Li Xiang refuses to bow to capital

![]() 09/04 2024

09/04 2024

![]() 495

495

Without the market, capital will eventually leave you, and only by firmly grasping the market can you have a future

Text

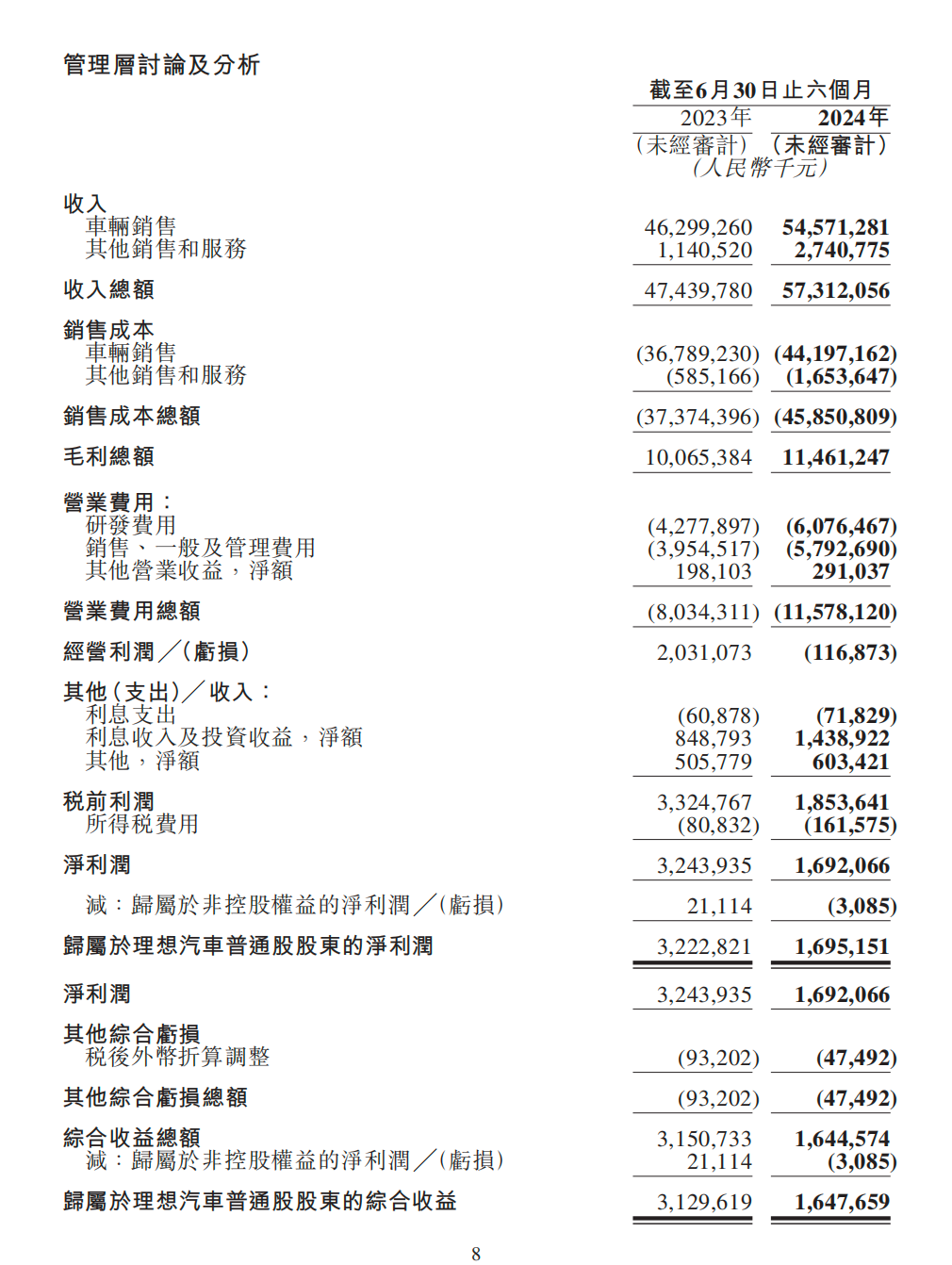

Recently, Lixiang One officially announced its second-quarter financial report, and the data is undeniably impressive.

Let's start with some core figures:

In terms of revenue, it reached 31.7 billion yuan, a year-on-year increase of 10.6%, setting a new high;

In terms of deliveries, 108,600 vehicles were delivered in the quarter, a year-on-year increase of 25.5%;

In terms of profits, and has achieved seven consecutive quarters of profitability, with an adjusted net profit of 1.5 billion yuan in Q2 and a quarterly gross margin maintained at a healthy level of 19.5%.

Great. Really great.

