China Telecom: weakened customer acquisition capabilities, and the "second pillar" has yet to be formed

![]() 09/04 2024

09/04 2024

![]() 602

602

Recently, China Telecom (601728.SH) released its semi-annual report for 2024. During the reporting period, the company achieved an operating revenue of RMB 266 billion, representing a year-on-year increase of 2.8%; net profit attributable to shareholders was RMB 21.8 billion, up 8.2% year-on-year.

Stockstar has noticed that behind the company's seemingly double-digit growth in both revenue and profit lies the hidden challenge of decelerating growth rates.

Upon further analysis, it was discovered that the company's core communication business has shown signs of weakness and lacks standout performance. New businesses centered on AI, big data, cloud services, etc., currently account for a relatively small proportion and have yet to emerge as the company's "second pillar." Critically, under intense industry competition and the impact of price wars, the growth momentum of the company's cloud services business has gradually weakened.

Moreover, China Telecom's asset-liability situation is also concerning. In recent years, the company's asset-liability ratio has been climbing year after year. As of the end of June this year, this indicator was higher than that of its peers, and monetary funds were insufficient to cover short-term debts.

01. Weak growth in revenue and net profit

Public information indicates that China Telecom primarily engages in comprehensive information services such as fixed-line telephony, mobile communications, satellite communications, Internet access, and applications.

Overall, China Telecom's growth rate is slowing down. From the first half of 2023 to the first half of 2024, the company's revenue was RMB 258.679 billion and RMB 266 billion, respectively, representing year-on-year growth rates of 7.68% and 2.8%. Net profit attributable to shareholders was RMB 20.153 billion and RMB 21.8 billion, respectively, up 10.18% and 8.2% year-on-year.

It should be noted that this trend is not unique to China Telecom but is a common challenge faced by domestic telecom operators.

From an industry perspective, according to the Ministry of Industry and Information Technology's "Economic Operation of the Telecommunications Industry in the First Half of 2024" report, telecom business revenue totaled RMB 894.1 billion in the first half of this year, a year-on-year increase of 3%. This growth rate represents a sharp decline compared to the 6.2% recorded in the same period last year.

In particular, the sluggish growth of traditional mobile voice and mobile data traffic services stands out. Data shows that in the first half of this year, mobile data traffic, which accounted for nearly 40% of telecom industry revenue, generated RMB 328 billion in revenue, a year-on-year decrease of 2.3%. Mobile voice service revenue reached RMB 55.24 billion, down 3.4% year-on-year.

Reflecting on China Telecom's performance, the company's service revenue was RMB 246.2 billion in the first half of this year, up 4.3% year-on-year, a slowdown compared to the 6.6% growth rate in the same period last year. Furthermore, Stockstar has noticed that the company's customer acquisition capabilities are weakening.

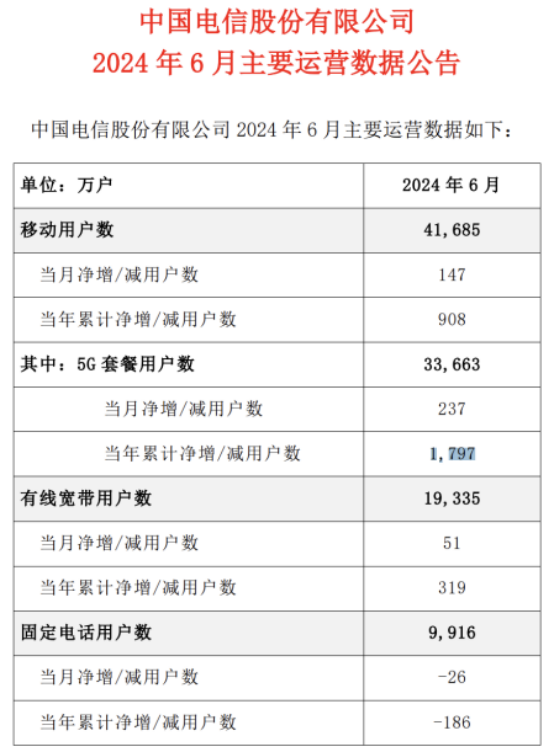

In the first half of 2024, China Telecom's mobile subscriber base reached 417 million, with a net increase of 9.08 million. In comparison, the net increase in the same period last year was 10.73 million. Both the net increase in 5G network customers and wired broadband subscribers slowed down, while the company's fixed-line telephone subscriber base declined by 4.02 million compared to the same period last year.

