China's automotive landscape and challenges

![]() 09/04 2024

09/04 2024

![]() 626

626

The current state of China's automotive industry is indeed complex and multifaceted, defying simple description.

On one hand, the new energy revolution continues to gain momentum, with domestic automakers making inroads globally and achieving remarkable success. On the other hand, the entire industry finds itself in an incredibly competitive environment, where unprofitability or even losses have become the norm.

To this day, the sector remains a dynamic and unpredictable field, a blend of promise and uncertainty, hope and disappointment. Many things are not as rosy as they seem, yet neither are they as dire as some might imagine.

[The Decline, but Not Demise, of Internal Combustion Engines]

According to the latest statistics from the China Passenger Car Association, in July 2024, retail sales of new energy vehicles (NEVs) in China reached 878,000 units, with a retail penetration rate of 51.1%. In contrast, this figure was only 32.8% in January this year.

The rapid rise of NEVs has directly squeezed the market share of internal combustion engine vehicles (ICEVs), putting traditional automakers like SAIC, GAC, Changan, and Dongfeng under significant pressure. This has led to a resurgence of the pessimistic view that ICEVs will soon be consigned to history.

However, upon closer examination of the broader automotive landscape, it becomes clear that ICEVs are unlikely to disappear overnight. Instead, they have a good chance of stabilizing their position and possibly engaging in a seesaw battle with NEVs.

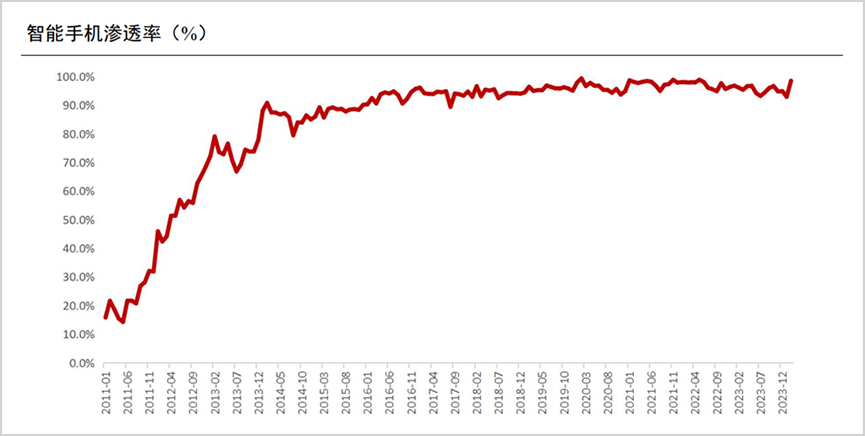

From a technological perspective, the adoption of any new technology or product follows a distinct 'S-curve' pattern. Initially, penetration grows slowly, accelerates rapidly past an inflection point, and then levels off. Consider the smartphone market, where penetration increased from 3% to 14% in the five years leading up to 2009 (the inflection point), before skyrocketing to nearly 70% over the following five years before plateauing.

China's NEV penetration rate began its rapid ascent in 2021, soaring from around 10% to over 50% in just over three years. The 50% mark may well be a turning point. Unlike smartphones, which offered a significant technological leap over feature phones, NEVs represent more of an incremental improvement over ICEVs. As such, a 50% penetration rate is already substantial, especially considering the upward pressure on NEV ownership costs.

Despite cost reductions in NEV manufacturing, price competitiveness remains heavily reliant on automakers sacrificing profits. The question remains whether this unsustainable model of loss-leading growth can continue. If not, NEV makers will inevitably pass on these costs to consumers, eroding their price advantage over ICEVs.

Furthermore, as NEV ownership surges, can the infrastructure – charging stations and swap stations – keep pace?

The answer is likely no.

According to the "Charging and Swapping Blue Paper (2023)," queueing for charging remains prevalent, with over 70% of users expressing a desire for faster charging to alleviate range anxiety. This translates into additional time costs for users. Additionally, rising charging fees since last year have weakened NEVs' competitive edge over ICEVs, further impacting purchase intentions.

Lastly, policy plays a crucial role.

It is undeniable that China's NEV boom owes much to strong government policies. However, with the predetermined penetration target of 50% already achieved eleven years ahead of schedule, questions arise about the future of government support. The goal has always been a balanced energy mix, not a monopoly by any one technology. Any policy shift could result in previous government subsidies being reflected as industry costs.

Considering all these factors, it is premature to write off ICEVs entirely. While NEVs represent the future, this transition will take time and involve numerous challenges.

[The Long Game of NEV Breakthrough]

In 2023, China's automotive production and sales both surpassed 30 million units, setting a new record. However, only 12 of the country's 18 listed automakers were profitable last year, with their combined net profits totaling less than 90 billion yuan. In contrast, Toyota reported a record net profit of approximately 248.5 billion yuan in 2023, more than 2.5 times that of all Chinese listed automakers combined.

The Chinese automotive industry appears prosperous but lacks substance, with automakers sacrificing profits for market share.

