Double-faced Huang Zheng, do not seek paper wealth

![]() 09/03 2024

09/03 2024

![]() 469

469

Written by Leon

Edited by Hou Yu

Shanghai Jin Hongqiao International Center is a high-tech high-end office building and the registered address of Shanghai Xunmeng Information Technology Co., Ltd., the operating entity of Pinduoduo.

Unlike other major internet companies, there are no Pinduoduo signs or logos visible on the building. This approach is consistent with the usual style of founder Huang Zheng.

After stepping down as CEO of Pinduoduo in 2020, Huang Zheng rarely appeared in the public eye. However, this did not prevent him from becoming China's richest man. On August 8, the Bloomberg Billionaires Index showed that Huang Zheng topped the Chinese rich list with a fortune of $48.6 billion (approximately RMB 345.1 billion), ending Zhong Shanshan's four-year reign at the top of the list.

However, paper wealth and media spotlight might be seen by Huang Zheng as an unbearable burden.

Pinduoduo executives "bearish" on the company

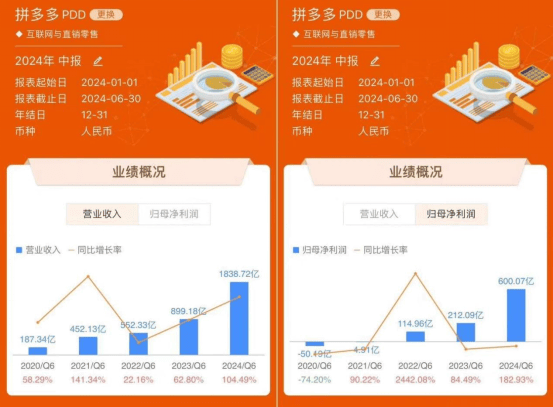

On August 26, Pinduoduo released its financial report for the first half of 2024. During the reporting period, Pinduoduo's revenue reached RMB 183.872 billion, an increase of 104.49% year-on-year; net profit attributable to shareholders was RMB 60.007 billion, an increase of 182.93% year-on-year. Undoubtedly, this is a very impressive performance, far surpassing peers in terms of growth and profitability.

Surprisingly, Pinduoduo's executives collectively expressed a "bearish" outlook on the company during the earnings call. Zhao Jiazhen, executive director and co-CEO of Pinduoduo, said that increased competition was the main theme in the e-commerce industry, and high revenue growth was unsustainable.

Chen Lei, Chairman of the Board and Co-CEO of Pinduoduo, stated that the company's profit growth over the past few quarters was a result of the misalignment between short-term investment cycles and financial reporting cycles and should not be viewed as a long-term trend. Chen Lei also announced that Pinduoduo would not conduct any share repurchases or dividends in the coming years.

The next day, Pinduoduo's U.S. shares (PDD) plummeted nearly 30%, falling from $139.87 per share to $99.23 per share. At the close, Pinduoduo's market value was $138.8 billion, a decrease of $55.4 billion from the previous trading day's value of $194.2 billion. In just 18 days, Huang Zheng's "China's richest man experience card" expired.

Typically, a listed company would strive to present its financial performance in the best possible light to protect the interests of shareholders and investors. Pinduoduo's "self-exposure" was clearly unusual.

According to Qichacha, Huang Zheng is still the actual controller of Pinduoduo and holds 100% voting rights. The statements made by senior executives must have been approved by Huang Zheng. The question arises: why would Huang Zheng "short" the company he founded?

Being China's richest man is not easy

Industry insiders perceive Huang Zheng as a typical tech-savvy male, low-key and quiet, not fond of socializing. Apart from a few interviews during his tenure as CEO of Pinduoduo, Huang Zheng is indeed not often seen in public, and other senior executives at Pinduoduo never participate in any forums, summits, or other public events.

This low-key approach contrasts sharply with that of Huang Zheng's predecessors, such as Jack Ma, who loves to give speeches, and Lei Jun and Zhou Hongyi, who excel at "internet celebrity-style marketing," not to mention Dong Mingzhu of Gree Electric, who remains in charge at the age of 70. It seems that the post-80s generation, represented by Huang Zheng and Zhang Yiming, prefer to withdraw from the limelight and stay behind the scenes.

So, does Huang Zheng really dislike being China's richest man? Not necessarily. In a 2018 interview with Caijing, Huang Zheng was asked about his motivations for founding Pinduoduo after achieving financial freedom. He responded, "In layman's terms, starting this company was more about seeking a sense of presence. When you create something that others find impressive, unique, and worthy of respect, it gives you a sense of accomplishment."

Seeking both a sense of presence and remaining low-key may seem contradictory. However, it could be understood that the sense of presence is Huang Zheng's genuine desire, while his low-key demeanor stems more from an instinct to avoid harm.

Huang Zheng is an intelligent man who may realize that the label of "China's richest man" brings more disadvantages than advantages.

