Net profit plummets by 96%, market value evaporates by nearly 40 billion, and the "first projector stock" is cooling off?

![]() 09/05 2024

09/05 2024

![]() 622

622

Source | Dark Blue Finance Written by Wu Ruixin

The dividends are gone, and the former "first projector stock" has also cooled off. Not long ago, "China's first domestic projector stock," Jimi Technology, released its 2024 interim report, and the figures were shocking!

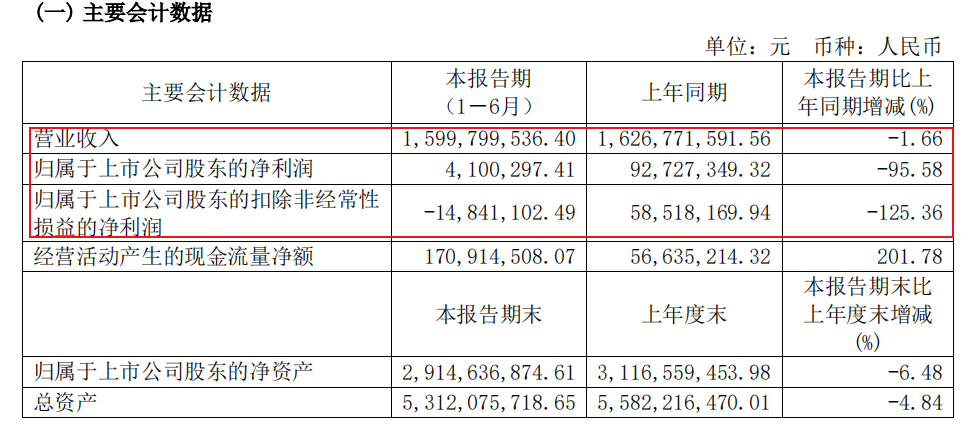

In the first half of this year, Jimi Technology achieved revenue of 1.6 billion yuan, a year-on-year decline of 1.66%; however, net profit attributable to shareholders was only 4.1 million yuan, a year-on-year decline of 95.58%!

In the 2022 interim report, Jimi Technology had proudly earned 269 million yuan. In just two years, Jimi Technology's net profit has plummeted from the sky to the ground. Is the projector industry no longer profitable?

When it went public in March 2021, Jimi Technology was popular among investors due to its high growth potential. Within three months of its listing, its share price soared to an all-time high of 626.68 yuan. However, over the following three years, as growth slowed and performance declined, Jimi Technology's share price continued to decline. Since 2024, it has even fallen below 100 yuan, reaching a low of 50.71 yuan at one point. Compared to its historical high, it has lost 90% of its value, with its market capitalization evaporating by nearly 40 billion yuan.

For Jimi Technology's stock, an even bigger blow came from shareholder "Baidu Group." Everyone knows it's easy to add flowers to the bouquet, but it's difficult to offer help in times of need. As Jimi Technology's share price continued to decline, the company's second-largest shareholder, "Baidu Group," began frantically reducing its holdings.

1

Earning only 4.1 million yuan in half a year, the "king of projectors" is also cooling off

Unexpectedly, the "first projector stock" that was once highly sought after by consumers and investors has cooled off so quickly.

Recently, Jimi Technology delivered its worst performance since going public.

According to the 2024 interim report, Jimi Technology's revenue for the first half of the year was approximately 1.6 billion yuan, a year-on-year decline of 1.66%. While the decline in revenue was not significant, the net profit was shocking. In the first half of 2024, Jimi Technology's net profit attributable to shareholders was 4.1003 million yuan, a year-on-year decline of 95.58%; after deducting non-recurring gains and losses, the net profit attributable to shareholders of listed companies was -14.8411 million yuan, a year-on-year decline of 125.36%.

Earning only 4.1 million yuan in half a year, what does that mean? Compare this to two years ago, when Jimi Technology proudly earned 269 million yuan in the 2022 interim report. Now, it doesn't even come close to that amount.

Upon closer examination of the financial report, it can be found that this is actually the sixth consecutive quarter in which Jimi Technology has experienced negative growth in its deducted net profit, and the eighth consecutive quarter in which it has experienced negative growth in its net profit attributable to shareholders.

The sharp decline in Jimi Technology's fortunes began to emerge as early as the third quarter of 2022. In the third quarter of 2022, Jimi Technology's net profit suddenly plummeted from 148 million yuan in the previous quarter to 60.2 million yuan.

Although net profit rebounded to previous levels in the following quarter, it was only a temporary respite. Starting in the first quarter of 2023, Jimi Technology entered a period of continuous profit decline, and the situation continued to deteriorate over time.

In the third quarter of 2023, Jimi Technology experienced its first quarterly loss since going public. Despite generating revenue of 795 million yuan in the third quarter of 2023, the company incurred a net loss of 6.561 million yuan, a year-on-year decline of 110.90%.