Unprofitable enterprises struggle to maintain quality, let alone establish competitive advantages. This, in turn, jeopardizes the interests of consumers, shareholders, and employees, potentially leading to a vicious cycle of declining performance. The industry and policymakers are increasingly recognizing the need to avoid short-term gains at the expense of long-term prospects.

On July 30, the Political Bureau of the CPC Central Committee held a meeting to analyze the current economic situation, emphasizing the importance of industry self-discipline and preventing vicious competition. Prior to this, several veteran automakers had already sounded the alarm.

Wei Jianjun, founder of Great Wall Motor, called for maintaining competition order and cherishing China's automotive industry achievements. Li Shufu, founder of Geely Automobile, warned against endless internal competition and simplistic price wars, which he believes will ultimately lead to disorderly competition. Zeng Qinghong, chairman of GAC Group, urged a long-term perspective, cautioning against unbridled competition.

Recently, new-energy vehicle startups have been hailed as the epitome of innovation, while traditional automakers have been overlooked. However, as the industry faces increasing challenges, the value of traditional automakers' stability and strategic planning is becoming increasingly apparent.

GAC Group, for instance, has made comprehensive preparations for long-term development.

Since 2013, GAC has focused on a multi-energy strategy, becoming one of the few automakers to offer a comprehensive range of EVs, PHEVs, HEVs, REVs, and hydrogen fuel cell vehicles. By the first half of this year, the sales proportion of NEVs and energy-efficient vehicles had risen to 40.63%.

In 2025, GAC plans to introduce new PHEV and REV models targeting various market segments, offering extended range, direct drive, parallel drive, and pure electric driving modes to meet diverse consumer needs.

Regardless of future energy structure changes, GAC Group is well-positioned to adapt.

In terms of core technologies such as autonomous driving, GAC is among the earliest Chinese automakers to embark on fully autonomous vehicle research. It has developed industry-leading technologies, including a large model platform, a centralized computing-based electronic and electrical architecture, and a connected big data platform. GAC has implemented these technologies, with L2 to L4 capabilities now available, and is commercializing its "multi-sensor fusion" and "mapless pure vision" routes.

In June 2023, GAC became one of the first Chinese automakers approved for L3 autonomous driving road tests. In the popular Robotaxi sector, GAC's L4 Robotaxi fleet ranks first among domestic mobility platforms.

GAC is also heavily invested in international expansion, with a strategic focus on long-term overseas presence and development rather than short-term sales figures. This comprehensive approach encompasses overseas manufacturing plants, energy solutions, supply chain integration, R&D facilities, and talent development initiatives.

▲Grandland Aion V rolls off the production line at GAC Aion's smart factory in Thailand

We emphasize that automaking is a marathon, not a sprint. Success is not measured by short-term gains but by endurance and vision.

Current success does not guarantee future prosperity, and vice versa.

[The Future is Unwritten, Value Will Prevail]

Fueled by capital inflows, China's NEV startups have flourished. However, the fundamental laws of the automotive industry remain unchanged: scale matters.

While the break-even point for electric vehicles is lower than that for ICEVs, barriers to entry still exist. Tesla, for example, only became profitable after annual deliveries surpassed 500,000 units. By this metric, no Chinese NEV startup has yet to truly establish itself, with even the most successful, like Lixiang and Wenjie, delivering around 189,000 and 181,000 units respectively in the first half of this year.

Until the window of opportunity closes, any player could emerge as a dark horse. One category of enterprises that cannot be overlooked are NEV brands spun off from traditional automakers, such as Aion and Zeekr.

These entities enjoy the best of both worlds: they are free from the historical baggage and path dependencies of traditional automakers, allowing them to innovate boldly in the smart electric revolution. At the same time, they benefit from the resources and support of their powerful parent companies, including funding, capacity, experience, and supply chain management. These advantages may seem inconsequential initially but become increasingly significant over time.

Aion serves as a prime example, having sold 480,000 units last year and ranking first among NEV startups for two consecutive years, while also topping the global unicorn ranking for NEVs. Meanwhile, many newer startups struggle with funding and capacity constraints.

Since the announcement of China's new energy strategy, a grand narrative of catching up with and surpassing advanced economies in the new energy era has emerged, fueled by governments, enterprises, media, and the public alike. Capital markets have poured in funds, valuing startups highly even when they lack profitability.

From a national strategic perspective, this focus is understandable. However, capital markets ultimately value profitability. While NEV makers could be forgiven for their lack of profitability at a 10% penetration rate, this leeway diminishes significantly as the penetration rate surpasses 50%. Unprofitable enterprises may struggle to justify their existence beyond this point.

If the past mission of China's automotive industry was to create a vision, the next phase will be about value realization. Regardless of one's stance, the time for automakers to rely solely on narratives is limited.

Disclaimer

This article contains information related to listed companies based on the author's personal analysis and judgment of publicly disclosed information (including but not limited to interim announcements, periodic reports, and official interaction platforms) provided by these companies in accordance with legal requirements. The information or opinions expressed herein do not constitute investment or other business advice. Market Value Watch shall not be liable for any actions taken based on this article.

-END-