Are Meitu's "shovel-selling" efforts profitable amid the siege of Honor, Xiaomi, Oppo, and Vivo?

![]() 09/03 2024

09/03 2024

![]() 436

436

Meitu embraces the "tool Contempt Chain " and earns an additional RMB 270 million in half a year

In 2024, we rarely discuss the term "beauty enhancement" anymore. On the one hand, major mobile phone manufacturers all have product lines focused on portrait selfies, complete with fill light, zoom, and photo editing features, significantly enhancing the success rate of photo taking. On the other hand, the photo editing functions within mobile phone cameras and albums have become extremely powerful, allowing users to instantly beautify their photos with just one click.

"Since I discovered the AI photo editing function of the OPPO Find X7 Ultra's native camera, I rarely take out-of-focus, overexposed, or noisy photos anymore. I've stopped using beauty apps like Meitu Xiuxiu and Xingtu," said Yu Zhenzhen, who enjoys documenting her life, whether it's beautiful scenery or delicious food, and promptly sharing it on her WeChat Moments.

On social platforms like Xiaohongshu, there are tens of thousands of posts sharing camera debugging tips. Besides the increasingly comprehensive built-in photo editing functions, the most significant factor is that they are free of charge.

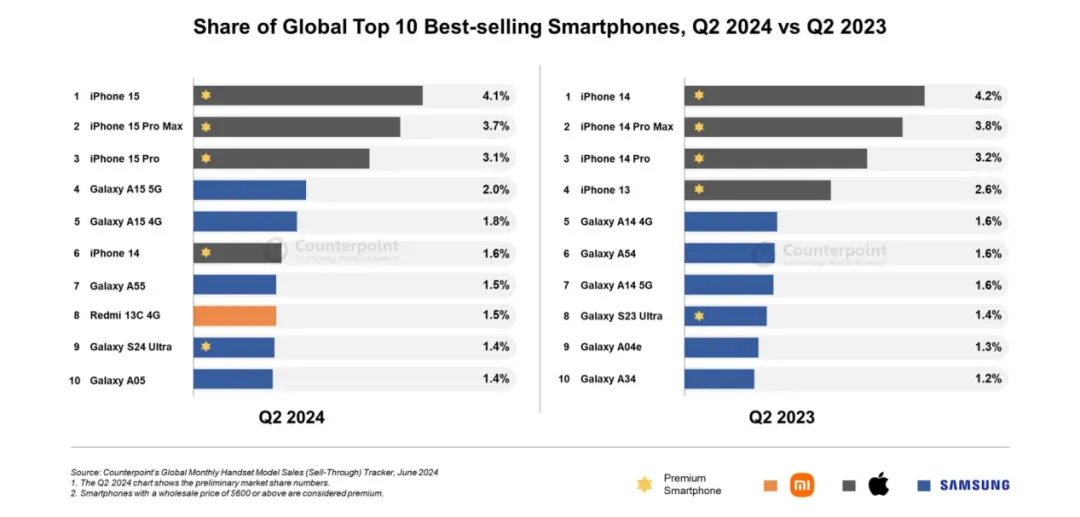

According to market research firm Counterpoint Research, image flagship smartphones account for 35% of the global high-end smartphone market share, representing a year-on-year growth of 12%.

It is evident that for mobile phone brands, creating image flagship phones has become a crucial element in establishing a premium brand image. Since mobile phone manufacturers have entered the AI arena, the image flagship phone market has transcended mere hardware specifications, delving into in-depth integration of imaging algorithms, user experience, and ecosystems. This, in turn, encroaches on the survival space of camera apps.

Amid the cross-industry incursions of major players, how is Meitu, a leading AI application company, faring in 2024?

01 Compete or coexist with mobile phone manufacturers? Meitu continues to solve the puzzle

By mid-2024, Honor, Oppo, Vivo, and Xiaomi had all released their ultra-high-end models, each meticulously crafted around the theme of "imaging." This year's image flagship phones have moved away from the hardware-focused "stacking" approach of the past, instead developing unique tones and styles while integrating large models, elevating mobile photography to new heights.