Industry insiders point out that while customer acquisition speed and scale in the telecom industry may not be as robust as in the past, operators still have room for refinement in their package and pricing strategies.

02. Slowdown in growth of cloud services business

Amidst sluggish growth in traditional telecom services, China Telecom is accelerating its digital transformation. Data shows that in the first half of 2024, the three major telecommunications enterprises actively developed emerging businesses such as IPTV, Internet data centers, big data, cloud computing, and the Internet of Things, generating a total revenue of RMB 227.9 billion, up 11.4% year-on-year.

However, in terms of revenue composition, China Telecom's traditional business still accounts for up to 70% of total revenue, with new businesses making up a relatively small proportion. In the first half of this year, the company's industrial digital revenue reached RMB 73.7 billion, accounting for 30% of service revenue and yet to emerge as the company's "second pillar."

Moreover, the growth momentum of the company's emerging businesses has noticeably slowed down. In the first half of this year, the company's industrial digital revenue grew by 7.2% year-on-year, a significant slowdown compared to the 16.7% growth rate in the same period of 2023. Notably, the revenue growth of the company's cloud service, Tianyi Cloud, declined by 43 percentage points year-on-year, with revenue amounting to RMB 55.2 billion.

The significant slowdown in growth for this business is related to intense market competition.

Currently, the domestic cloud services market is highly competitive. In addition to traditional Internet cloud vendors such as Alibaba Cloud and Tencent Cloud, which continue to grow and occupy leading positions in technology, service, and market share, they also continuously invest resources in innovation and expansion. Meanwhile, technology companies like Huawei Cloud are also making inroads into the cloud services sector, leveraging their technological advantages and industry solutions to compete for market share. Furthermore, foreign cloud service providers are also attempting to enter the Chinese market, all of which exert tremendous competitive pressure on domestic cloud services businesses.

Moreover, to compete for customers and market share, cloud service providers have engaged in a "price war." In March of this year, Alibaba Cloud took the lead in launching a significant price reduction on its official website, covering over 100 products and more than 500 product specifications, with an average price reduction of up to 20%. Moreover, Alibaba Cloud actively pursued multiple action plans through direct sales and telesales channels, attracting customers with ultra-low discounts. JD Cloud followed suit shortly after Alibaba Cloud's price reduction, while Tencent Cloud promoted sales through activities such as "flash sales" and "coupon packs."

03. Asset-liability ratio climbing year after year

Stockstar has noticed that China Telecom's asset-liability ratio has been climbing year after year, reaching a level higher than its peers by the end of June 2024.

Specifically, at the end of each reporting period from 2021 to 2023, China Telecom's asset-liability ratio was 43.43%, 45.97%, and 46.5%, respectively, showing a gradual increase. By the end of June 2024, the company's asset-liability ratio had climbed further to 47.11%, higher than China Mobile's 32.11% and China Unicom's 44.91%.

At the same time, China Telecom's solvency performance is average among its peers. In the first half of 2024, the company's current ratio was 0.61, lower than China Mobile's 0.96 and China Unicom's 0.67.

Among current liabilities, China Telecom's accounts payable and notes payable account for a relatively high proportion. As of the end of June 2024, the company's combined accounts payable and notes payable amounted to RMB 162.739 billion, an increase of 11.56% from the beginning of the year, accounting for nearly 50% of current liabilities. Specifically, the company's notes payable increased by 115.86% from the beginning of the year to RMB 16.392 billion. The company attributed this significant increase in notes payable to the rise in service fees, engineering, and equipment payments settled through notes.

Stockstar notes that as of the end of June 2024, the company's combined monetary funds and trading financial assets amounted to RMB 100.754 billion, indicating that the company's on-book funds are insufficient to cover short-term debts. (First published on Stockstar, written by Li Ruohan)

- End -