Can "spending money" alleviate commercialization anxiety in the big model marketing war?

![]() 09/03 2024

09/03 2024

![]() 547

547

AI applications' face-to-face marketing drives ad platforms' profits skyrocket.

In the era of big model commercialization, not only NVIDIA but also internet advertising is taking off together.

Recent media reports claim that after approximately five months of advertising, Kimi offered a CPA (Cost Per Action, cost per user conversion) quote of around RMB 30 on Bilibili, a "dimensional downgrade" for most startups.

Image source: Weibo screenshot

According to data from AppGrowing, a mobile advertising intelligence analysis platform, from April to May this year, ByteDance's AI application "Doubao" invested approximately RMB 15-17.5 million. However, in early June, a new round of large-scale advertising investments soared directly to RMB 124 million.

Can large-scale marketing advertisements bring corresponding commercial returns to AI enterprises? Apart from marketing investments, where is the way out for domestic big model companies?

01. Spending money on advertising: Are AI vendors "losing money to gain fame"?

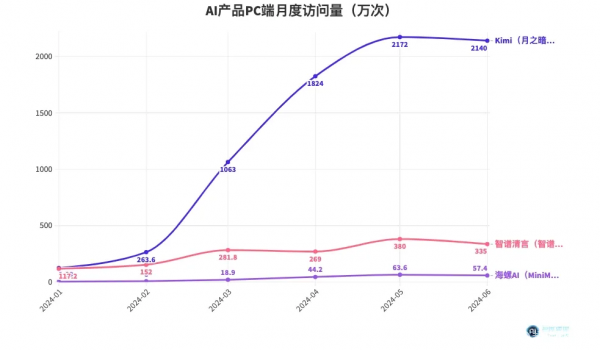

Data from Similarweb, a website analysis platform, shows that after strengthening promotion on Bilibili in March this year, Kimi's traffic volume increased by up to 402.9%, significantly outpacing products like Zhipu Qingyan and Hailuo AI.

Image source: AI Alignment Forum

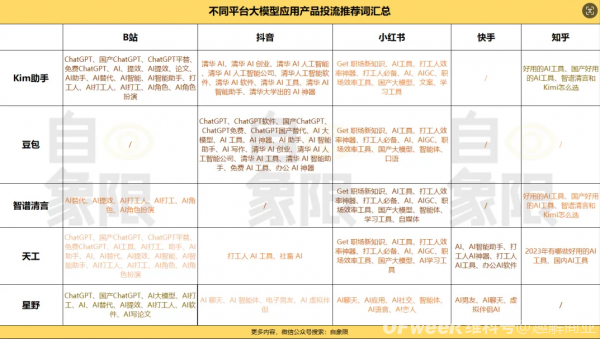

On Bilibili, Kimi is associated with almost all search terms related to "AI," such as ChatGPT series, AI series, efficiency series, assistant series, and working people series. Meanwhile, Tiangong targets terms like "domestic ChatGPT" to dilute competitors' labels.

Not only on Bilibili, but big model vendors are also associated with all technology and scenario-related keywords on search engines and social platforms, especially efficiency scenarios across various industries.