For instance, Honor has successfully simulated the complex lighting effects of portrait photography studios during shoots by fine-tuning its AI large model. Huawei utilizes AI technology in its snapshot function, ensuring clarity and brightness through vector calculations of double-exposed images.

Xiaomi has pioneered the introduction of a portrait beautification large model on its Civi4 Pro model, which learns and remembers users' facial features upon initial use, tailoring beauty settings to each selfie accordingly.

Vivo's BlueHeart AI large model, meanwhile, enhances image quality through physical modeling data and multi-frame fusion algorithms. Its photo editing capabilities include automatic beautification, whitening, acne and spot removal, undereye bag removal, face slimming, skin softening, eye enlargement, nose refinement, makeup styles, and lip gloss addition.

In terms of functionality, system cameras have become increasingly similar to Meitu apps in terms of photography and photo editing capabilities. However, in terms of rapidly responding to user demands, major mobile phone brands rely on operating system updates for their photo-taking and editing functions, inherently lagging behind Meitu apps in terms of staying up-to-date with trends.

In contrast, Meitu has developed an AI product ecosystem consisting of a bottom layer, middle layer, and application layer. It boasts a comprehensive product matrix spanning entertainment to productivity scenarios, offering diverse application scenarios. When AI products are launched on basic applications, they can directly reach a large number of users, making Meitu a more systematic and scalable platform.

Meitu Beauty Camera can accurately grasp users' aesthetic needs, understand the three primary photography demands of young people today, and rapidly develop corresponding segmented functions, such as dewy skin, hairline enhancement, wrinkle removal, jawline shaping, and video beautification. Additionally, emerging technologies like AI portraiture, AI dancing photos, AI portrait refinement, and AI hair styling have helped Meitu Beauty Camera establish a certain product barrier.

This might explain why Samsung's new Galaxy S24 series has chosen to deepen its collaboration with Meitu once again. Through Meitu's MiracleVision large model, images can achieve professional levels in terms of lighting effects, color usage, and composition during the image generation process.

In particular, the "Doodle to Image" function leverages image recognition technology to accurately identify doodle content, making the generation process more precise and controllable. The "Text to Image Wallpaper" function supports various personalized settings, ensuring that each wallpaper possesses a unique artistic style.

At these levels, beauty apps are unlikely to be fully replaced by system cameras in the short term.

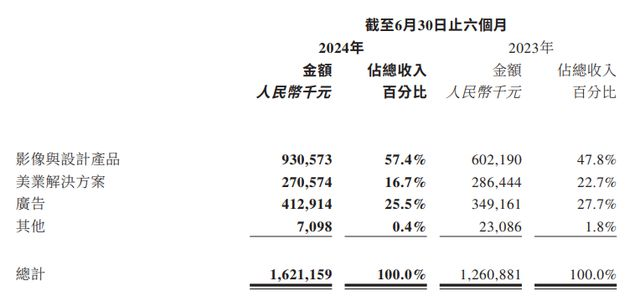

According to Meitu's 2024 interim report, the company's total revenue reached RMB 1.62 billion, a year-on-year increase of 28.6%. Adjusted net profit attributable to equity holders of the parent company amounted to RMB 270 million, up 80.3% year-on-year, with over 10.81 million paid subscribers, setting a new record high and a paid penetration rate of approximately 4.2%.

The primary drivers of the company's revenue growth are twofold. Firstly, by enhancing generative AI technology, Meitu has bolstered the capabilities of its imaging and design products, providing users with higher-quality image and video processing, visual creative design, and other functions, continuously driving user willingness to pay. Secondly, the company has achieved rapid global expansion, with Meitu's imaging products leading app store rankings in multiple countries outside mainland China, fostering dual growth in user numbers and subscriptions.

In the first half of 2024, Meitu's revenue from imaging and design products, primarily driven by paid subscriptions, reached RMB 930 million, a year-on-year increase of 54.5%, accounting for 57.4% of total revenue. Advertising revenue amounted to RMB 410 million, up 18.3% year-on-year. Revenue from beauty industry solutions totaled RMB 270 million, while other revenues stood at RMB 7.1 million.

