Anheng Information's market value has shrunk by over 20 billion yuan in three years

![]() 09/04 2024

09/04 2024

![]() 494

494

Produced by | Entrepreneurship Frontline

Art Editor | Li Yufei

Editor | Song Wen

Anheng Information is still struggling on the road to loss.

On August 28, Anheng Information disclosed its semi-annual report for 2024. During the reporting period, the company achieved operating revenue of 698 million yuan, a year-on-year increase of 0.29%; net profit attributable to shareholders was -276 million yuan, a narrowing of 32.56% compared to the same period last year.

In fact, the entire cybersecurity industry has been under significant pressure. According to Caijing, among the top 20 companies in terms of revenue in the information security industry in the first half of this year, only 3 were profitable, and all of the top 10 incurred losses. For example, companies like Sangfor and QiAnXin were also in a state of loss.

Amid the pressure on the entire industry, Anheng Information's former president Song Duanzhi recently announced his resignation to start a food stall business and transition into the catering industry. People can't help but wonder when the cybersecurity industry will finally overcome this period of adversity.

1. Years of consecutive losses, what happened to Anheng Information

Anheng Information is an information security technology service provider, offering comprehensive solutions such as application security, database security, website security monitoring, and security management platforms.

In 2020, despite the impact of the pandemic, Anheng Information experienced a "highlight" moment in terms of profit – achieving a net profit attributable to shareholders of 134 million yuan, a year-on-year increase of 45.43%.

At that time, the company mentioned in its financial report that despite the pandemic, it had firmly grasped the opportunity presented by the digital transformation of the domestic economy. Sales of new-generation network information security products such as cloud security and big data grew rapidly, and the scale of security services continued to expand.

However, after 2020, Anheng Information fell into a quagmire of losses.

In 2021, the company achieved operating revenue of 1.82 billion yuan, a year-on-year increase of 37.59%, but its net profit attributable to shareholders declined by 89.71% year-on-year, leaving only 13.81 million yuan. Affected by macroeconomic factors, Anheng Information's research and development expenses, sales expenses, and other period costs increased rapidly, and employee cost expenditures were significant, leading to a significant decline in profits.

(Chart / Wind (Unit: Billion Yuan))

Since then, Anheng Information has been trapped in a dilemma of "increasing revenue without increasing profits."

Public data shows that in 2022 and 2023, the company's operating revenues were 1.98 billion yuan and 2.17 billion yuan, respectively, representing year-on-year increases of 8.77% and 9.60%. However, net profits attributable to shareholders were -253 million yuan and -360 million yuan, respectively, with the losses continuing to expand.

In its 2023 financial report, Anheng Information explained the losses by stating that although the company's overall operating revenue achieved stable growth, the growth rate failed to meet expectations. Additionally, the company had a large number of employees, and rigid labor costs continued to rise, which had a certain impact on net profit in 2023.

Moreover, in 2023, Anheng Information made occasional higher investments to support major events such as the Hangzhou Asian Games and Chengdu Universiade, and sales expenses also increased by 6.47% year-on-year.

(Chart / Anheng Information's 2023 Financial Report)

It is evident that high costs are a significant contributor to Anheng Information's losses.

As a result, Anheng Information began consciously implementing cost reduction and efficiency enhancement measures.

On December 25, 2023, a notice circulated on the internet from Anheng Information, mentioning that the company's senior managers (M4 and above) would voluntarily reduce their salaries by 15%-30% based on their salary levels, taking the lead in supporting the company's cost reduction and efficiency enhancement plan through practical actions. Interface News' Entrepreneurship Frontline sought confirmation from Anheng Information, but as of press time, Anheng Information had not responded.

(Chart / Internet)

In addition to salary reductions for senior executives, Anheng Information also reduced its workforce size.