Image source: Zixiangxiang

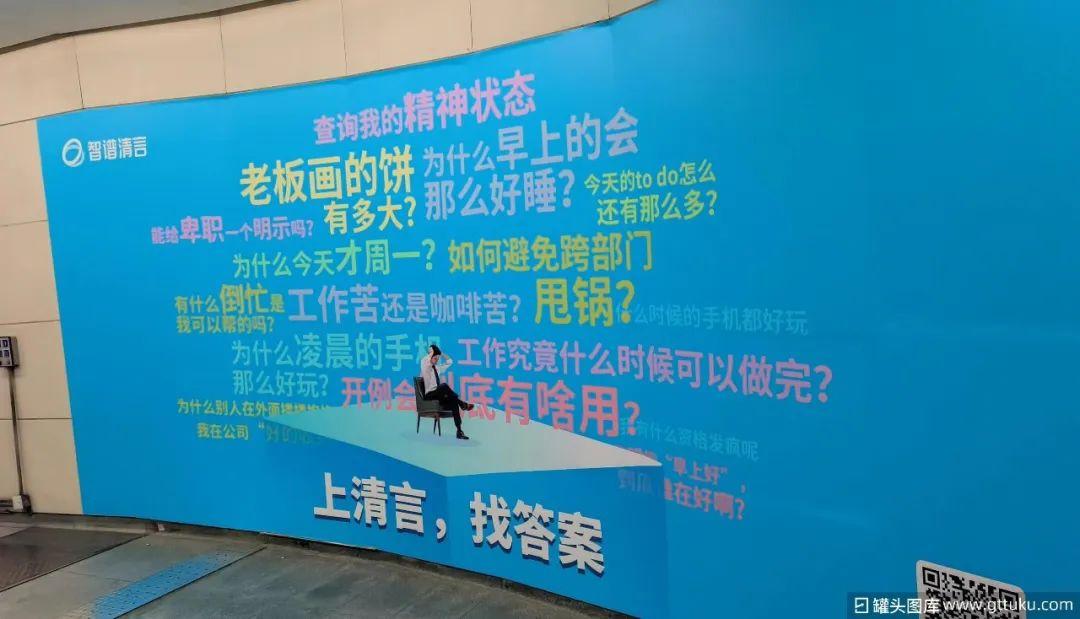

Offline, eye-catching big model advertisements have frequently appeared in subway stations and airports. Many working people in first-tier cities exclaim: AI applications have become a new form of consumption?

Image source: Toutiao Image Library

The competition among big models has turned into a "money-burning" marketing war. Leo Fu, Chairman and CEO of Cheetah Mobile, complained, "Recently, some big model apps' promotion costs are exorbitantly high, making ROI calculations impractical."

A crucial reason for AI applications' urgent need for marketing and promotion is that inference costs have been significantly reduced this year, a positive signal for the industry's commercialization exploration.

