Xiaomi, OnePlus, vivo, and Honor, the new battle will ignite in September

![]() 09/03 2024

09/03 2024

![]() 551

551

This article is written based on public information and is intended solely for information exchange purposes and does not constitute any investment advice.

Since the 5G cycle, innovation in the smartphone industry has stagnated, with the sector essentially treading water for at least five years. AI is now being hailed as a potential game-changer and lifeline for the industry.

According to the latest news, Apple plans to hold its autumn product launch event on September 10, 2024. Based on previous teasers and announcements, it's clear that the focus of the event will be AI, and defining what an AI phone entails will be a key highlight. It is understood that iOS will receive its biggest update in a decade.

After a long drought, the introduction of AI phones promises to bring about significant change. The influx of attention and traffic will encourage the industry to envision a new cycle of device upgrades driven by AI.

However, we seem to have overlooked the broader implications, especially for domestic smartphone brands: Will the industry see a general uplift, or will it be a case of the new replacing the old?

01 The Challenges Are Greater Than Expected

Compared to smartphones from three or four years ago, there have been no significant performance improvements across major brands. Most people upgrade their phones not because they seek better products but because their old phones have become unusable.

Regardless of manufacturers' marketing claims, there are no secrets in the industry without technological innovation, leaving everyone on an even playing field.

Apart from Apple, user loyalty is low for all other smartphone brands, leading to an endless cycle of competition. Choosing a smartphone has become akin to selecting an air conditioner, with consumers ultimately deciding based on price among a myriad of specifications they may not fully comprehend.

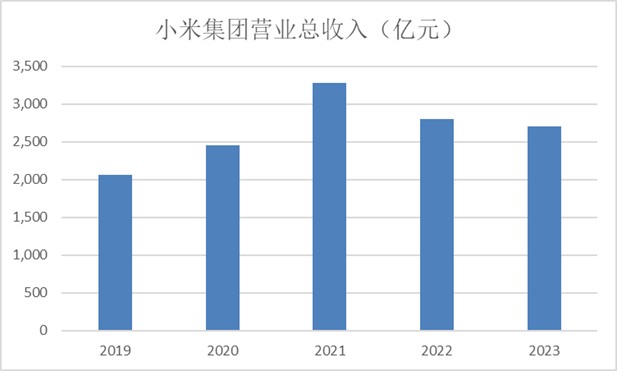

2021 marked the peak of the smartphone industry. Take Xiaomi Group, for example, its total revenue has fluctuated between 200 and 300 billion yuan over the past five years, with growth primarily driven by non-smartphone IoT products. Pure smartphone shipments have remained stable at 150 to 200 million units for several years.

OPPO, VIVO, and Honor, though not publicly listed, have fared no better than Xiaomi in the past three years.

Source: Company Financial Reports

1) The Dream of Total Growth Shattered

Before AI sparked innovation expectations, the challenges faced by domestic smartphone manufacturers were even greater than reflected in their financial data.

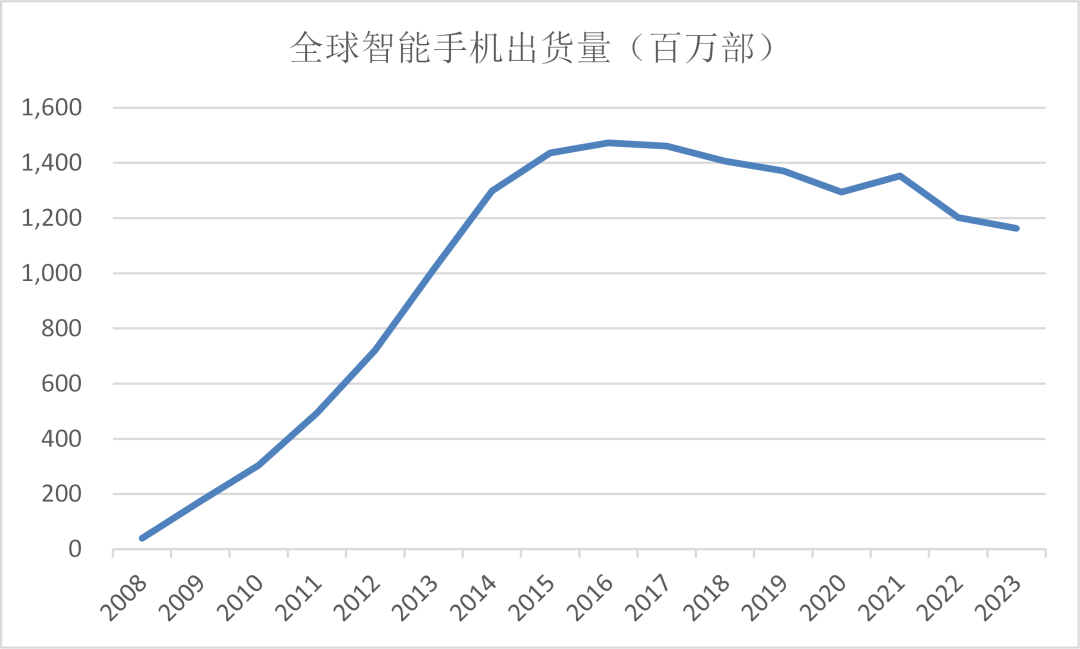

As early as 2016, global smartphone shipments peaked at 1.47 billion units before embarking on a steady decline over the following seven years. During this period, only Apple, partially aided by Huawei's sanctions, managed to demonstrate its brand value and moat.

