Xiaomi's second car, evolving from a 'Porsche-style Mi' to a 'Ferrari-style Mi'?

![]() 09/06 2024

09/06 2024

![]() 503

503

By Sandian

It is well known that the current competition in the new energy vehicle market has become fiercely intense, with an increasingly palpable sense of rivalry among automakers. At the recent Chengdu Auto Show, Yu Jingmin, Senior Vice President of SAIC Passenger Vehicle Company, was particularly vocal in accusing Xiaomi of 'copying' Porsche in its automotive designs, lambasting the behavior as 'audacious.'

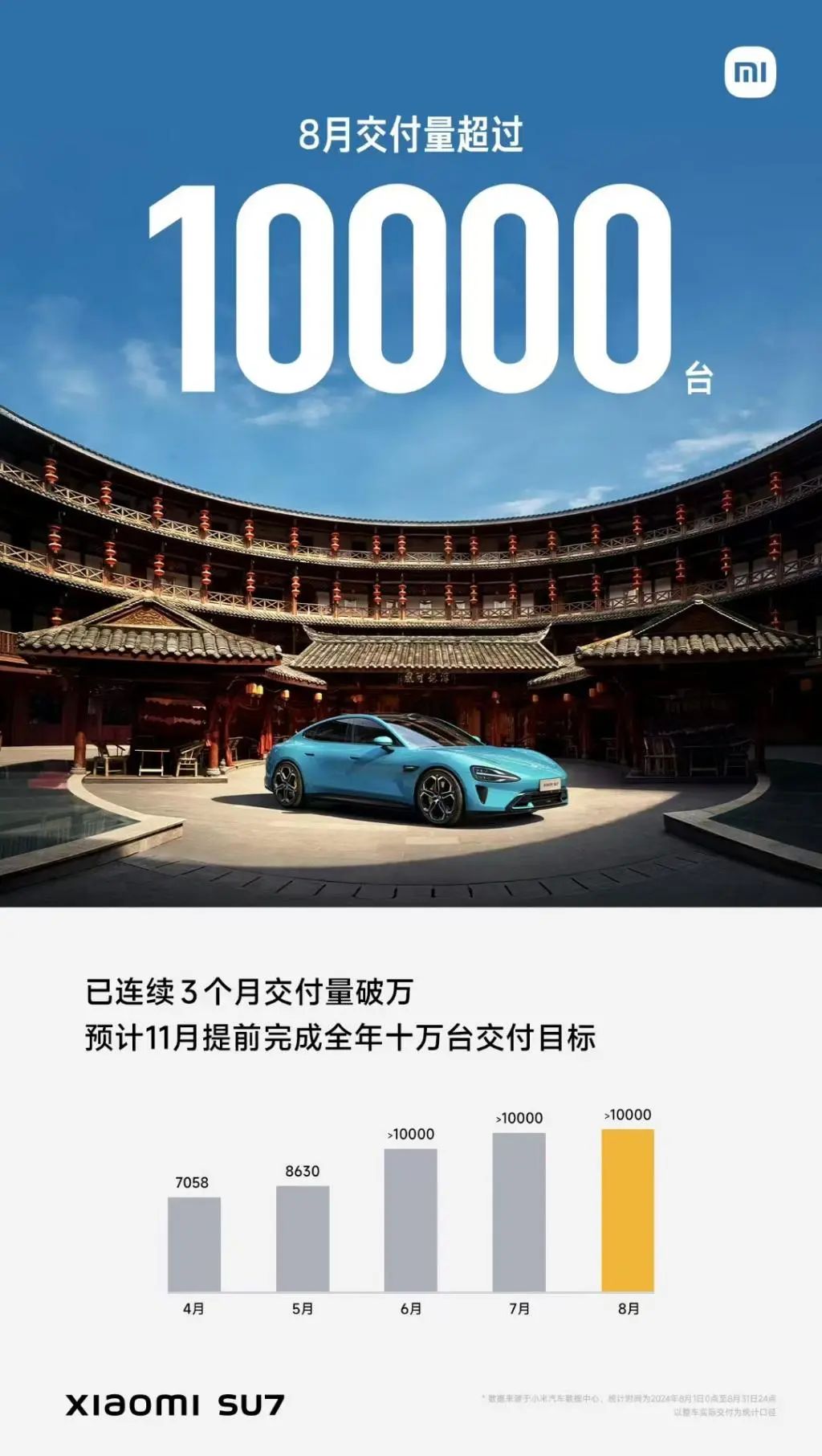

While it is difficult to ascertain the veracity of Yu Jingmin's remarks, they nonetheless underscore a salient fact: as a rising star, Xiaomi has indeed stirred up considerable commotion in the new energy vehicle market. Judging solely by sales figures, the latest data reveals that Xiaomi delivered over 10,000 SU7 vehicles in August, marking the third consecutive month of achieving this milestone. This performance is poised to bring forward the anticipated completion of Xiaomi's annual delivery target of 100,000 units to November.