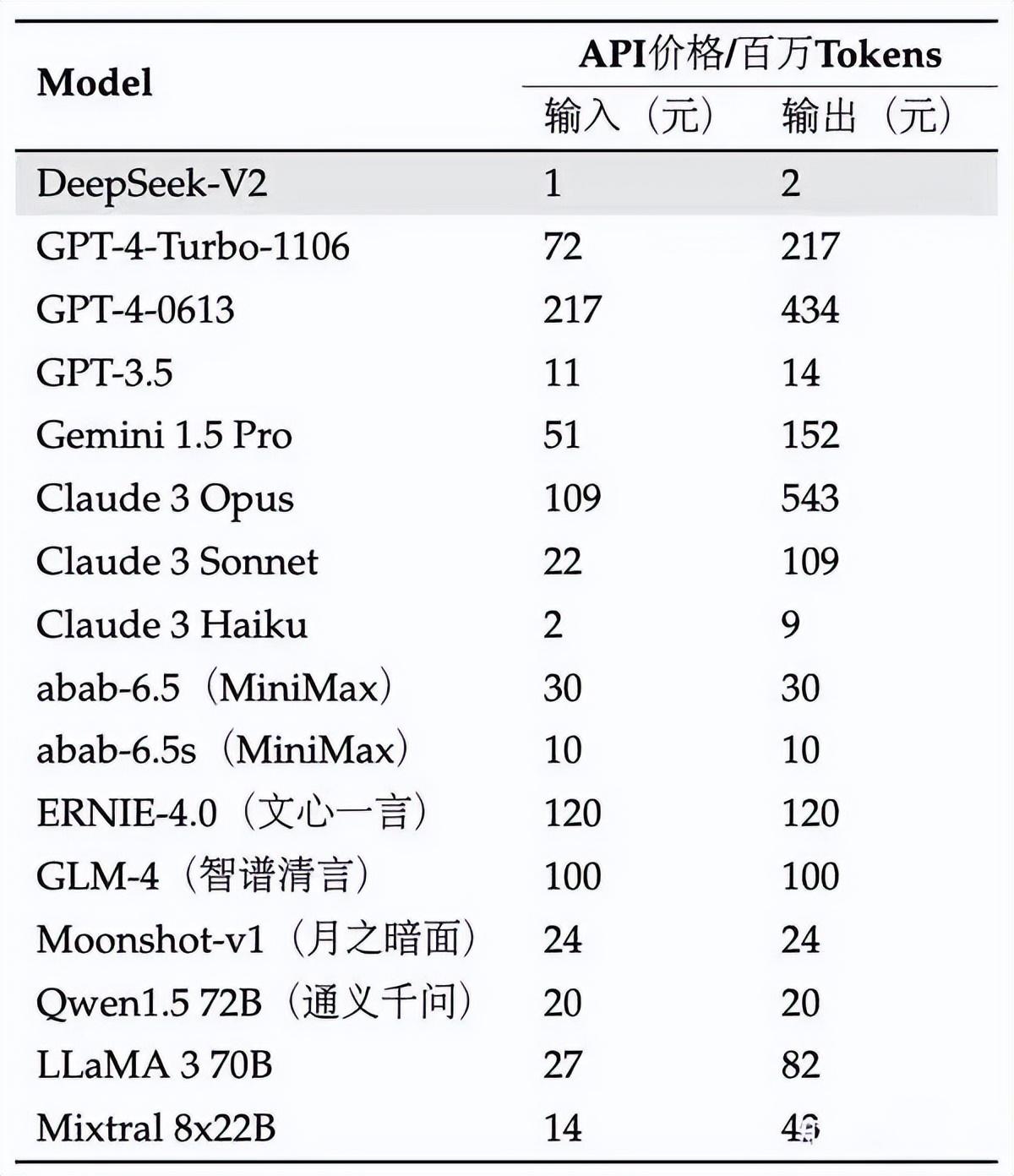

Cost reduction refers to the decrease in the price of tokens consumed by developers and users when accessing big model APIs to input commands. This includes inference input pricing and inference output pricing.

Before commercializing for C-end and B-end users, the tokens consumed by developers accessing APIs were essentially the "only" source of revenue for big models. Mainstream big models' price adjustments or even going free are more likely driven by market competition considerations.

Image source: Weibo screenshot

Last year, big model companies were choosing between ToB and ToC commercialization directions. This year, with the "application wave" gaining popularity, practitioners from different big model companies have stated that they are "studying how to achieve user fission."

Entering 2024, the application landing and commercialization outlets of big models have become the focus. Robin Li, the founder of Baidu, even bluntly stated at this year's WAIC conference forum, "Without applications, having only a basic model, whether open-source or closed-source, is worthless." Wang Xiaochuan, the founder of Baichuan Intelligence, summed it up succinctly, "The ToB market is limited."

Growing user numbers are easier than serving enterprises. Gaining users means winning the market, turning into a tangible "bidding war." In this wave of big model application advertising wars, the direct beneficiaries are still those head big model companies with large user bases or traffic advertising platforms with precise targeting.

Image source: Toutiao Image Library

Additionally, ChatGPT's revenue structure reveals that even without "killer apps," general big model subscriptions remain the primary source of income. As OpenAI's largest revenue stream, ChatGPT Plus contributes 55% of total revenue, approximately USD 1.9 billion, mainly from subscriptions by 7.7 million global ChatGPT Plus users paying USD 20 per month.

This trend is even more pronounced in the domestic market, where the Matthew Effect brought about by user scale is increasingly obvious. This also puts pressure on big model applications like Zhipu Qingyan, iFLYTEK Spark, and Tongyi, as well as Doubao and Kimi, which emerged from intense competition.

The essence of marketing is, of course, to acquire and convert customers. Big models' "spending money" on advertising is not solely to "lose money to gain fame" but a path forced by investors and the market to accelerate commercialization.

02. Will the big model's internal competition continue to "burn money"?

In the previous stage, short-lived hit products like "Miaoya Camera" effectively raised user awareness and explored commercialization with a price of RMB 9.9. However, considering long-term commercialization, single-point hits with excessive entertainment value are no longer sought after by big model companies.

Gaining user recognition of a big model itself is the guarantee for these companies' future ROI. Heavy advertising investments and price competition have become the go-to methods for big model companies to acquire customers.

Advertising investments aim to reach the ceiling, while price cuts aim to seize market share.

For instance, DeepSeek, known as the "price slayer," gained fame in the already established big model landscape by astonishingly reducing the input price of one million tokens to just RMB 1 in May this year.

Image source: The Wall Street Journal

Some big model companies or teams are not adept at creating "super apps," but seizing market share incentivizes developers to rapidly co-create applications. Consequently, domestic AI big model companies have joined the race to substantially reduce prices.

Image source: zhidx

Although Baidu emphasizes that "price does not determine the quality of a big model," it honestly made its two main big models, ERNIE Speed and ERNIE Lite, free. Similarly, Alibaba's Tongyi simultaneously slashed prices and offered free trials for both its commercial and open-source models.

Despite the continuous decline in model inference costs, such "violent" price wars reveal mainstream vendors' determination to compete and "force" tail-end big models out of the game.

Opinions vary within the industry regarding this trend.