All other domestic brands engaged in a game of share swapping, with short-term gains for individual models quickly eroded by competitors offering similar products at lower prices.

There are few technical secrets among brands. What is lesser known is that over half of Android phone models rely on the same contract manufacturers for R&D and design, akin to eating pre-cooked meals at different restaurants.

Source: IDC

2) The End of Structural Innovation

Why hasn't the smartphone industry felt as dire as the declining shipments suggest? The industry turned to the concept of 'micro-innovation.' For example:

Phone chip process technology has advanced from 14nm to the latest 3nm, indirectly driving TSMC's prosperity. Phone storage has increased from 64GB to 1TB, boosting Hynix's performance.

Improvements in communication quality, from 4G to 5G, have increased demand for PCB, RF components, and inductors.

Screen and camera innovations include foldable displays with various folding mechanisms and camera upgrades from single to dual and finally to multi-lens systems.

Despite declining shipments, manufacturers piled on unnecessary features and raised prices for mid-to-high-end models. While this brought structural opportunities to the supply chain, it was a short-sighted approach to maintaining revenue growth.

Micro-innovations eventually backfire. Camera upgrades have plateaued, with Xiaomi 14 Ultra sparking controversy for resembling a digital camera with phone capabilities. The industry even saw a resurgence in refurbished phones, blurring the lines between smartphones and household appliances.

Without further innovation, we can confidently conclude that the decline in smartphone shipments represents a slow-motion suicide for the Android ecosystem.

02 Good News: AI Truly Transforms the Core of Smartphones

1) Does AI Need Smartphones as a Carrier?

Debates rage on how AI can be commercially applied, with various hardware options including cars, computers, glasses, phones, speakers, and watches. Why focus solely on smartphones?

The debate has effectively ended with Apple's partnership with OpenAI. At WWDC24, Tim Cook announced a deep collaboration with OpenAI, integrating ChatGPT powered by GPT-4o into all Apple operating systems, including iOS, iPadOS, and macOS. Users can connect their ChatGPT accounts and access paid features directly within Apple's ecosystem. This partnership addresses both companies' needs: OpenAI lacks application scenarios, while Apple lacks a high-quality large model.

Smartphones, with mature hardware, operating systems, and ecosystems, offer the ideal platform for AI to reach billions of users and form a closed-loop business model.

In 2023, OpenAI generated $2 billion in revenue, with optimistic projections of $5 billion in 2024. However, this is insufficient to sustain the company's expenses, despite Microsoft's support. AI integration into smartphones could generate a disruptive impact.

Google's partnership with Apple serves as a comparable example. Google pays an estimated $15 billion annually to maintain its default search engine status on Apple devices, generating over $300 billion in search-related revenue after deducting costs.

If OpenAI achieves similar success with Apple, it could directly increase its revenue by over $10 billion. This speculation is fueled by Apple's announcement of potentially charging a monthly fee of around $20 for advanced AI features in Apple Intelligence.

A simple calculation shows that if 10% of Apple's 1.5 billion users opt for this service, it would generate $36 billion annually. If half of this revenue went to OpenAI, it would amount to over $10 billion.

2) What Changes Can AI Bring to Smartphones?

Beyond the viable business model, users are keen to know how AI will transform their smartphone experience. AI phones are expected to offer features like meeting transcription, real-time effects rendering, simultaneous interpretation, intelligent photo editing, and email management, enhancing efficiency and providing novel experiences. However, these are merely surface-level changes.

The essence of a smartphone lies in its interaction model. Smartphones replaced feature phones by transforming interaction from buttons to touch screens. Apple's Siri failed due to weak voice interaction capabilities.

AI touches the soul of smartphones by revolutionizing their interaction model, shifting from passive input to active, interactive, and multimodal communication. Your smartphone could become your personal AI assistant.

02 Bad News: AI May Prove Toxic for Domestic Smartphone Manufacturers

From the second half of this year to the first half of next year, AI phone penetration is expected to challenge the 10% threshold. If the transformation in interaction models proves successful, AI phone penetration could rapidly reach 50% within three years.

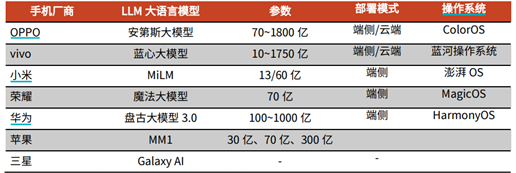

On paper, all major smartphone manufacturers seem poised to embrace this change, each with their own large language models and operating systems. However, Android brands may face greater pressures than opportunities.