Subscription revenue primarily stems from membership packages offered within the apps. For example, VIP members of Meitu Xiuxiu's Pink Diamond membership can enjoy exclusive functions, advanced beauty tools, ID photo design and refinement, image quality restoration, exclusive templates, and other services. It also includes one-time payment features within the app, such as ID photo design.

The growth in subscription revenue is closely tied to the deepening application of AIGC (Artificial Intelligence Generated Content) in products. Besides one-time purchases, some AIGC functions are also included in VIP membership privileges, such as Meitu Xiuxiu's Doodle to Image function and the AI anime effect in the Wink app.

However, all of this is built upon Meitu's existing business foundation and the prevailing trend of AIGC.

Apart from smartphones, Meitu faces competition from numerous rivals, including apps under major players like Jianying, Qingyan, Yitian Camera, Tiantian Pitu, Xingtu, and more. How Meitu will respond to the dimensionality reduction attacks from major players in terms of product experience and AI technology capabilities, and whether it can meet consumer expectations, will be crucial tests.

02 Attracting C-end users and supporting B-end businesses: Has Meitu transformed into a "tool expert"?

According to a report by Fortune Business Insights, the AI image generation market size is projected to reach USD 917 million by 2030, with a compound annual growth rate of 17.4%. AI image and video generation have wide applications, rapidly gaining traction in digital art, illustration creation, visual element production for marketing materials, and various other fields like architectural design, graphic design, game development, and animation production.

Since QuestMobile released its rankings in 2016, Meitu Xiuxiu has consistently ranked first in its category, while Meitu Beauty Camera has also consistently ranked among the top in the photography category.

However, user scale is one thing, and paid user scale is another.

In fact, Meitu's C-end user base has been stagnant for a long time. In the first half of 2024, Meitu's monthly active users numbered 258 million, a year-on-year increase of only 4.3%, representing a decline of over 40% compared to the peak period in 2016.

Since 2022, Meitu's paid subscription business has surpassed advertising as its primary source of revenue, accounting for 37.5% of total revenue. By 2023, this business achieved a year-on-year growth of 52.8%.