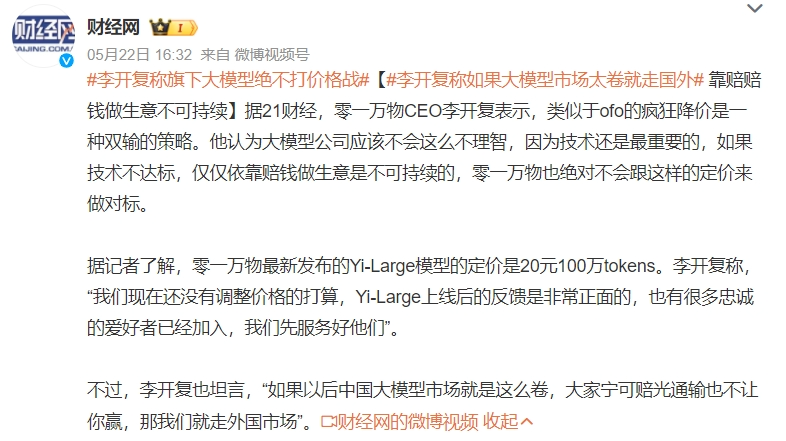

Kai-Fu Lee, CEO of Sinovation Ventures, unequivocally believes that crazy price cuts similar to those of ofo are a lose-lose strategy. Wang Xiaochuan, CEO of Baichuan Intelligence, has also stated that burning money to acquire customers at this stage not only strains companies' capital chains but may also lead to a loss of independent development capabilities due to over-reliance on external investments.

Image source: Weibo screenshot

Eric Schmidt, former CEO of Google, recently stated in a speech that the gap between models is widening and that the significant bubble in the market will correct itself.

Luan Jian, head of Xiaomi's big model team, believes that user stickiness is equally important, which could be an opportunity for Xiaomi's self-developed products like its big model to overtake competitors.

In essence, reducing inference costs is about grabbing resources from a limited pool of developers and ecosystems, while online and offline advertising investments are about fishing suitable users from the pan-C-end traffic pool to pave the way for traffic inlets. However, apart from user growth, many big model companies have yet to consider how to enhance user stickiness.

From the perspective of ecological players like Xiaomi, Lenovo, and Microsoft, smart devices and operating systems are already natural traffic inlets, and these capabilities and ecosystems are weaknesses for big model "rookies."

03. In the AI marketing war, can "Kimi and others" compete with big factories?

Since the summer vacation this year, domestic AI applications, including Doubao, Kimi, Tongyi Qianwen, and Tiangong, have intensified marketing efforts by "spending money" to increase exposure and compete for users.

Recently, Bilibili stated in its financial report meeting that "in the first half of the year, the number of advertisers on Bilibili increased by 50% year-on-year, with more advertisers from emerging industries joining, including over 90% coverage of AI vendors."

It remains uncertain how much commercial return advertising marketing can bring to AI enterprises, but it is certain that the beneficiaries of the AI marketing war are traffic platforms. Some netizens even joke, "In the AI era, the most successful commercialization is Bilibili."

Image source: Bilibili screenshot

How long will this marketing war last? Industry insiders predict that the money-burning war may continue until the first half of 2025.