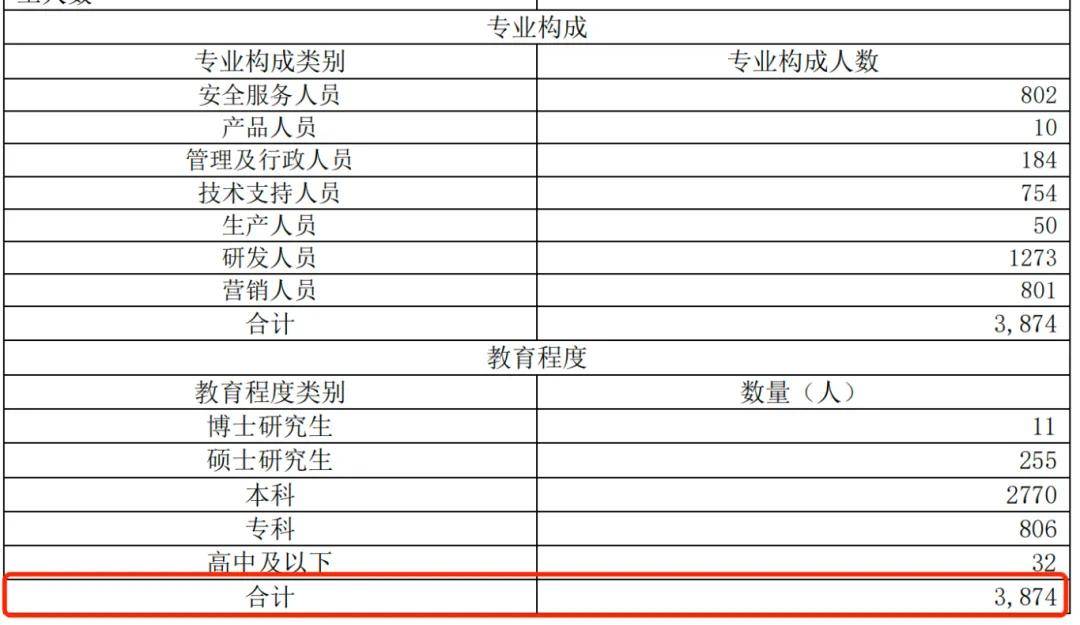

In 2023, Anheng Information's workforce was reduced to 3,874 employees, a decrease of 476 employees from 2022. Among them, R&D personnel were the core group affected by layoffs, with the number declining from 1,505 in 2022 to 1,273 in 2023, a reduction of 232 R&D personnel.

By the first half of 2024, the number of R&D personnel at Anheng Information had further decreased to 1,003.

(Chart / Anheng Information's 2023 Financial Report)

(Chart / Anheng Information's Semi-Annual Report 2024)

Through a series of cost reduction and efficiency enhancement measures, Anheng Information narrowed its loss scale.

The financial report shows that in the first half of 2024, the company achieved operating revenue of 698 million yuan, a year-on-year increase of 0.29%, and net profit attributable to shareholders was -276 million yuan, a narrowing of 32.56% compared to the same period last year. However, the company still has not turned a profit.

It is clear that in the midst of an industry downturn, while "cost reduction and efficiency enhancement" is indeed a means for enterprises to survive, it is far from sufficient to achieve a turnaround in performance.

2. High accounts receivable and rising short-term debt

Public data shows that Anheng Information's main products and services include basic network information security products, network information security platforms, data element infrastructure, AI security, network information security services, and commercial encryption products.

Currently, the company's customer base primarily includes governments, financial institutions, educational institutions, telecom operators, and other entities.

Generally speaking, B-end customers such as governments and large enterprises tend to have longer settlement cycles, which contributes to Anheng Information's high accounts receivable balance.