In the second quarter of 2024, Jimi Technology again incurred a quarterly loss of 10.22 million yuan, a year-on-year decline of 125.21%.

What's wrong with Jimi Technology?

2

Industry dividends are gone, and market competition is intensifying

Is it that projectors are no longer selling?

This is indeed one of the reasons. According to data disclosed by IDC, China's projector market shipped 4.736 million units in 2023, a year-on-year decline of 6.2%; sales amounted to 14.77 billion yuan, a year-on-year decline of 25.6%. Overall, the projector market has indeed lost its dividends compared to the previous two years.

However, judging from the financial report, the scale of Jimi Technology's revenue basically aligns with industry trends and is even better than the overall industry situation.

So why has net profit experienced such a steep decline?

According to Jimi Technology's explanation in its financial report, due to the destocking of some older products, the company's gross profit margin declined compared to the same period last year, leading to a year-on-year decline in the company's net profit and deducted net profit.

There is actually not much of a technical barrier in the projector industry. The rapid development of the home projector market in recent years has attracted the participation of many small and medium-sized manufacturers, leading to increasingly fierce market competition. According to relevant data, there were nearly 300 projector brands sold online in China in 2023.

As the market becomes more competitive, the projector market is also shifting downwards. According to online monitoring data from RUNTO, the average price of China's smart projector online market was 1756 yuan in 2023, a decrease of 212 yuan from 2022, a drop of 11%.

Among them, according to online monitoring data from AVC Cloud, retail sales of products priced below 500 yuan accounted for 32.8% of the market in 2023, an increase of 4.5 percentage points year-on-year.

Amid this intense industry competition, Jimi Technology has also been forced to participate in the price war, which directly affects its gross profit margin.

Facing increasingly fierce market competition, Jimi Technology can only reduce prices to drive sales. As a result, despite relatively stable revenue, net profit has experienced a steep decline.

In addition to reducing prices to clear old inventory, Jimi Technology is also actively "sinking" by introducing products covering a wider range of prices, including those priced below 2000 yuan.

In the short term, the future of Jimi Technology is not optimistic. In this interim report, Jimi Technology also admitted that as the projector market continues to expand and new players enter, market competition is expected to intensify further. This not only poses challenges to the company's sustained growth but also increases the likelihood of product price reductions.

3

Share price drops by 90%, market value evaporates by nearly 40 billion, and "Baidu Group" begins frantic share sales

When Jimi Technology first went public, it was highly sought after by investors due to its high growth potential. Just over three months after its listing, its share price reached an all-time high of 626.68 yuan.

However, as performance pressures mounted in recent years, Jimi Technology's halo faded, and the capital market began to vote with its feet.

Seeing Jimi Technology's continuous decline, the second-largest shareholder, "Baidu Group," also began frantically reducing its holdings, suggesting a pessimistic outlook for the company.

Since the lifting of restrictions in March 2022, Baidu and its affiliates have repeatedly reduced their holdings on a large scale. As of August 26, 2024, Baidu Group's shareholding ratio had decreased from 11.61% to 5.53%.

According to statistics from China Fund News, over the past two years, Baidu Group has reduced its holdings by a cumulative 6.08%, realizing cash proceeds of over 370 million yuan.

According to previous reports by Red Star News, in Jimi's first capital increase in December 2017, Baidu Netcom subscribed for 711,699 yuan, and Baidu Biwei subscribed for 237,233 yuan. The price of this capital increase was 210.76 yuan per subscription. Based on this calculation, Baidu Netcom and Baidu Biwei invested approximately 200 million yuan. On March 16, 2018, Jimi held another shareholders' meeting, approving the transfer of a shareholder's 647,223 yuan subscription to Baidu Netcom. The transfer price was approximately 179.15 yuan per subscription. Based on this calculation, Baidu Netcom invested approximately 116 million yuan.

Baidu Group's initial investment totaled approximately 316 million yuan. At present, Baidu has already recovered its investment through several share reductions.

However, Jimi Technology's share price has continued to decline amid Baidu Group's multiple share reductions.

As of the close on September 4, Jimi Technology's share price had fallen to 55.88 yuan, a 50% decline for the year so far. Compared to its historical high, it has lost 91% of its value, with its market capitalization evaporating by nearly 40 billion yuan.

4

Conclusion

Industry dividends are gone, market competition is intensifying, net profit is continuing to decline, and share prices are falling relentlessly...

For the future, Jimi Technology is full of concerns. It is actively sinking and even setting its sights on overseas markets, which may temporarily ease the current pressure on the company. However, in the long run, it remains to be seen whether Jimi Technology can stand out in an even more competitive market and continue to hold onto its position as the industry leader.