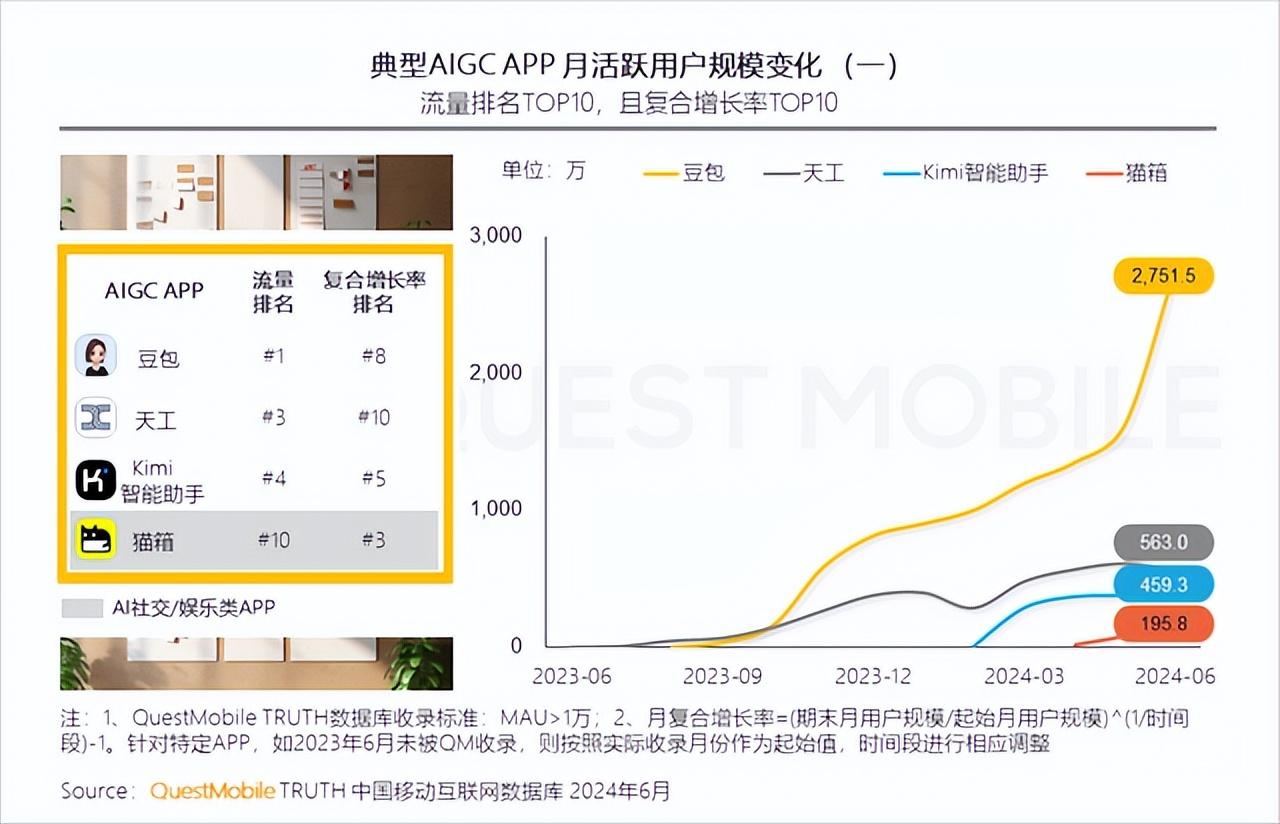

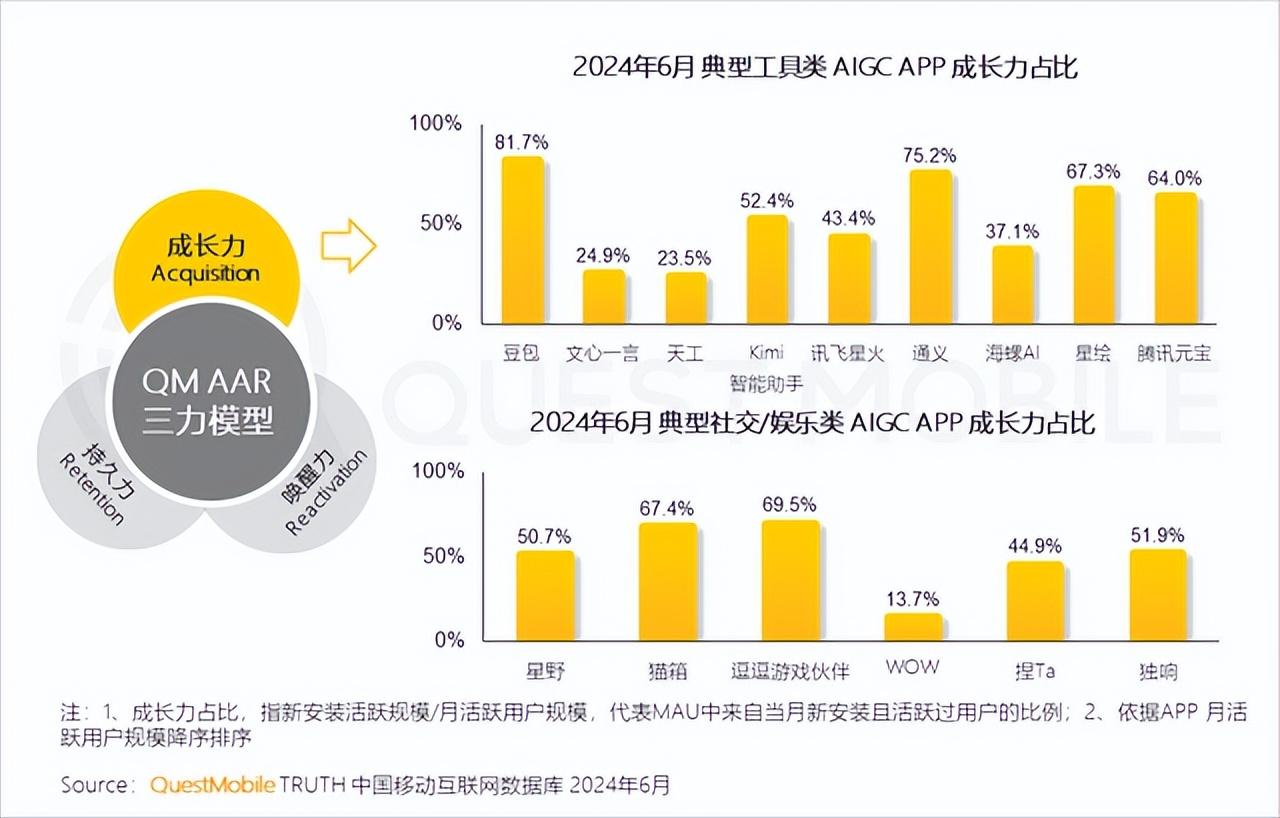

"Spending money" is undoubtedly beneficial to the overall industry's prosperity. In June this year, AI applications like Maoxiang and Kimi showed remarkable growth in monthly active users, a stark contrast to their obscurity six months ago.

Image source: QuestMobile

From a traffic composition perspective, Doubao and Kimi, the heavy advertisers, derived over half of their monthly active installations from new user acquisition, demonstrating robust growth momentum.

Image source: QuestMobile

An advertising platform staff member who has worked with several big model companies stated that everyone believes in the anchoring effect. Current heavy advertising investments stem from fear of rising costs and higher user migration costs if delayed.

Doubao's need to compete in big model advertising investments alongside other companies may stem from ByteDance's later start compared to other major factories. According to June data from AppGrowing, Doubao uploaded 26,521 advertising materials in a week, while Kimi, ranking second, uploaded about half that but still saw a 160% month-on-month surge.

With ByteDance's support, Doubao has delivered impressive results. As of August 30, "Qujiexieshangye" searches revealed that on Xiaomi's app store, Doubao, iFLYTEK Spark, ERNIE Bot, and Kimi had been downloaded 100 million, 73.1 million, 54.27 million, and 28.21 million times, respectively, with a notable gap between Kimi and the others.

Image source: Xiaomi App Store screenshot

This raises concerns: Since big model commercialization has turned into a "resource game," can vendors like Darkmoon, Zhipu, and MiniMax compete financially with big factories? How long can big model companies without commercial profitability continue burning money on high marketing costs?

