Consumer electronics peak season approaching, multiple indicators indicate an upturn in the semiconductor industry

![]() 09/04 2024

09/04 2024

![]() 472

472

From September to October, the major mobile phone manufacturers will hold a concentrated period of new product launches. On September 10th, Apple will hold a new product launch conference at 1 am, announcing the new iPhone 16 series, the new generation Apple Watch Series 10, and the new AirPods earbuds. On the same day, at 2:30 pm, Huawei will hold a launch conference for its extraordinary brand event and HarmonyOS intelligent driving products. This also means that the two major manufacturers will face direct competition with their new products.

[End-user demand drives supply chain recovery]

September is traditionally the peak season for consumer electronics. The launch of new products not only attracts consumers' attention but often triggers a wave of device upgrades, further stimulating market demand.

Taking Apple as an example, according to supply chain information, the iPhone 16 series is stocked with 88 to 90 million units. Apple Intelligence is expected to empower the iPhone 16, accelerating the device upgrade cycle. In other words, Apple Intelligence allows the market to envision the potential for increased iPhone ownership.

Guoyuan Securities estimates iPhone sales for 2025. Assuming a base of 1.5 billion units in ownership and a cautious upgrade rate of 17% under the influence of Apple Intelligence, this corresponds to 255 million iPhone sales in 2025, representing a year-on-year increase of 11.4% in shipments over 2024.

At the same time, it also means that supply chains and manufacturers have already begun the intense stockpiling phase beforehand to ensure they can meet the upcoming holiday shopping season's demand. Based on historical data, sales during this period tend to show significant growth, making September a crucial time of year for both retailers and manufacturers.

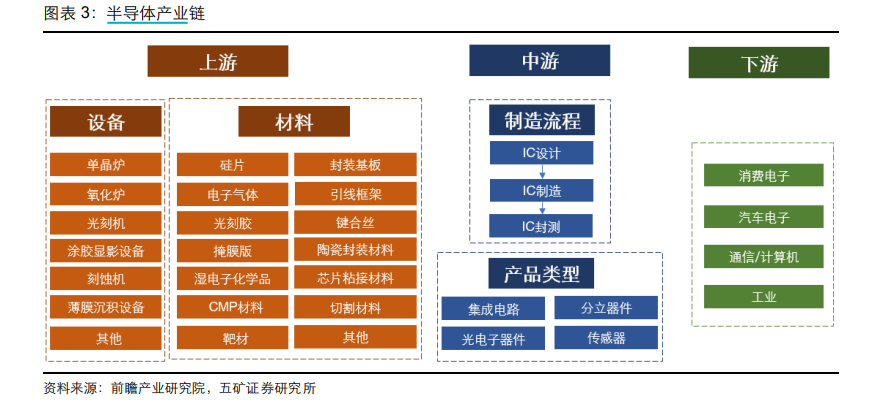

As seen in the supply chain diagram below, consumer electronics can be considered products at the application level, targeting end-users and providing various functions and services. One of the core technologies supporting the operation of consumer electronics is semiconductor technology, a crucial infrastructure in the entire electronics supply chain. Semiconductor manufacturing encompasses multiple stages, including chip design, manufacturing, packaging, and testing. The upstream supply chain of the semiconductor industry primarily consists of semiconductor materials and equipment, which serve as essential pillars for chip manufacturing and determine the performance of the chips.

[Multiple indicators validate the recovery of the semiconductor industry]

Given that semiconductors are upstream of consumer electronics, the cycles of these two industries are correlated. From a simple supply and demand perspective, changes in demand in the consumer electronics market directly impact production plans in the semiconductor industry. For example, if a new smartphone model is expected to sell well, semiconductor manufacturers may increase chip production in advance. Conversely, fluctuations in demand in the consumer electronics market, such as a decline in sales leading to inventory accumulation, can result in reduced orders for semiconductor manufacturers, adjustments to production lines, and even reduced or halted production of certain chip models.