In fact, Huang Zheng's predecessors have provided ample case studies. Wang Jianlin and Jack Ma need no introduction. Zhong Shanshan, who held the title of China's richest man for the longest time, was once at the center of public scrutiny.

On one hand, "benfen" (duty and responsibility), on the other, a "wolf mentality"

In this light, Huang Zheng is a double-faced figure. Indeed, Huang Zheng is a complex character. "Benfen" (duty and responsibility) is another label associated with Huang Zheng, a term he has mentioned frequently in interviews. Those familiar with the mobile phone industry may find this term familiar, as it is also the core value of OPPO, derived from Duan Yongping, the founder of Little Genius and an early investor in OPPO and vivo.

While working at Google in the United States, Huang Zheng met his mentor Duan Yongping, who even took Huang to Warren Buffett's annual lunch, demonstrating his high regard for Huang. As a result, Huang Zheng adopted "benfen" as the company's core value and elaborated on it in the prospectus before Pinduoduo's 2018 IPO.

At its core, Pinduoduo's values embody "benfen." However, in practice, the company is often associated with a controversial "wolf mentality."

Firstly, the "996" work schedule has long been a hallmark of China's internet and technology companies, and Pinduoduo is no exception, with even more intense workloads and an iron-fisted management style.

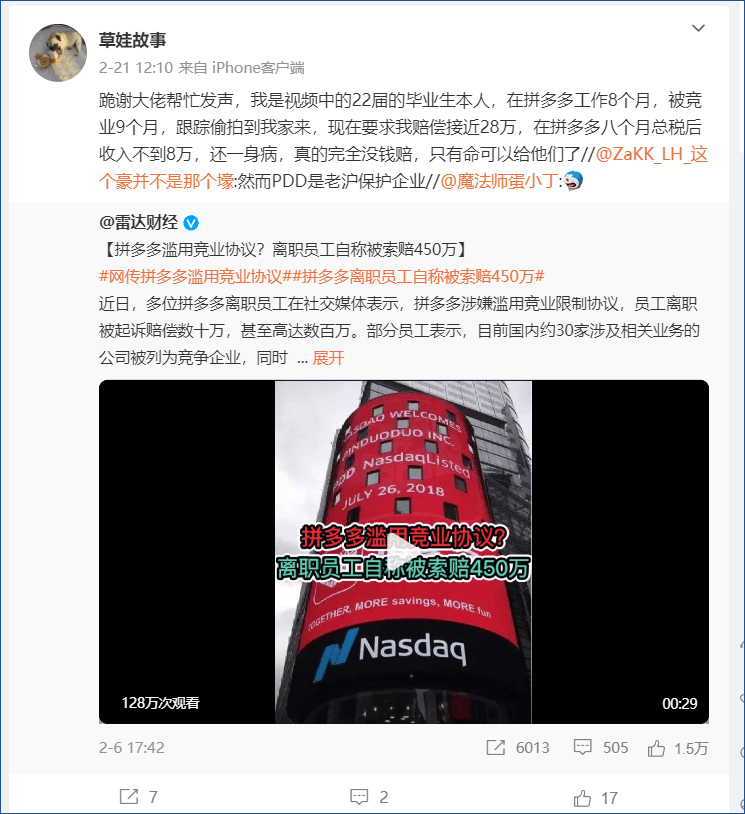

In addition, Pinduoduo's non-compete agreements have been controversial. In February this year, several former Pinduoduo employees took to Weibo to publicly demand their rights, alleging that the company had abused non-compete agreements and demanded exorbitant damages. One former employee, whose Weibo handle is "Coding Cat 2018," stated that during his four-year tenure, he worked over 300 hours per month, often leading to burnout and ultimately prompting him to resign. Subsequently, he received a demand for RMB 4.5 million in damages from Pinduoduo for allegedly violating the non-compete agreement.

Pinduoduo's assertiveness is also evident in its treatment of small and medium-sized sellers, with strict store operation rules and severe penalties for non-compliance, including heavy fines and frozen payments. Coincidentally, on the same day that Pinduoduo released its interim report, a woman knelt outside the Guangzhou office of Temu, a subsidiary brand of Pinduoduo, begging for the return of fines and frozen payments, drawing a crowd.

Such incidents are not uncommon for Pinduoduo. In June 2018, dozens of Pinduoduo sellers protested outside the company's headquarters in Shanghai, with some claiming to have been fined RMB 90,000 for quality issues and having RMB 400,000 in payments frozen for three years.

Under public pressure, Pinduoduo held a press conference, where Huang Zheng told the media, "All fines imposed by Pinduoduo are paid to consumers. Pinduoduo does not profit from them." He also emphasized that user funds first enter a third-party escrow account before being transferred to merchants, and that Pinduoduo does not touch the funds.

However, despite such statements, tensions between Pinduoduo and merchants have escalated with the introduction of the "only refund" policy and the overseas subsidiary brand Temu.