However, something interesting happened. While the financial report data was impressive, the capital market did not seem to buy it.

On the day the financial report was released, Lixiang Auto ADR fell 16.12%.

Why is that?

Revenue soars, but profits plummet

An important reason is related to Lixiang's profitability performance.

Although Lixiang remained profitable in the second quarter, its profitability fell short of analysts' expectations, with profits halving by 52% year-on-year, and the second quarter's profit mainly came from investment income.

What do you mean by investment income? Financial management.

Earning money through financial management. Hmm. It's somewhat embarrassing for a physical enterprise. Of course, it can also indicate that Lixiang has good fund management.

But why did profits plummet despite a significant increase in revenue? Because Lixiang cannot achieve both profits and sales at the same time.

In March this year, after the launch of Lixiang MEGA, sales were sluggish, which directly dragged down Lixiang's profitability calculations. Coupled with the mediocre market performance of the L series, Lixiang had to resort to price attacks and choose to lower prices.

Maintaining sales by lowering prices.

The entire L7, L8, and L9 series saw price reductions of 18,000 to 20,000 yuan, while MEGA saw a 30,000 yuan price cut.

Then the "budget version" L6 was launched, driving up Lixiang's sales once again.

This series of measures led to a gradual recovery in sales, and by July, Lixiang Auto's sales returned to over 50,000 for the first time in half a year, with monthly deliveries reaching 51,000 units, a year-on-year increase of 49.41%.

As a result, Lixiang's sales and revenue were secured. But profits? Hmm. Not so ideal.

However, this may not be the only reason for Lixiang's cold reception in the capital market, as the financial report also reveals other hidden concerns about Lixiang's future.

Pure electric Lixiang, currently somewhat awkward

The financial report also shows that as of Q2, Lixiang's charging network has surpassed 700 stations, ranking first among automakers in terms of self-built high-speed supercharging stations.

Obviously, this is Lixiang paving the way for pure electric models.

Last year, Lixiang announced that by 2025, it will form a product lineup consisting of "1 super flagship + 5 extended-range electric models + 5 high-voltage pure electric models," positioning pure electric and extended-range models equally strategically.

However, for now, whether this goal can be achieved remains to be seen.

Why? The most direct reason is that the market is not willing to pay for Lixiang's pure electric models. Or, perhaps Lixiang's extended-range technology cannot be perfectly replicated in the pure electric field.

Lixiang has always followed an extended-range technology route, so it is natural to assume that compared to other new energy vehicle manufacturers, Lixiang's technological accumulation in the pure electric field is hardly outstanding.

So what can be done? Invest heavily in research and development.

As a result, we see that Lixiang invested another 3 billion yuan in research and development in the second quarter.

However, investments in areas such as battery, motor, and controller technology and charging infrastructure are unlikely to yield immediate results, so operational pressures and growing pains are inevitable.

It must be acknowledged that this is the right path, and one that Lixiang has resolutely chosen.

How competitive can a refrigerator, TV, and large sofa really be?

However, these difficulties mentioned above can at most be considered short-term and medium-term growing pains.

The crucial question that Lixiang must answer is what its core competitiveness truly is.

What do you mean by that?

At this stage, virtually every brand needs to establish its brand image through its core strengths.

Considering only NIO, XPeng, and Lixiang.

NIO's core competitiveness lies in its service and battery swap technology. Battery swap is unique among new energy vehicle manufacturers, and although its feasibility is yet to be determined, it is at least a viable approach.

XPeng's core competitiveness, on the other hand, lies in autonomous driving and cost control. This is also related to scale; for example, XPeng's recently launched MONA M03 is priced close to 100,000 yuan but still manages to turn a profit. Such cost control capabilities are crucial in today's price war environment.

And Lixiang? After much searching, it seems that product strength and unique product positioning are currently Lixiang's biggest brand characteristics. For users, this translates to refrigerators, sofas, and large TVs.

But. But. Can these really be considered core competitiveness?

Are these things that only Lixiang can do and other automakers cannot?

With domestic brands increasingly focusing on interior design and product strength, how long can Lixiang maintain its product strength advantage? Or, if other brands start targeting Lixiang's positioning, will Lixiang be able to withstand the competition?

Certainly, we can see that Lixiang is continuously strengthening its barriers through technology investment.

However, it must be acknowledged that with Xiaomi's entry, the door to the new energy vehicle market has essentially closed. With the door shut, the elimination round has officially begun. Yu Chengdong previously stated that there will ultimately only be five domestic new energy vehicle manufacturers left, which may not be an alarmist statement.

Nevertheless, it is evident from this financial report that Li Xiang is leading Lixiang to face this future battle, unswayed by short-term capital fluctuations and committed to doing the right thing.

Blessings.