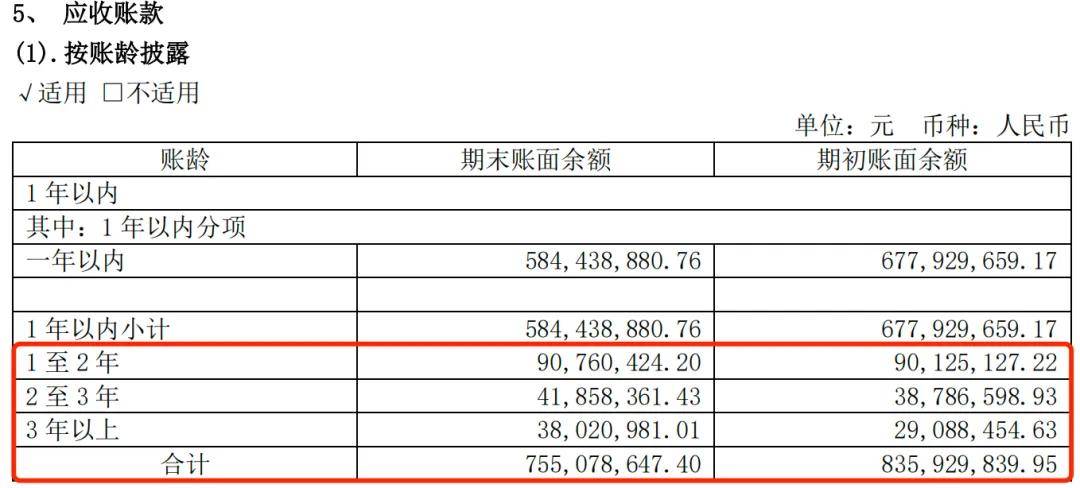

In the first half of 2024, Anheng Information's closing balance of accounts receivable was 755 million yuan, accounting for 108.17% of current operating revenue, a decrease of 9.7% from the opening balance of 836 million yuan.

(Chart / Anheng Information's Semi-Annual Report 2024)

While the overall scale of Anheng Information's accounts receivable has decreased, it is still far higher than current operating revenue.

Furthermore, Interface News' Entrepreneurship Frontline noticed that the company's accounts receivable with an aging of over one year have all increased compared to the beginning of the period. As of the first half of 2024, the closing balance of accounts receivable with an aging of over three years was 38.02 million yuan, an increase of 30.7% from 29.09 million yuan at the beginning of the period.

The high level of accounts receivable also leads to rising bad debt provisions. The financial report shows that the amount of bad debt provisions increased from 83.63 million yuan at the beginning of the period to 88.88 million yuan in the first half of 2024.

(Chart / Anheng Information's Semi-Annual Report 2024)

A high level of accounts receivable means that a significant amount of funds are tied up by customers. If accounts receivable are difficult to recover, it may lead to tension in the company's capital chain and trigger liquidity risks.

In the event of such risks, it would undoubtedly be a double blow to Anheng Information, which already has rising debt. The financial report shows that as of the end of the first half of 2024, Anheng Information's short-term borrowings were 385 million yuan, an increase of 51.98% from the end of the previous year; long-term borrowings were 460 million yuan, an increase of 37.27% from the end of the previous year.

(Chart / Anheng Information's Semi-Annual Report 2024 (Unit: Yuan))

It is worth mentioning that since 2021, the company's operating cash flow has been continuously "bleeding." From 2021 to the first half of 2024, the company's net operating cash flow was -61 million yuan, -179 million yuan, -256 million yuan, and -429 million yuan, respectively, remaining negative for an extended period.

(Chart / Wind (Unit: Billion Yuan))

Moreover, Anheng Information's monetary funds have also declined. As of June 30, 2024, the company's monetary funds amounted to 1.334 billion yuan. In early 2023, the company's monetary funds were as high as 1.853 billion yuan. In just one and a half years, its monetary funds have decreased by 500 million yuan.

(Chart / Left: Anheng Information's Semi-Annual Report 2024; Right: Anheng Information's Financial Report 2023)

Currently, Anheng Information's monetary funds can still cover its short-term debt and leave sufficient room for maneuver. However, this does not mean that Anheng Information can rest easy. After all, in a downturn industry, overcoming the cycle remains a challenge for enterprises.

3. Significant decline in market value, former president resigns to transform his career

Compared to Anheng Information, people are more concerned about the Alibaba Group behind it.