If traditional competition were scored on a 100-point scale, Apple would score 100, while Android brands, despite catching up from 60 to 90 points amidst declining shipments, may struggle further with AI, raising the game's difficulty to 200 points.

Figure: Comparison of Edge-side Model Parameters Among Different AI Phone Manufacturers Source: Everbright Securities

1) The Real Reason for Apple's Innovation Surge

Historically, Apple invested heavily in AI but made a strategic misstep by overlooking large models, considering them valuable only for search. However, the emergence of intelligence in large models prompted Apple to recognize its error.

In mid-2024, Apple emerged from its struggles with automotive and MR projects to focus solely on AI. By integrating external large models like OpenAI, Apple completed its AI puzzle and returned to the right track.

Unlike other manufacturers using AI as a gimmick, Apple envisions AI restoring the most natural forms of interaction, transcending passive structured commands.

To achieve this, Apple has outlined a ten-year vision divided into three phases:

Phase 1: The Siri phase focuses on voice interaction. iOS 18, set for a major update this year, will transform Siri into an intelligent control center using AI architecture.

Phase 2: Leveraging external and internally trained multimodal large models, Apple aims to solve traditionally challenging image and text processing tasks with AI, aided by hybrid cloud computing power. Full AI integration is expected in the iPhone 18 series.

Phase 3: Over the next decade, AI will become an integral part of Apple's operating systems, understanding the world and users' needs with genuine intelligence.

Beyond strategic differences, Apple holds more technical advantages. Enjoying the benefits of the low-power ARM ecosystem, Apple maximizes the use of proprietary IP, integrating it with its operating system and cutting-edge manufacturing processes. Theoretically, Apple can support the largest models on the edge side, estimated at up to 50 billion parameters.

AI's premium pricing will initially target high-end devices. With a 20% market share and a loyal customer base willing to pay for premium features, Apple is well-positioned.

Apple's definition of AI as an innovative interaction model, coupled with its high success potential and viable business models, underpins its record-high market valuation.

2) Can Android Brands Compete? The Gap Widens

Amidst the AI phone wave, while all manufacturers claim to prioritize AI, the reality is that performance lags and strategic neglect put Xiaomi and others at a disadvantage compared to Apple.

Unlike Apple's ecosystem approach, Android relies on a fragmented ecosystem with Qualcomm/Mediatek for chips, Google for operating systems, and OVM for products. Each link falls short of Apple, compounding the disparity.

Performance gaps can be bridged over time, but strategic missteps can lead to failure despite efforts.

Xiaomi stands out for its strategic deviation. While Apple focuses on interaction model innovation, Xiaomi's latest financial report emphasizes an 'Ecosystem of People, Cars, and Homes' strategy, reminiscent of outdated approaches.

Source: Xiaomi Group 2024 Interim Report

Xiaomi's understanding of AI remains superficial, positioning it as an added feature for phones, cars, and IoT products, without mentioning interaction model innovation.

Source: Xiaomi Group 2024 Interim Report

Xiaomi's supply chain prowess is undeniable, evidenced by its successful automotive venture. However, Lei Jun's initial rationale for entering the automotive industry—that cars would siphon smartphone technology—has shifted as AI has emerged as the cutting-edge technology, as evidenced by Apple's decision to halt its automotive projects to focus on AI.

So in 2024, Apple will introduce Apple Intelligence, while Xiaomi will still focus on human, vehicle, and home. Apple wants to grasp the revolution of interaction modes, while Xiaomi wants to expand application scenarios and defines AI as an empowerment tool.

Due to the great success of Xiaomi SU7, we are also optimistic about the competitiveness of Xiaomi Automobiles. The investment in automobiles will definitely take up too much of Xiaomi's energy. It won't be easy to turn around in the future.

If Xiaomi struggles to respond, OPPO, VIVO, and Honor may not fare much better. Apart from their less close relationship with Qualcomm compared to Xiaomi, these brands are not listed and have cross-shareholding with the supply chain, which leads them to pay more attention to cash flow and profits. This will only hinder their R&D investment efforts.

Some people will surely mention Transsion, which is completely out of competition. It makes low-to-mid-end mobile phones with an average price of less than $150. Will it bring us surprises with its "inclusive AI"? We suggest not to have too high expectations. For Transsion, let's not even talk about the technical feasibility. Since AI is bound to increase the daily use cost of mobile phones, it will take at least five years before it can penetrate into low-end mobile phones.

If we look back at the past seven years, when the growth rate of total mobile phone sales declined, Xiaomi and other companies managed to maintain their market share through cost-effectiveness, channels, marketing, and other means, achieving great success in global sales of domestic mobile phones. However, facing the next decade, AI has awakened Apple, the sleeping lion.