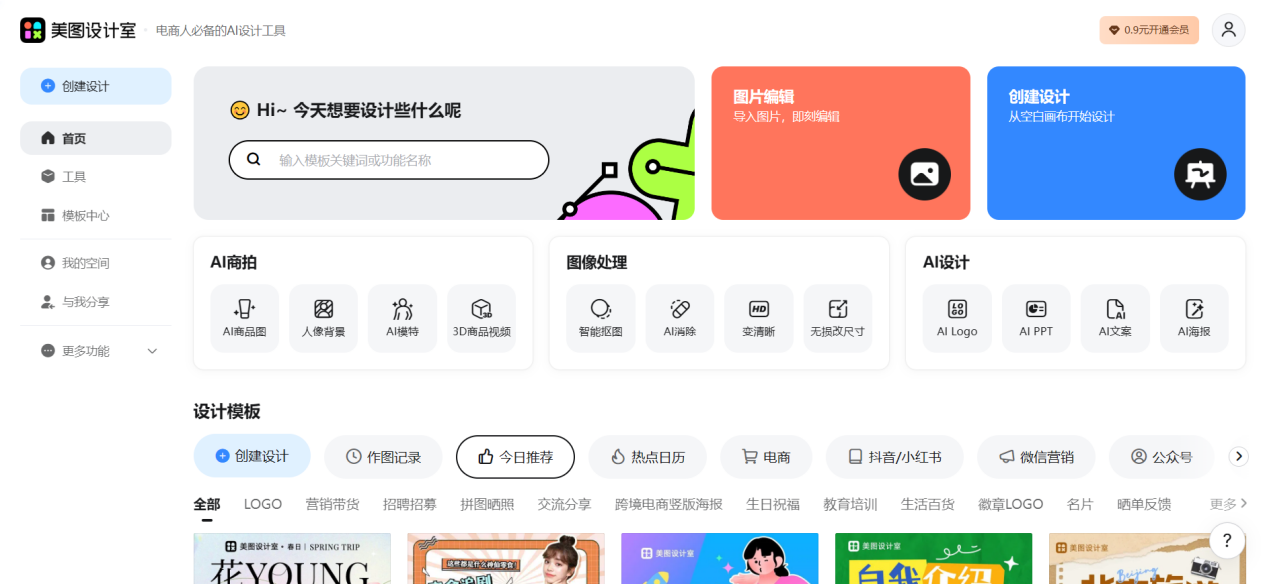

To tap into new user scenarios, Meitu unveiled seven AI products in June last year, including AI visual creation tool "WHEE," AI voiceover video tool "Kaipai," desktop AI video editing tool "WinkStudio," AI commercial design-focused "Meitu Design Studio 2.0," AI digital human generation tool "DreamAvatar," Meitu AI assistant "RoboNeo," and Meitu's visual large model "MiracleVision."

These seven new tools launched by Meitu signify a shift from C-end lifestyle scenarios to B-end productivity scenarios, with Meitu Design Studio standing out prominently. Not only does its AI-native workflow enable AI integration throughout the entire process of commercial photography, design, and marketing at just one-third the cost of traditional methods, but it also extends Meitu's solid C-end user base downstream to influencers, online sellers, media operators, and other small B-end users.

Li Shihan, an e-commerce designer, commented, "In the past, I had to manually cut out product images and spend a lot of time searching for background materials, focusing mainly on refinement. I could only produce a maximum of 15 images per day, whereas Meitu Design Studio can churn out 50. Now, most people I know in e-commerce enterprises or individual businesses in Yiwu are using it."

According to Meitu's financial report, the number of paid subscribers to Meitu Design Studio is approximately 960,000, with product revenue growing by 152% year-on-year. During Meitu's 2023 annual report conference call in March this year, it was revealed that Meitu Design Studio generated RMB 100 million in revenue for the entire year. Based on Meitu's total revenue of RMB 1.3 billion from imaging and design products in 2023, Meitu Design Studio contributed approximately 7.5% of this figure. Considering that the product has only been online for over two years, this is a remarkable performance.

Another notable product is Kaipai, an AI voiceover video tool launched in 2023, featuring AI script optimization and video editing functions that reduce the production time for high-quality voiceover videos to just 10 minutes. As of May this year, its monthly active user count approached 700,000, with over 40 million content creations accumulated.

At the individual user level, besides the traditional SaaS paid subscription model, AI has introduced a new token-based billing model. It is understood that Meitu is planning to launch a high-frequency AIGC (Artificial Intelligence Generated Content) one-time purchase payment system called "Meitu Beans." At the enterprise user level, new billing models have been added, including API call charges, usage-based procurement fees, and customized solution fees for large models.

Built upon AIGC technology, these products have further enriched Meitu's business service capabilities and product lines. The introduction of more high-value AI products has directly increased Meitu's gross margin, which rose from 56.9% in 2022 to 61.4% in 2023.

Overall, Meitu has made impressive strides in transitioning to a To B focus in China, achieving leading positions in niche segments such as voiceovers and e-commerce design. Overseas, however, Meitu has not focused on C-end efforts, primarily introducing AI functions to existing products, with only Vmake targeting the B-end market.

In its interim report for the first half of 2024, Meitu specifically highlighted Wink, which saw its MAU grow by 99% year-on-year as of June 30, 2024, with China, India, and Indonesia being its top three markets. However, Wink's total revenue for the first half of the year was USD 4.41 million, up 79% year-on-year, primarily sourced from domestic markets.

As a company with years of overseas expansion experience, failing to establish an earlier presence in higher-penetration overseas markets undoubtedly impacts its future commercialization capabilities. Finding breakthroughs in overseas markets will be a crucial strategy for Meitu in the coming years.

03 Conclusion

Amid the technological revolution sparked by generative AI, large models that provide foundational technical support and have broad applicability have become the focus of capital and industry giants. While Meitu positions itself as an application-layer service provider, avoiding direct competition with large internet companies, the prevalence of large models has significantly lowered the technical barriers for application-layer service providers, intensifying competition in this field.

Meitu has transformed into an AI-driven tool company. The stability, longevity, and sustainability of AI technology will significantly determine Meitu's future direction.

With a declining traffic base and a downward trend in advertising revenue, coupled with SaaS operations still incurring losses, Meitu's path forward remains fraught with challenges.