From a technological innovation perspective, fluctuations in demand in the consumer electronics market can also lead to reduced orders, production line adjustments, and even reduced or halted production of certain chip models by semiconductor manufacturers due to inventory accumulation caused by declining sales.

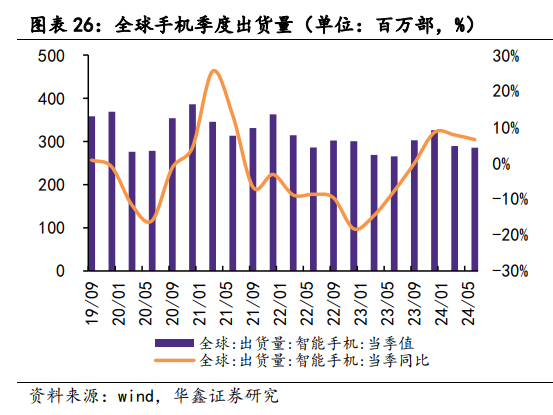

Combining data, the year-on-year decline in global smartphone shipments narrowed quarter by quarter in the first three quarters. The year-on-year change turned positive in the fourth quarter of 2023, and global smartphone shipments continued to rise in the second quarter of 2024, with a year-on-year growth of 6.5%. End-user demand has shown a clear recovery since the fourth quarter of last year.

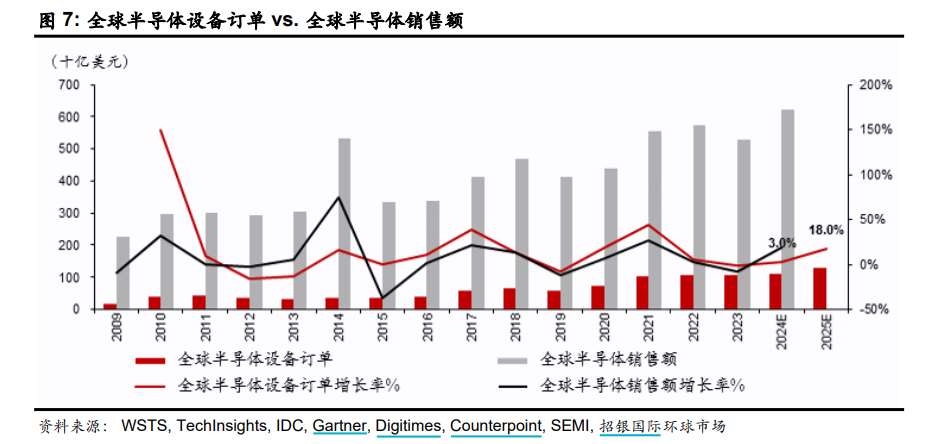

China Merchants Bank International believes that end-user demand affects wafer fab utilization rates, which in turn influences capital expenditure decisions, including equipment orders received by semiconductor equipment suppliers.

According to SEMI's forecast, the global semiconductor equipment market is expected to grow at 3% and 18% over the next two years. The slightly lower growth rate in 2024 is primarily due to limited expansion of memory production lines and slower expansion of mature process nodes. It is believed that next year, the signal for downstream demand recovery will be clearer, and global semiconductor equipment spending will see a growth rate of 18% by then.