To reduce costs, Temu adopts a "fully managed" model for domestic merchants, where merchants only participate in product selection and pricing, shipping products to Temu's warehouse in Guangzhou. Temu handles overseas sales, logistics, and after-sales services.

As a result, Temu has significant control over after-sales issues and tends to favor consumers in cases of overseas customer complaints, including offering refunds without requiring the return of products. However, merchants face frequent fines, frozen deposits, and payments. One merchant reported being fined 1,882 times in a single month on Temu.

As a result, Temu's Guangzhou headquarters has become a focal point for merchant protests. According to incomplete statistics, there have been protests of varying sizes by merchants in October 2023 and May, July, and August 2024. Angered merchants have even stormed into Temu's offices to demand answers.

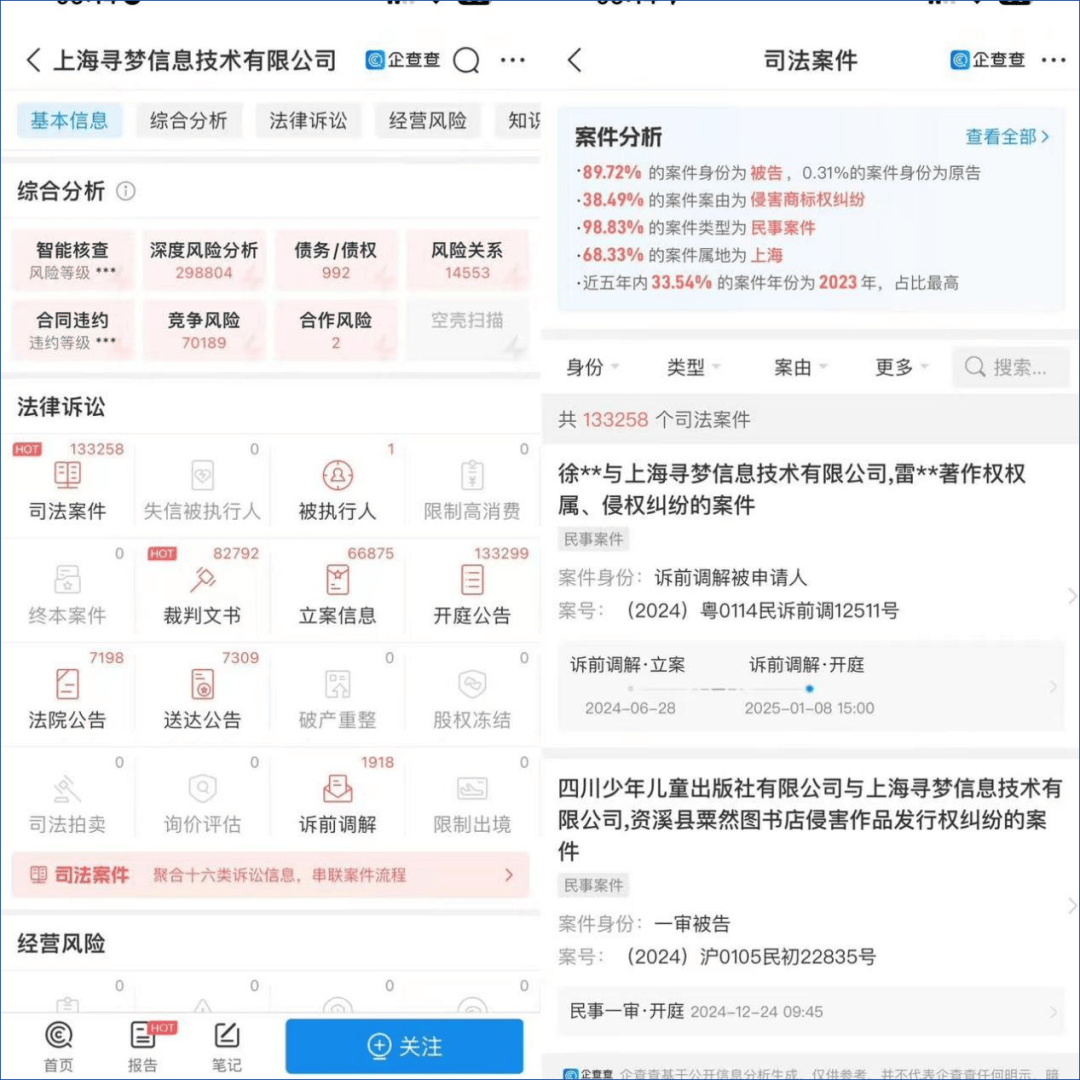

According to Qichacha, Pinduoduo's operating entity, "Shanghai Xunmeng Information Technology Co., Ltd.," has been involved in as many as 133,258 legal cases, with 89.72% of them involving the company as the defendant. Cases include civil disputes and trademark infringement, with 33.54% of them occurring in 2023.

There is undoubtedly a significant disconnect between Pinduoduo's stated values and its actual corporate style. From the outside, Huang Zheng appears to be a complex and contradictory figure.