As of the end of the first half of 2024, Ali Group Ventures held a 10.14% stake in Anheng Information, making it the company's second-largest shareholder.

Backed by the Alibaba Group, Anheng Information has also experienced its heyday in the capital market.

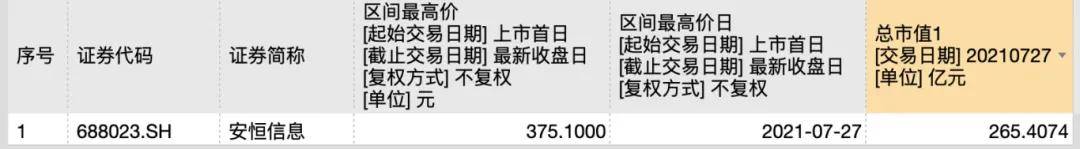

On July 27, 2021, the company's share price soared to an intraday high of 375.1 yuan per share, with a total market value of 26.541 billion yuan.

(Chart / Wind)

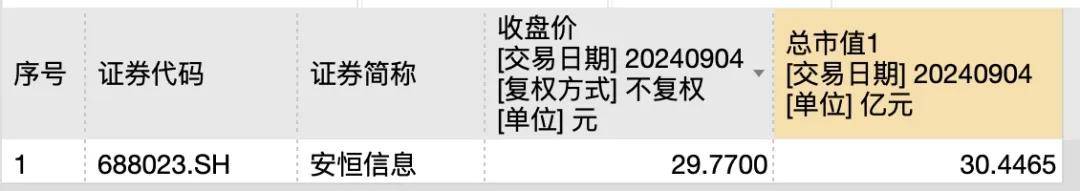

Since then, Anheng Information's share price has fluctuated downwards. As of September 4, Anheng Information's closing price was 29.77 yuan per share, and its market value was only 3.045 billion yuan, a decline of over 20 billion yuan from its peak.

(Chart / Wind)

Interestingly, Anheng Information's former president Song Duanzhi recently chose to resign and transition into the catering industry. On August 20, Song Duanzhi, the former president of Anheng Information, announced his resignation from the company on his public account "Duan Ye Private Kitchen" and began his entrepreneurial journey into the catering industry by opening a Sichuan-style food stall.

According to the Meituan platform, Song Duanzhi has already opened two outlets in Hangzhou, specializing in dishes such as lobster and barbecue.

It is reported that Song Duanzhi previously worked at Huawei for nearly 20 years and has extensive experience in network and security product research and development management. In 2021, he joined Anheng Information as president.

Song Duanzhi self-deprecatingly said that "catering is the fastest path for the middle class to return to poverty," but he still chose to abandon the experience and contacts accumulated over many years in network information security and resolutely transitioned into the catering industry. There must be various factors behind his decision, and the pressure on the entire industry undoubtedly influenced it to some extent.

After all, the entire cybersecurity industry is clearly under pressure.

According to IDC's "China IT Security Hardware Market Tracker Report, Q4 2023," the market size of China's IT security hardware reached 22.48 billion yuan in 2023, a year-on-year decrease of 0.9%, and the growth rate fell short of expectations.

Interface News' Entrepreneurship Frontline selected leading listed companies in the cybersecurity field for comparison and found that in the first half of 2024, the operating revenue scales of 360 Security, Sangfor, QiAnXin, and NSFOCUS were all higher than that of Anheng Information, but all of these companies were in a state of loss.

Among them, QiAnXin, which incurred the largest loss, had a net loss attributable to shareholders of 820 million yuan in the first half of 2024. This underscores the significant pressure faced by the cybersecurity industry.

(Chart / Wind)

Amid the "winter" of the information security industry, how Anheng Information actively seeks innovation and change is the core to turning around its losses. Interface News' Entrepreneurship Frontline will continue to pay close attention to how Anheng Information will change in the future.

*Note: The lead image in this article is from Shutterstock and is based on the VRF agreement.