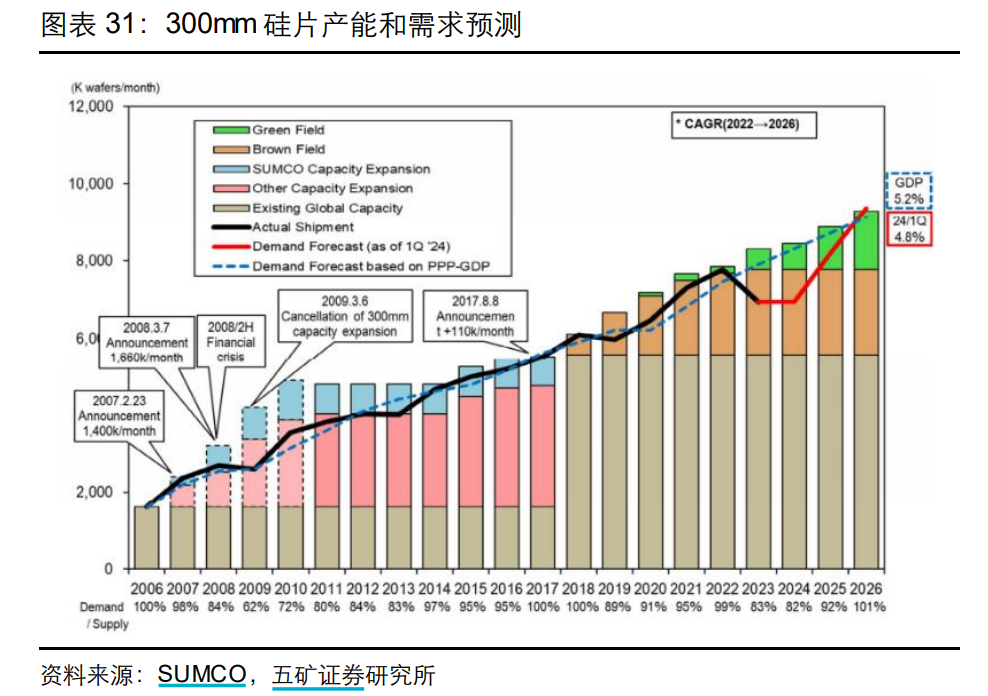

From the perspective of semiconductor materials, another essential component of the upstream semiconductor industry, similar conclusions can be drawn. Wuzhou Securities believes that the semiconductor industry reached a cyclical peak in 2022. However, after entering 2022, due to the increase in global overall capacity and weak market demand, downstream chip industries experienced inventory surpluses. In 2023, the semiconductor silicon wafer industry was at the bottom of the cycle.

Nevertheless, as industry inventories gradually return to normal levels, it is expected that the global inventory surplus situation will ease in 2024, and market demand will gradually recover and begin to grow. Looking ahead, starting from 2026, demand is expected to exceed the total global capacity for 12-inch silicon wafers, returning to a state of oversupply.

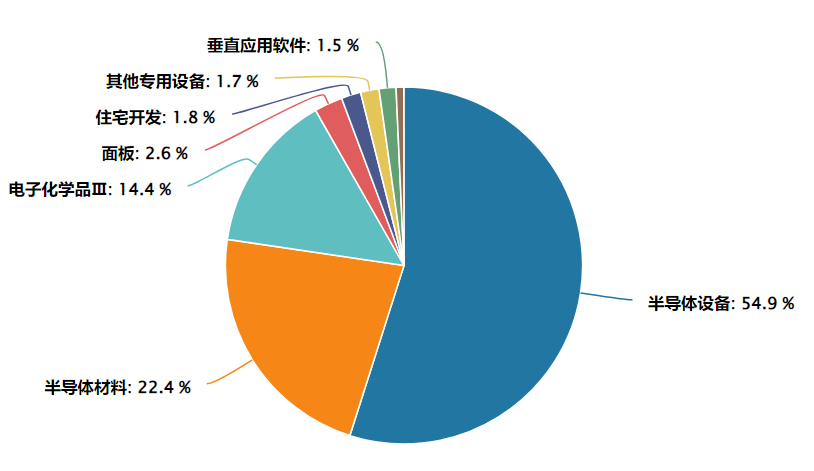

['Equipment' + 'Materials' content exceeds 76%]

The Semiconductor Materials ETF (562590) and its feeder funds (Class A: 020356, Class C: 020357) closely track the CSI Semiconductor Materials and Equipment Index. Semiconductor equipment (54.9%) and semiconductor materials (22.4%) have the highest weights in the index, totaling over 76%, fully focusing on the index theme.

Data Source: Wind, as of August 30th.