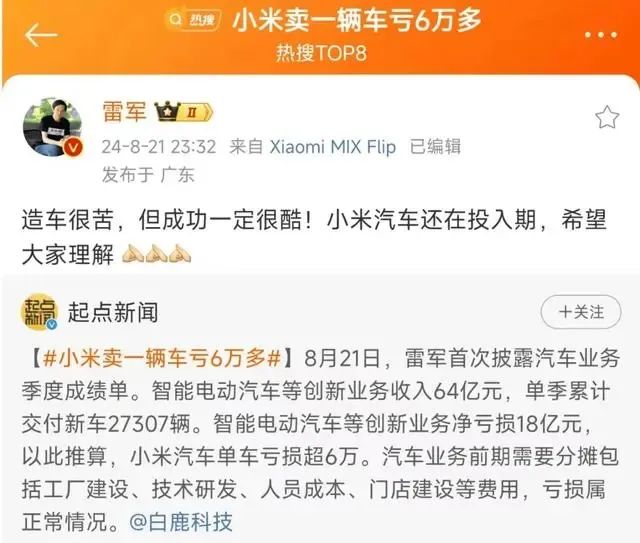

Against this backdrop, when Xiaomi's second automotive offering will hit the market has gradually emerged as a focal point of public interest. Despite the reported loss of RMB 60,000 per Xiaomi SU7 sold, Lei Jun, Xiaomi's founder, has declared, 'Car manufacturing is tough, but success will undoubtedly be gratifying.' On this path, the launch of Xiaomi's second vehicle, driven by both Xiaomi and Lei Jun, is now all but inevitable.

So, where does Xiaomi stand with its second car at present?

01 What will Xiaomi's second car look like?

Regarding Xiaomi's second vehicle, Autohome released a teaser in July, accompanied by an original rendering. In the poster, the second mass-produced Xiaomi car was named the 'Xiaomi SU8.' However, this information was swiftly refuted by Xiaomi, with Wang Hua, General Manager of Xiaomi's Public Relations Department, stating categorically, 'There is no SU8; it's fake!'

Yet, Wang's denial was limited to the name SU8, not the existence of a second vehicle altogether. According to leaked road test images, Xiaomi's second mass-produced car bears the internal codename MX11 and is positioned as an SUV model.

In terms of design, the Xiaomi MX11 adopts a long hood and short front overhang, with sleek rooflines reminiscent of a coupe-styled SUV. The headlights echo those of the Xiaomi SU7, featuring a low front compartment and a clamshell-style bonnet, with the front engine compartment occupying a significant portion of the vehicle's length.

On the sides, yellow sport calipers are faintly visible through the wheels, consistent with the Xiaomi SU7 and underscoring its sporty nature. The car boasts a short front and rear overhang with a long wheelbase, offering ample interior space without compromising on compactness.

Currently, information on the Xiaomi MX11 remains scarce, but based on its positioning, it appears to be a 'coupe-styled SUV,' sharing a similar emphasis on sporty handling with the Xiaomi SU7, catering to the preferences of younger consumers. Similar to the Xiaomi SU7, the MX11 has also faced accusations of 'high imitation,' as its appearance bears a striking resemblance to Ferrari's first SUV, the Purosangue.

In this regard, Jiedian Auto finds no surprise, as it aligns with Xiaomi's automotive approach. Echoing Yu Jingmin's accusations at the outset of this article, debates have persisted in the market regarding whether the Xiaomi SU7's exterior design plagiarizes Porsche since its launch.

In contrast, Porsche has adopted a more lenient stance. Oliver Blume, President and CEO of Porsche China, once remarked, 'From my personal perspective, the similarities between the Xiaomi SU7 and Porsche may stem from the fact that excellent designs often share an inherent affinity.'

At this juncture, whether the design constitutes plagiarism becomes less significant. Nevertheless, should Xiaomi's second car indeed bear a striking resemblance to the Ferrari Purosangue, it remains uncertain whether Ferrari would exhibit similar leniency. In Jiedian Auto's view, neither Porsche nor Ferrari need fret unduly, as Xiaomi's true benchmark in the automotive sector does not lie with such high-end luxury vehicles but rather with new energy automakers like Tesla and emerging players, who have responded most vigorously.

Even if selling each car incurs a loss of RMB 60,000, the competition must persist.

02 Is SUV the inevitable choice for Xiaomi's automotive venture?

Indeed, in the new energy vehicle industry, it is commonplace for the first and even second vehicles to operate at a loss. The crucial factor lies in striking a balance between losses, capital, and sales to sustain the automaker's rollout of subsequent models and ultimately achieve profitability.

