile phone market remains carrier-dominated, with five major carriers accounting for 90% of the market share.

In this environment, the Japanese mobile phone market has become self-sufficient, forming a closed internal cycle that is nearly impenetrable to outside brands.

Even global mobile phone giants like Nokia struggled in the Japanese market. In 2008, Nokia announced it would stop selling and promoting its branded phones in Japan due to unmet market share expectations.

However, Japan's domestic mobile phone industry thrived and struggled due to its closed system. While i-mode met Japan's advanced mobile internet needs, it also turned Japanese phones into carrier-dependent factories, focusing on hardware craftsmanship at the expense of software development.

This opened a significant opportunity for Apple.

02

Apple Dominates Half the Market

Even the strongest walls cannot withstand groundbreaking technology.

In 2007, Apple launched the first iPhone, ushering in the era of smartphones and revolutionizing the global mobile phone market.

In Japan, despite i-mode's cultivation of mobile internet habits, the iPhone's advanced hardware and software integration provided an experience that surpassed i-mode, winning over Japanese consumers. Thus, Apple successfully penetrated the previously inaccessible Japanese market.

However, entry alone does not guarantee success. For rapid growth, Apple still needed carrier support.

Initially, NTT DOCOMO planned to introduce the iPhone but ultimately declined due to Apple's demanding terms, including requiring access to NTT's patents.

According to early reports by Nikkei, an NTT Group executive stated, "Apple offered conditions for selling the iPhone through DOCOMO, including access to all NTT labs' patents. That's impossible."

As Japan's largest research institution, NTT's treatment of its technology can impact the country's competitiveness. Even with the iPhone's global popularity, Apple couldn't secure access to all NTT patents. The two sides also disagreed on sales volume and pricing.

Without NTT DOCOMO's cooperation, Apple turned to the weaker carrier SoftBank and reached an agreement.

SoftBank offered services like zero-down payment, free replacements for battery damage within a year, and widespread WiFi access for iPhone users. These initiatives propelled the iPhone's popularity in Japan, significantly shaking up the market landscape.

From SoftBank's official iPhone launch in 2008 to 2012, the iPhone became Japan's dominant mobile phone brand in just four years.

According to IDC, the iPhone captured 23.3% of Japan's mobile phone market in 2012, topping the charts for the first time. Fujitsu, Sharp, Sony, and Kyocera followed with 18.0%, 14.0%, 8.4%, and 8.0% shares, respectively.

After establishing its reputation, Apple attracted other carriers, including NTT DOCOMO, which initially refused to cooperate but later succumbed to pressure and began selling iPhones.

By 2018, Apple surpassed 50% market share in Japan, dominating half the market ever since.

03

Opportunities for Chinese Phones

In fact, Chinese phone brands have entered the Japanese market for years, including Huawei in 2007, ZTE in 2015, OPPO in 2018, and Xiaomi in 2019.

Among Chinese brands, Huawei led SIM-free phone sales and ranked top three in Android phone sales across all channels in Japan in the first half of 2019. However, due to well-known sanctions, Huawei's momentum in Japan stalled.

Today, brands like Huawei, ZTE, and OPPO have lost significant presence in the Japanese market.

The root cause lies in carriers' significant influence, especially over phone features, configurations, and pricing strategies, effectively neutralizing Chinese phones' cost-effectiveness advantage.

In Japan, due to carrier subsidies and discounts, nearly all phones offer good value. iPhones are among the cheapest globally in Japan, further reduced by carrier subsidies.

Source: Strategy Analytics

In short, without deep integration with major carriers, Chinese phones cannot compete on cost-effectiveness in Japan. Securing carrier channels requires negotiation power, which is challenging without initial sales volumes to establish partnerships and gain influence.

Xiaomi's 6% market share and top-three ranking in Japan stem from its successful carrier partnerships.

Before partnering with SoftBank in 2023, Xiaomi struggled in Japan. However, after launching the Xiaomi 12T Pro with SoftBank, sales improved significantly.

In May this year, the Xiaomi 14 Ultra became a hit in Japan, with its initial stock sold out and sales exceeding expectations, topping Rakuten's sales charts.

Similarly, Huawei's 5% market share in 2019 was due to breakthroughs with carriers like NTT DOCOMO.

In Japan, carriers heavily customize phones based on user habits, creating a relatively closed system that clashes with Chinese brands' custom systems and apps.

In other words, Chinese phones' localized software customization hasn't resonated well in Japan.

In conclusion, while entering the Japanese market poses challenges, Chinese phone manufacturers' resilience means conquering it is only a matter of time.