A former SaaS product founder who has transitioned to developing GPT applications believes that the CPA war cannot last long, perhaps another year at most. "Firstly, the pricing strategy blind box has yet to be opened, and no domestic general big model has genuinely found a long-term scenario advantage. The traffic pool is limited, and everyone is advertising on the same platforms and bloggers. What's the difference?"

Contrary to high customer acquisition costs, Kimi and Doubao have recently chosen the simple scenario of "browser plugins" to penetrate the C-end market.

Image source: WeChat official account screenshot

Tencent's big model industry research report this year mentions the compatibility of big model applications with the "smiling curve": The closer to high value-added R&D design, marketing services, and other knowledge- or service-intensive scenarios, the faster the application landing. It concludes that "big models should avoid the misconception of unilaterally pursuing short-term gains."

A more reasonable approach is to regard big models as R&D or incubation projects, focusing not on absolute short-term financial indicators but on relative business improvements and adopting a broad portfolio investment strategy.

Kimi's commercialization is still in its infancy, and marketing investments can only be financed through fundraising. Recently, media reported that Darkmoon completed over USD 300 million in fresh funding, with Tencent participating. Darkmoon's latest valuation subsequently soared to USD 3.3 billion.

Source: Baidu screenshot

Investors are bound to have expectations for their investments in "real money". Although large models are still in the high-investment development stage, investors will eventually demand the returns they seek.

In the future, the "Hundred Models War" is bound to shrink to "Ten Models," and the battlefield will shift from computing power to the market, which is in line with the value laws of technological change. By this time next year, there may be a "result" regarding the outcome of the bidding game.