In this process, mass production emerges as the linchpin for automakers to attain profitability. Zhu Jiangming, Chairman of NIO Automobiles, has frequently emphasized that new energy vehicles adhere to Moore's Law in the electronics industry, where greater scale translates into lower component costs and enhanced profitability.

As a rising star, Xiaomi's automotive venture initially grappled with high procurement and manufacturing costs due to limited scale. Additionally, expenses related to factory construction, dealership establishment, and technological R&D, particularly for core technologies such as batteries, motors, and electronic controls, were substantial.

Regarding the capital-intensive nature of car manufacturing, Lei Jun's stance is unequivocal. In his 2024 annual speech, he affirmed that Xiaomi Group would forgo shortcuts, acquisitions, and outsourcing, instead investing tenfold in core technologies to meticulously craft quality vehicles.

His words are inspiring, yet realizing this vision is no mean feat. As a publicly traded company, Xiaomi must swiftly demonstrate profitability to its investors. Therefore, should Xiaomi's second automotive offering indeed be an SUV, it would constitute a prudent choice.

In China's new energy vehicle market, SUVs reign supreme, as evidenced by the popularity of Tesla's Model Y and leading emerging brands like Lixiang, AITO, and NIO, all of which underscore the segment's immense market potential.

Nevertheless, an SUV launch by Xiaomi Automobiles would intensify competition. Consistent with Xiaomi's branding strategy, its SUV is likely to adopt a similar approach as the Xiaomi SU7, prioritizing 'cost-effectiveness,' enabling young consumers to upgrade from their first 'Porsche-style Mi' to a 'Ferrari-style Mi.'

Regardless of external perceptions, Lei Jun, a seasoned marketer, possesses the acumen to transform Xiaomi's second car into another blockbuster hit. Simultaneously, it is not difficult to surmise that the second vehicle may continue to incur losses upon sale. Given Xiaomi's current production capacity and order growth rate, it must significantly scale up its output, potentially doubling or more, to approach the breakeven point. Consequently, Xiaomi Automobiles confront numerous challenges ahead.

03 Under siege, what poses the greatest challenge?

In Jiedian Auto's assessment, Xiaomi Automobiles' most pressing challenge lies in sustaining order growth. While the Xiaomi SU7, as an all-electric coupe, garnered immense popularity upon its launch, amassing over 110,000 orders and marking a promising start for Xiaomi's automotive venture.

However, as time passes, Xiaomi Automobiles must confront the reality that consumer novelty wanes, and patience dwindles amidst prolonged delivery timelines. Simultaneously, competitors continue to introduce products that compete directly with the Xiaomi SU7.

For instance, Jiedian Auto has personal acquaintances who initially placed orders for the Xiaomi SU7 in April but subsequently tested drive other SUV models during the waiting period. After comparing prices, practicality, and immediate availability, they opted to cancel their Xiaomi SU7 order in June.

From April's initial order lock-in to August, Xiaomi Automobiles' existing orders and potential customers faced numerous enticements. Apart from the Zeekr 001, which directly competes with the Xiaomi SU7, the Leking Z10 entered mass production in June, with its entry-level pricing even lower than that of the Xiaomi SU7.

Entering the second half of the year, NIO's second brand, Nedao, will launch the L60 in September, while XPeng's M03 is scheduled for release in the third quarter. He Xiaopeng, XPeng's CEO, has boldly proclaimed that the M03 will outsell the Xiaomi SU7. Furthermore, Tesla, Han EV, IM Motors L6, and even the recently popular EnjoyAuto S9, have all encircled the Xiaomi SU7.

In June, Xiaomi delivered 14,296 SU7 units, followed by 13,120 in July. While Xiaomi has not disclosed specific August sales figures, third-party weekly order data indicates that the Xiaomi SU7 secured an additional 4,000 orders in the second week of August, narrowly surpassed by the Zeekr 001's 4,200 orders, some of which likely originated from potential Xiaomi SU7 customers.

Despite the pressure on Xiaomi SU7 deliveries, achieving the established target appears feasible. Moreover, Xiaomi boasts a significant competitive edge through its vast user base and robust financial backing as the 'King of Cash in Beijing,' a status that eludes many of its rivals.

Comprehensively, Jiedian Auto believes that profitability is not an immediate concern for Xiaomi Automobiles. Rather, the company should prioritize delivery volumes, scale growth, and establishing a robust brand identity. Consequently, the success of Xiaomi's second vehicle in creating another blockbuster hit is paramount. The future of new energy vehicles will transcend mere price competition, encompassing a multifaceted race encompassing technology, service, branding, and more. Relying solely on 'cost-effectiveness' and marketing may prove insufficient in attaining Lei Jun's ultimate vision.